The BofA Perspective On Elevated Stock Market Valuations

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

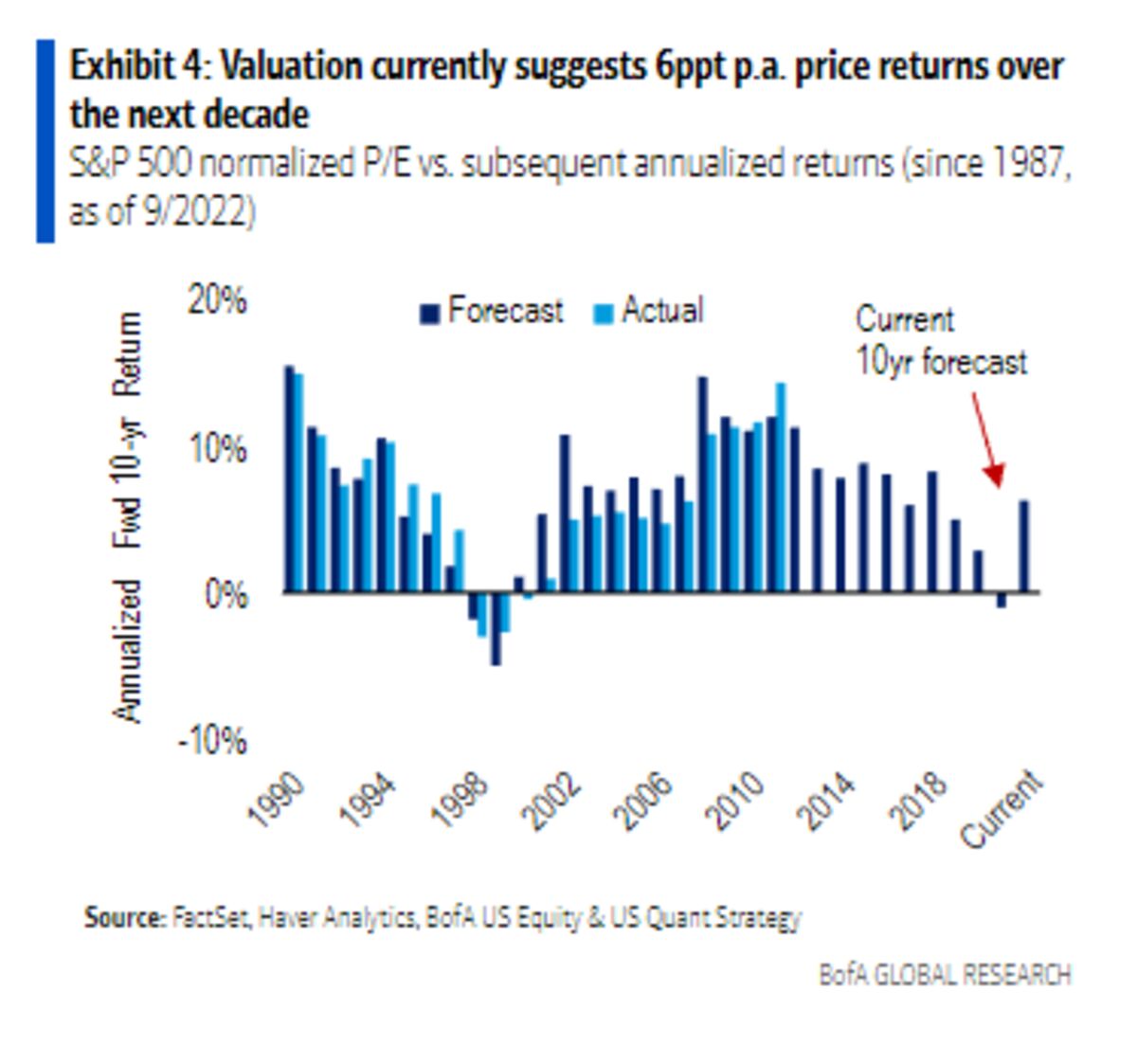

BofA's market outlook often relies on a comprehensive analysis of key market valuation metrics. These metrics provide a crucial lens through which to assess whether current stock prices are justified by underlying fundamentals or represent a bubble. BofA's forecasts are closely watched by investors worldwide, offering insights into potential future market behavior.

-

Price-to-Earnings Ratio (P/E): BofA analysts scrutinize P/E ratios across various sectors. A high P/E ratio can suggest that the market is anticipating significant future earnings growth. However, an excessively high P/E ratio compared to historical averages might signal overvaluation and increased risk. BofA's sector-specific analyses often highlight discrepancies in P/E ratios, indicating potential opportunities or areas of concern.

-

Price-to-Sales Ratio (P/S): The P/S ratio offers another perspective on market valuation, particularly useful for companies with low or negative earnings. BofA's analysis considers the P/S ratio alongside other metrics to provide a more holistic picture. High P/S ratios in certain sectors might point to potentially inflated valuations.

-

BofA Forecasts: BofA regularly publishes forecasts for earnings growth across different sectors. These forecasts are integral to their valuation analysis. If BofA's projections indicate slower-than-expected earnings growth, it could suggest that current market valuations are unsustainable. Conversely, robust earnings growth forecasts might support the current valuation levels. Access to these detailed forecasts requires subscription to BofA's research services, but summaries are often available through financial news outlets.

-

Underlying Fundamentals: BofA's assessment of whether current valuations are justified considers factors beyond simple ratios. They examine macroeconomic conditions, interest rate environments, geopolitical factors and the financial health of individual companies. This qualitative assessment is vital for a balanced perspective on market valuation.

Identifying Potential Risks Associated with High Valuations

BofA's risk assessment in a high-valuation environment highlights several crucial concerns for investors. Understanding these risks is paramount for building a resilient investment portfolio.

-

Increased Market Volatility: Elevated stock market valuations often translate to increased market sensitivity. Even minor negative news can trigger significant price swings, leading to heightened volatility. BofA's analysts frequently caution investors about this heightened risk.

-

Potential for a Market Correction: High valuations increase the probability of a market correction – a sharp decline in prices. BofA might warn about sectors or asset classes particularly susceptible to a correction. This is especially important for investors with shorter-term investment horizons.

-

Impact of Rising Interest Rates and Inflation: Rising interest rates and inflation can negatively impact stock valuations, particularly growth stocks that rely on future earnings projections. BofA’s analysis often examines the potential impact of monetary policy changes on the market. They would typically warn of higher interest rate pressures impacting valuations.

-

BofA's Cautionary Statements: It's essential to monitor BofA's public statements and research reports. They frequently issue warnings or cautionary statements regarding specific sectors or the market overall, providing valuable insights for investors.

BofA's Recommended Investment Strategies in a High-Valuation Environment

Navigating a high-valuation market requires a carefully considered investment strategy. BofA generally advocates for a cautious yet opportunistic approach.

-

Portfolio Diversification: BofA emphasizes the importance of diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. A diversified portfolio can help reduce exposure to potential market downturns.

-

Focus on Value Stocks: In high-valuation environments, BofA might recommend shifting towards value stocks – companies trading at lower valuations relative to their fundamentals. These stocks often offer a more attractive risk-reward profile.

-

Consider Alternative Investments: BofA may suggest exploring alternative investments, such as private equity or hedge funds, to diversify beyond traditional equity markets. These options often have different risk-return profiles.

-

BofA Model Portfolios: BofA often presents model portfolios illustrating their recommended asset allocation strategies in various market conditions. These models provide valuable examples of practical portfolio construction.

Considering Defensive Investment Options

In a climate of elevated stock market valuations, BofA’s defensive strategies become particularly relevant.

-

Defensive Stocks: These stocks typically exhibit lower volatility than the broader market. They often represent established companies with consistent earnings and dividends, proving relatively resilient during market downturns.

-

Low-Volatility Stocks: Similar to defensive stocks, low-volatility stocks are designed to minimize risk, providing stability within a volatile market. BofA's research helps identify such stocks.

-

Bond Allocation: BofA often advocates for a strategic allocation of bonds in a portfolio to counterbalance the risk associated with equities. Bonds can provide stability and income during periods of market uncertainty.

Conclusion

This article has examined Bank of America's (BofA) perspective on elevated stock market valuations, highlighting their market outlook, identified risks, and suggested investment strategies. Understanding BofA's analysis is crucial for making informed decisions in the current market. By paying close attention to their market forecasts, risk assessments, and recommended strategies, you can navigate the complexities of high valuations and build a robust and resilient investment portfolio.

Call to Action: Stay informed about shifts in the market by regularly reviewing BofA's research and analysis on elevated stock market valuations and adjusting your investment strategy accordingly. Learn more about navigating elevated stock market valuations by visiting the BofA website. Remember, this information is for general knowledge and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

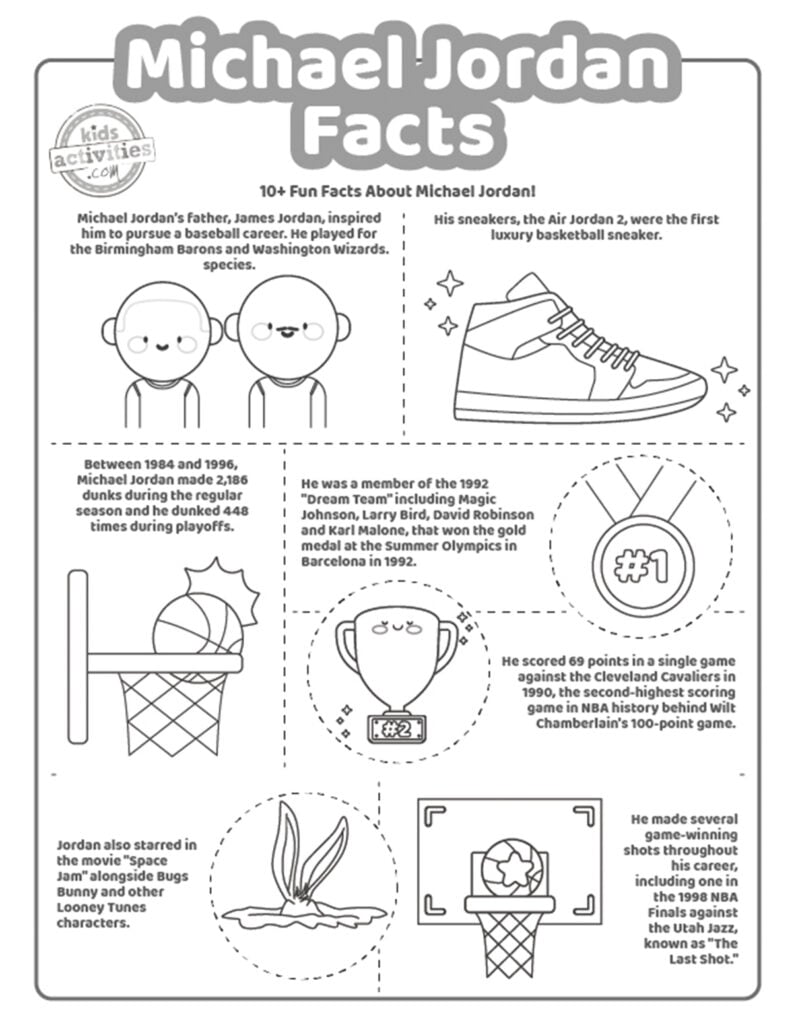

The Ultimate Guide To Michael Jordan Fast Facts

Apr 30, 2025

The Ultimate Guide To Michael Jordan Fast Facts

Apr 30, 2025 -

San Diego Jail Death Family Alleges Failure To Respond To Inmates Torture

Apr 30, 2025

San Diego Jail Death Family Alleges Failure To Respond To Inmates Torture

Apr 30, 2025 -

L Impact Des Celebrations Avec Armes A Feu Sur La Carriere D Une Star Nba Et Sa Famille

Apr 30, 2025

L Impact Des Celebrations Avec Armes A Feu Sur La Carriere D Une Star Nba Et Sa Famille

Apr 30, 2025 -

Caso Becciu Condanna Vaticana E Obbligo Di Risarcimento

Apr 30, 2025

Caso Becciu Condanna Vaticana E Obbligo Di Risarcimento

Apr 30, 2025 -

Il Cardinale Becciu Chat Segrete Processo Falsato E Accuse Di Infangamento

Apr 30, 2025

Il Cardinale Becciu Chat Segrete Processo Falsato E Accuse Di Infangamento

Apr 30, 2025