The Economic Ripple Effects Of The Student Loan Crisis

Table of Contents

Reduced Consumer Spending and Economic Growth

High student loan debt significantly restricts disposable income, acting as a major drag on consumer spending and, consequently, economic growth. The sheer weight of monthly repayments leaves many borrowers with little to spend on discretionary items, impacting various sectors of the economy. This reduced aggregate demand translates directly into slower GDP growth.

- Data: Recent studies show that a significant percentage (often exceeding 20%) of post-graduate income is allocated to student loan repayments, leaving little room for other expenses.

- Impact on Sectors: Reduced consumer spending directly affects retail sales, tourism, and the restaurant industry, leading to decreased employment and business revenue in these sectors.

- Correlation with Economic Growth: Numerous economic analyses demonstrate a clear correlation between rising student loan debt and slower economic growth, suggesting a strong causal relationship. This sluggish growth hinders overall economic prosperity and impacts future investment and innovation.

Impact on the Housing Market

The student loan crisis is also significantly impacting the housing market. The difficulty of saving for a substantial down payment while juggling substantial monthly loan repayments is pushing homeownership out of reach for many young adults. This has profound consequences for both the current generation and future economic growth.

- Homeownership Rates: Statistics reveal a noticeable decline in homeownership rates among millennials and Gen Z, compared to previous generations. This is directly attributable to the burden of student loan debt, making it difficult to accumulate the necessary savings.

- Rental Market: The decreased homeownership rate fuels increased demand in the rental market, driving up rental prices and creating further financial strain for those struggling with student loan payments.

- Property Values: While the impact on property values is complex, the reduced demand for home purchases due to student loan debt can contribute to slower growth in certain segments of the real estate market.

Struggling Small Businesses and Entrepreneurship

High student loan debt presents a considerable obstacle for aspiring entrepreneurs and the growth of small businesses. The significant financial burden limits access to capital, increases financial risk, and reduces the willingness to take on the uncertainties inherent in starting a new business.

- Start-up Hindered: Many potential entrepreneurs postpone or abandon their business ideas due to the overwhelming weight of student loan repayments, significantly reducing the number of new businesses entering the market.

- Business Investment: Existing small business owners might find themselves prioritizing loan repayments over business investments, hindering expansion, innovation, and job creation.

- Job Creation: The reduced growth of small businesses, a key driver of job creation and economic diversification, is a direct consequence of the student loan crisis, potentially leading to higher unemployment rates and a less dynamic economy.

The Long-Term Consequences: A Generational Impact

The economic consequences of the student loan crisis are not confined to the present; they extend into the future, creating a significant generational impact and potentially leading to a prolonged period of slower economic growth.

- Future Economic Growth: Economic models predict that the persistent burden of student loan debt could significantly dampen future economic growth, affecting the prosperity of generations to come.

- Retirement Savings and Social Security: The reduced disposable income caused by student loans inevitably diminishes the ability to save for retirement, potentially increasing the strain on social security and other retirement systems.

- Increased Social Inequality: The student loan crisis exacerbates existing social and economic inequalities, disproportionately affecting lower-income individuals and widening the gap between the wealthy and the less fortunate.

Addressing the Economic Ripple Effects of the Student Loan Crisis

The student loan crisis is a multifaceted problem with far-reaching economic consequences. The interconnectedness of its impact on consumer spending, the housing market, small businesses, and overall economic growth necessitates a comprehensive and proactive approach. Addressing this crisis is not just a matter of personal finance; it's crucial for promoting sustainable economic growth and fostering long-term financial stability.

We must advocate for impactful policy changes, including comprehensive student loan relief programs, reforms to higher education funding, and initiatives to promote financial literacy. Contact your elected officials, support organizations dedicated to student loan debt relief, and educate yourself and others about the urgency of this issue. Solving the student loan crisis is essential for unlocking economic potential and ensuring a brighter financial future for all. Take action today and help us build a more economically sound tomorrow.

Featured Posts

-

Ozhidaemiy Noviy Film Ot Uesa Andersona

May 28, 2025

Ozhidaemiy Noviy Film Ot Uesa Andersona

May 28, 2025 -

Young Fan Rejected Garnachos Autograph Incident Stirs Controversy

May 28, 2025

Young Fan Rejected Garnachos Autograph Incident Stirs Controversy

May 28, 2025 -

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025 -

Mikor Erkezett Gyoekeres Az Arsenalhoz Teljesitmenyenek Elemzese

May 28, 2025

Mikor Erkezett Gyoekeres Az Arsenalhoz Teljesitmenyenek Elemzese

May 28, 2025 -

Hujan Petir Landa Jawa Timur Prakiraan Cuaca Besok 29 Maret 2024

May 28, 2025

Hujan Petir Landa Jawa Timur Prakiraan Cuaca Besok 29 Maret 2024

May 28, 2025

Latest Posts

-

Presidente Da Fecomercio Luta Por Titulo De Cidadao Baiano Para Ronaldo Caiado

May 30, 2025

Presidente Da Fecomercio Luta Por Titulo De Cidadao Baiano Para Ronaldo Caiado

May 30, 2025 -

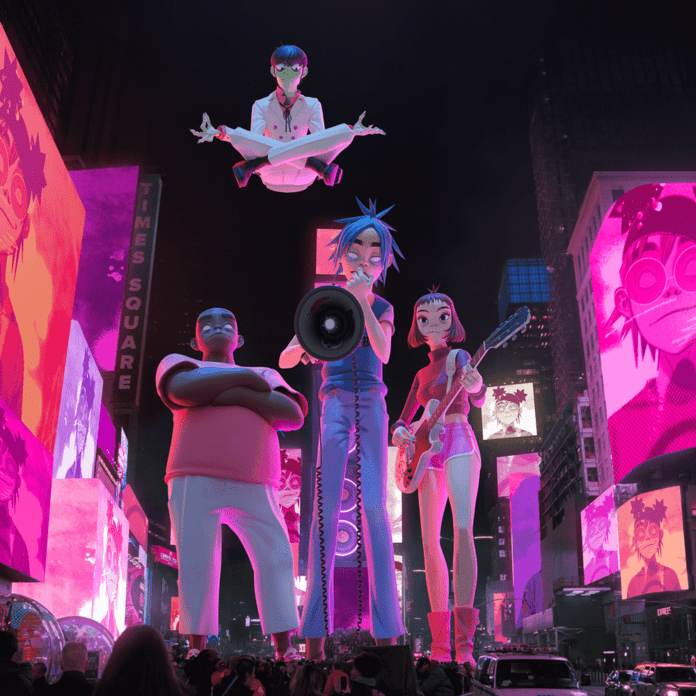

Gorillaz First Three Albums Performed Live At Exclusive London Gigs

May 30, 2025

Gorillaz First Three Albums Performed Live At Exclusive London Gigs

May 30, 2025 -

Gorillaz Announce Four Special September Live Shows

May 30, 2025

Gorillaz Announce Four Special September Live Shows

May 30, 2025 -

Caiado Pode Receber Titulo De Cidadao Baiano Entenda A Proposta Da Fecomercio

May 30, 2025

Caiado Pode Receber Titulo De Cidadao Baiano Entenda A Proposta Da Fecomercio

May 30, 2025 -

Gorillaz To Play First Three Albums Live In London One Off Shows Announced

May 30, 2025

Gorillaz To Play First Three Albums Live In London One Off Shows Announced

May 30, 2025