The CoreWeave Inc. (CRWV) Stock Dip On Thursday: What Happened?

Table of Contents

Analyzing the CoreWeave (CRWV) Stock Decline

The sharp decrease in CRWV's stock price on Thursday requires a multifaceted analysis. Several contributing factors might have played a role, independently or in combination.

Lack of Immediate Catalysts

Notably, the CRWV stock dip wasn't preceded by any major negative news or announcements directly from CoreWeave itself. This makes the decline all the more perplexing.

- Absence of earnings reports: There were no negative earnings reports released that could explain the drop.

- Lack of significant contract losses: No public announcements indicated significant contract losses or disruptions to CoreWeave's business operations.

- No regulatory announcements: There were no regulatory actions or announcements that could have negatively impacted the company's stock.

However, it's crucial to consider the market sentiment leading up to the dip. While no catastrophic news emerged, a subtle shift in investor confidence might have been brewing, creating a vulnerability to even minor negative pressures. A deeper dive into pre-Thursday trading patterns and analyst sentiment could reveal clues.

Broader Market Sentiment and Tech Sector Downturn

The Thursday CRWV stock dip needs to be viewed within the context of broader market conditions. The technology sector, in particular, has faced headwinds recently.

- Prevailing economic anxieties: Concerns about inflation, interest rate hikes, and a potential recession have created a climate of uncertainty affecting many tech stocks.

- Interest rate hikes: The Federal Reserve's interest rate increases impact borrowing costs for companies, potentially slowing growth and impacting investor confidence.

- Overall tech sector performance: The tech sector as a whole experienced a period of volatility, with several large-cap companies seeing significant price adjustments.

These factors could have indirectly influenced CRWV's stock price, creating a ripple effect that disproportionately impacted smaller or newer companies in the sector, even in the absence of company-specific negative news.

Investor Profit-Taking and Technical Factors

Another possible explanation lies in profit-taking and technical market factors. After a period of growth, some investors may have chosen to secure their gains, leading to a sell-off.

- Chart analysis: Technical analysis of CRWV's chart might reveal resistance levels or other technical indicators that contributed to the price drop.

- Trading volume: An unusually high trading volume on Thursday could suggest a wave of selling pressure.

- Short-selling activity: Increased short-selling activity might have exacerbated the downward pressure on the stock price.

These technical elements, often intertwined, can significantly influence short-term price movements, independent of fundamental company performance.

The Impact on CoreWeave's Long-Term Prospects

While the CRWV stock dip is concerning, it's crucial to assess its impact on CoreWeave's long-term prospects.

Fundamental Strength of CoreWeave's Business Model

CoreWeave remains a significant player in the rapidly expanding cloud computing and AI infrastructure market. Its long-term potential remains largely intact.

- Strong partnerships: CoreWeave enjoys strong partnerships with key players in the tech industry, bolstering its market position.

- Innovative technology: CoreWeave's innovative technology provides a competitive edge in a rapidly evolving market.

- Large addressable market: The cloud computing and AI infrastructure market is massive and growing exponentially, offering significant growth opportunities for CoreWeave.

The short-term stock fluctuation likely doesn't fully reflect the company's underlying fundamental strength and long-term value proposition.

Future Outlook and Investment Strategies

Predicting future stock performance is inherently challenging. However, several scenarios are possible for CRWV.

- Buy-the-dip strategy: Some investors might see the dip as a buying opportunity, anticipating a rebound based on the company's strong fundamentals.

- Waiting for further clarification: Others might prefer to wait for further information or clarity before making investment decisions.

- Diversification strategies: Diversification remains a crucial risk-management strategy, irrespective of individual stock performance.

Investors should conduct thorough due diligence, considering both the short-term volatility and the long-term potential of CoreWeave before making any investment decisions. Consulting a financial advisor is always recommended.

Conclusion

The CoreWeave (CRWV) stock dip on Thursday was likely a confluence of factors, including broader market sentiment, potential profit-taking, and technical market dynamics, rather than a direct reflection of company-specific issues. While the short-term fluctuation warrants attention, it's crucial to remember that short-term market movements don't always accurately reflect long-term value. The fundamental strength of CoreWeave's business model in the growing cloud computing and AI market remains a significant positive factor.

Call to Action: While the CRWV stock dip is noteworthy, investors should carefully analyze the fundamentals of CoreWeave's business and the broader market conditions before reacting. Stay informed about further developments regarding CoreWeave stock and the cloud computing market to make well-informed investment choices. Conduct thorough research and consult financial professionals before making any investment decisions related to CoreWeave (CRWV) stock or any other investment.

Featured Posts

-

Google Ai Progress Challenges And The Path To Investor Trust

May 22, 2025

Google Ai Progress Challenges And The Path To Investor Trust

May 22, 2025 -

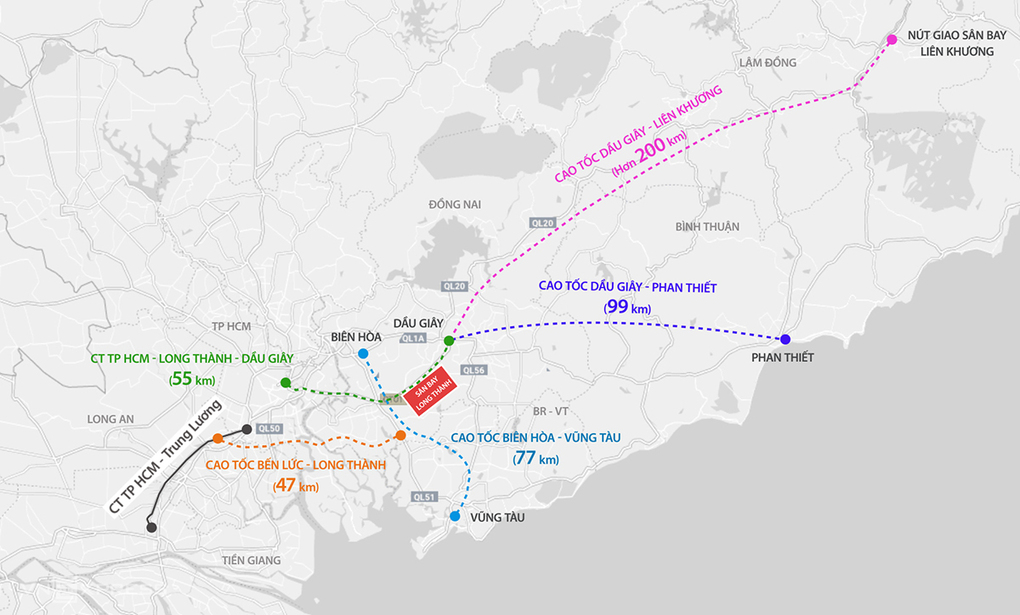

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Thong Xe Du Kien 2 9

May 22, 2025 -

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025

Cao Toc Dong Nai Vung Tau Du Kien Thong Xe Thang 9

May 22, 2025 -

Understanding The Love Monster Character Analysis And Themes

May 22, 2025

Understanding The Love Monster Character Analysis And Themes

May 22, 2025 -

Core Weave Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Core Weave Crwv Stock Surge Reasons Behind Last Weeks Rise

May 22, 2025

Latest Posts

-

Kristi Ano Ronaldo Mu Chestita Na Kho Lund Poraka Po Imitatsi Ata Na Slavenjeto

May 22, 2025

Kristi Ano Ronaldo Mu Chestita Na Kho Lund Poraka Po Imitatsi Ata Na Slavenjeto

May 22, 2025 -

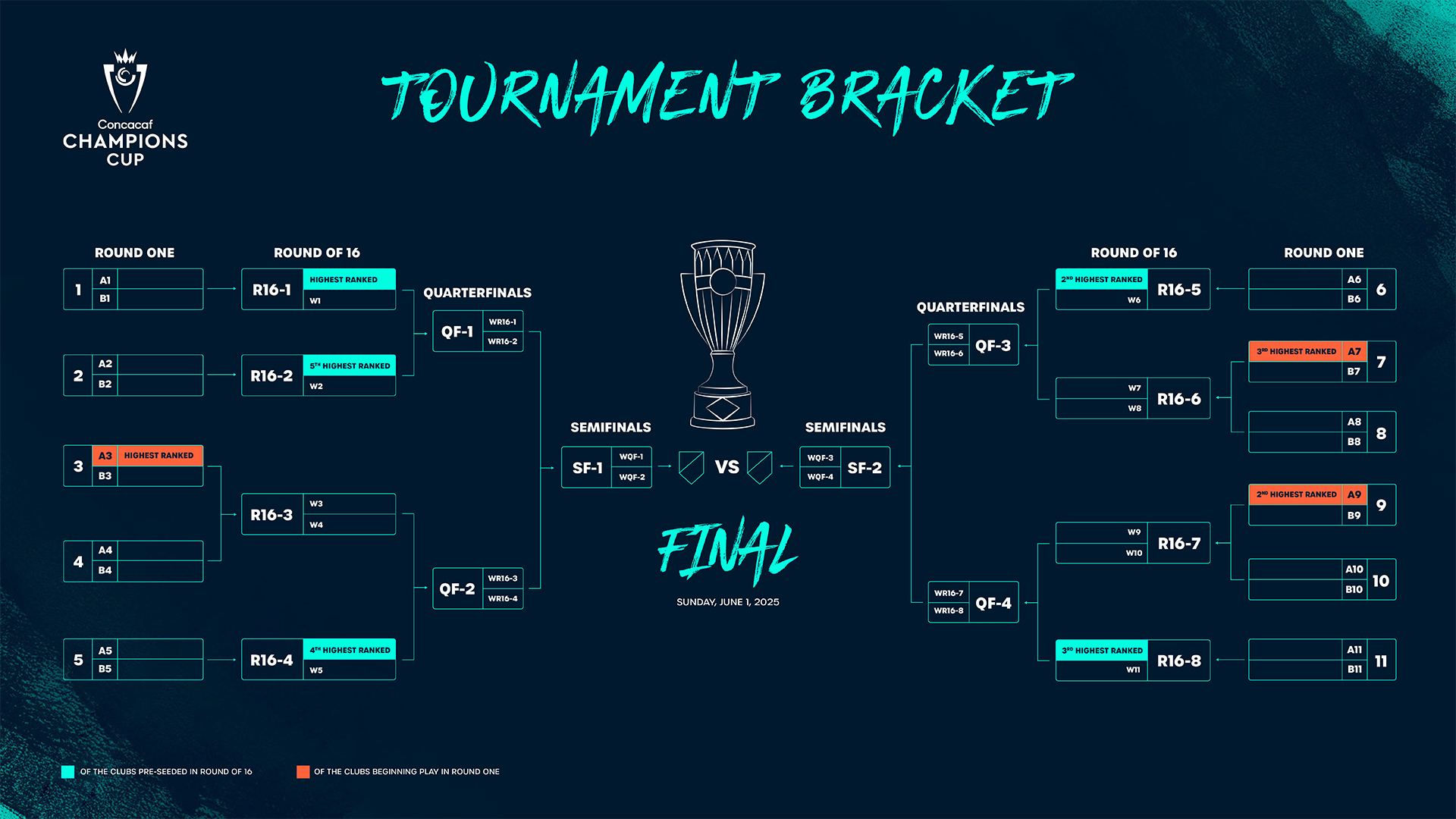

Partido Mexico Vs Panama Todo Sobre La Final De La Concacaf

May 22, 2025

Partido Mexico Vs Panama Todo Sobre La Final De La Concacaf

May 22, 2025 -

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025 -

Liga De Naciones Concacaf Mexico Vs Panama Informacion Del Partido Final

May 22, 2025

Liga De Naciones Concacaf Mexico Vs Panama Informacion Del Partido Final

May 22, 2025 -

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 22, 2025

Cuando Y Donde Ver La Final Concacaf Mexico Contra Panama

May 22, 2025