Thailand Economic Outlook: Negative Inflation And Monetary Policy

Table of Contents

Thailand's economy is currently facing a complex landscape, characterized by unexpected negative inflation and the Bank of Thailand's (BOT) strategic response through monetary policy adjustments. This article analyzes the current economic outlook, exploring the causes of deflation, the BOT's actions, and the potential implications for businesses and investors. We will examine the challenges and opportunities presented by this unique economic climate.

Understanding Negative Inflation in Thailand

Causes of Deflation

Thailand's current negative inflation is a multifaceted issue stemming from several interconnected factors. The global economic slowdown has significantly impacted consumer spending within the country. Uncertainty surrounding geopolitical events and potential future economic downturns has led to a more cautious approach among Thai consumers.

- Decreased Consumer Spending: Consumer confidence indices have shown a decline, resulting in a reduced demand for goods and services. For example, retail sales figures for [Insert Month, Year] showed a [Insert Percentage]% decrease compared to the same period last year.

- Lower Energy Prices: The global decline in energy prices, particularly oil, has exerted downward pressure on overall inflation. This is particularly significant in Thailand, where energy costs contribute substantially to the cost of goods and services. For instance, petrol prices have decreased by an average of [Insert Percentage]% since [Insert Date].

- Stronger Thai Baht: The appreciation of the Thai Baht against major currencies has made imports cheaper, further contributing to deflationary pressures. This impacts domestic producers who face increased competition from cheaper imports.

- Government Subsidies and Fiscal Policies: Government interventions, including subsidies on certain goods and services, have also played a role in suppressing inflation. While intended to support consumers, these policies can artificially depress price levels.

Consequences of Negative Inflation

While seemingly positive at first glance, negative inflation presents several significant risks to the Thai economy. Prolonged deflation can create a vicious cycle that harms both consumers and businesses.

- Delayed Consumer Spending: Consumers may postpone purchases expecting further price reductions, leading to decreased demand and potentially further deflation.

- Debt Deflation: As prices fall, the real value of debt increases, making it harder for individuals and businesses to service their loans. This can lead to bankruptcies and a contraction in credit availability.

- Reduced Profit Margins for Businesses: Businesses face falling revenues as prices decrease, leading to squeezed profit margins and potentially impacting investment and hiring. This is particularly challenging for businesses with high debt levels.

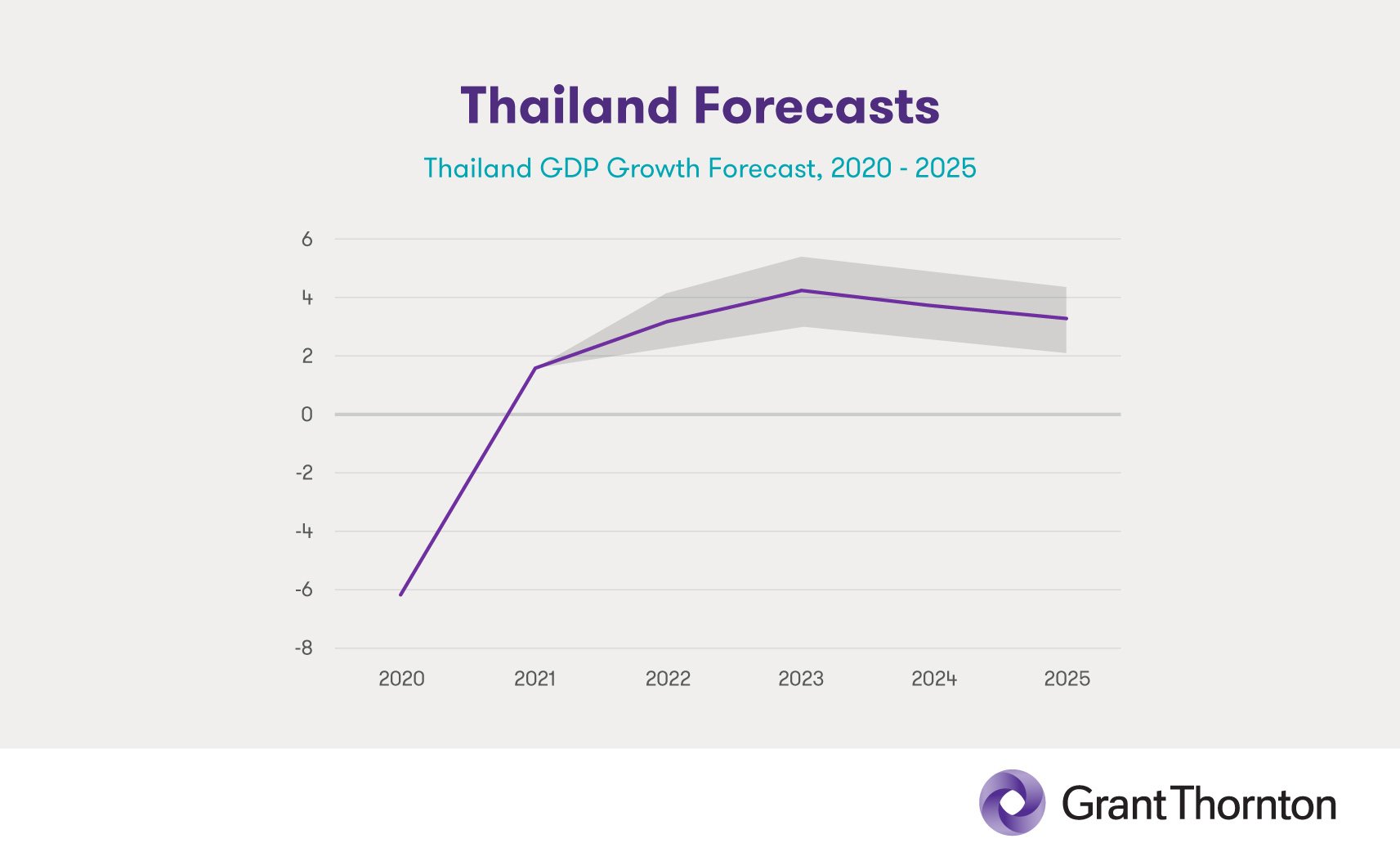

- Impact on Economic Growth: Negative inflation can significantly dampen economic growth projections for Thailand, creating a challenging environment for both short-term and long-term economic expansion. The BOT's growth forecasts are likely to be revised downward.

The Bank of Thailand's Monetary Policy Response

Current Interest Rate Strategies

The Bank of Thailand (BOT) has been actively responding to the deflationary pressures through adjustments to its monetary policy. The central bank's primary tool is the policy interest rate, which influences borrowing costs throughout the economy.

- Current Interest Rate Stance: The BOT has [Insert Current Interest Rate Policy – e.g., maintained, lowered] its policy interest rate to [Insert Current Rate]% in an attempt to stimulate economic activity and counteract deflationary pressures.

- Effectiveness of Previous Rate Adjustments: Previous rate cuts [Insert Description of Effectiveness – e.g., have had a limited impact, have shown some signs of stimulating growth]. The central bank is carefully monitoring the effectiveness of these adjustments.

- Potential Future Rate Changes: Future adjustments to interest rates will depend on the evolving economic data, including inflation expectations, economic growth figures, and other key indicators. The BOT will likely continue its assessment of the situation, adjusting its policies as needed.

Other Monetary Policy Tools

Beyond interest rates, the BOT employs several other monetary policy tools to influence liquidity and credit conditions within the Thai economy.

- Liquidity Management: The BOT utilizes various open market operations to manage liquidity in the banking system. This can involve buying or selling government bonds to influence interest rates and credit availability.

- Effectiveness of Other Tools: The effectiveness of these additional tools in countering deflation depends on various factors, including the overall economic climate and the responsiveness of the financial markets.

- Potential Future Use: The BOT may employ a combination of these tools in future policy adjustments to ensure a balanced and effective response to the current situation.

Outlook and Implications for Businesses and Investors

Impact on Businesses

The current deflationary environment presents both challenges and opportunities for Thai businesses.

- Strategies for Businesses: Businesses should adopt cost-cutting measures, explore innovative pricing strategies, and focus on enhancing productivity to maintain profitability. Diversification and exploration of new markets can also mitigate risks.

- Opportunities for Businesses: Sectors less susceptible to deflationary pressures, such as essential goods and services, may experience increased demand. Businesses in these sectors may benefit from this.

- Challenges Faced by Businesses: Small and medium-sized enterprises (SMEs) may be particularly vulnerable to the deflationary environment due to their limited financial resources and market power.

Implications for Investors

The economic landscape presents a complex set of opportunities and risks for investors in the Thai economy.

- Investment Opportunities: The lower interest rate environment could make certain asset classes, such as bonds, more attractive. However, a thorough risk assessment is crucial.

- Impact on the Thai Baht: The strength of the Thai Baht needs to be carefully considered when making investment decisions, as it can impact returns for foreign investors.

- Attractiveness of Thai Assets: The overall attractiveness of Thai assets relative to global markets will depend on several factors, including economic growth forecasts, political stability, and investor sentiment.

Conclusion

This analysis of Thailand's economic outlook reveals a complex interplay between negative inflation and the BOT's monetary policy responses. The causes of deflation are multi-faceted, and the effectiveness of the BOT's actions remains to be fully seen. Businesses and investors need to carefully consider the implications of this unique economic climate and adapt their strategies accordingly.

Call to Action: Stay informed on the evolving Thailand economic outlook, including updates on negative inflation and monetary policy shifts, to make informed business and investment decisions. Regularly monitor the Bank of Thailand's announcements and economic reports for the latest data and insights into the Thai economy. Understanding the nuances of the Thai economy and its response to negative inflation is crucial for navigating this dynamic period.

Featured Posts

-

Cassidy Hutchinsons Memoir Key Witness To January 6th To Detail Events This Fall

May 07, 2025

Cassidy Hutchinsons Memoir Key Witness To January 6th To Detail Events This Fall

May 07, 2025 -

Understanding Dinas Role In The Last Of Us Season 2 Isabela Merceds Performance

May 07, 2025

Understanding Dinas Role In The Last Of Us Season 2 Isabela Merceds Performance

May 07, 2025 -

Jayzt Injaz Alemr Ljaky Shan Fy Mhrjan Lwkarnw Alsynmayy

May 07, 2025

Jayzt Injaz Alemr Ljaky Shan Fy Mhrjan Lwkarnw Alsynmayy

May 07, 2025 -

Expert Insight Predicting The Future Of Steelers Wide Receiver George Pickens

May 07, 2025

Expert Insight Predicting The Future Of Steelers Wide Receiver George Pickens

May 07, 2025 -

Analyzing Randles Performance Lakers Vs Timberwolves

May 07, 2025

Analyzing Randles Performance Lakers Vs Timberwolves

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025