Thailand Inflation: Negative Turn Signals More Interest Rate Cuts

Table of Contents

Declining Inflation Rates in Thailand

Recent Data and its Implications

The Consumer Price Index (CPI), a key measure of Thailand inflation, has shown a concerning downward trend. For example, the year-on-year CPI change in August 2024 (replace with actual data when available) registered a decrease of X%, significantly lower than the projected Y% and marking a considerable deviation from the positive inflation rates observed earlier in the year. This negative turn signifies a weakening domestic demand and presents a challenge to the economic outlook. This unexpected drop signals a cooling economy, unlike the predicted modest inflationary pressure. The implications are far-reaching, potentially affecting everything from consumer spending to business investment.

- August 2024 CPI: -X% (Year-on-Year) – replace with actual data

- July 2024 CPI: -Z% (Year-on-Year) – replace with actual data

- Deviation from prediction: -W percentage points – replace with actual data

Factors Contributing to the Negative Turn

Several factors have converged to contribute to this negative turn in Thailand inflation. Understanding these contributing factors is crucial for predicting future trends and formulating appropriate economic policies.

- Global Economic Slowdown: Reduced global demand has dampened exports, a significant contributor to the Thai economy. Lower export volumes translate to decreased prices and contribute to deflationary pressures.

- Lower Oil Prices: The decline in global oil prices has significantly reduced transportation and production costs across various sectors. This has a direct impact on the prices of goods and services, pushing inflation downwards.

- Government Policies: Government initiatives aimed at controlling inflation, such as subsidies or price controls on essential goods, might have contributed to the downward trend, although their effectiveness needs further analysis.

- Seasonal Factors: Seasonal fluctuations in agricultural prices and tourism can also influence the CPI, contributing to temporary dips in inflation.

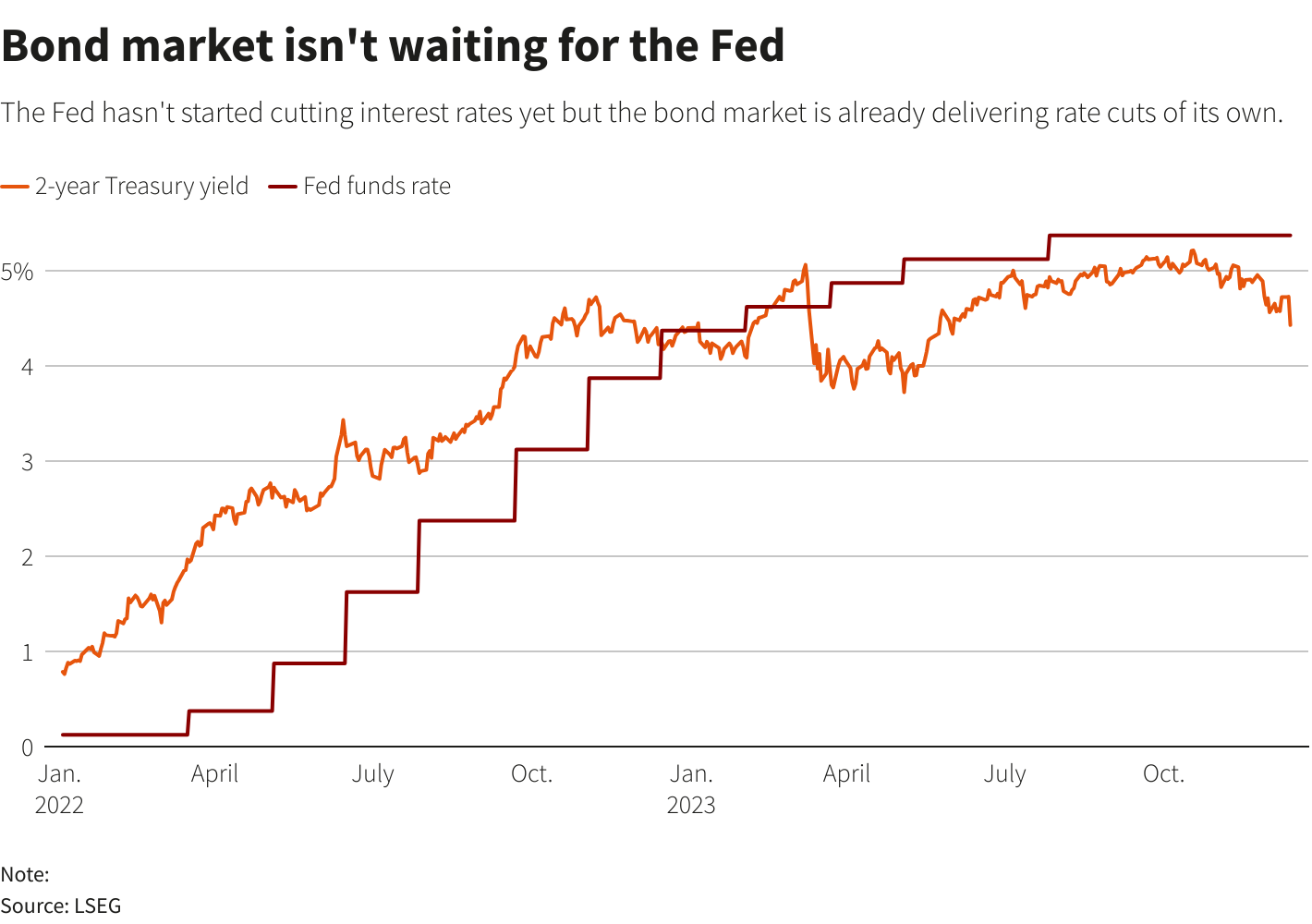

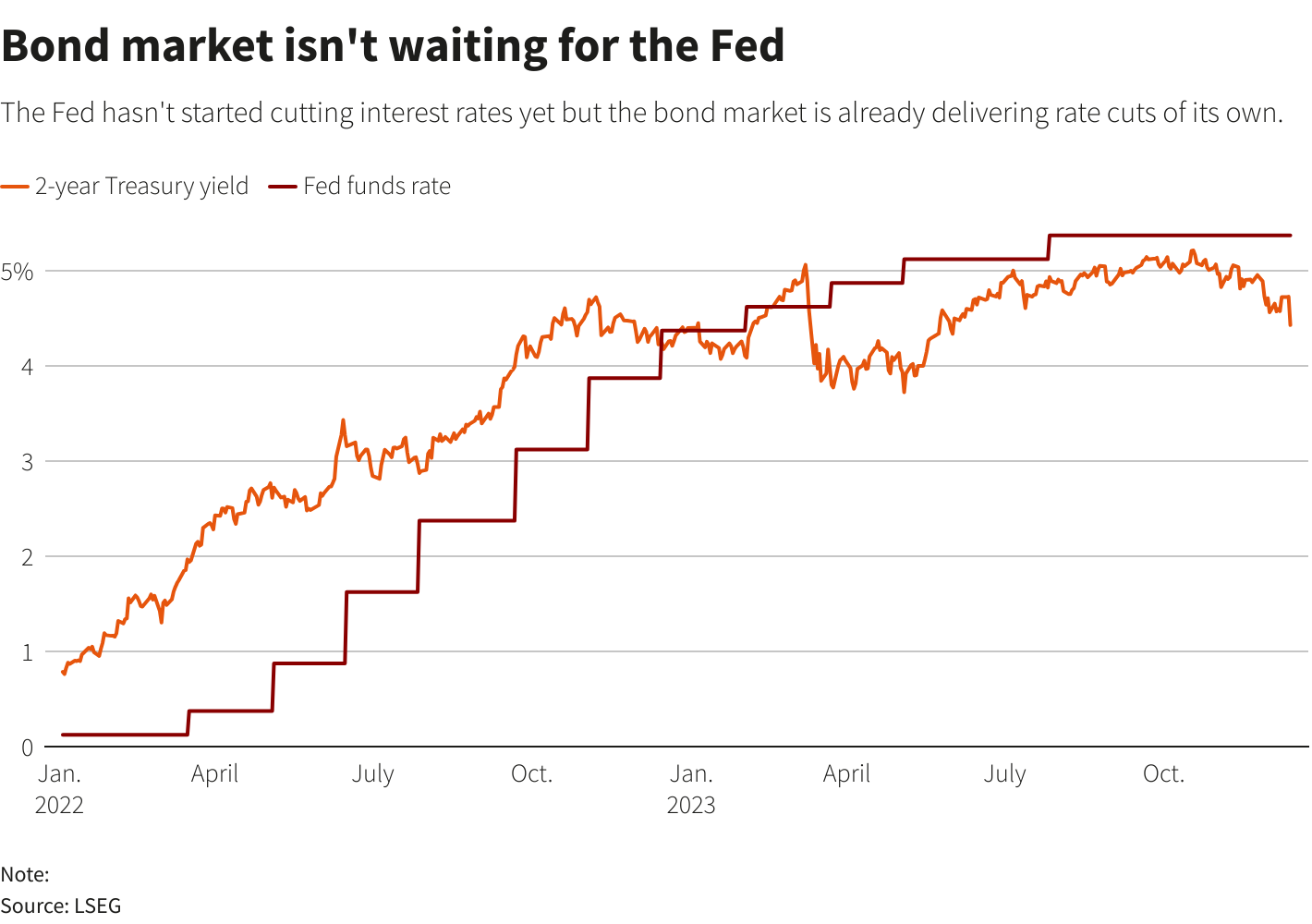

The Bank of Thailand's Response and Future Monetary Policy

Probability of Further Interest Rate Cuts

Given the negative turn in Thailand inflation, the Bank of Thailand (BOT) is likely to respond with further interest rate cuts. The rationale is straightforward: stimulate economic activity by making borrowing cheaper for businesses and consumers. Lower interest rates can encourage investment and spending, ultimately boosting demand and pulling the economy out of its current slump.

- Potential Rate Cut: A reduction of 0.25% or even 0.5% is being speculated by market analysts. replace with actual data or analysis from financial news

- Economic Rationale: To counter deflationary risks and stimulate economic growth.

- Risks: While rate cuts can stimulate growth, there's a risk of fueling excessive borrowing and potentially leading to future inflationary pressures if not managed carefully.

Impact on the Thai Economy

The impact of further interest rate cuts on the Thai economy will be multifaceted.

- Stimulating Economic Growth: Lower interest rates should incentivize businesses to invest and expand, creating jobs and boosting economic growth.

- Impact on Borrowing Costs: Businesses and consumers will benefit from lower borrowing costs, making it cheaper to finance investments and purchases.

- Potential Risks: While stimulating short-term growth, prolonged periods of low interest rates could inflate asset bubbles and lead to future instability.

- Sectoral Impact: The tourism sector might benefit from increased consumer spending, while manufacturing might see improvements in export competitiveness. The real estate sector could experience increased activity due to lower mortgage rates.

Risks and Uncertainties

Potential for Deflation

A prolonged period of negative inflation could lead to deflation, a scenario where prices consistently fall. This can have severe consequences, as consumers delay purchases anticipating further price drops, leading to decreased demand and economic stagnation. A deflationary spiral can be difficult to escape, requiring strong government intervention. The BOT needs to carefully monitor the situation to mitigate the risk of such a spiral.

Global Economic Factors

Thailand's economy is significantly influenced by global economic conditions. A further slowdown in major economies or unexpected global events could exacerbate deflationary pressures in Thailand, creating significant uncertainties. The interconnectedness of the global economy means that Thailand's inflation trajectory is susceptible to external shocks.

Conclusion

The unexpected negative turn in Thailand inflation presents a complex scenario for the Thai economy. While further interest rate cuts are likely in response to this trend, careful consideration must be given to the potential risks of deflation and the impact on various sectors. Staying informed about the evolving situation of Thailand inflation is crucial for businesses and investors alike. Monitor the Bank of Thailand's announcements closely and consult with financial experts to navigate this dynamic economic landscape. Understanding the intricacies of Thailand inflation and its implications is vital for making informed financial decisions. Keep updated on the latest news and analysis regarding Thailand's inflation rate to best manage your investments and economic strategies.

Featured Posts

-

Who Wants To Be A Millionaire Easy Question Three Lifelines Used Can You Solve It

May 07, 2025

Who Wants To Be A Millionaire Easy Question Three Lifelines Used Can You Solve It

May 07, 2025 -

Jenna Ortega And Glen Powell New Fantasy Film To Begin Filming In London

May 07, 2025

Jenna Ortega And Glen Powell New Fantasy Film To Begin Filming In London

May 07, 2025 -

The Trump Presidency And The American Film Industry A Retrospective On Production Shifts

May 07, 2025

The Trump Presidency And The American Film Industry A Retrospective On Production Shifts

May 07, 2025 -

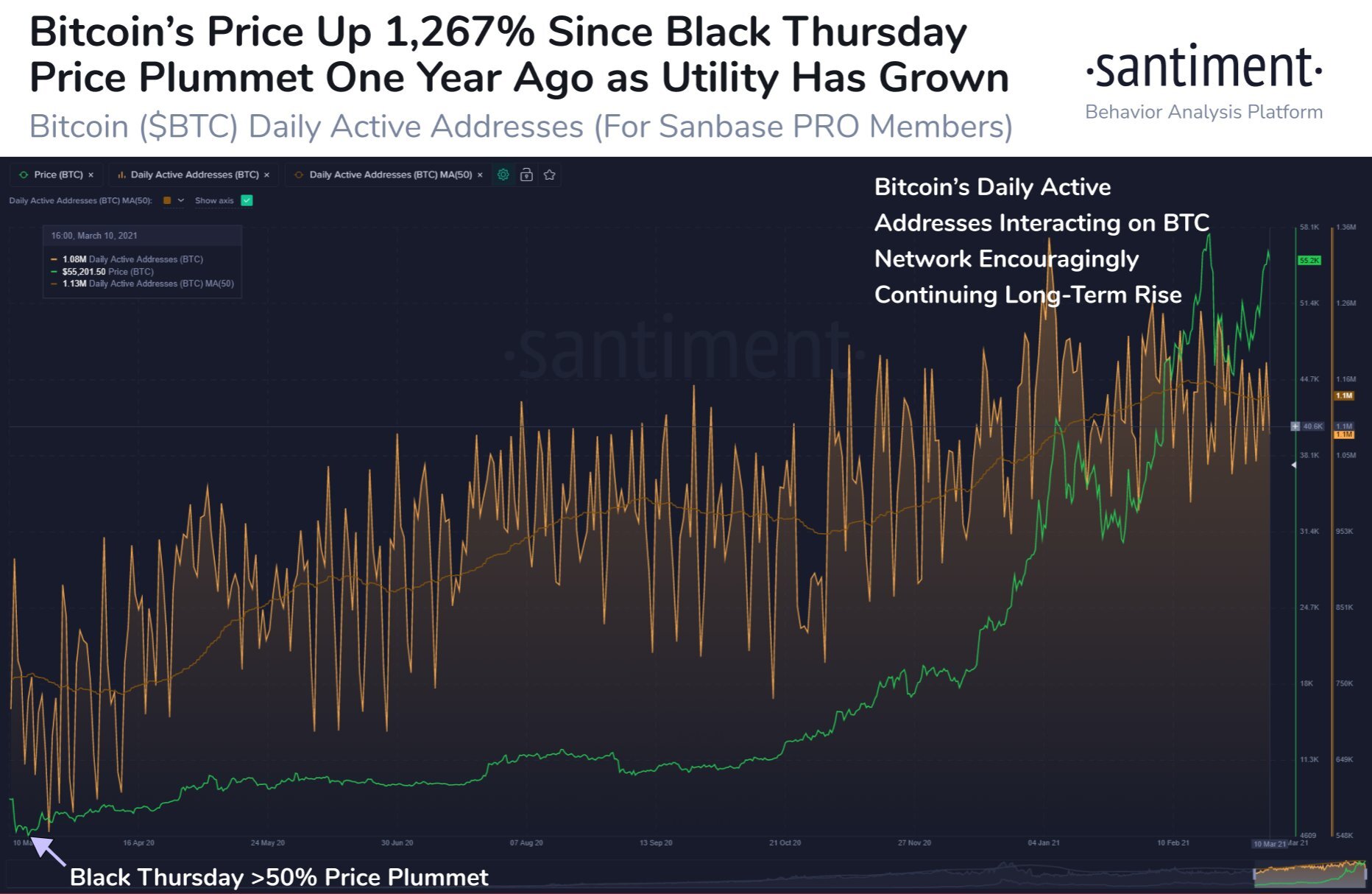

Bitcoin Surges Past 10 Week High Nearing Us 100 000

May 07, 2025

Bitcoin Surges Past 10 Week High Nearing Us 100 000

May 07, 2025 -

Wednesday April 9th Lotto Results Check The Winning Numbers Now

May 07, 2025

Wednesday April 9th Lotto Results Check The Winning Numbers Now

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025