The Fate Of Trump's Tax Cuts: Challenges And Potential For Success

Table of Contents

Economic Impacts of Trump's Tax Cuts

Short-Term Economic Growth

Trump's tax cuts initially spurred some economic growth. The reduction in corporate tax rates from 35% to 21% was touted as a catalyst for increased investment and job creation.

- Increased Business Investment: Some businesses did indeed reinvest profits, leading to a short-term boost in capital expenditures. However, the extent of this investment remains a subject of ongoing debate. Data from the Bureau of Economic Analysis (BEA) shows a modest increase in business investment in the years immediately following the tax cuts.

- GDP Growth: While GDP growth did increase in the short term, attributing this solely to the tax cuts is difficult, as other economic factors were also at play. The Congressional Budget Office (CBO) provides varying estimates on the direct impact of the tax cuts on GDP growth.

- Job Creation: The impact on job creation was less dramatic than initially predicted. While some sectors experienced growth, the overall effect on employment was modest, according to various analyses by organizations like the Economic Policy Institute (EPI).

Keywords: economic growth, GDP growth, job creation, investment, short-term effects, BEA, CBO, EPI

Long-Term Economic Sustainability

The long-term economic implications of Trump's tax cuts are more concerning. The significant reduction in tax revenue has led to a substantial increase in the national debt.

- National Debt Increase: The CBO projected a substantial increase in the national debt due to reduced government revenue, and this prediction has largely materialized. The sustained deficits pose risks to long-term economic stability.

- Inflationary Pressures: While inflation wasn't immediately rampant, the potential for increased inflationary pressures exists, particularly with sustained government spending and robust economic growth.

- Income Inequality: Critics argue that the tax cuts disproportionately benefited high-income earners, exacerbating income inequality. Studies from organizations like the Institute on Taxation and Economic Policy (ITEP) have explored this distributional effect.

Keywords: national debt, inflation, income inequality, long-term effects, fiscal sustainability, ITEP

Political Ramifications of Trump's Tax Cuts

Political Polarization

Trump's tax cuts became a highly partisan issue, further fueling political polarization in the United States.

- Party-Line Votes: The tax cuts passed largely along party lines, with minimal bipartisan support. This lack of consensus reflected pre-existing divisions within Congress and the broader electorate.

- Ongoing Controversies: Debates continue surrounding the fairness and effectiveness of the tax cuts, hindering efforts to address other pressing economic issues. The tax cuts became a potent symbol in the broader political landscape.

Keywords: political polarization, bipartisan support, legislative gridlock, partisan politics

Impact on Future Tax Policy

The tax cuts significantly impacted subsequent tax policy debates.

- Potential for Revisions or Repeal: Discussions regarding potential revisions or even repeal of certain aspects of the tax cuts have been ongoing, reflecting ongoing political and economic realities.

- Future Tax Legislation: The debate surrounding Trump's tax cuts will continue to shape the landscape of future tax legislation, influencing the conversations on tax reform and long-term fiscal planning.

Keywords: tax reform, future tax policy, tax legislation, repeal, revision

Social and Demographic Effects of Trump's Tax Cuts

Impact on Different Income Groups

The distributional effects of Trump's tax cuts were uneven.

- Benefits Concentrated at the Top: A significant portion of the tax cuts' benefits accrued to high-income households and corporations. This exacerbated existing income inequality.

- Limited Impact on Lower and Middle-Income Groups: While some lower and middle-income families received tax relief, the magnitude of the benefits was considerably less than for higher-income groups.

Keywords: income inequality, tax brackets, social mobility, wealth distribution

Long-Term Societal Impacts

The long-term social consequences of Trump's tax cuts are still unfolding.

- Reduced Funding for Social Programs: Reduced government revenue due to the tax cuts has put pressure on social programs, potentially impacting education, healthcare, and infrastructure investment.

- Increased Social Inequality: The unequal distribution of benefits from the tax cuts could lead to increased social inequality and reduced social mobility.

Keywords: social programs, infrastructure investment, social welfare, healthcare, education

Conclusion

Trump's tax cuts generated a short-term economic boost, but their long-term sustainability remains questionable. The significant increase in the national debt, potential for inflation, and exacerbation of income inequality present serious challenges. Furthermore, the political polarization surrounding the tax cuts has complicated efforts to address other pressing economic issues and will undoubtedly influence future tax policy debates.

Key Takeaways:

- The short-term economic benefits of Trump's tax cuts were modest compared to the long-term fiscal risks.

- The tax cuts significantly increased income inequality, further dividing the nation.

- The political fallout from the tax cuts continues to affect legislative efforts and broader policy debates.

Understanding the complex legacy of Trump's tax cuts is crucial for informed participation in the ongoing debate surrounding future tax policy. Continue your research and engage in the discussion to shape a more equitable and sustainable economic future.

Featured Posts

-

What Caused The Core Weave Crwv Stock Decline On Thursday

May 22, 2025

What Caused The Core Weave Crwv Stock Decline On Thursday

May 22, 2025 -

Appeal Fails Councillors Wifes Social Media Rant About Migrants After Southport Incident

May 22, 2025

Appeal Fails Councillors Wifes Social Media Rant About Migrants After Southport Incident

May 22, 2025 -

Sound Perimeter A Study Of Musics Social Impact

May 22, 2025

Sound Perimeter A Study Of Musics Social Impact

May 22, 2025 -

The Goldbergs Where To Watch And How To Stream Every Episode

May 22, 2025

The Goldbergs Where To Watch And How To Stream Every Episode

May 22, 2025 -

Jackson Hole Elk Feedground Cwd Detection And Implications

May 22, 2025

Jackson Hole Elk Feedground Cwd Detection And Implications

May 22, 2025

Latest Posts

-

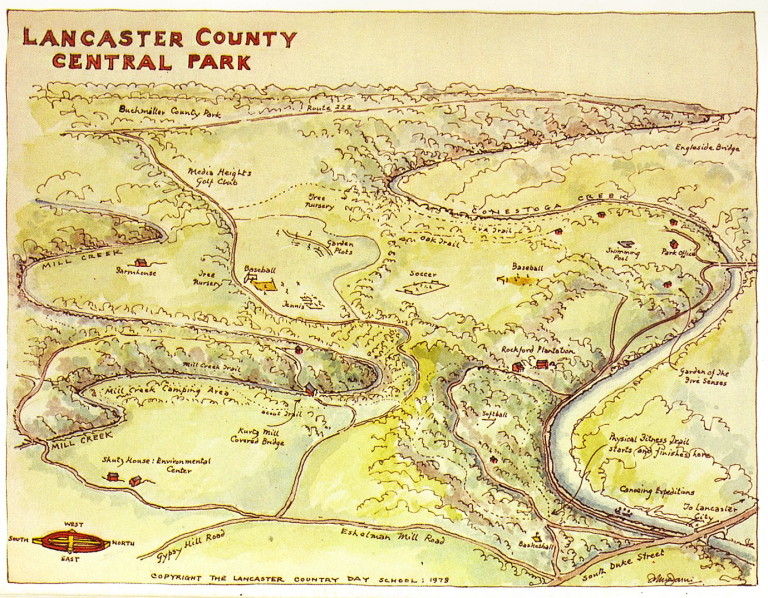

Report Two Cows Loose In Lancaster County Park

May 22, 2025

Report Two Cows Loose In Lancaster County Park

May 22, 2025 -

Lancaster County Crash Pilot And Son Released From Burn Center

May 22, 2025

Lancaster County Crash Pilot And Son Released From Burn Center

May 22, 2025 -

Pilot Son Severely Injured In Lancaster County Crash Released From Lehigh Valley Burn Center

May 22, 2025

Pilot Son Severely Injured In Lancaster County Crash Released From Lehigh Valley Burn Center

May 22, 2025 -

Lancaster County Park Cow Escape Location And Updates

May 22, 2025

Lancaster County Park Cow Escape Location And Updates

May 22, 2025 -

York County Pa Firefighters Battle Two Alarm Blaze Property Loss And Investigation

May 22, 2025

York County Pa Firefighters Battle Two Alarm Blaze Property Loss And Investigation

May 22, 2025