The Falling Dollar And Its Consequences For Asian Economies

Table of Contents

Increased Export Competitiveness for Some Asian Nations

A weaker dollar makes Asian exports cheaper for buyers using other currencies, potentially leading to increased demand and higher sales. This is a significant factor for many Asian economies heavily reliant on exports.

Boosted Demand for Asian Goods

- Increased demand for manufactured goods: Countries like China, Vietnam, and Bangladesh, known for their manufacturing prowess, could see a surge in demand for their goods as they become more affordable internationally. This increased affordability directly translates into a competitive advantage in the global marketplace.

- Potential for higher export revenue and economic growth: Higher export volumes lead to increased revenue, boosting GDP growth and potentially creating more jobs within these exporting sectors. The positive feedback loop between increased exports and economic growth is a key benefit for nations experiencing a weakened dollar.

- Increased competitiveness against other exporting nations: A falling dollar can significantly enhance the competitiveness of Asian exporters against those from countries whose currencies aren't weakening, capturing a larger share of the global market. This shift in market share can have long-term implications for economic dominance.

Challenges for Export-Dependent Economies

However, not all Asian economies benefit equally. While some experience a boost, others face challenges if their export markets are saturated or if their production costs rise proportionally with the dollar's fall.

- Potential for increased competition from other low-cost producers: Even with a weaker dollar, Asian nations may still face intensified competition from other low-cost producers in regions like Southeast Asia or South America. Maintaining a competitive edge requires continuous innovation and efficiency improvements.

- Need for diversification of export markets: Over-reliance on specific markets can expose economies to vulnerability. Diversifying export destinations helps mitigate the risk associated with a fluctuating dollar and changing global demand.

- Potential inflationary pressure: If increased demand outpaces supply, the increased export activity can lead to inflationary pressures within the domestic market. Careful management of production capacity and supply chains is therefore crucial.

Impact on Investment and Capital Flows

A falling dollar influences investment and capital flows significantly, impacting Asian economies in both positive and negative ways.

Foreign Direct Investment (FDI)

A falling dollar can make investments in Asian markets more attractive for foreign investors holding other currencies.

- Increased FDI inflows into Asian economies: The lower dollar cost of assets makes them more appealing, leading to increased foreign investment. This inflow fuels economic growth and development.

- Potential for boosting economic growth through infrastructure development and job creation: FDI often targets infrastructure projects and industrial expansion, leading to job creation and long-term economic development.

- Risk of capital flight: Political instability or economic uncertainty can cause investors to withdraw their investments, leading to capital flight. Maintaining political and economic stability is essential for attracting and retaining foreign investment.

Portfolio Investment

Fluctuations in the dollar significantly affect portfolio investment flows.

- Increased volatility in stock and bond markets: Changes in the dollar’s value can trigger volatility, influencing investor sentiment and impacting market performance.

- Potential for capital outflows: If investors seek higher returns in other currencies or perceive increased risk, they might withdraw investments from Asian markets.

- Need for robust financial regulations: Strong regulatory frameworks are essential to mitigate risks and maintain stability within the financial markets during periods of dollar volatility.

Inflationary Pressures and Currency Fluctuations

A falling dollar creates ripple effects, influencing import costs and currency volatility within Asian economies.

Import Costs

A weaker dollar increases the cost of imported goods, potentially leading to inflation.

- Increased prices for energy, raw materials, and consumer goods: Many Asian economies rely on imports for essential goods, and a weaker dollar directly translates to higher import prices.

- Impact on consumer spending and overall economic growth: Rising prices reduce consumer purchasing power, potentially impacting economic growth.

- Need for effective monetary policy: Central banks need to implement appropriate monetary policies to manage inflation and maintain price stability.

Currency Volatility

A falling dollar can create instability in Asian currency markets.

- Increased exchange rate risk for importers and exporters: Fluctuating exchange rates make it difficult to predict future costs and revenues, increasing risk for businesses engaged in international trade.

- Need for hedging strategies: Businesses need to employ hedging strategies to mitigate currency risk and protect their profits.

- Potential impact on international trade and investment: Uncertainty surrounding exchange rates can negatively impact investment decisions and international trade flows.

Conclusion

The falling dollar presents a complex and multifaceted challenge for Asian economies. While some nations might benefit from increased export competitiveness, others face risks related to inflation, currency volatility, and investment flows. Understanding these potential consequences is crucial for policymakers and businesses. Proactive measures, including diversification strategies, robust financial regulations, and effective monetary policies, are necessary to navigate the implications of a falling dollar and ensure sustainable economic growth in Asian economies. Staying informed about dollar fluctuations and their potential effects is vital for making sound economic decisions in this dynamic global landscape.

Featured Posts

-

Blake Lively And Anna Kendricks Another Simple Favor Event

May 05, 2025

Blake Lively And Anna Kendricks Another Simple Favor Event

May 05, 2025 -

The Potent Powder Understanding Cocaines Global Surge

May 05, 2025

The Potent Powder Understanding Cocaines Global Surge

May 05, 2025 -

Post Split Trip Sydney Sweeney Enjoys African Safari With Friends

May 05, 2025

Post Split Trip Sydney Sweeney Enjoys African Safari With Friends

May 05, 2025 -

Estimating The 2025 Kentucky Derby Pace Factors And Forecasts

May 05, 2025

Estimating The 2025 Kentucky Derby Pace Factors And Forecasts

May 05, 2025 -

La Prevencion De La Necedad Guia Completa

May 05, 2025

La Prevencion De La Necedad Guia Completa

May 05, 2025

Latest Posts

-

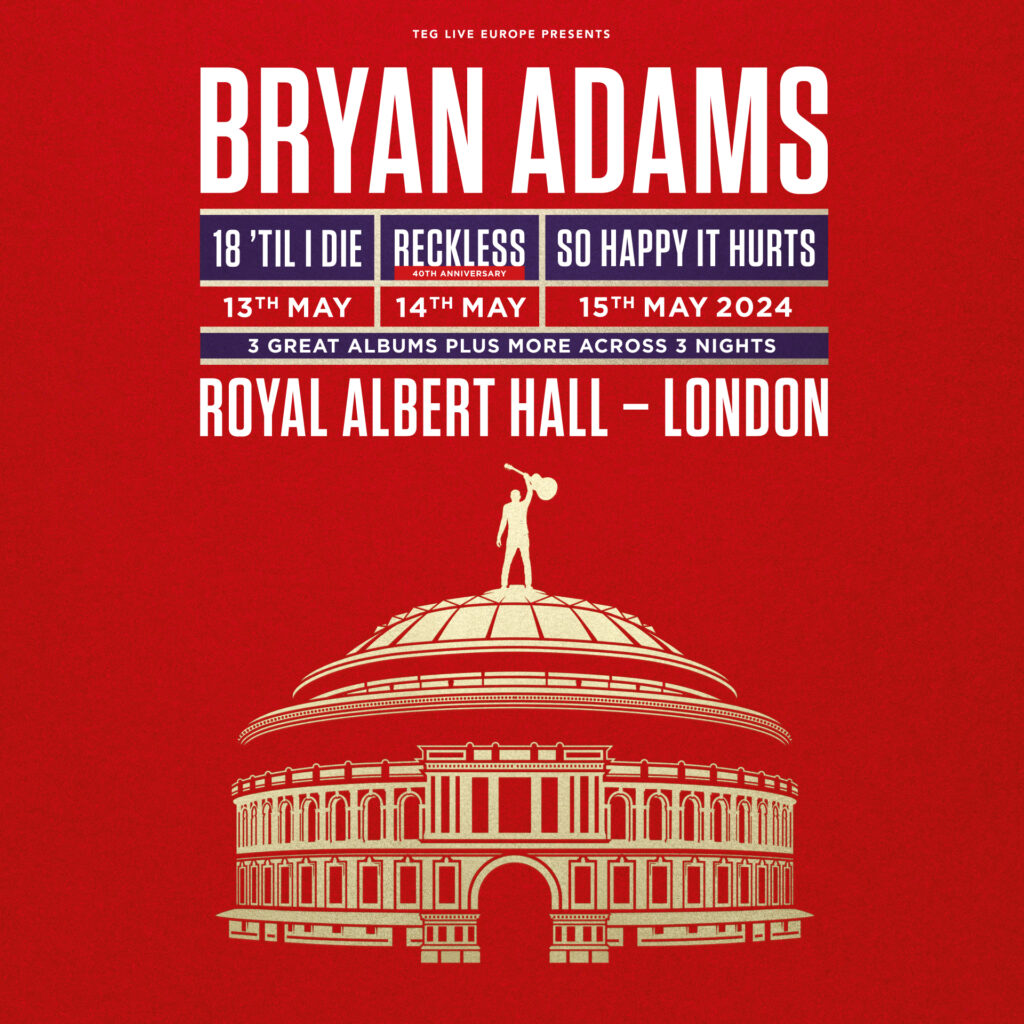

Reliving The Magic Diana Ross At The Royal Albert Hall 1973

May 06, 2025

Reliving The Magic Diana Ross At The Royal Albert Hall 1973

May 06, 2025 -

Diana Ross Unrevealed Promise To Her Late Friend Michael Jackson

May 06, 2025

Diana Ross Unrevealed Promise To Her Late Friend Michael Jackson

May 06, 2025 -

Tracee Ellis Ross Back On The Runway For Marni After Three Decades

May 06, 2025

Tracee Ellis Ross Back On The Runway For Marni After Three Decades

May 06, 2025 -

Diana Ross Live At The Royal Albert Hall 1973 A Concert For The Ages

May 06, 2025

Diana Ross Live At The Royal Albert Hall 1973 A Concert For The Ages

May 06, 2025 -

Plan Your Trip Diana Ross Symphonic Celebration 2025 Uk Tour

May 06, 2025

Plan Your Trip Diana Ross Symphonic Celebration 2025 Uk Tour

May 06, 2025