Thames Water Executive Bonuses: A Case Study In Corporate Governance

Table of Contents

The Scale and Justification of the Bonuses

Financial Performance vs. Bonus Payments

A significant disconnect exists between Thames Water's financial performance and the substantial executive bonuses awarded. While precise figures fluctuate depending on the year and individual executive, reports indicate millions of pounds were paid out in bonuses despite significant operational challenges and environmental failings. For instance, [insert specific data on bonus payments with source citation, e.g., "In 2022, the CEO received a bonus of £X million, while the company reported a Y% decrease in profit" (Source: [ reputable news source])]. This contrasts sharply with metrics reflecting poor performance, including:

- Increased instances of sewage discharges into rivers and waterways.

- Significant debt levels impacting investment in infrastructure upgrades.

- Falling customer satisfaction ratings.

- Deteriorating water quality in several areas.

The metrics used to justify these bonuses are questionable, often prioritizing short-term financial gains over long-term sustainability and environmental responsibility. Were these metrics appropriate, given the severe operational failures? A thorough investigation is required to determine whether the metrics were accurately assessed and represented the true state of the company.

Public Scrutiny and the Negative PR

The public backlash against Thames Water executive bonuses has been intense and widespread. Negative press coverage has included [insert specific examples of negative media coverage with links, e.g., "Articles in the Guardian and BBC News highlighted the stark contrast between executive pay and the state of the water system" (Links to articles)]. Social media has been flooded with outrage, with #ThamesWater and related hashtags trending frequently. This negative publicity has significantly damaged Thames Water's reputation and brand image, leading to a loss of public trust. The company's failure to adequately address public concerns has further exacerbated the negative sentiment.

Corporate Governance Failures at Thames Water

Role of the Board of Directors

The board of directors bears significant responsibility for overseeing executive compensation. Questions remain about the board's composition, the independence of its members, and their relevant expertise in managing a water utility facing such significant challenges. The approval process for the executive bonuses needs scrutiny. Were there sufficient discussions and considerations of the company's performance and its impact on public services and the environment? Were any conflicts of interest present among board members? Investigating these questions is crucial for understanding the failures in corporate governance.

Regulatory Oversight and Accountability

Ofwat, the water regulator, has a crucial role in overseeing Thames Water and ensuring responsible executive compensation. Its powers to intervene and enforce regulations on executive pay require closer examination. Did Ofwat take sufficient action to prevent or address the excessive bonuses? Were existing regulations adequate to prevent this situation? If not, what further regulatory mechanisms are needed? A review of Ofwat's response is necessary to ensure accountability and to prevent similar incidents in the future.

Shareholder Activism and Response

The role of shareholders in challenging the executive bonuses warrants scrutiny. Were there shareholder votes on executive compensation? What level of shareholder pressure, if any, was exerted to modify compensation practices? Did institutional investors exercise their influence to demand changes? The lack of significant shareholder activism raises concerns about the effectiveness of shareholder engagement in influencing corporate decision-making.

Ethical Considerations and Public Trust

The Moral Hazard of Excessive Bonuses

Awarding substantial bonuses despite widespread sewage spills and poor service creates a significant moral hazard. It undermines public trust not only in Thames Water but in the broader corporate sector and regulatory bodies. Such practices create a perception that environmental responsibility and public service are secondary to executive enrichment. This contrasts starkly with best practices in corporate governance which emphasize ethical conduct, accountability, and social responsibility.

Long-Term Consequences for Thames Water

The Thames Water executive bonuses scandal will have long-term consequences. Investor confidence has likely been shaken, potentially impacting the company's ability to secure future funding. Increased regulatory scrutiny is inevitable, potentially leading to stricter rules governing executive compensation and performance metrics. This case underscores the need for significant reforms in compensation structures within the water industry and more broadly.

Conclusion: Learning from the Thames Water Executive Bonuses Case

The Thames Water executive bonuses case highlights a profound disconnect between executive compensation, corporate performance, and public service. The substantial bonuses awarded despite poor performance and significant environmental damage represent a failure of corporate governance at multiple levels. Understanding Thames Water executive bonuses is crucial for understanding the broader issues of corporate accountability and the need for stronger regulatory oversight. Further research into Thames Water executive compensation is needed to inform future reforms. The Thames Water case should prompt a review of executive pay structures, regulatory frameworks, and the role of shareholders in holding companies accountable for their actions. Let's ensure this doesn't happen again.

Featured Posts

-

Melanie Thierry Une Carriere Exceptionnelle Et Une Vie Privee Discrete

May 26, 2025

Melanie Thierry Une Carriere Exceptionnelle Et Une Vie Privee Discrete

May 26, 2025 -

Top 5 Hudson Valley Restaurants For Shrimp

May 26, 2025

Top 5 Hudson Valley Restaurants For Shrimp

May 26, 2025 -

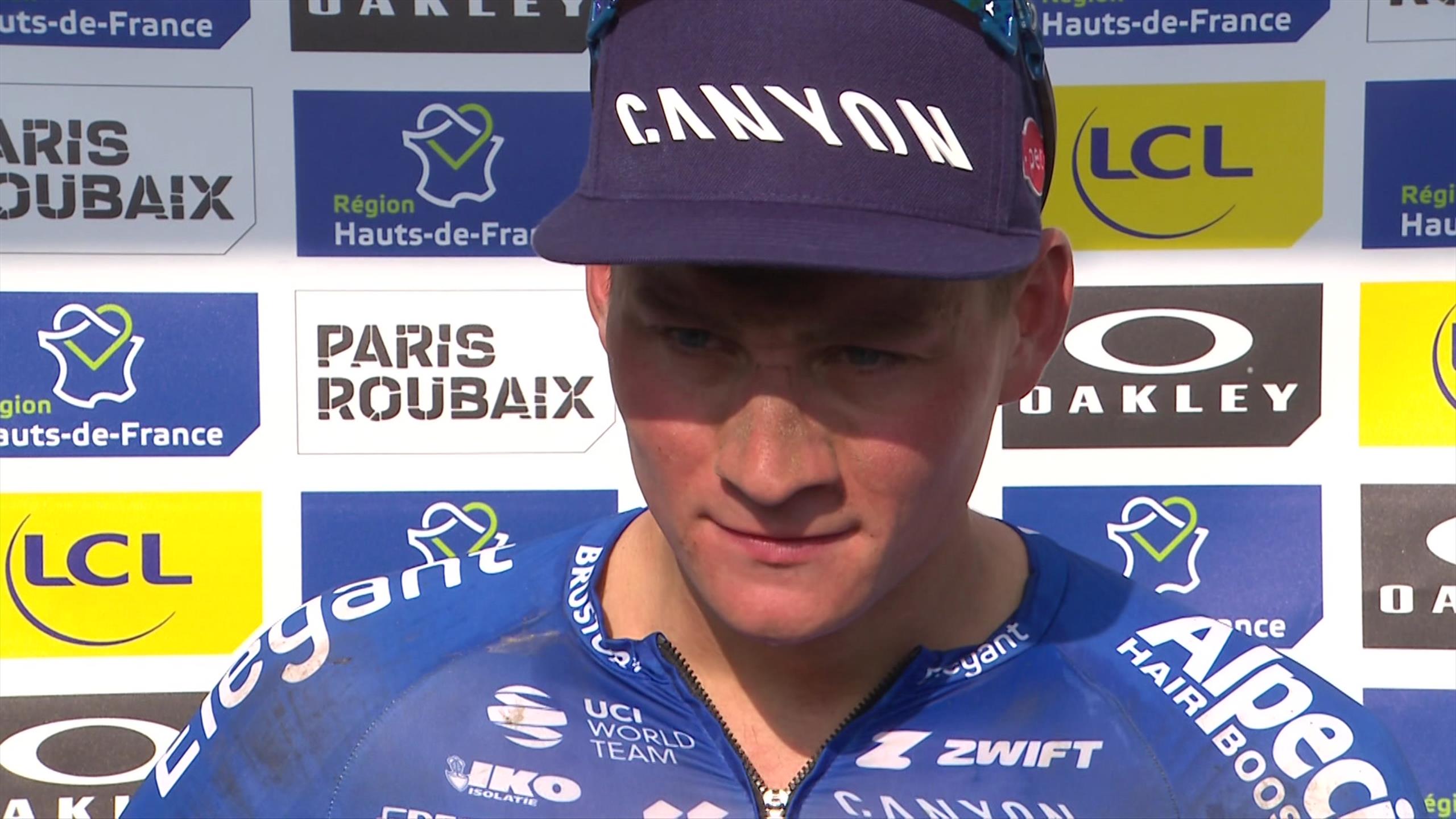

Mathieu Van Der Poel Achieves Historic Paris Roubaix Hat Trick

May 26, 2025

Mathieu Van Der Poel Achieves Historic Paris Roubaix Hat Trick

May 26, 2025 -

Finding Joy Amidst Sorrow Jonathan Peretzs Story Of Loss And Resilience

May 26, 2025

Finding Joy Amidst Sorrow Jonathan Peretzs Story Of Loss And Resilience

May 26, 2025 -

Flood Warning Stay Safe With Nws Flood Safety Tips

May 26, 2025

Flood Warning Stay Safe With Nws Flood Safety Tips

May 26, 2025

Latest Posts

-

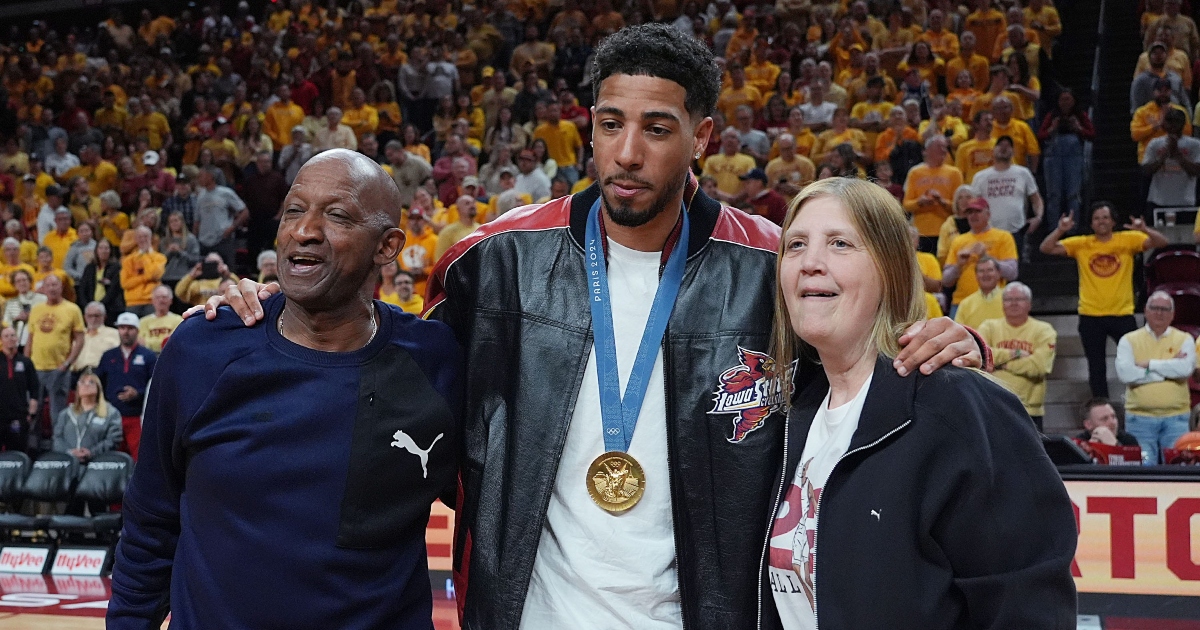

Indiana Pacers Lift Suspension Against Tyrese Haliburtons Father

May 28, 2025

Indiana Pacers Lift Suspension Against Tyrese Haliburtons Father

May 28, 2025 -

Haliburtons Fathers Pacers Suspension Lifted

May 28, 2025

Haliburtons Fathers Pacers Suspension Lifted

May 28, 2025 -

Nba Ban Lifted John Haliburton Returns To Support Tyrese Haliburton

May 28, 2025

Nba Ban Lifted John Haliburton Returns To Support Tyrese Haliburton

May 28, 2025 -

John Haliburton The Significance Of His Return To Pacers Games

May 28, 2025

John Haliburton The Significance Of His Return To Pacers Games

May 28, 2025 -

Tyrese Haliburtons Father Back At Pacers Games Following Nba Ban

May 28, 2025

Tyrese Haliburtons Father Back At Pacers Games Following Nba Ban

May 28, 2025