The Easiest Path To High Dividend Income: A Simple, Profitable Strategy

Table of Contents

Understanding Dividend Investing and its Benefits

Dividend investing is the practice of owning shares in companies that regularly distribute a portion of their profits to shareholders as cash payments—dividends. It's an attractive strategy because it offers a combination of capital appreciation (potential increase in share price) and regular income generation. This dual approach to wealth building makes it a compelling alternative to relying solely on capital gains.

The benefits of dividend investing are numerous:

- Regular cash flow: Dividends provide a steady stream of income that can be used to cover living expenses, reinvest in your portfolio, or pursue other financial goals. This passive income is particularly appealing for those seeking financial security or retirement planning.

- Reduced reliance on capital appreciation: While capital appreciation is always a possibility, dividend investing reduces your dependence on significant share price increases for returns. Dividends contribute directly to your overall returns, providing a cushion during market volatility.

- Long-term wealth building through dividend reinvestment plans (DRIPs): DRIPs allow you to automatically reinvest your dividends to purchase more shares. This powerful tool leverages the magic of compounding, accelerating your wealth growth over time. High dividend income strategies often rely on DRIPs.

- Lower risk (relatively): Compared to some high-growth stocks that can experience significant price swings, established companies with a history of paying consistent dividends often demonstrate greater stability, although no investment is entirely without risk.

Identifying High-Yield Dividend Stocks: A Step-by-Step Approach

Successful dividend investing requires thorough due diligence and a realistic risk assessment. Don't be lured solely by high dividend yields; a comprehensive analysis is crucial. Here’s how to approach it:

Key Metrics to Consider:

- Dividend Yield: This represents the annual dividend payment relative to the stock price. A higher yield generally indicates a higher payout, but always consider the underlying factors contributing to that yield.

- Payout Ratio: This is the percentage of a company's earnings that are paid out as dividends. A sustainable payout ratio is typically below 70%, indicating the company retains sufficient earnings for reinvestment and growth. High dividend income is most often sustainable with moderate payout ratios.

- Dividend Growth History: Look for companies with a history of consistently increasing their dividend payments over time. This demonstrates financial health and a commitment to returning value to shareholders.

Resources for Screening Stocks:

Many financial websites and brokerage platforms offer stock screeners that allow you to filter for stocks based on specific criteria such as dividend yield, payout ratio, and growth history. Use these tools to identify potential candidates, but always conduct your own thorough research before investing.

Avoiding Dividend Traps:

- Excessively High Yields: Be wary of companies offering unusually high dividend yields. This could be a red flag indicating financial distress, impending dividend cuts, or unsustainable business practices. A high dividend income shouldn't come at the cost of stability.

- Signs of Financial Distress: Before investing in a high-yield stock, examine the company's financial statements closely. Look for signs of declining revenue, increasing debt, or consistently negative cash flow—all indicators that could lead to a dividend cut.

Avoiding Dividend Traps: Warning signs of unsustainable high yields and potential pitfalls.

Companies facing financial difficulties sometimes maintain high dividend payouts to attract investors, even if it's unsustainable. This practice can lead to a sudden dividend cut, significantly impacting investor returns. Watch out for companies with:

- High debt levels: Excessive debt can strain a company's finances, making dividend payments unsustainable.

- Declining earnings: Consistent drops in earnings are a serious warning sign, suggesting the company may struggle to maintain its dividend.

- Negative cash flow: If a company's cash outflow exceeds its inflow, it may not have the funds to pay dividends consistently.

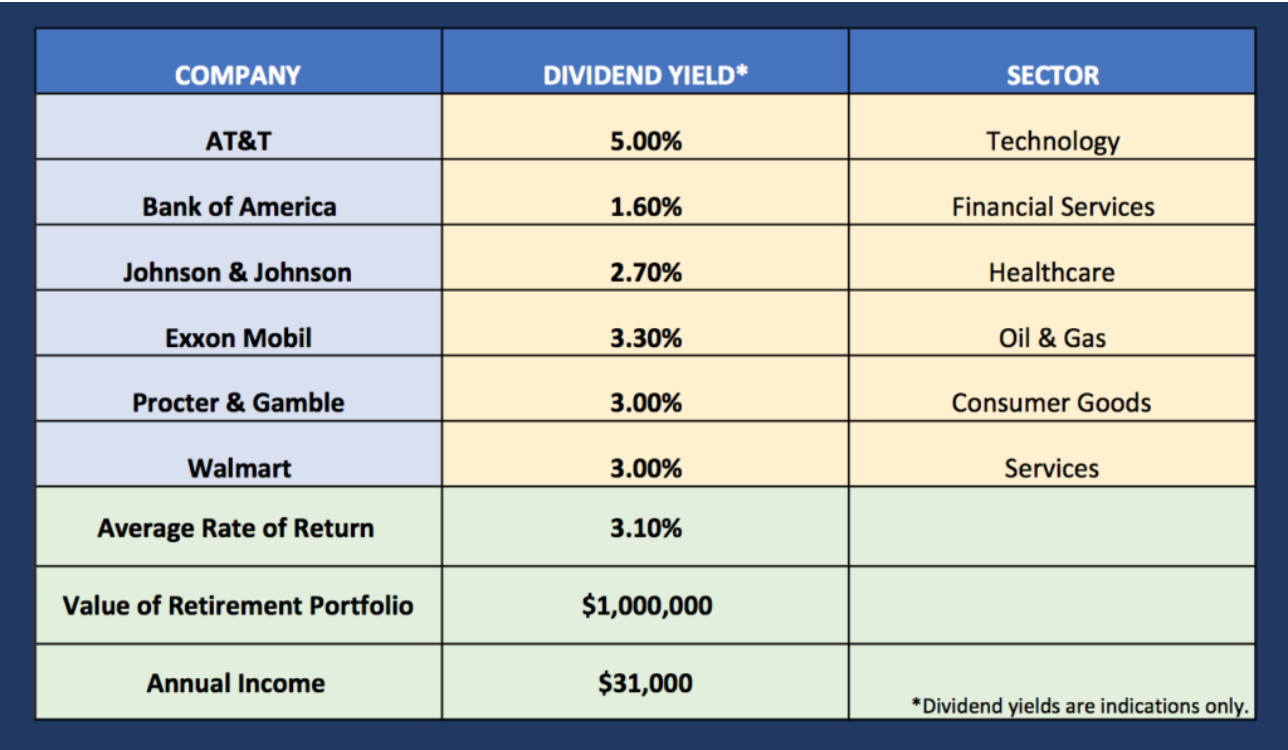

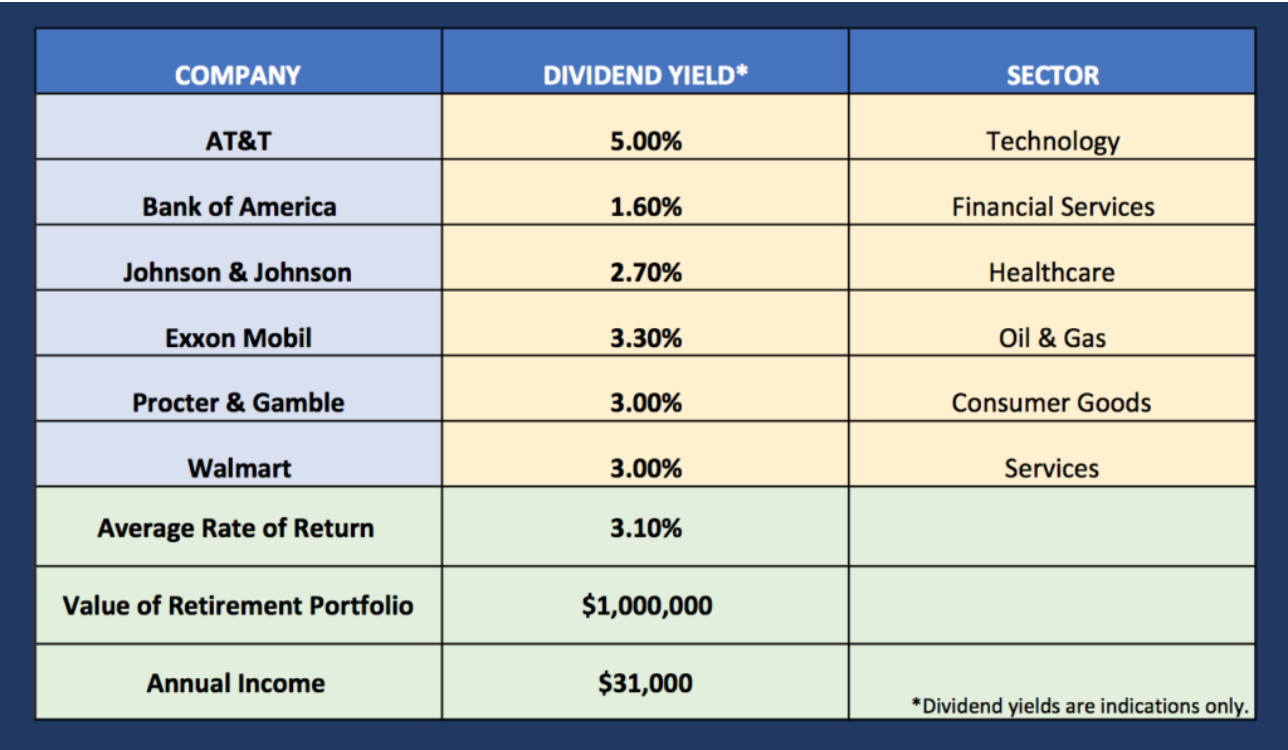

Building a Diversified Dividend Portfolio

Diversification is crucial in mitigating risk. Don't put all your eggs in one basket! Spread your investments across various sectors and companies to reduce the impact of any single investment underperforming.

Diversification Strategies:

- Sector Diversification: Invest in companies from different sectors (e.g., technology, healthcare, consumer goods) to reduce your exposure to sector-specific risks.

- Geographic Diversification: Consider investing in companies based in different countries to further diversify your portfolio and reduce reliance on a single economy.

Starting Small and Expanding Gradually:

Begin by investing in a small number of high-quality dividend stocks that you understand and have thoroughly researched. As your knowledge and portfolio grow, you can gradually add more diverse investments.

Reinvesting Dividends for Accelerated Growth (DRIPs)

Dividend reinvestment plans (DRIPs) are a powerful tool for accelerating wealth growth. They allow you to automatically reinvest your dividends to purchase additional shares of the same company. This strategy leverages the power of compounding, resulting in significant long-term gains.

Benefits of DRIPs:

- Automatic Reinvestment: DRIPs automate the process of buying more shares, eliminating the need for manual transactions.

- Compounding Returns: By reinvesting dividends, you earn dividends on your dividends, creating a snowball effect that significantly boosts your returns over time.

- Reduced Transaction Costs: DRIPs often reduce or eliminate transaction fees associated with buying shares individually, leading to higher overall returns.

Tax Implications: The tax implications of DRIPs vary depending on your jurisdiction. Consult a financial advisor for specific guidance on how DRIPs might affect your tax obligations. This is especially important when considering high dividend income strategies.

Conclusion

This guide has outlined a simple, yet effective strategy for achieving high dividend income. By understanding the basics of dividend investing, carefully selecting high-yield stocks, and diversifying your portfolio, you can create a passive income stream that works for you. Remember, consistent research, patience, and a long-term perspective are key to success in dividend investing. Start building your high-dividend portfolio today and experience the easiest path to achieving your financial goals! Begin your journey to high dividend income now!

Featured Posts

-

Cissokho Vs Kavaliauskas Wbc Final Eliminator Showdown

May 11, 2025

Cissokho Vs Kavaliauskas Wbc Final Eliminator Showdown

May 11, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 11, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Presence In Buildings

May 11, 2025 -

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Lawsuit

May 11, 2025

Ray Epps Sues Fox News For Defamation January 6th Allegations At The Center Of The Lawsuit

May 11, 2025 -

Lily Collins In Calvin Klein A Look At The New Campaign

May 11, 2025

Lily Collins In Calvin Klein A Look At The New Campaign

May 11, 2025 -

Quien Sera El Proximo Papa Explorando Las Posibilidades

May 11, 2025

Quien Sera El Proximo Papa Explorando Las Posibilidades

May 11, 2025