The Bank Of Canada's Monetary Policy Under Fire: Rosenberg's Sharp Criticism

Table of Contents

Rosenberg's Core Criticisms of the Bank of Canada's Approach

David Rosenberg's criticisms of the Bank of Canada's monetary policy center around several key arguments, each raising concerns about the current economic trajectory. He believes the Bank's actions are not only ineffective in addressing inflation but also actively harming the Canadian economy.

-

Argument 1: Overly Aggressive Interest Rate Hikes are Stifling Economic Growth: Rosenberg argues that the Bank of Canada's rapid and significant interest rate hikes, aimed at curbing inflation, are unnecessarily harsh and are stifling economic growth. He points to slowing GDP growth figures and weakening consumer confidence as evidence. For example, the recent drop in GDP growth to [insert data point if available, e.g., 0.5% in Q2 2024] supports his claim that the aggressive interest rate policy is having a negative impact on economic expansion. This contrasts with the Bank's projections of [insert contrasting data point if available, e.g., a more optimistic GDP forecast].

-

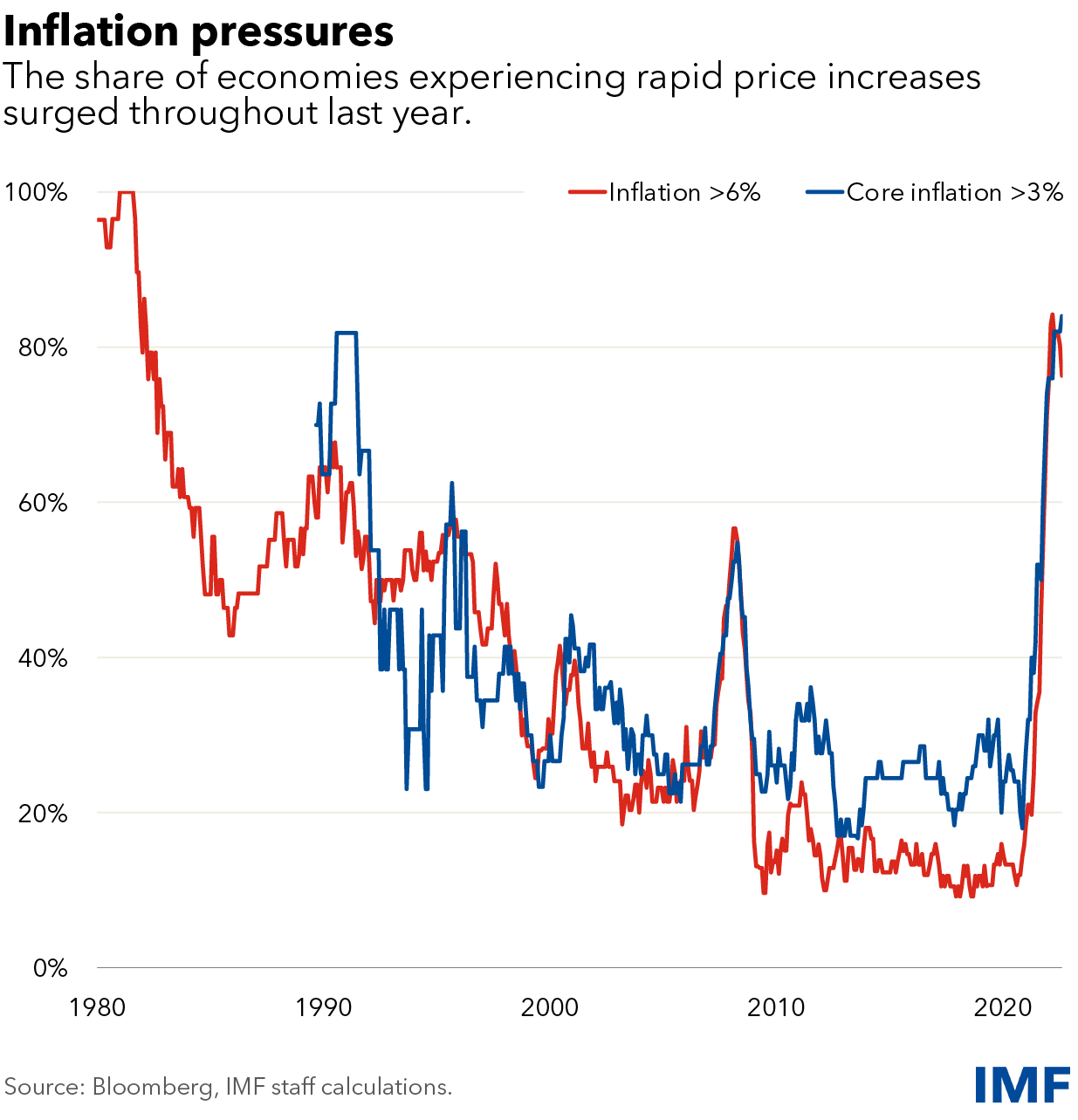

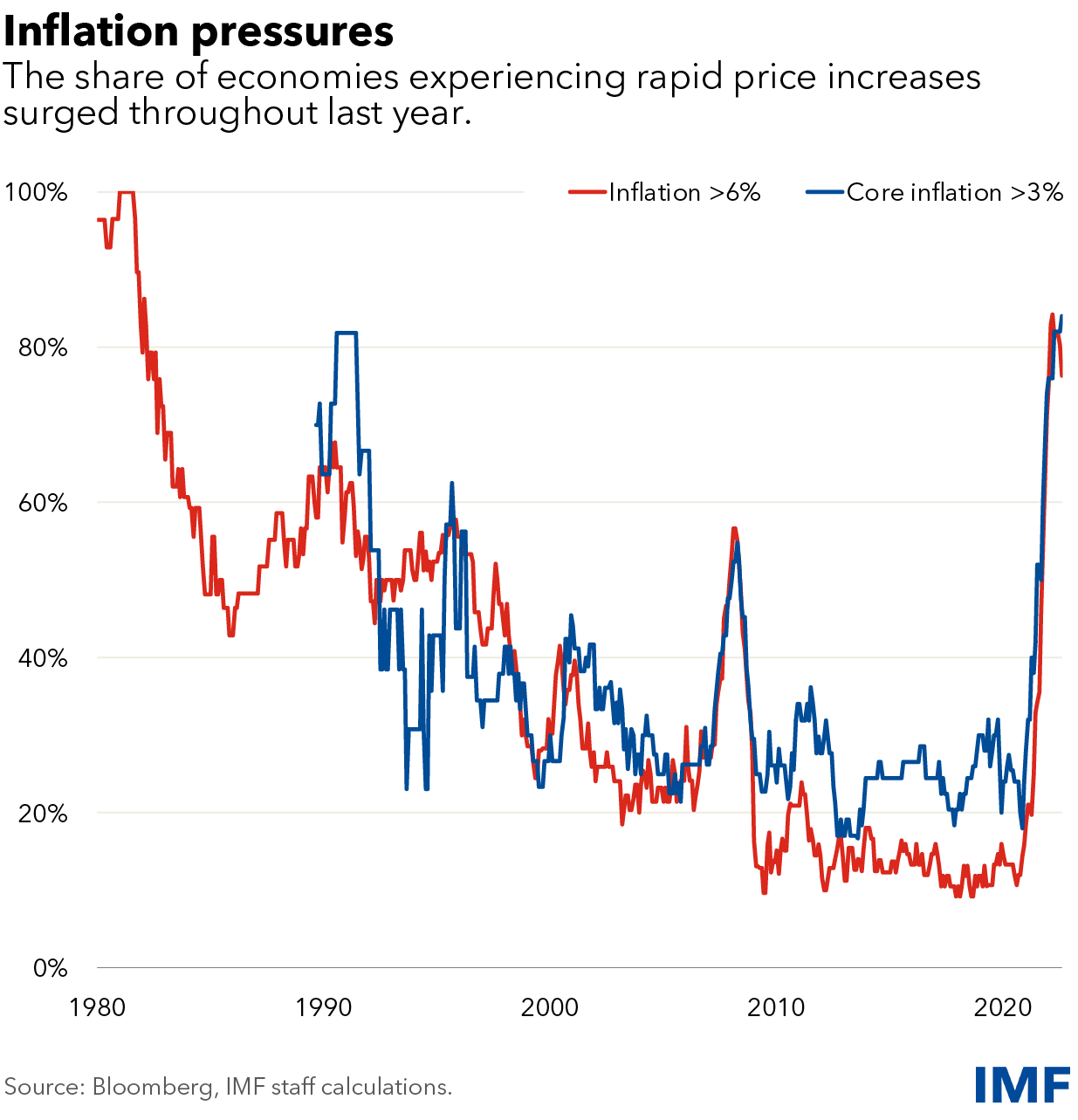

Argument 2: The Bank of Canada is Behind the Curve on Inflation: Rosenberg contends that the Bank of Canada was slow to react to the initial surge in inflation, allowing it to become entrenched. He argues that this delay necessitates more aggressive measures now, leading to unnecessary economic hardship. Evidence supporting this could include comparing the Bank's inflation forecasts with the actual inflation rates over the past [period of time, e.g., two years]. The significant divergence between forecast and reality could indicate a failure to accurately predict and react to inflationary pressures.

-

Argument 3: The Current Monetary Policy is Exacerbating Existing Inequalities: Rosenberg highlights that the impact of high-interest rates disproportionately affects lower-income Canadians, who often carry higher debt burdens relative to their income. The increased cost of borrowing and decreased economic activity disproportionately impact those already struggling financially, widening the wealth gap and exacerbating existing social and economic inequalities. This could manifest in higher rates of mortgage defaults among lower income groups and reduced access to credit for small businesses.

The Impact of High Interest Rates on the Canadian Economy

The Bank of Canada's interest rate decisions have wide-ranging consequences throughout the Canadian economy. The impact is felt across various sectors, leading to both intended and unintended consequences.

-

Housing Market Slowdown and Potential for a Correction: Higher interest rates directly impact the housing market, leading to a significant slowdown in sales and potentially a correction in prices. This is particularly true for the highly leveraged Canadian housing market, where affordability was already stretched before the interest rate hikes.

-

Impact on Consumer Spending and Business Investment: Increased borrowing costs reduce consumer spending and business investment, dampening overall economic activity. Businesses may delay expansion plans, and consumers may postpone large purchases, negatively impacting economic growth.

-

Increased Debt Burden for Households and Businesses: Higher interest rates increase the debt burden for households and businesses with existing loans, reducing their disposable income and potentially triggering defaults. This can lead to a cascading effect on the financial system.

-

Potential for Increased Unemployment: As economic activity slows due to higher interest rates, businesses may be forced to reduce their workforce, leading to an increase in unemployment.

Alternative Approaches and Policy Recommendations

While Rosenberg's criticisms are sharp, alternative policy approaches deserve consideration. While he doesn't explicitly propose a single alternative, his arguments implicitly suggest a less aggressive approach to interest rate hikes and perhaps a greater focus on other policy levers.

-

Potential Alternative Policies: These could include targeted fiscal policies to address specific inflationary pressures, or a more gradual approach to interest rate adjustments, allowing more time for the economy to adjust.

-

Analysis of Pros and Cons: A gradual approach, for example, would reduce the immediate negative impact on economic growth but might allow inflation to persist for longer. Targeted fiscal policies could be more effective in addressing specific inflationary drivers but might be politically challenging to implement.

-

Feasibility of Implementing Changes: The feasibility of each alternative depends on various factors, including the political climate, the effectiveness of other policy instruments, and the overall economic outlook.

Counterarguments and Rebuttals

It is essential to acknowledge counterarguments to Rosenberg's views. The Bank of Canada defends its approach by arguing that aggressive action is necessary to control inflation and prevent more severe long-term economic consequences.

-

Summary of Counterarguments: The Bank maintains that its actions are preventing a wage-price spiral and protecting the long-term stability of the Canadian economy. They may point to positive indicators, such as a potential slowdown in inflation, to support their approach.

-

Analysis of Strengths and Weaknesses: While the Bank's actions aim to prevent long-term harm, the immediate negative consequences are undeniable. The effectiveness of their strategy will only become clear over time.

Conclusion

David Rosenberg's critique of the Bank of Canada's monetary policy highlights significant concerns about the current approach. His arguments regarding overly aggressive interest rate hikes, the Bank's response to inflation, and the impact on economic inequality raise important questions. While counterarguments exist, the ongoing debate underscores the complex challenges facing policymakers in managing the Canadian economy. The significant impact on the housing market, consumer spending, and potential unemployment necessitates ongoing scrutiny of the Bank of Canada's monetary policy decisions.

The ongoing debate surrounding the Bank of Canada's monetary policy demands careful consideration. Stay informed about future developments and engage in thoughtful discussions on the effectiveness of the Bank of Canada's approach to managing inflation and fostering sustainable economic growth. Understanding the nuances of the Bank of Canada's monetary policy is crucial for all Canadians.

Featured Posts

-

Hungary Defies Us Pressure Maintaining Strong Economic Ties With China

Apr 29, 2025

Hungary Defies Us Pressure Maintaining Strong Economic Ties With China

Apr 29, 2025 -

Senate Leadership Schumer Rejects Calls To Step Down Declares I Am Staying Put

Apr 29, 2025

Senate Leadership Schumer Rejects Calls To Step Down Declares I Am Staying Put

Apr 29, 2025 -

Record Breaking Speedboat Flip At Arizona Lake Competition

Apr 29, 2025

Record Breaking Speedboat Flip At Arizona Lake Competition

Apr 29, 2025 -

Examining The Ccp United Front Work Departments Operations In Minnesota

Apr 29, 2025

Examining The Ccp United Front Work Departments Operations In Minnesota

Apr 29, 2025 -

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 29, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 29, 2025

Latest Posts

-

Austria Klagenfurt Jancker Uebernimmt Traineramt

Apr 29, 2025

Austria Klagenfurt Jancker Uebernimmt Traineramt

Apr 29, 2025 -

Janckers Zukunft Nach Leoben Wohin Fuehrt Der Weg

Apr 29, 2025

Janckers Zukunft Nach Leoben Wohin Fuehrt Der Weg

Apr 29, 2025 -

Nyr Porsche Macan Allt Um Fyrstu Rafutgafuna

Apr 29, 2025

Nyr Porsche Macan Allt Um Fyrstu Rafutgafuna

Apr 29, 2025 -

Buy A Pts Riviera Blue Porsche 911 S T Exceptional Condition

Apr 29, 2025

Buy A Pts Riviera Blue Porsche 911 S T Exceptional Condition

Apr 29, 2025 -

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025

Porsche Macan Fyrsta 100 Rafutgafan Kynnt

Apr 29, 2025