The Canadian Dollar's Performance: A Detailed Analysis

Table of Contents

Factors Influencing the Canadian Dollar's Exchange Rate

The Canadian dollar's exchange rate, often denoted as CAD, is a dynamic entity, influenced by a multitude of interconnected factors. Let's delve into some of the most prominent ones:

Commodity Prices (Oil, Natural Gas, etc.): Canada is a major exporter of commodities, with oil and natural gas being particularly significant. The price of these commodities has a strong positive correlation with the CAD. When global demand for oil increases, so does the price, leading to increased export revenue for Canada and bolstering the value of the Canadian dollar. Conversely, a slump in oil prices negatively impacts the CAD.

- Impact of OPEC decisions: Decisions by the Organization of the Petroleum Exporting Countries (OPEC) regarding oil production quotas significantly influence global oil prices and, consequently, the CAD.

- Global demand for energy: Global economic growth and industrial activity directly impact the demand for energy, affecting oil and gas prices.

- Canadian oil production levels: Changes in Canadian oil production due to technological advancements, government regulations, or pipeline capacity affect the supply side and impact prices.

- Alternative energy sources: The rise of renewable energy sources and their impact on global energy demand is a significant factor impacting long-term oil prices and consequently the CAD.

Interest Rate Differentials: The Bank of Canada (BoC)'s monetary policy plays a crucial role in determining the CAD's value. Interest rate hikes generally attract foreign investment, increasing demand for the Canadian dollar and strengthening its value against other currencies. Conversely, interest rate cuts can weaken the CAD.

- Comparison of BoC rates with other central banks: The relative difference between the BoC's interest rate and those of other major central banks (like the US Federal Reserve) influences the flow of capital and impacts exchange rates.

- Impact of inflation on interest rate decisions: High inflation pressures typically lead to interest rate hikes by the BoC, aiming to cool down the economy.

- Investor sentiment related to interest rates: Market expectations regarding future interest rate adjustments also influence investor behavior and the CAD's value.

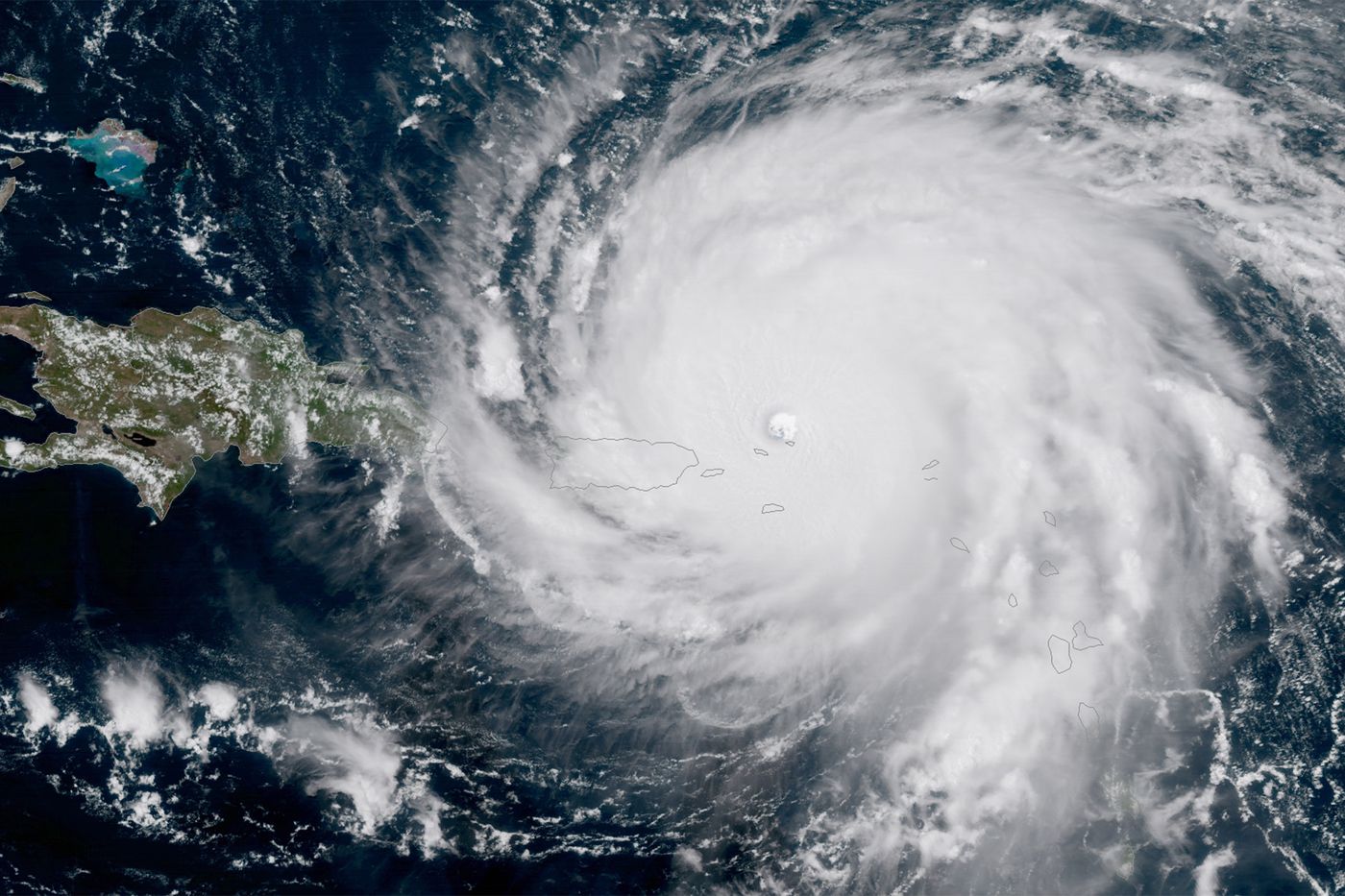

Geopolitical Events and Global Economic Uncertainty: Global events and economic uncertainties significantly influence investor confidence and capital flows, impacting the CAD. During periods of global uncertainty, investors often seek "safe-haven" currencies like the US dollar, leading to a weakening of the CAD.

- Examples of geopolitical events: Trade wars, political instability in major economies, and international conflicts can all negatively affect the CAD.

- Global economic recessions: Global economic downturns reduce demand for commodities and generally weaken the Canadian dollar.

- Investor flight to safety: During times of uncertainty, investors move their capital to perceived safer assets, often leading to a decrease in the value of riskier currencies like the CAD.

Canada's Economic Performance (GDP, Employment, etc.): The strength of the Canadian economy, as reflected in key economic indicators, influences the CAD's performance. Strong GDP growth, low unemployment rates, and high consumer confidence generally support a strong CAD.

- GDP growth: A robust GDP signifies a healthy economy, attracting foreign investment and strengthening the currency.

- Employment rates: Low unemployment rates reflect a strong labor market and positive economic outlook, supporting the CAD.

- Inflation figures: High inflation can erode purchasing power and lead to interest rate hikes, impacting the CAD's value.

- Consumer confidence: Positive consumer sentiment indicates economic optimism and can contribute to a stronger CAD.

Analyzing Historical Canadian Dollar's Performance

Understanding the historical Canadian dollar's performance provides valuable context for future predictions.

Long-Term Trends: Over the past decade, the Canadian dollar has experienced considerable fluctuation, strongly correlated with commodity prices, particularly oil. There have been periods of significant strength, often coinciding with high commodity prices, and periods of weakness, particularly during global economic downturns. Charts and graphs illustrating the CAD's exchange rate against major currencies like the USD, EUR, and GBP over this period would clearly demonstrate these trends.

- Key periods of strength and weakness: Identifying these periods and their corresponding economic and geopolitical events is essential for understanding the CAD's behavior.

- Average annual exchange rates against major currencies: Tracking these averages provides a long-term perspective on the CAD's performance.

Recent Performance: A detailed analysis of the CAD's performance in the last year reveals significant fluctuations, often tied to specific news events. For example, shifts in oil prices, announcements from the BoC, or changes in global risk sentiment have all had a noticeable impact.

- Monthly exchange rate movements: Tracking monthly changes provides a granular view of recent performance.

- Significant news events that impacted the CAD: Identifying these events and their impact is crucial for understanding recent volatility.

- Predictions by financial analysts: Examining forecasts from reputable financial institutions offers insights into market sentiment and expectations.

Predicting Future Canadian Dollar's Performance

Predicting the future of the Canadian dollar is inherently challenging due to the numerous intertwined factors at play. However, analyzing expert forecasts and identifying potential risks and opportunities can offer a clearer picture.

Expert Forecasts and Market Sentiment: Financial institutions and analysts regularly publish forecasts for the Canadian dollar, considering various economic and geopolitical factors. These forecasts often vary, reflecting different perspectives and methodologies.

- Consensus forecasts: Identifying the prevailing consensus among analysts provides a useful benchmark.

- Range of predictions: Understanding the range of predictions highlights the inherent uncertainty in forecasting exchange rates.

- Factors influencing these predictions: Analyzing the factors considered by analysts (e.g., commodity prices, interest rates, geopolitical risks) is crucial for evaluating the reliability of their forecasts.

Potential Risks and Opportunities: Several potential risks and opportunities could impact the Canadian dollar's performance in the coming years.

- Geopolitical risks: Ongoing geopolitical tensions and potential future conflicts can create uncertainty and impact investor confidence.

- Economic uncertainties: Global economic slowdowns or unexpected domestic economic shocks could negatively affect the CAD.

- Potential changes in commodity prices and interest rates: Fluctuations in commodity prices and changes in monetary policy by the BoC will continue to be significant drivers of CAD performance.

Conclusion

The Canadian dollar's performance is a complex issue shaped by a variety of factors, including commodity prices, interest rate differentials, geopolitical events, and the overall health of the Canadian economy. Analyzing historical trends and expert forecasts provides valuable insight, but predicting future performance remains challenging. Understanding the interplay of these factors is key to navigating the fluctuations of the Canadian dollar.

Key Takeaways: The CAD's value is strongly linked to commodity prices, especially oil; interest rate decisions by the BoC significantly influence its value; global economic and geopolitical factors play a crucial role; and analyzing historical trends and expert forecasts offers valuable insight, though predicting the future remains difficult.

Call to Action: Stay informed about the Canadian dollar's performance by regularly consulting reputable financial news sources and consider seeking professional advice to effectively manage your investments impacted by the Canadian dollar's fluctuations. Understanding the Canadian dollar's performance is crucial for making sound financial decisions.

Featured Posts

-

Tornado Season And Trumps Budget A Dangerous Combination

Apr 24, 2025

Tornado Season And Trumps Budget A Dangerous Combination

Apr 24, 2025 -

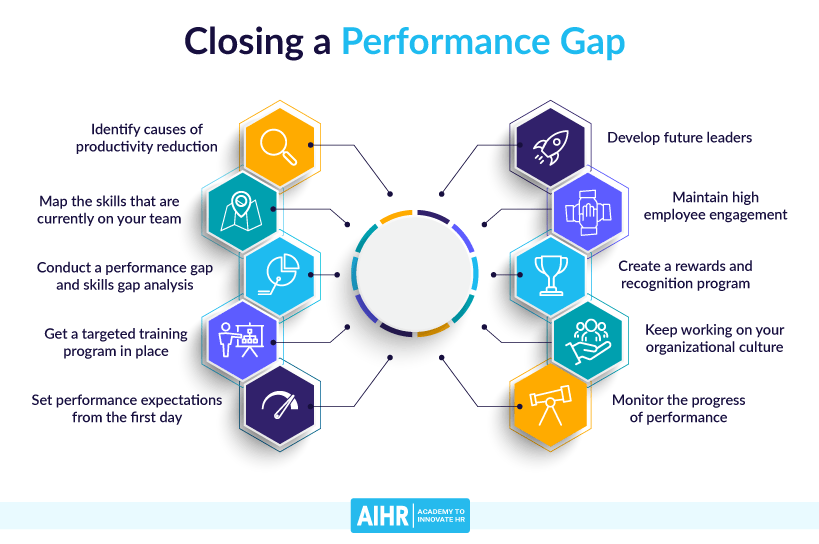

Middle Management Bridging The Gap Between Leadership And Employees For Improved Performance

Apr 24, 2025

Middle Management Bridging The Gap Between Leadership And Employees For Improved Performance

Apr 24, 2025 -

Review Lg C3 77 Inch Oled Tv Performance And Features

Apr 24, 2025

Review Lg C3 77 Inch Oled Tv Performance And Features

Apr 24, 2025 -

La Fires Fuel Landlord Price Gouging Debate A Real Estate Perspective

Apr 24, 2025

La Fires Fuel Landlord Price Gouging Debate A Real Estate Perspective

Apr 24, 2025 -

Us Lawyer Stonewalling Ends Judge Abrego Garcias Ruling

Apr 24, 2025

Us Lawyer Stonewalling Ends Judge Abrego Garcias Ruling

Apr 24, 2025

Latest Posts

-

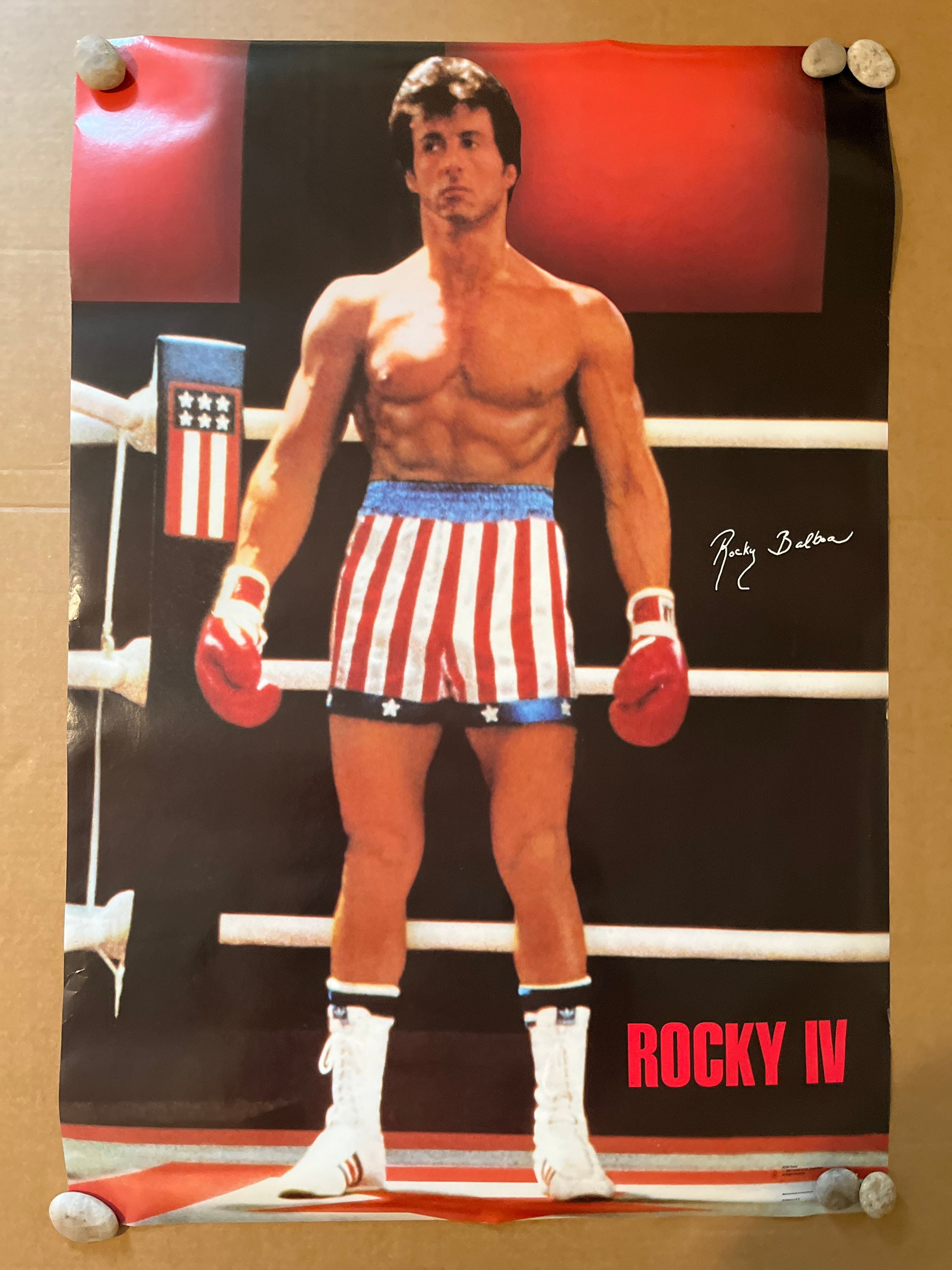

The Most Emotional Rocky Movie Stallones Personal Choice

May 12, 2025

The Most Emotional Rocky Movie Stallones Personal Choice

May 12, 2025 -

Rockys Emotional Core Stallone Reveals His Favorite Film

May 12, 2025

Rockys Emotional Core Stallone Reveals His Favorite Film

May 12, 2025 -

Sylvester Stallones Directing Career A Focus On His One Unstarred Film

May 12, 2025

Sylvester Stallones Directing Career A Focus On His One Unstarred Film

May 12, 2025 -

Stallone On Rocky Which Film Touches Him Most

May 12, 2025

Stallone On Rocky Which Film Touches Him Most

May 12, 2025 -

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical Analysis

May 12, 2025

The One Movie Sylvester Stallone Directed But Didnt Star In A Critical Analysis

May 12, 2025