The Autonomous Future Of Uber: A Look At Potential ETF Returns

Table of Contents

Uber's Autonomous Vehicle Initiatives and Their Potential

Current State of Uber's Self-Driving Technology

Uber's autonomous vehicle program, while facing challenges, has made significant strides. Their self-driving fleet utilizes advanced technologies such as Lidar (light detection and ranging) for precise environmental mapping, sophisticated AI algorithms for decision-making, and high-definition cameras for object recognition. Recent milestones include successful test runs in select cities and the expansion of their testing programs.

- Technological Advancements: Uber continues to refine its AI algorithms, focusing on improved object detection and prediction capabilities in complex urban environments.

- Testing and Deployment: The company has conducted extensive testing in cities like Pittsburgh, San Francisco, and Phoenix, gradually expanding its operational area.

- Challenges: Significant challenges remain, including regulatory hurdles concerning autonomous vehicle operation, ensuring the safety and reliability of the technology, and overcoming technical limitations in unpredictable driving situations.

Long-Term Vision and Market Domination

Uber's long-term vision involves seamlessly integrating autonomous vehicles into its existing ride-sharing platform. This strategy aims for significant cost reductions by eliminating the need for human drivers, representing a substantial portion of their current operational expenses.

- Cost Reduction: The transition to driverless cars promises a dramatic decrease in labor costs, significantly improving Uber's profit margins.

- Increased Efficiency: Autonomous vehicles can operate 24/7, increasing operational efficiency and potentially expanding service offerings to include autonomous delivery services.

- Market Disruption and Share Growth: Successful implementation of this technology could disrupt the transportation industry, allowing Uber to solidify its position as a dominant player and capture a larger market share.

The Impact on ETF Performance

Identifying Relevant ETFs

Several ETFs hold significant Uber stock, providing investors with exposure to the company's performance and, consequently, its autonomous vehicle initiatives. These include ETFs focused on the technology sector or broader market indices. Examples (note: Specific ETF holdings change, so always check current holdings):

- [Insert Example ETF Ticker Symbol 1 and brief description]: This ETF focuses on...

- [Insert Example ETF Ticker Symbol 2 and brief description]: This ETF provides exposure to…

- [Insert Example ETF Ticker Symbol 3 and brief description]: A more broadly diversified ETF that includes…

Analyzing Potential ROI

The potential return on investment (ROI) for ETFs holding Uber stock hinges on several factors. The success (or failure) of Uber's autonomous vehicle program will be a major determinant.

- Risks: Technological setbacks, regulatory delays, intense competition from established players like Waymo and Tesla, and unforeseen economic downturns pose significant risks.

- Rewards: Successful autonomous vehicle integration could lead to substantial market share growth, cost reductions, and increased profitability, driving significant ROI for investors.

- Diversification: As with any investment, diversification is crucial. Investing solely in Uber-related ETFs would expose investors to considerable risk.

Future Projections and Market Analysis

Predicting the future is inherently challenging, but based on current trends and expert analysis, several scenarios are plausible.

- Optimistic Scenario: Uber successfully integrates autonomous vehicles, achieving significant cost savings and market share gains, resulting in strong ETF performance.

- Pessimistic Scenario: Technological challenges, regulatory hurdles, or intense competition hinder Uber's progress, negatively impacting ETF returns.

- Moderate Scenario: Uber makes gradual progress in autonomous vehicle deployment, leading to moderate growth and moderate ETF returns.

Risks and Considerations for Investors

Regulatory Uncertainty

The regulatory landscape surrounding autonomous vehicles is constantly evolving. Changes in regulations could significantly impact the timeline and cost of deployment, affecting Uber's progress and ETF valuations.

Technological Risks

Developing and deploying safe and reliable autonomous technology is inherently complex and risky. Unforeseen technical challenges or safety concerns could delay progress or lead to significant financial losses.

Competitive Landscape

The autonomous vehicle market is fiercely competitive. Established players like Waymo and Tesla, along with other emerging companies, pose a significant threat to Uber's market position.

Economic Factors

Broader economic trends, such as recessions or changes in consumer spending, can significantly impact demand for ride-sharing services and, consequently, Uber's performance and ETF valuations.

Conclusion

Uber's autonomous vehicle initiatives hold significant promise but also carry considerable risk. Investing in ETFs with exposure to Uber offers the potential for substantial returns but requires a thorough understanding of the inherent uncertainties. The successful integration of self-driving technology is not guaranteed, and investors must carefully weigh the potential rewards against the significant risks involved.

Call to Action: Investing wisely in the autonomous vehicle revolution requires careful research. Explore the potential of Uber ETFs, but remember to conduct thorough due diligence before investing in any ETF related to autonomous vehicle technology. Learn more about investing in the future of transportation and make informed decisions to mitigate risk while pursuing potential high returns.

Featured Posts

-

New Bet Mgm Bonus Code Cuse 150 Claim Your 150 Bonus Now

May 18, 2025

New Bet Mgm Bonus Code Cuse 150 Claim Your 150 Bonus Now

May 18, 2025 -

Secure Bitcoin And Crypto Casinos A 2025 Selection

May 18, 2025

Secure Bitcoin And Crypto Casinos A 2025 Selection

May 18, 2025 -

Best Online Casinos Canada 7 Bit Casino Review And Expert Rating

May 18, 2025

Best Online Casinos Canada 7 Bit Casino Review And Expert Rating

May 18, 2025 -

Wild Casino Your Guide To Real Money Online Gambling In The Us 2025

May 18, 2025

Wild Casino Your Guide To Real Money Online Gambling In The Us 2025

May 18, 2025 -

City Pickle To Open 60 000 Square Foot Pickleball Complex In Brooklyn

May 18, 2025

City Pickle To Open 60 000 Square Foot Pickleball Complex In Brooklyn

May 18, 2025

Latest Posts

-

Candidatos A Diputado Por Rescate Y Transformacion En Cortes Informacion Y Plataformas

May 19, 2025

Candidatos A Diputado Por Rescate Y Transformacion En Cortes Informacion Y Plataformas

May 19, 2025 -

Sitio Web Del Cne Apagado Seis Enlaces Confirman La Decision

May 19, 2025

Sitio Web Del Cne Apagado Seis Enlaces Confirman La Decision

May 19, 2025 -

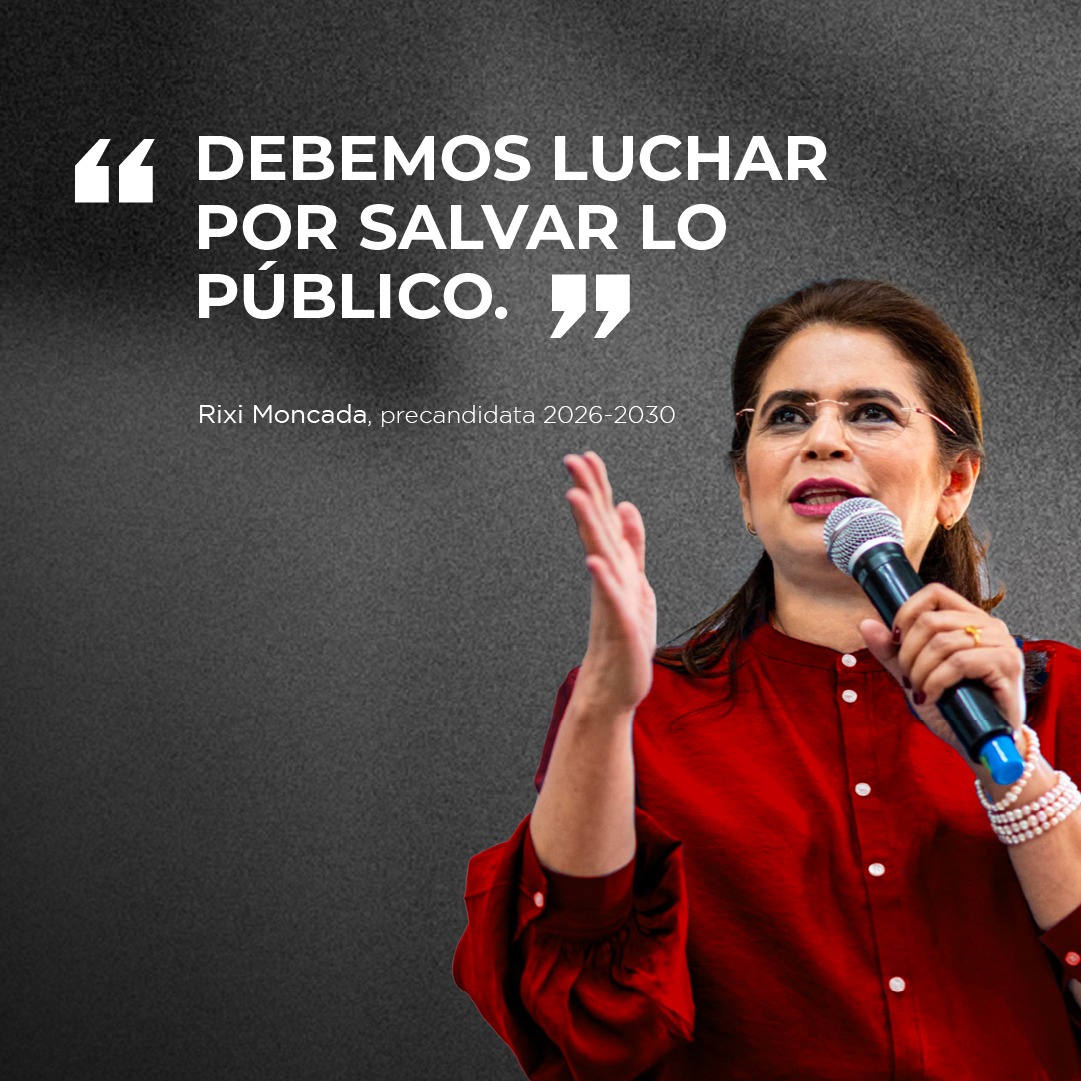

Rixi Moncada Responde A Cossette Lopez Un Choque De Posturas

May 19, 2025

Rixi Moncada Responde A Cossette Lopez Un Choque De Posturas

May 19, 2025 -

Cne Seis Enlaces Demuestran El Apagon Deliberado De Su Sitio Web

May 19, 2025

Cne Seis Enlaces Demuestran El Apagon Deliberado De Su Sitio Web

May 19, 2025 -

Choque De Posturas Rixi Moncada Vs Cossette Lopez

May 19, 2025

Choque De Posturas Rixi Moncada Vs Cossette Lopez

May 19, 2025