The 2025 D-Wave Quantum (QBTS) Stock Market Performance: A Comprehensive Review

Table of Contents

QBTS Stock Price Fluctuations and Key Influencing Factors in 2025

Our hypothetical analysis of QBTS stock price movements throughout 2025 reveals a dynamic and fluctuating market. Several key factors would significantly influence its performance. The overall market sentiment towards quantum computing plays a crucial role, with positive news and technological breakthroughs leading to price increases and negative news causing dips.

-

Impact of successful product launches or partnerships on QBTS stock price: Imagine a scenario where D-Wave successfully launches a groundbreaking new quantum annealing system, securing major partnerships with leading industries. This would likely trigger a significant surge in QBTS stock price, driven by increased investor confidence and market demand.

-

Effect of competitor advancements on QBTS valuation: Conversely, significant advancements by competitors like IBM or Google in gate-based quantum computing could negatively impact QBTS's valuation. Investors might shift their focus to companies perceived as having more competitive technologies.

-

Influence of government regulations and funding on the quantum computing sector and QBTS: Government regulations and funding initiatives targeting quantum computing research and development would profoundly impact the entire sector, including QBTS. Increased government support could lead to a surge in QBTS stock price, while restrictive regulations could have the opposite effect.

-

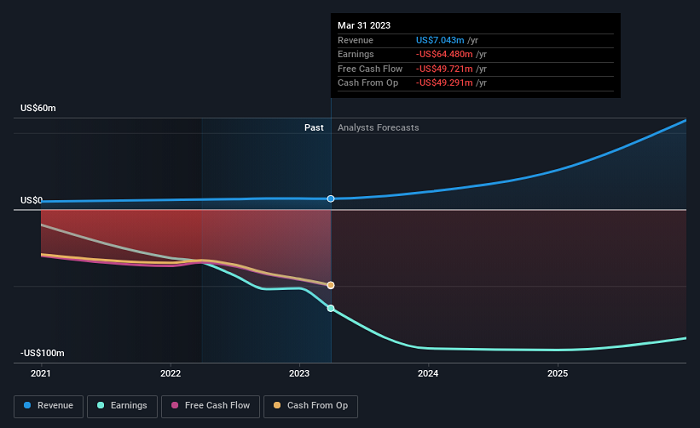

Analysis of QBTS's financial performance (revenue, profit, etc.) and its effect on stock price: QBTS's financial performance, including revenue growth, profitability, and overall financial health, would directly influence its stock price. Positive financial results would typically lead to an increase in stock value, while disappointing results could lead to a decrease.

Investment Analysis: QBTS Stock as a Long-Term Investment in 2025

Considering the projected growth trajectory of the quantum computing industry, QBTS stock presents both high potential and considerable risk as a long-term investment in 2025.

-

Comparison with other quantum computing stocks and the overall tech market: The performance of QBTS would need to be compared to other players in the quantum computing market and the broader technology sector. Outperformance in comparison to the market would be a positive indicator.

-

Discussion of valuation metrics (P/E ratio, etc., if applicable): Traditional valuation metrics, though challenging to apply consistently to early-stage companies, could offer insights into QBTS's relative value. However, considering the inherent uncertainties of the quantum computing sector, these metrics need to be interpreted with caution.

-

Potential return on investment (ROI) scenarios: The potential ROI for QBTS in 2025 would depend on various factors, including the company's success in commercializing its technology, market adoption rate, and competitive landscape. Scenarios ranging from significant gains to potential losses need to be considered.

-

Risk mitigation strategies for investors: Investors should diversify their portfolio, avoid over-investing in a single quantum computing stock, and conduct thorough due diligence before investing in QBTS.

Competitive Landscape and D-Wave's Market Positioning in 2025

D-Wave's competitive landscape in 2025 would be intense. The company's success hinges on its ability to maintain a strong market position amidst competition from giants like IBM and Google.

-

Comparison of D-Wave's technology with competitors (e.g., superconducting vs. trapped ion technologies): D-Wave's quantum annealing technology differentiates it from gate-based approaches employed by competitors. The relative advantages and disadvantages of each approach will shape the market share distribution.

-

Discussion of D-Wave's strategic partnerships and collaborations: D-Wave's partnerships and collaborations with leading organizations across various industries will be crucial for driving market adoption and revenue growth.

-

Analysis of D-Wave's R&D investments and their impact on future competitiveness: Continuous investment in research and development is vital for D-Wave to remain competitive. Advancements in its technology and ability to address market needs will be decisive factors.

Analyst Predictions and Future Outlook for QBTS in 2025

Hypothetical analyst predictions for QBTS in 2025 would likely range from bullish to bearish, reflecting the inherent uncertainty in the quantum computing sector.

-

Summary of bullish and bearish predictions: Bullish predictions might highlight the potential for significant growth driven by successful product launches and market adoption. Bearish predictions could focus on competitive pressures and challenges in scaling the technology.

-

Potential catalysts for significant stock price movements: Major technological breakthroughs, successful partnerships, regulatory changes, and overall market sentiment shifts would be potential catalysts for significant stock price movements.

-

Long-term growth potential of the quantum computing industry and its reflection on QBTS: The long-term growth potential of the quantum computing industry remains immense. D-Wave's success in capitalizing on this potential would significantly influence QBTS's long-term trajectory.

Conclusion: Investing in D-Wave Quantum (QBTS) in 2025: A Final Verdict

Our hypothetical analysis of QBTS stock performance in 2025 reveals a complex picture shaped by technological advancements, competitive pressures, and overall market sentiment. While the potential returns are significant, so are the risks. The success of QBTS would strongly depend on D-Wave's ability to innovate, secure partnerships, and navigate a competitive landscape. This hypothetical analysis underscores the importance of thorough research and diversification before investing in QBTS or any other quantum computing stock. Remember to consult financial professionals and utilize resources like SEC filings and financial news sources to make informed decisions regarding your investment in D-Wave Quantum (QBTS). This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Allegations

May 20, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over January 6th Allegations

May 20, 2025 -

Mick Schumachers Cadillac Hopes Rise As F1 Champion Offers Support

May 20, 2025

Mick Schumachers Cadillac Hopes Rise As F1 Champion Offers Support

May 20, 2025 -

Chivas Regal And Charles Leclerc A Winning Partnership

May 20, 2025

Chivas Regal And Charles Leclerc A Winning Partnership

May 20, 2025 -

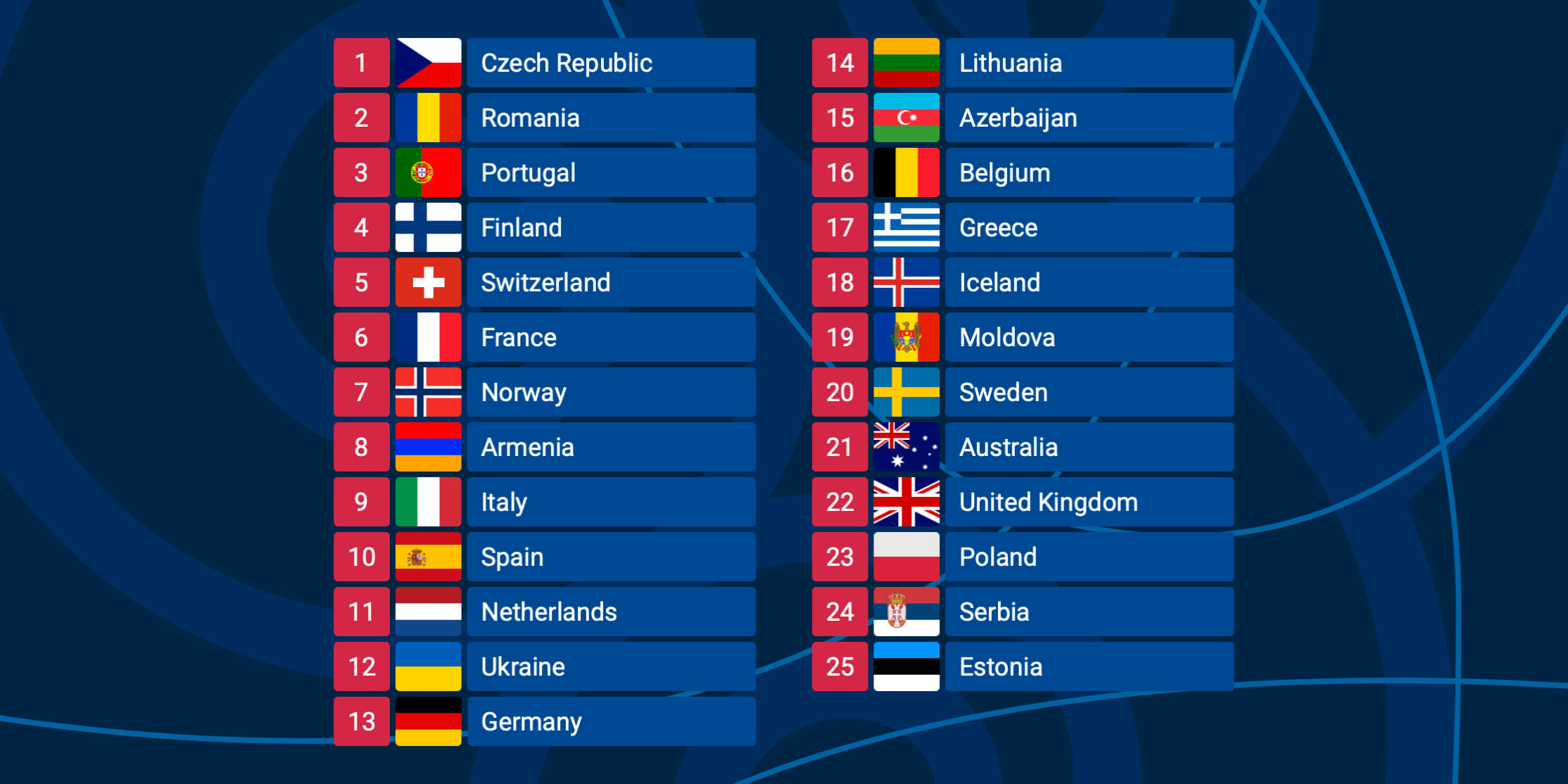

Eurovision 2025 Finalists A Ranking From Hypnotic To Atrocious

May 20, 2025

Eurovision 2025 Finalists A Ranking From Hypnotic To Atrocious

May 20, 2025 -

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Jennifer Lawrence Majcinstvo I Drugo Dijete

May 20, 2025

Latest Posts

-

Ktore Pracovne Prostredie Je Efektivnejsie Home Office Alebo Kancelaria

May 20, 2025

Ktore Pracovne Prostredie Je Efektivnejsie Home Office Alebo Kancelaria

May 20, 2025 -

Ekdilosi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

Ekdilosi Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Nvidia Ai

May 20, 2025

Nvidia Ai

May 20, 2025 -

Buducnost Prace Home Office Kancelaria Alebo Hybridny Model

May 20, 2025

Buducnost Prace Home Office Kancelaria Alebo Hybridny Model

May 20, 2025 -

I Megali Tessarakosti Esperida Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025

I Megali Tessarakosti Esperida Stin Patriarxiki Ekklisiastiki Akadimia Kritis

May 20, 2025