The Airline Industry's Vulnerability To Oil Supply Chain Instability

Table of Contents

The Direct Impact of Oil Price Volatility on Airline Operations

The most immediate and significant impact of oil supply chain instability is the volatility of oil prices. This volatility directly translates into fluctuating fuel costs, a major expense for airlines, often exceeding 30% of their operating costs.

Increased Fuel Costs:

Higher oil prices lead to significantly increased fuel costs, squeezing profit margins and forcing airlines to make difficult decisions. This can manifest in several ways:

-

Reduced Profit Margins: Airlines face decreased profitability, impacting their ability to invest in fleet upgrades, expansion, and employee compensation.

-

Increased Ticket Prices: To offset increased fuel costs, airlines may pass some of the expense onto consumers through higher ticket prices, potentially reducing demand.

-

Unequal Impact: Airlines with less fuel-efficient aircraft or less effective fuel management strategies are disproportionately affected by price spikes.

-

Examples: During the 2008 oil price spike, many airlines experienced significant financial distress. Similarly, the price fluctuations seen in recent years have highlighted the industry's vulnerability. Data from IATA (International Air Transport Association) shows that fuel costs consistently rank among the top three operating expenses for most airlines globally.

Fuel Hedging Strategies and their Limitations:

To mitigate the risk of oil price volatility, airlines often employ hedging strategies, such as purchasing futures contracts or options. These strategies aim to lock in fuel prices at a predetermined rate, reducing the impact of future price increases. However, they are not without their limitations:

-

Market Prediction Inaccuracy: Hedging relies on accurate market predictions. If oil prices move contrary to the prediction, airlines can incur substantial losses.

-

Contract Length and Flexibility: The effectiveness of hedging depends significantly on the length of the contract and the ability to adjust positions based on changing market conditions. Long-term contracts can offer protection but limit flexibility in response to sudden price shifts.

-

Complex Strategies: Effective hedging requires sophisticated financial modeling and expertise, making it costly and complex to implement.

-

Examples: While some airlines have successfully utilized hedging to reduce their exposure to price volatility, others have experienced significant losses due to inaccurate market forecasts and unforeseen events. The effectiveness of hedging is also highly dependent on the time horizon and the specific market conditions.

Indirect Impacts of Oil Supply Chain Disruptions

Beyond price volatility, disruptions to the oil supply chain itself can have significant indirect consequences for the airline industry.

Operational Disruptions and Flight Delays:

Supply chain disruptions, such as refinery outages, logistical bottlenecks, or geopolitical instability, can directly impact fuel availability at airports. This can lead to:

-

Fuel Shortages: Airports may experience temporary or even prolonged fuel shortages, resulting in flight delays and cancellations.

-

Revenue Loss: Delays and cancellations directly translate into lost revenue for airlines, affecting both passenger and cargo operations.

-

Reputational Damage: Disruptions can damage an airline's reputation, impacting customer loyalty and future bookings. Poor on-time performance becomes a major customer concern.

-

Examples: Several instances in recent years have shown how even minor disruptions to the fuel supply chain can have a cascading effect, leading to widespread flight cancellations and significant operational challenges. The ripple effect on connecting flights can further exacerbate the problem.

Geopolitical Instability and its Influence:

Geopolitical events significantly influence oil supply and prices. Airlines are particularly vulnerable to events in oil-producing regions, as any instability in these areas can severely disrupt fuel supplies and lead to price spikes.

-

Regional Vulnerabilities: Airlines operating in or near politically unstable regions face higher risks, making it challenging to plan operations effectively.

-

Long-Term Planning Challenges: The uncertainty caused by geopolitical events makes long-term investment planning difficult for airlines.

-

Price Volatility: Geopolitical tensions often lead to increased price volatility, further exacerbating the challenges faced by airlines.

-

Examples: The ongoing war in Ukraine has highlighted the interconnectedness of geopolitical events and oil prices, impacting fuel costs across the globe and presenting ongoing challenges to airline planning and operations.

Mitigation Strategies for Airline Companies

Airlines need to adopt proactive strategies to mitigate the risks posed by oil supply chain instability.

Fuel Efficiency Improvements:

Reducing fuel consumption is paramount to lessen the impact of price volatility. Strategies include:

-

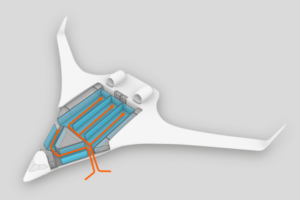

Fuel-Efficient Aircraft: Investing in modern, fuel-efficient aircraft is a long-term solution that delivers significant fuel savings.

-

Alternative Fuels: Exploring and adopting sustainable aviation fuel (SAF) and other biofuels helps reduce reliance on traditional fossil fuels.

-

Route Optimization: Optimizing flight routes and schedules to minimize fuel consumption through efficient flight planning.

-

Examples: Many airlines are investing heavily in new aircraft technologies designed for enhanced fuel efficiency. Airlines are also actively participating in SAF initiatives and exploring alternative fuel sources to reduce their carbon footprint and lessen fuel price volatility.

Enhanced Risk Management and Supply Chain Resilience:

Robust risk management frameworks are crucial for navigating the uncertainties of the oil market:

-

Risk Assessment: Conduct regular risk assessments to identify potential threats and vulnerabilities in the oil supply chain.

-

Fuel Supply Diversification: Secure fuel from multiple suppliers and locations to minimize disruption risk from a single source failure.

-

Contingency Planning: Develop contingency plans to address potential supply chain disruptions, including fuel shortages and price spikes.

-

Examples: Successful risk management strategies involve a combination of proactive monitoring, diversification of suppliers, and the development of detailed contingency plans to mitigate the impact of unexpected disruptions. Building strong relationships with fuel suppliers is another critical factor in enhancing supply chain resilience.

Conclusion

The airline industry's dependence on a stable oil supply chain is undeniable. Volatility in oil prices and disruptions in the supply chain pose significant threats to airline profitability, operational efficiency, and overall sustainability. By implementing proactive mitigation strategies such as fuel efficiency improvements, diversified fuel sourcing, and robust risk management, airlines can enhance their resilience against the challenges of oil supply chain instability. Understanding and addressing the vulnerability of the airline industry to oil supply chain instability is crucial for ensuring the continued growth and success of this vital sector. Proactive planning and investment in effective oil price risk management strategies are essential for the future of the airline industry.

Featured Posts

-

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025 -

Progress Update Jet Zeros Unique Aircraft To Fly By 2027

May 04, 2025

Progress Update Jet Zeros Unique Aircraft To Fly By 2027

May 04, 2025 -

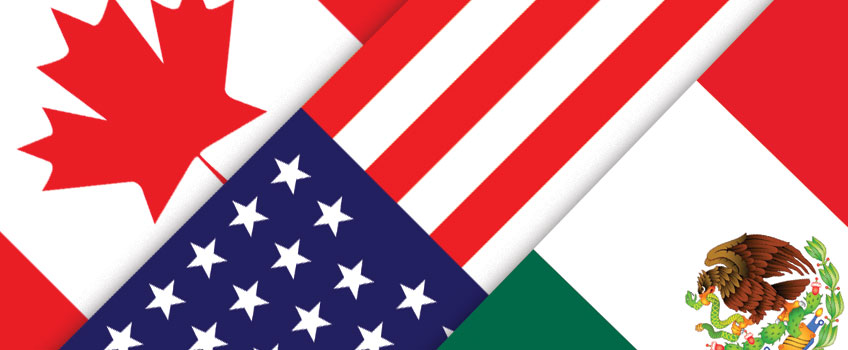

Carneys Meeting With Trump The Future Of Cusma

May 04, 2025

Carneys Meeting With Trump The Future Of Cusma

May 04, 2025 -

Sheins London Ipo Delay Impact Of Us Tariffs

May 04, 2025

Sheins London Ipo Delay Impact Of Us Tariffs

May 04, 2025 -

Analyzing Nicolai Tangens Investment Strategy During The Trump Tariff Era

May 04, 2025

Analyzing Nicolai Tangens Investment Strategy During The Trump Tariff Era

May 04, 2025

Latest Posts

-

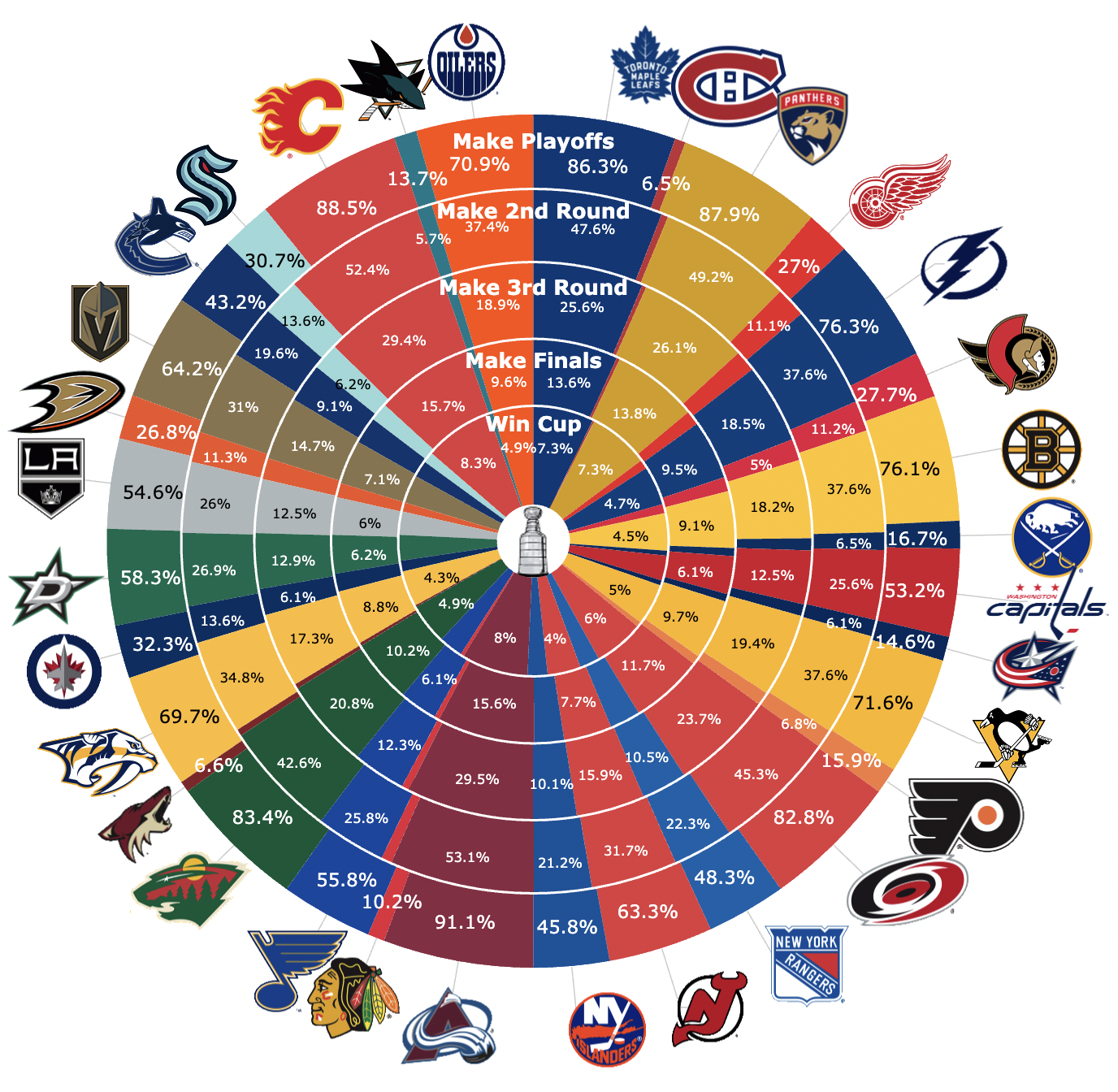

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025

Nhl Playoffs 2024 Who Will Win The Stanley Cup

May 04, 2025 -

Nhl Playoff Matchups Predicting The Stanley Cup Champion

May 04, 2025

Nhl Playoff Matchups Predicting The Stanley Cup Champion

May 04, 2025 -

Gold Investment Concerns Back To Back Weekly Losses In 2025

May 04, 2025

Gold Investment Concerns Back To Back Weekly Losses In 2025

May 04, 2025 -

The Low Uptake Of 10 Year Mortgages In Canada An Analysis

May 04, 2025

The Low Uptake Of 10 Year Mortgages In Canada An Analysis

May 04, 2025 -

Golds 2025 Outlook Assessing The Risk Of Back To Back Weekly Drops

May 04, 2025

Golds 2025 Outlook Assessing The Risk Of Back To Back Weekly Drops

May 04, 2025