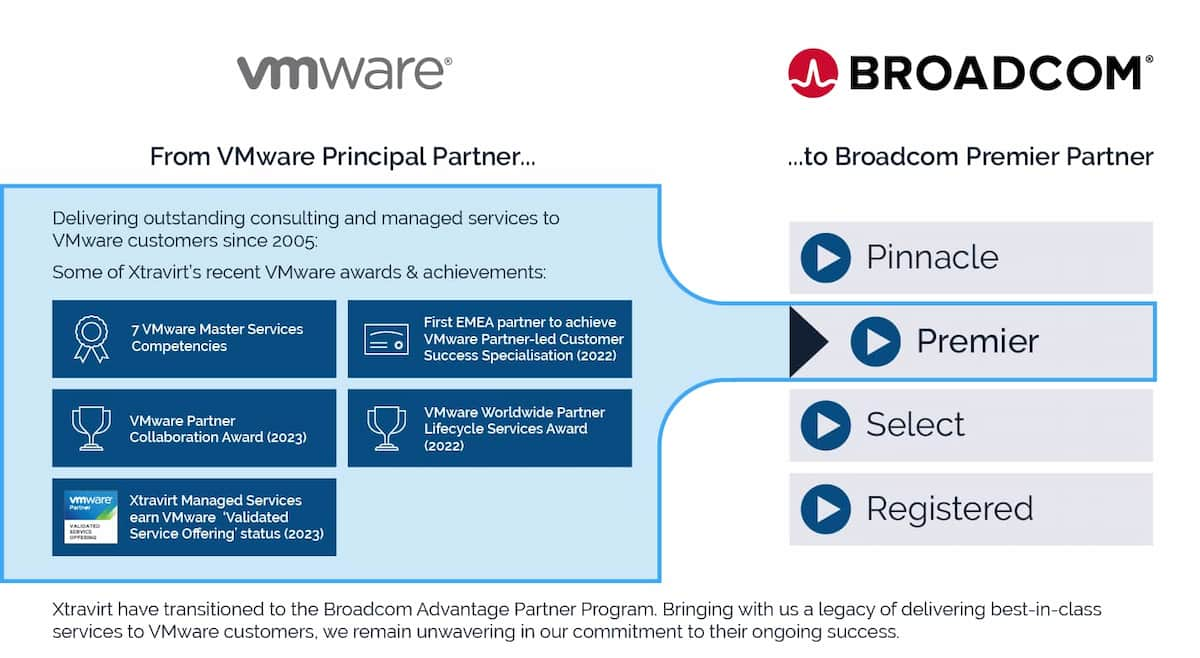

The Extreme Cost Of Broadcom's VMware Acquisition: AT&T's Perspective

Table of Contents

Increased Licensing Costs for AT&T

AT&T, like many large enterprises, heavily relies on VMware's virtualization technologies for its core infrastructure. The Broadcom VMware acquisition cost for AT&T will significantly increase due to rising licensing fees and reduced negotiating leverage.

VMware vSphere and other key products

AT&T's infrastructure likely utilizes a range of VMware products, including vSphere (for server virtualization), vSAN (for software-defined storage), and NSX (for network virtualization). These are crucial for maintaining AT&T's vast network and providing services to millions of customers. Broadcom's acquisition could drastically alter the pricing structure for these essential tools.

- Increased licensing fees for vSphere, vSAN, NSX: Expect significant price hikes across the board as Broadcom seeks to maximize returns on its massive investment.

- Loss of competitive pricing options: The competitive landscape will likely shift, reducing AT&T's ability to negotiate favorable pricing deals.

- Potential for reduced support quality under new ownership: Changes in support structures and potentially reduced investment in customer service could lead to degraded support quality.

- Difficulty in budget forecasting due to price uncertainty: The lack of transparency regarding future pricing makes accurate budget planning extremely challenging for AT&T.

Integration Challenges and Downtime Risks

The integration of VMware into Broadcom's portfolio presents considerable operational risks for AT&T. The Broadcom VMware acquisition cost extends beyond licensing fees to include potential downtime and integration complexities.

Disruption to AT&T's existing VMware environment

Migrating to Broadcom's systems is a complex undertaking, posing significant challenges for AT&T’s already intricate network infrastructure.

- Complexity of migrating to Broadcom's systems: The transition process is likely to be lengthy and resource-intensive, requiring extensive planning and execution.

- Potential for network outages and service disruptions: Integration issues could lead to disruptions in AT&T's critical services, resulting in significant financial losses and reputational damage.

- Increased IT support costs during the transition period: The migration process will inevitably require extra IT support, adding to the overall Broadcom VMware acquisition cost for AT&T.

- Risk of incompatibility issues between existing AT&T systems and new Broadcom solutions: Existing systems may not seamlessly integrate with Broadcom's offerings, requiring costly modifications or replacements.

Impact on AT&T's Innovation and Competitive Advantage

Broadcom's acquisition of VMware could also indirectly impact AT&T's innovation capabilities and competitive standing in the telecommunications market. The overall Broadcom VMware acquisition cost calculation must include this potentially significant intangible factor.

Reduced innovation and flexibility

Broadcom's focus on maximizing profits might prioritize short-term gains over long-term innovation within VMware.

- Slower development cycles for new VMware features and updates: Reduced investment in R&D could result in slower innovation and fewer new features.

- Limited options for customized solutions: AT&T might have less flexibility in tailoring VMware solutions to its specific needs.

- Potential loss of access to beta programs and early adopters' benefits: Changes in VMware's policies might limit AT&T's access to cutting-edge technologies.

- Reduced competitive advantage in the telecommunications market: Slower innovation could put AT&T at a disadvantage against competitors using more advanced technologies.

Long-Term Strategic Implications for AT&T

The Broadcom VMware acquisition cost necessitates a comprehensive reevaluation of AT&T's IT strategy and vendor relationships.

Re-evaluating IT strategy and vendor relationships

In light of the acquisition, AT&T needs to proactively assess its long-term dependence on VMware and Broadcom.

- Exploring open-source alternatives to VMware products: Open-source solutions could offer cost savings and greater flexibility.

- Diversifying vendor relationships to reduce dependence on Broadcom: Spreading risk across multiple vendors is a crucial strategy for mitigating future cost increases.

- Investing in internal development of alternative technologies: Developing in-house solutions might prove a long-term cost-effective strategy.

- Long-term cost-benefit analysis of sticking with Broadcom vs. switching: A careful evaluation is essential to determine the most financially viable path.

Conclusion

The Broadcom VMware acquisition presents substantial challenges for AT&T, ranging from immediate cost increases to long-term strategic concerns. Increased licensing costs, integration hurdles, and potential impacts on innovation necessitate a thorough reassessment of AT&T's IT strategy. Understanding the true Broadcom VMware Acquisition Cost is crucial for AT&T, and proactively addressing these challenges is vital to mitigate the financial and operational risks. Companies relying heavily on VMware should closely examine their own exposure to these potential escalating costs and explore strategies for mitigation. Understanding the implications of the Broadcom VMware acquisition is crucial for strategic planning.

Featured Posts

-

Nhl 25 Arcade Mode Returns Gameplay Features And More

May 07, 2025

Nhl 25 Arcade Mode Returns Gameplay Features And More

May 07, 2025 -

Isabela Merced Hawkgirl Role A Big Improvement Over Madame Web

May 07, 2025

Isabela Merced Hawkgirl Role A Big Improvement Over Madame Web

May 07, 2025 -

Lewis Capaldis Comeback New Music Confirmed By Friend

May 07, 2025

Lewis Capaldis Comeback New Music Confirmed By Friend

May 07, 2025 -

Bulls Fall To Cavaliers Ceding Eastern Conferences Top Ranking

May 07, 2025

Bulls Fall To Cavaliers Ceding Eastern Conferences Top Ranking

May 07, 2025 -

Ps 5 Stock Where To Buy Before The Expected Price Increase

May 07, 2025

Ps 5 Stock Where To Buy Before The Expected Price Increase

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025