The BofA View: Why Current Stock Market Valuations Aren't Necessarily A Problem

Table of Contents

The Role of Interest Rates in Shaping Stock Market Valuations

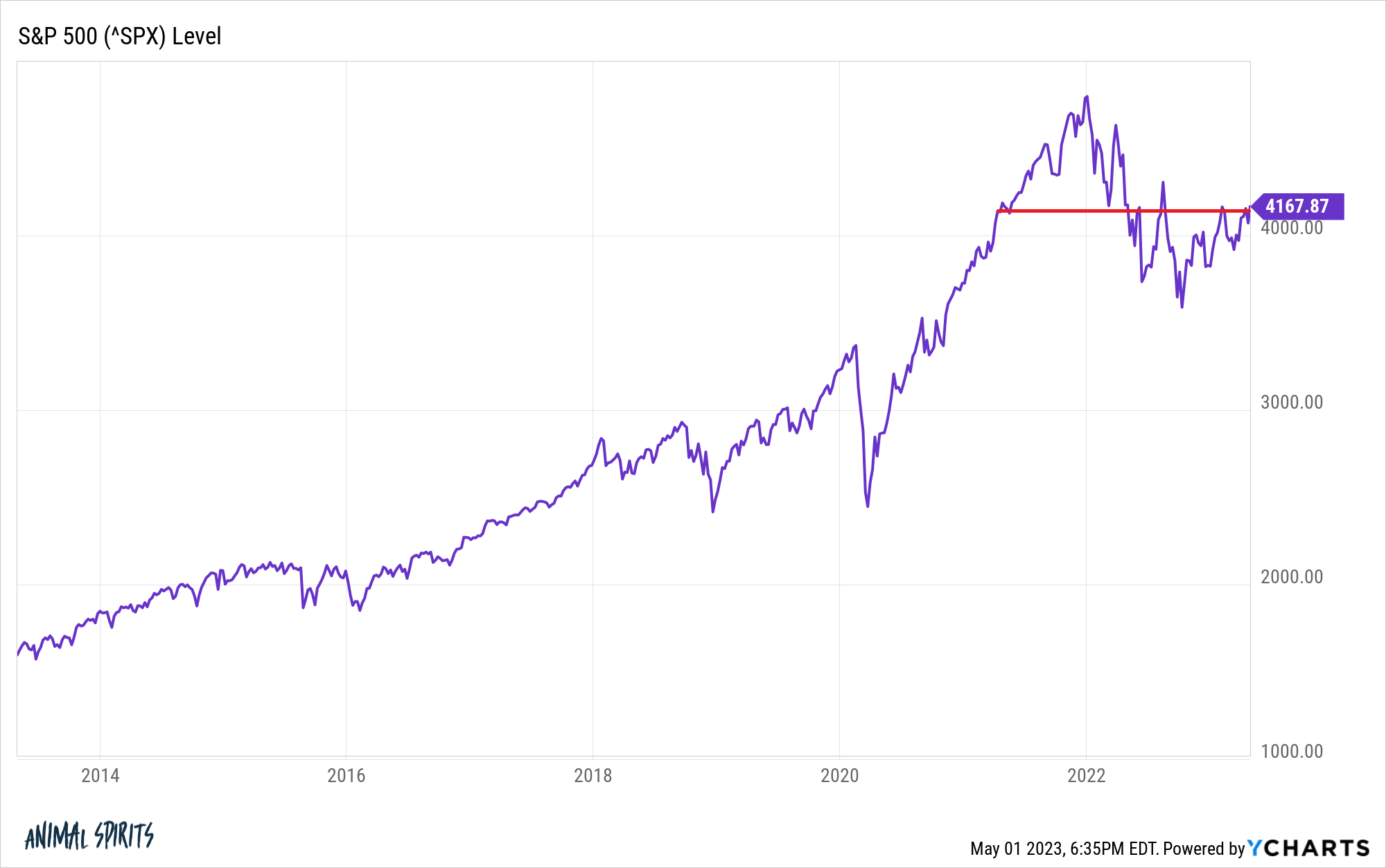

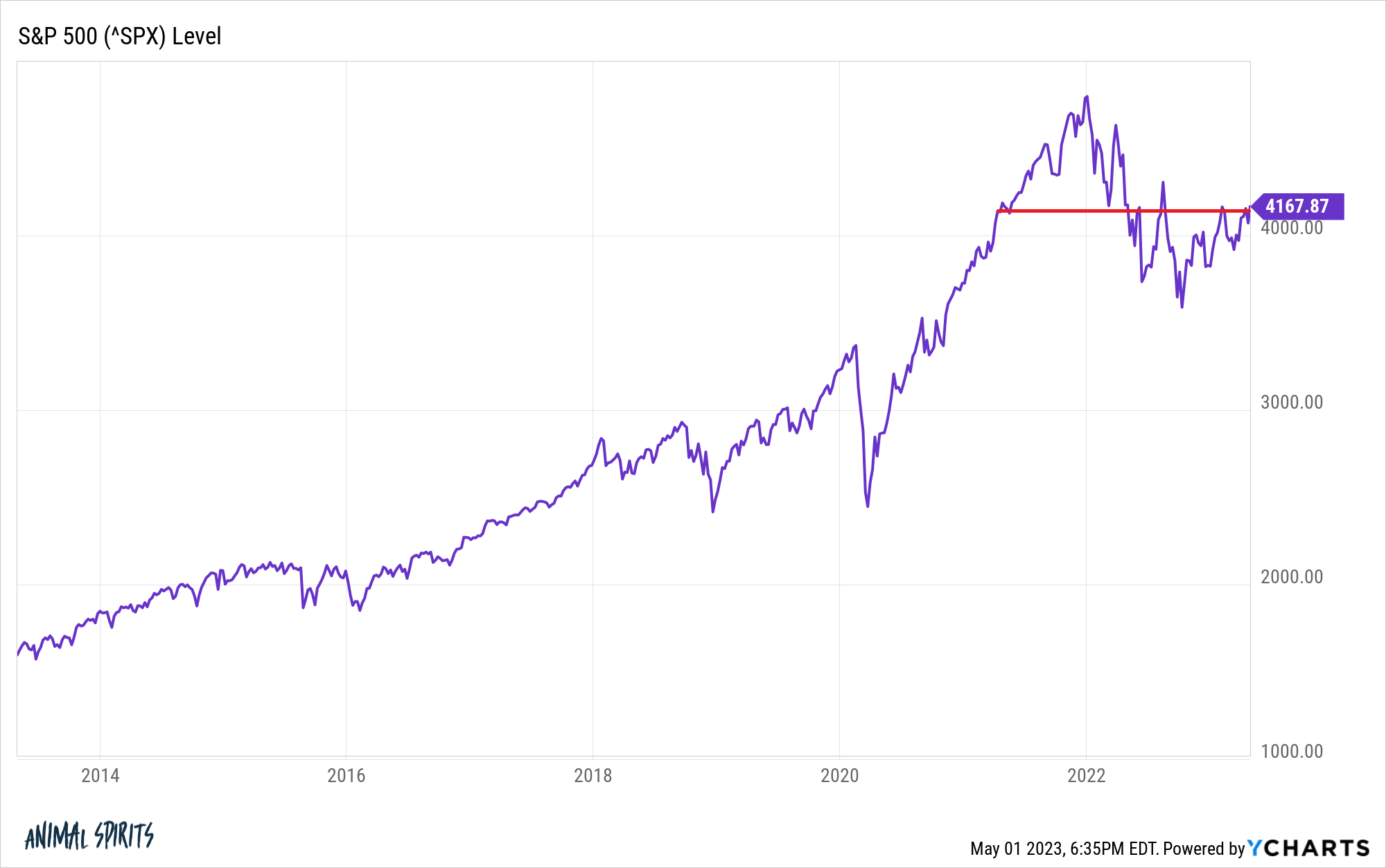

The relationship between interest rates and stock valuations is inversely correlated. Lower interest rates generally make borrowing cheaper for companies, stimulating investment and boosting earnings, which in turn supports higher stock prices. Conversely, higher interest rates increase borrowing costs, potentially slowing economic growth and dampening stock market valuations. BofA's predicted interest rate trajectory plays a crucial role in their assessment of current stock market valuations.

- Lower interest rates generally support higher valuations. This is because companies can access capital more easily, fueling expansion and increasing profitability. Lower rates also make bonds less attractive relative to stocks.

- BofA's forecast for interest rate increases/decreases. (Note: This section requires current BofA forecasts on interest rates. Insert specific data and predictions here. For example: "BofA predicts a gradual increase in interest rates over the next year, peaking at X%, before potentially stabilizing.")

- Impact of inflation on interest rate expectations. Inflation significantly influences interest rate decisions by central banks. High inflation generally leads to higher interest rates to control price increases, which can negatively impact stock valuations. (Note: Insert current inflation data and its projected impact on BofA's interest rate forecasts).

Keywords: Interest rates, stock valuation, inflation, BofA forecast, bond yields

Earnings Growth: A Key Driver of Stock Market Performance

BofA emphasizes that robust earnings growth is a critical justification for current valuations. Simply put, if companies continue to demonstrate strong earnings, higher price-to-earnings (P/E) ratios become more sustainable. BofA's earnings growth projections for the coming quarters and years are central to their optimistic outlook.

- BofA's projected earnings growth rates across different sectors. (Note: Insert specific data from BofA's research, providing growth rates for key sectors like technology, healthcare, financials, etc.)

- Discussion of factors driving earnings growth (e.g., technological advancements, consumer spending). BofA likely identifies factors such as increased adoption of new technologies, robust consumer spending, and global economic recovery as key drivers. (Insert specific examples from BofA's analysis.)

- Comparison of current P/E ratios to historical averages in the context of earnings growth. BofA may argue that current P/E ratios are justified by higher-than-average earnings growth, making the market less overvalued than it might initially appear. (Insert relevant data comparing current P/E ratios to historical averages and BofA's interpretation).

Keywords: Earnings growth, P/E ratio, stock market performance, sector performance, BofA earnings forecast

Addressing Concerns About Potential Market Corrections

While acknowledging the inherent risks associated with high valuations, BofA doesn't necessarily foresee an imminent and drastic market correction. They likely emphasize the resilience of the current market based on their analysis of fundamental economic factors.

- Factors that could trigger a market correction. These could include unexpected geopolitical events, a sharper-than-expected rise in interest rates, or a significant downturn in consumer spending. (Elaborate on these factors and their potential impact based on BofA's analysis).

- BofA's assessment of the resilience of the current market. BofA likely points to factors such as strong corporate earnings, resilient consumer spending, and accommodative monetary policy as reasons for their relatively optimistic outlook on market resilience. (Include specifics from BofA's research supporting this view).

- Strategies for mitigating risk (diversification, hedging, etc.). BofA likely recommends diversification across asset classes, employing hedging strategies to protect against potential downside risk, and maintaining a long-term investment horizon.

Keywords: Market correction, risk management, stock market volatility, investment strategies, BofA investment advice

Long-Term Growth Potential and Sector-Specific Opportunities

BofA's long-term outlook for economic growth is a critical component of their assessment of current stock market valuations. Their identification of promising sectors further contributes to their relatively positive perspective.

- Long-term growth forecasts from BofA. (Insert BofA's long-term GDP growth projections and their rationale.)

- Attractive sectors according to BofA (e.g., technology, healthcare). (List specific sectors BofA identifies as promising and provide reasoning based on their analysis. This could include technological innovation, demographic trends, or regulatory changes.)

- Rationale for selecting these sectors. (Detail the reasons why BofA believes these sectors are positioned for strong long-term growth.)

Keywords: Long-term investment, sector analysis, economic growth, investment opportunities, BofA sector outlook

Conclusion: Understanding BofA's Perspective on Current Stock Market Valuations

In summary, BofA's assessment of current stock market valuations considers several crucial factors: a predicted interest rate trajectory, strong earnings growth projections across various sectors, and a long-term outlook for economic expansion. While acknowledging the potential for market corrections, their analysis suggests that current valuations are not necessarily cause for immediate alarm. The importance of considering interest rates, earnings growth, and long-term economic prospects cannot be overstated when evaluating stock market valuations.

While BofA's view offers valuable insights into current stock market valuations, remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Understanding BofA's detailed research and analysis on stock market valuations is crucial for informed investment planning.

Featured Posts

-

Jazz Cash And K Trade Partner To Democratize Stock Investment And Trading

May 10, 2025

Jazz Cash And K Trade Partner To Democratize Stock Investment And Trading

May 10, 2025 -

Mdkhnw Krt Alqdm Asmae Shhyrt Wmsyrt Mhnyt

May 10, 2025

Mdkhnw Krt Alqdm Asmae Shhyrt Wmsyrt Mhnyt

May 10, 2025 -

Violences Conjugales A Dijon Le Proces Du Boxeur Bilel Latreche

May 10, 2025

Violences Conjugales A Dijon Le Proces Du Boxeur Bilel Latreche

May 10, 2025 -

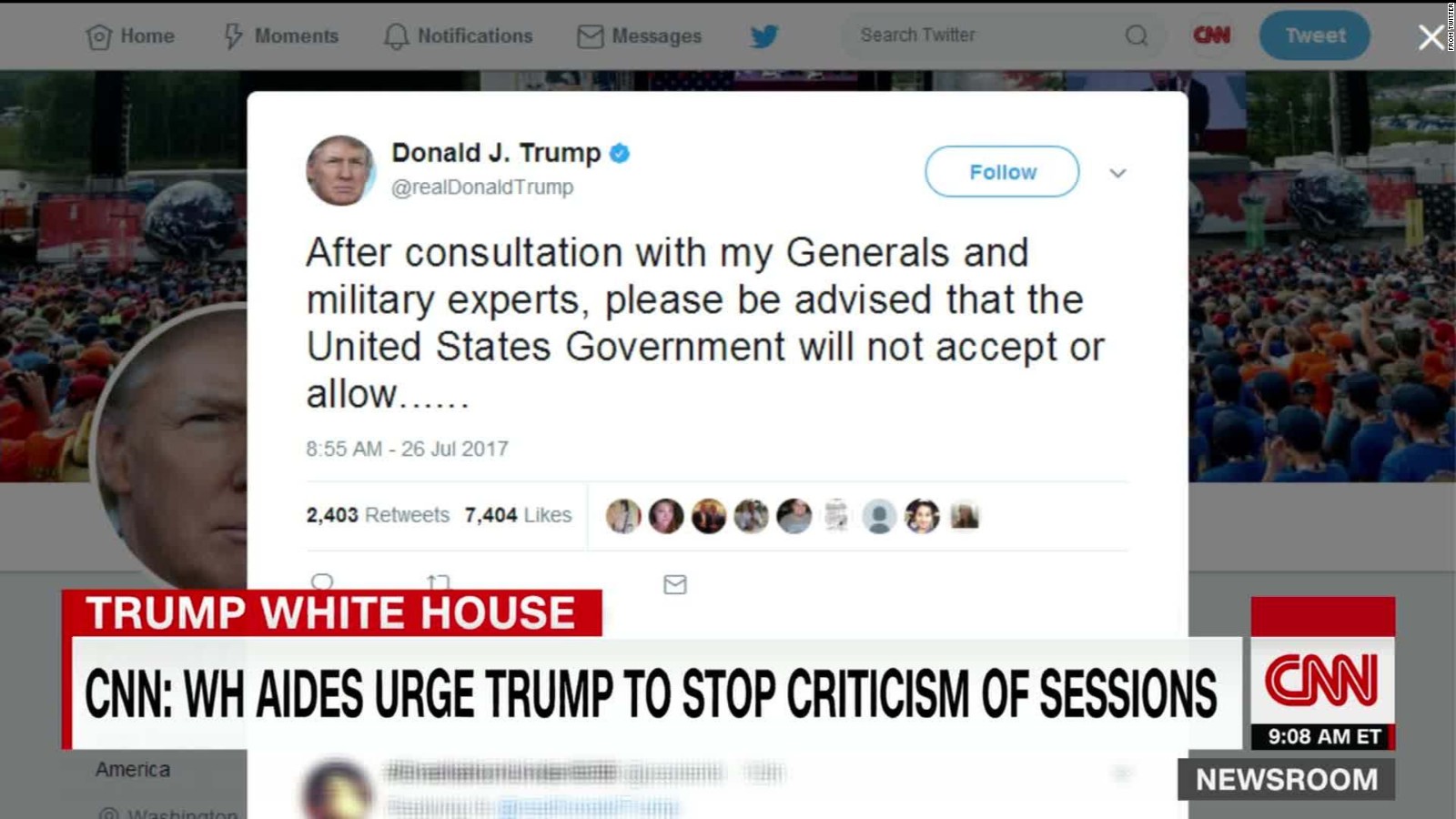

Is Trumps Transgender Military Ban Fair A Balanced Perspective

May 10, 2025

Is Trumps Transgender Military Ban Fair A Balanced Perspective

May 10, 2025 -

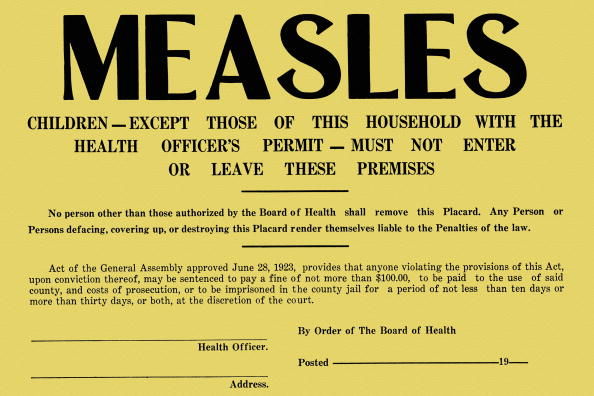

North Dakotas Measles Crisis Impact On Unvaccinated Schoolchildren

May 10, 2025

North Dakotas Measles Crisis Impact On Unvaccinated Schoolchildren

May 10, 2025