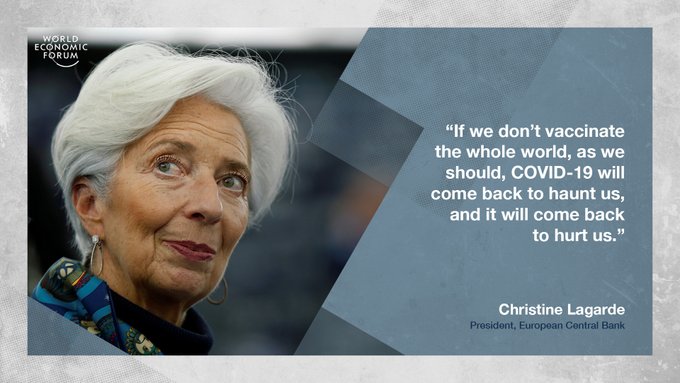

The Euro's Global Role: Lagarde's EUR/USD Strategy And Its Implications

Table of Contents

Lagarde's Monetary Policy and its Effect on the EUR/USD Exchange Rate

The current ECB monetary policy under Lagarde is primarily focused on managing inflation within the Eurozone. This involves carefully calibrated interest rate decisions and other monetary tools. The impact of these decisions on the EUR/USD exchange rate is substantial.

- Higher interest rates generally strengthen the Euro. Higher rates make Euro-denominated assets more attractive to international investors, increasing demand and pushing up the value of the Euro against the dollar. This is because investors seek higher returns.

- Lower interest rates can weaken the Euro. Conversely, lower rates make the Euro less attractive, potentially leading to capital outflows and a depreciation of the Euro against the dollar.

The ECB's inflation targets are key drivers of these decisions.

- Inflation exceeding targets might lead to aggressive rate hikes, boosting the Euro. If inflation remains persistently above the ECB's target, Lagarde and the ECB are likely to respond with aggressive interest rate increases to curb price rises, leading to a stronger Euro. This is a classic response to inflationary pressures.

- Inflation below targets could result in easing policies, weakening the Euro. Conversely, if inflation falls below the target, the ECB might opt for a more accommodative policy, potentially lowering interest rates and weakening the Euro's value. This reflects a less urgent need to control inflation.

Geopolitical Factors Influencing the Euro's Value

The Euro's value is not solely determined by monetary policy. Geopolitical events significantly influence its performance against the US dollar.

-

The impact of the Russia-Ukraine conflict on the Euro: The ongoing conflict has had a profound impact.

- Energy dependence and sanctions impact: The Eurozone's reliance on Russian energy has made it vulnerable to supply disruptions and price shocks, impacting economic growth and negatively affecting the Euro's value.

- Flight to safety effects: During times of geopolitical uncertainty, investors often seek the safety of the US dollar, leading to a decline in the EUR/USD exchange rate.

-

The role of the Eurozone's political stability: Political stability within the Eurozone is crucial for maintaining investor confidence.

- Impact of potential political crises within the Eurozone: Political instability, such as disagreements among member states or potential exits from the Eurozone, can negatively impact investor sentiment and weaken the Euro.

- Influence of EU-wide policies on market sentiment: EU-wide policies, such as those addressing migration or fiscal issues, can also impact investor confidence and influence the EUR/USD exchange rate.

-

Influence of global economic events (e.g., US economic performance) on the EUR/USD: The performance of the US economy directly influences the dollar's strength, and by extension, the EUR/USD.

- US recessionary fears impacting the Euro: Fears of a US recession can lead to a flight to safety, strengthening the dollar and weakening the Euro.

- Strong US dollar affecting the EUR/USD: A strong US dollar generally means a weaker Euro, as investors shift their assets towards dollar-denominated investments.

The Euro's Role in International Trade and Finance

The Euro plays a significant role in international trade and finance, though it remains second to the US dollar.

-

The Euro's importance as a reserve currency: While the US dollar dominates as a reserve currency, the Euro is a significant contender.

- Comparison with the US dollar's dominance: The Euro's share of global foreign exchange reserves continues to be a significant portion, demonstrating its global acceptance.

- Impact of Euro adoption by non-Eurozone countries: The potential for wider adoption of the Euro by countries outside the Eurozone could further strengthen its role in international finance.

-

The Euro's impact on global trade balances: The Euro's role in international trade settlements is substantial.

- Eurozone exports and imports: A significant portion of global trade is conducted using Euros, directly impacting trade balances.

- The Euro's role in international trade settlements: The Euro facilitates trade across borders, simplifying transactions and reducing costs for businesses within the Eurozone and beyond.

Predicting Future Trends of the EUR/USD based on Lagarde's Strategy

Predicting future EUR/USD trends based on Lagarde's strategy is challenging, but some potential scenarios can be outlined.

-

Potential scenarios based on different ECB policy decisions:

- Scenario 1: Continued rate hikes, strong Euro. If the ECB continues its aggressive rate hike policy to combat inflation, the Euro is likely to strengthen against the dollar.

- Scenario 2: Rate pause or cuts, weak Euro. If the ECB pauses or even cuts interest rates due to concerns about economic growth, the Euro could weaken against the dollar.

-

Assessing the risks and uncertainties involved in predicting the EUR/USD: Predicting currency movements is inherently risky due to several factors.

- Unforeseen geopolitical events: Unexpected geopolitical events can significantly impact currency markets, making accurate predictions difficult.

- Market volatility and speculation: Market speculation and volatility can cause short-term fluctuations unrelated to fundamental economic factors.

-

Potential implications for investors and businesses: The EUR/USD exchange rate significantly impacts investors and businesses.

- Impact on investment strategies: Fluctuations in the EUR/USD influence investment returns for both international and domestic investors.

- Effects on international trade and finance: Changes in the EUR/USD can impact the profitability of international transactions and affect businesses engaged in international trade.

Conclusion

The Euro's global role is inextricably linked to the ECB's monetary policy under Christine Lagarde. Her strategic decisions significantly impact the EUR/USD exchange rate, influenced by factors ranging from domestic inflation targets to global geopolitical events. Understanding these intricate relationships is crucial for investors, businesses, and policymakers alike. Continued monitoring of the ECB's actions and global economic developments is vital to effectively navigate the complexities of the Euro's future. To stay informed about the latest developments concerning the Euro's global role and Lagarde's impact, continue researching and following financial news outlets closely. Staying abreast of shifts in the Euro's global role is critical for successful financial decision-making.

Featured Posts

-

Bethlehem Elections Negative Campaigning Takes Center Stage

May 28, 2025

Bethlehem Elections Negative Campaigning Takes Center Stage

May 28, 2025 -

Pacers Vs Kings Latest Injury News Before March 31st Game

May 28, 2025

Pacers Vs Kings Latest Injury News Before March 31st Game

May 28, 2025 -

Garnacho Transfer Manchester Uniteds E60 Million Valuation

May 28, 2025

Garnacho Transfer Manchester Uniteds E60 Million Valuation

May 28, 2025 -

Angels Continue Winning Ways With Fourth Straight Victory

May 28, 2025

Angels Continue Winning Ways With Fourth Straight Victory

May 28, 2025 -

Remembering Charlie Rangel The Life And Career Of A New York Giant

May 28, 2025

Remembering Charlie Rangel The Life And Career Of A New York Giant

May 28, 2025

Latest Posts

-

First Time Ever Banksy Art Showcased In Dubai World News

May 31, 2025

First Time Ever Banksy Art Showcased In Dubai World News

May 31, 2025 -

World News Banksy Artworks Arrive In Dubai

May 31, 2025

World News Banksy Artworks Arrive In Dubai

May 31, 2025 -

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025

World News Banksy Artwork Makes Its Dubai Premiere

May 31, 2025 -

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025

Dubai Hosts First Ever Banksy Art Exhibition World News

May 31, 2025 -

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025

Banksys Art Debuts In Dubai A World News Exclusive

May 31, 2025