The Dax And The Bundestag: Understanding The Correlation Between Politics And Markets

Table of Contents

Government Policies and their Impact on the DAX

Government policies emanating from the Bundestag directly influence the performance of the DAX. Understanding these impacts is key to successful investment in the German market.

Fiscal Policy

Government spending, taxation, and budget deficits significantly impact investor confidence and, consequently, the DAX. Fiscal policies can either stimulate economic growth or lead to market downturns.

- Tax cuts: Reductions in corporate or individual income taxes can boost disposable income, leading to increased consumer spending and business investment, positively impacting the DAX.

- Austerity measures: Conversely, austerity measures, such as spending cuts and tax increases, can dampen economic activity, leading to decreased investor confidence and a potential decline in the DAX. For example, the austerity measures implemented in several Eurozone countries following the 2008 financial crisis led to significant market volatility.

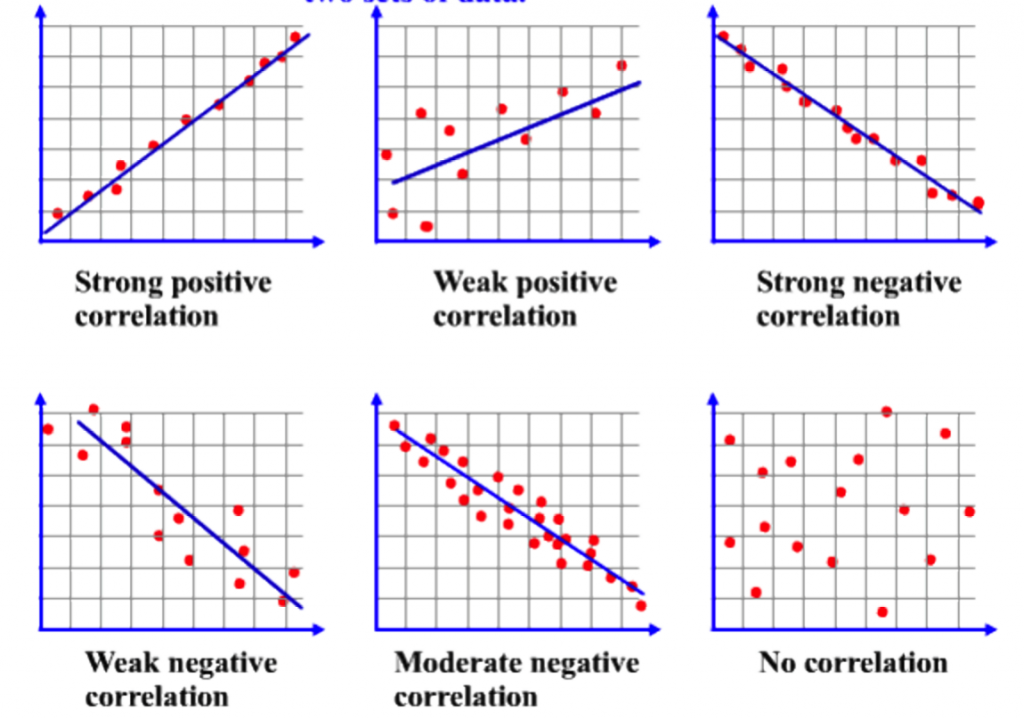

Data from the German Federal Statistical Office (Destatis) shows a clear correlation between changes in fiscal policy and DAX performance. Periods of expansionary fiscal policy often coincide with periods of DAX growth, while contractionary fiscal policies are frequently associated with market corrections.

Monetary Policy

The European Central Bank (ECB), while independent, plays a crucial role in shaping the economic environment in Germany and thus influencing the DAX. The ECB's monetary policy decisions, particularly regarding interest rates, directly impact borrowing costs for businesses and consumers.

- Interest rate cuts: Lower interest rates encourage borrowing and investment, potentially leading to DAX growth.

- Interest rate hikes: Conversely, higher interest rates can curb inflation but may also slow economic growth and negatively impact the DAX.

The interplay between ECB policies and the German government's economic objectives is crucial. For example, if the German government prioritizes economic growth, it might advocate for lower interest rates from the ECB, even if it risks higher inflation. The coordination (or lack thereof) between these two entities significantly impacts market sentiment and DAX performance.

Regulatory Changes

New regulations and legislation passed by the Bundestag can have a significant impact on specific sectors listed in the DAX. Uncertainty surrounding these changes can create market volatility.

- Environmental regulations: Stringent environmental regulations, while beneficial in the long term, can impose short-term costs on businesses, potentially affecting their stock prices and the overall DAX performance. The transition to renewable energy, for instance, has created both opportunities and challenges for companies listed on the DAX.

- Banking reforms: Changes in banking regulations can impact the profitability and stability of financial institutions listed on the DAX. Post-2008 financial crisis reforms significantly altered the operating landscape for German banks.

The uncertainty surrounding new regulations often leads to market volatility. Investors may react negatively to unexpected regulatory changes, even if the long-term impact is positive.

Political Stability and its Influence on Investor Sentiment

Political stability in Germany, as reflected in the Bundestag's functioning, is a key factor influencing investor sentiment and the DAX.

Coalition Governments and Policy Uncertainty

The formation and stability of coalition governments can impact investor confidence. Frequent changes in government or prolonged coalition negotiations can lead to policy uncertainty, negatively impacting the DAX.

- Examples: Periods of political instability in Germany, such as the formation of grand coalitions or the challenges faced by minority governments, have often been associated with periods of market volatility.

Political gridlock can lead to delayed policy decisions and increased uncertainty, making investors hesitant to commit capital.

Election Cycles and Market Volatility

Election cycles and the associated campaign promises significantly influence the DAX. Pre-election periods often witness increased market volatility as investors anticipate potential policy changes.

- Examples: The run-up to major German federal elections frequently sees fluctuations in the DAX as investors react to different parties' economic platforms and campaign promises.

Different political parties’ economic platforms significantly influence investor expectations. A party advocating for fiscal conservatism might lead to investor confidence, while a party promising significant spending increases could cause uncertainty.

Geopolitical Events and their Impact on the German Economy and DAX

International relations and global events significantly affect the German economy and, consequently, the DAX.

- Examples: Trade wars, global financial crises, and geopolitical tensions can all impact German exports, economic growth, and investor sentiment, leading to fluctuations in the DAX.

Considering international factors is crucial when analyzing the DAX. Germany's strong export orientation makes it particularly susceptible to global economic shocks.

Analyzing the DAX for Political Risk

Investors need to develop robust strategies for assessing and managing political risks when investing in the DAX.

Using Economic Indicators

Monitoring key economic indicators is crucial for assessing potential political risks.

- GDP Growth: A slowing GDP can signal economic weakness and potentially influence government policies.

- Inflation: High inflation can lead to interest rate hikes by the ECB and impact investor sentiment.

- Unemployment: Rising unemployment can pressure the government to implement expansionary fiscal policies.

News Sentiment Analysis

Analyzing news articles and social media sentiment can gauge investor sentiment regarding political developments. This can provide early warnings of potential market shifts.

Expert Opinions and Forecasts

Incorporating expert opinions from economic analysts and political scientists enhances risk assessment. Utilizing diverse sources provides a more comprehensive view.

Conclusion

The DAX and the Bundestag are inextricably linked. Political decisions, stability, and external factors significantly influence the German stock market. Understanding this correlation is vital for investment success. By closely monitoring political developments in Germany and their impact on economic indicators, investors can better understand and manage the risks associated with investing in the DAX. Stay informed about the interplay between the DAX and the Bundestag to make smarter investment decisions. Learn more about effective strategies for navigating political risk in the German market.

Featured Posts

-

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champ Collins In Charleston

Apr 27, 2025 -

Justin Herbert And The Chargers 2025 Season Opener In Brazil

Apr 27, 2025

Justin Herbert And The Chargers 2025 Season Opener In Brazil

Apr 27, 2025 -

Kanopys Hidden Gems Free Movies And Shows You Shouldnt Miss

Apr 27, 2025

Kanopys Hidden Gems Free Movies And Shows You Shouldnt Miss

Apr 27, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025 -

Wta Action Finals In Austria And Singapore

Apr 27, 2025

Wta Action Finals In Austria And Singapore

Apr 27, 2025

Latest Posts

-

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

Apr 28, 2025

Investigation Into Lingering Toxic Chemicals Following Ohio Train Derailment

Apr 28, 2025 -

Voice Assistant Creation Simplified Key Announcements From Open Ais 2024 Event

Apr 28, 2025

Voice Assistant Creation Simplified Key Announcements From Open Ais 2024 Event

Apr 28, 2025 -

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025

Open Ai Unveils Streamlined Voice Assistant Development Tools

Apr 28, 2025 -

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 28, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 28, 2025 -

Podcast Power Ais Role In Processing Repetitive Scatological Documents

Apr 28, 2025

Podcast Power Ais Role In Processing Repetitive Scatological Documents

Apr 28, 2025