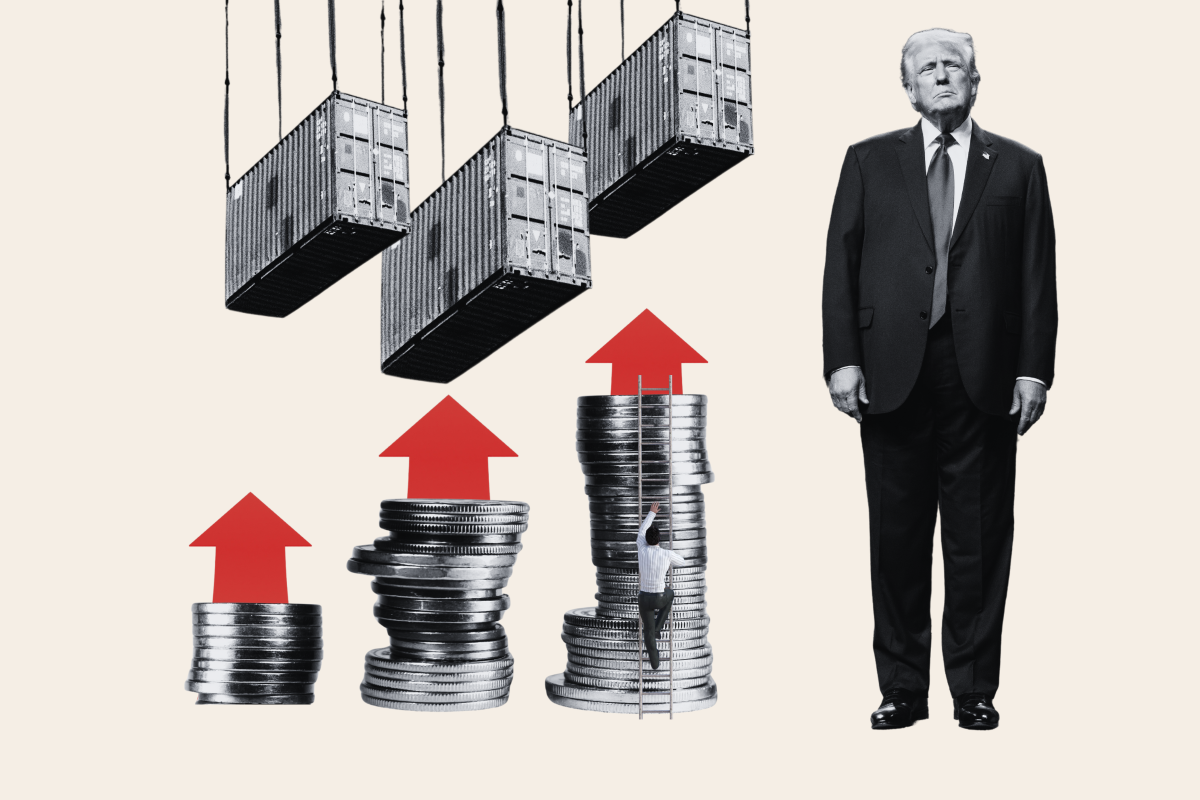

The Economic Fallout Of Trump's China Tariffs: Inflation, Shortages, And Future Implications

Table of Contents

Trump's China Tariffs: Between 2018 and 2020, the Trump administration imposed tariffs on hundreds of billions of dollars worth of Chinese goods. These tariffs, implemented in stages, targeted a wide range of products, from steel and aluminum to consumer electronics and agricultural goods, as part of a broader trade war aimed at addressing trade imbalances and intellectual property concerns. The aim was to pressure China into changing its trade practices; however, the resulting economic consequences were far-reaching and complex. This article argues that these tariffs led to significant economic fallout, including increased inflation, widespread supply chain disruptions, and long-term economic consequences that continue to impact the US today.

Increased Inflation Driven by Tariffs

Tariffs directly increase the price of imported goods. When the US government imposes a tariff, importers must pay an additional fee on top of the product's original cost. This increased import cost is typically passed on to consumers in the form of higher prices. This mechanism, compounded by other factors, significantly contributed to tariff inflation during this period.

The impact wasn't limited to a few specific products. Goods affected included everything from furniture and appliances to steel and electronic components. For example, tariffs on steel led to higher prices for automobiles and construction materials, while tariffs on consumer electronics resulted in increased prices for smartphones and laptops.

- Increased import costs passed onto consumers: The added tariff cost is rarely absorbed by businesses, instead becoming an additional expense for the end-user.

- Reduced competition leading to higher prices: Tariffs can reduce competition by making imports less attractive, potentially leading to domestic price increases.

- Supply chain disruptions exacerbating inflationary pressures: Tariffs often disrupt established supply chains, leading to bottlenecks and higher transportation costs, further fueling inflation.

- Specific examples of price increases: The consumer price index showed notable increases in the prices of steel, furniture, and various electronics directly following the implementation of tariffs. This trade war inflation had a tangible impact on household budgets.

Supply Chain Disruptions and Shortages Caused by Tariffs

Trump's tariffs significantly disrupted global supply chains, leading to shortages of various goods. The imposition of tariffs prompted retaliatory measures from China, further complicating the situation and creating a climate of uncertainty. Businesses faced increased lead times for manufacturing and shipping, leading to stockouts and reduced product availability.

The impact wasn't confined to specific industries. The interconnected nature of global supply chains meant disruptions rippled across the economy. A shortage of one component could halt the production of a finished good, impacting businesses and consumers alike.

- Reduced imports of essential goods: Businesses were forced to find alternative suppliers or reduce reliance on imported goods, sometimes leading to shortages.

- Increased lead times for manufacturing and shipping: Delays in sourcing raw materials and transporting goods increased costs and reduced availability.

- Stockouts and product unavailability: Consumers faced empty shelves and difficulty in finding certain products.

- Examples of specific goods experiencing shortages: Certain types of electronics, particularly those reliant on specific components sourced from China, experienced shortages, alongside various raw materials crucial for numerous manufacturing processes. The impact of import restrictions significantly reduced available supply.

Long-Term Economic Implications of Trump's China Tariffs

The long-term effects of Trump's China tariffs extend beyond immediate price increases and shortages. The economic consequences of tariffs included retaliatory tariffs from China, which hurt US exporters. This created considerable economic uncertainty, discouraging investment and hindering long-term economic growth. The damage to US-China trade relations remains a significant concern, impacting future trade negotiations and economic cooperation.

- Retaliatory tariffs from China: China responded to US tariffs with its own, creating a tit-for-tat scenario that hurt both economies.

- Damage to US-China trade relations: The trade war strained relations between the two largest economies in the world, creating a climate of distrust.

- Uncertainty and investment hesitation: Businesses became hesitant to invest due to the unpredictable nature of trade policies.

- Potential long-term impact on economic growth: The overall impact on US economic growth remains a subject of ongoing debate, but the negative effects are undeniable. The long-term effects of trade wars are still unfolding.

Alternative Economic Policies and Their Potential Impacts

The reliance on tariffs as a primary tool for trade policy is debatable. Alternative approaches could have yielded better results. Instead of protectionist measures, focusing on free trade agreements and fostering fair competition might have achieved better outcomes. This could have been complemented by investing in domestic industries and strengthening domestic supply chains to reduce reliance on foreign sources.

- Negotiated trade agreements: Focusing on collaborative trade agreements could have addressed trade imbalances more effectively.

- Investment in domestic industries: Boosting domestic manufacturing and innovation could reduce reliance on imports.

- Strengthening domestic supply chains: Investing in resilient and diverse supply chains within the US could mitigate the risks associated with global disruptions. This addresses concerns around trade policy alternatives and economic diversification.

Conclusion: Understanding the Lasting Impact of Trump's China Tariffs

In conclusion, Trump's China tariffs had a significant negative impact on the US economy. They contributed to increased inflation (tariff inflation, trade war inflation), disrupted global supply chains, leading to shortages (supply chain disruption, trade war shortages), and damaged long-term economic prospects (economic consequences of tariffs, long-term effects of trade wars). These policies highlighted the complex interplay between trade, economic growth, and international relations. Understanding the economic fallout of Trump's China tariffs is crucial to informed decision-making. Further research into the complexities of trade policy and its impact on inflation, shortages, and future economic implications is essential.

Featured Posts

-

First Look Adidas Anthony Edwards 2 Basketball Shoes

Apr 29, 2025

First Look Adidas Anthony Edwards 2 Basketball Shoes

Apr 29, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 29, 2025

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 29, 2025 -

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025 -

Los Angeles Palisades Fires A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 29, 2025

Los Angeles Palisades Fires A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 29, 2025 -

Ukraine Conflict North Korea Acknowledges Sending Troops To Russia

Apr 29, 2025

Ukraine Conflict North Korea Acknowledges Sending Troops To Russia

Apr 29, 2025

Latest Posts

-

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025

One Teen Convicted Of Murder Following Deadly Rock Throwing Game

Apr 29, 2025 -

Fatal Rock Throwing Teen Receives Murder Conviction

Apr 29, 2025

Fatal Rock Throwing Teen Receives Murder Conviction

Apr 29, 2025 -

Murder Conviction For Teen Involved In Fatal Rock Throwing

Apr 29, 2025

Murder Conviction For Teen Involved In Fatal Rock Throwing

Apr 29, 2025 -

Teen Guilty Of Murder After Deadly Rock Throwing Game

Apr 29, 2025

Teen Guilty Of Murder After Deadly Rock Throwing Game

Apr 29, 2025 -

How Does Ai Think A Deep Dive Into The Mechanics Of Artificial Intelligence

Apr 29, 2025

How Does Ai Think A Deep Dive Into The Mechanics Of Artificial Intelligence

Apr 29, 2025