The Feasibility Of Affordable Housing Without Lowering Home Prices: A Case Study

Table of Contents

Innovative Financing Models for Affordable Housing

Addressing the affordable housing shortage requires creative financial solutions that don't rely solely on depressing the overall housing market. Several innovative models offer promising pathways.

Government Subsidies and Incentives

Governments play a vital role in stimulating affordable housing development through various financial mechanisms. These include:

- Tax credits: These incentivize developers to build affordable units by reducing their tax burden. The Low-Income Housing Tax Credit (LIHTC) program in the United States, for example, has financed millions of affordable housing units.

- Grants: Direct government grants provide upfront capital for affordable housing projects, supporting construction and rehabilitation efforts.

- Low-interest loans: These loans offer favorable terms to developers, making projects more financially viable.

The impact of these programs varies. While LIHTC has proven effective in many areas, its availability and funding levels often fluctuate, limiting its overall impact. Data shows that LIHTC-funded projects often provide significantly lower rents than market-rate alternatives, demonstrating the program's effectiveness in achieving its goals. However, challenges remain, including limited funding and the need for streamlined application processes.

Public-Private Partnerships (PPPs)

Public-private partnerships leverage the strengths of both public and private sectors to finance and develop affordable housing. PPPs can combine government funding with private investment, expertise, and management capabilities.

- Advantages: Shared risk, access to private capital, efficient project management.

- Disadvantages: Negotiating agreements can be complex, potential conflicts of interest, and the need for clear accountability mechanisms.

Successful PPPs often feature innovative risk-sharing mechanisms and transparent funding structures. For instance, a partnership between a city and a non-profit developer might involve the city providing land and infrastructure, while the private partner contributes financing and expertise in construction and management.

Community Land Trusts (CLTs)

Community Land Trusts offer a unique approach to affordable housing by separating land ownership from housing ownership. CLTs own the land, while residents own the homes built upon it.

- How they function: CLTs acquire land, often through donations or government partnerships, and lease it to residents at a permanently affordable rate. This keeps housing costs down, even as market values rise.

- Benefits: Long-term affordability, community stewardship, and increased housing stability.

- Drawbacks: Can be complex to establish and manage, potential challenges with accessing sufficient land.

Numerous successful CLT initiatives demonstrate their effectiveness in providing long-term affordable housing options. These initiatives highlight the importance of community engagement and the power of community-based solutions.

Strategies for Increasing Housing Density and Supply

Increasing the overall housing supply is critical to addressing affordability. This can be achieved without impacting existing home values through strategic planning and development.

Upzoning and Density Bonuses

Upzoning allows for the construction of taller and denser buildings in existing areas. Density bonuses offer additional incentives for developers to include affordable units in their projects.

- Benefits: Increased housing supply, reduced sprawl, and potential for increased transit access.

- Concerns: Potential impacts on neighborhood character, increased traffic congestion (mitigated by TOD strategies).

Successful upzoning initiatives often incorporate community engagement to address concerns about neighborhood character and minimize negative impacts. Data consistently shows that areas with higher density tend to have more affordable housing options.

Accessory Dwelling Units (ADUs)

Accessory Dwelling Units (ADUs), also known as granny flats or backyard cottages, are secondary dwelling units located on a single residential lot. They offer significant potential to increase housing supply without altering the overall housing stock.

- Regulations: Vary widely across jurisdictions. Streamlining ADU regulations can significantly boost their impact.

- Benefits: Increased housing options, supplemental income for homeowners, and added housing diversity.

Many municipalities are successfully implementing ADU programs, witnessing increased housing supply and affordability. These programs demonstrate the ability to leverage existing residential land more efficiently.

Transit-Oriented Development (TOD)

Transit-Oriented Development (TOD) focuses on building housing near public transportation hubs. This reduces reliance on cars, lowers commuting costs, and enhances accessibility.

- Benefits: Reduced traffic congestion, environmental benefits, increased affordability by reducing transportation expenses.

- Examples: Many successful TOD projects demonstrate that locating affordable housing near transit options increases accessibility and reduces overall housing costs for residents.

TOD projects are often integrated with mixed-use developments, providing a vibrant and walkable environment that supports both affordability and quality of life.

Addressing Regulatory Barriers and Streamlining Development

Regulatory hurdles often hinder the development of affordable housing. Streamlining regulations and improving the permitting process is crucial.

Reducing Zoning Restrictions

Outdated and overly restrictive zoning codes significantly limit housing density and the creation of affordable units. Zoning reform is crucial to unlocking the potential for greater housing supply.

- Examples of restrictive zoning: Minimum lot size requirements, height restrictions, limitations on the number of dwelling units per lot.

Relaxing unnecessary zoning restrictions can significantly increase the feasibility of affordable housing development.

Streamlining the Permitting Process

Lengthy and opaque permitting processes increase development costs and timelines. Improving efficiency and transparency is essential.

- Improving efficiency: Reducing bureaucratic delays, establishing clear timelines, and improving communication between developers and regulatory agencies.

A streamlined permitting process can significantly reduce the time and cost required for affordable housing development.

Inclusionary Zoning

Inclusionary zoning mandates that developers include a certain percentage of affordable units in new developments.

- Benefits: Ensures the creation of affordable housing within new developments, preventing the segregation of affordable housing to specific areas.

- Drawbacks: Can increase development costs, potentially leading to reduced overall construction.

Successfully implemented inclusionary zoning policies demonstrate the potential to integrate affordable units seamlessly into new developments while managing potential drawbacks. Mitigation strategies can focus on minimizing cost increases and maximizing the overall impact.

Conclusion

Achieving affordable housing without lowering overall home prices is feasible through a multi-pronged approach. Innovative financing models, strategies to increase housing density and supply, and regulatory reforms are essential tools. The strategies discussed—government subsidies, public-private partnerships, community land trusts, upzoning, ADUs, TOD, and streamlined permitting—offer realistic solutions to the affordable housing crisis. Their combined effect can significantly expand housing options and affordability without negatively impacting market-rate housing. Learn more about affordable housing solutions in your community and contribute to building a future where everyone has access to safe and affordable housing. Support policies that promote sustainable and innovative approaches to affordable housing development.

Featured Posts

-

All The Alien Movies Now Streaming On Hulu Which To Watch

May 27, 2025

All The Alien Movies Now Streaming On Hulu Which To Watch

May 27, 2025 -

Avrupa Merkez Bankasi Nin Tarifelere Yoenelik Uyarisi Ve Ekonomik Etkileri

May 27, 2025

Avrupa Merkez Bankasi Nin Tarifelere Yoenelik Uyarisi Ve Ekonomik Etkileri

May 27, 2025 -

Understanding Private Equity Key Insights From Four Crucial Books

May 27, 2025

Understanding Private Equity Key Insights From Four Crucial Books

May 27, 2025 -

Greenes 2026 Plans Senate Or Governor

May 27, 2025

Greenes 2026 Plans Senate Or Governor

May 27, 2025 -

Global Trade Tensions G7 Ministers Statement Sidesteps Tariff Concerns

May 27, 2025

Global Trade Tensions G7 Ministers Statement Sidesteps Tariff Concerns

May 27, 2025

Latest Posts

-

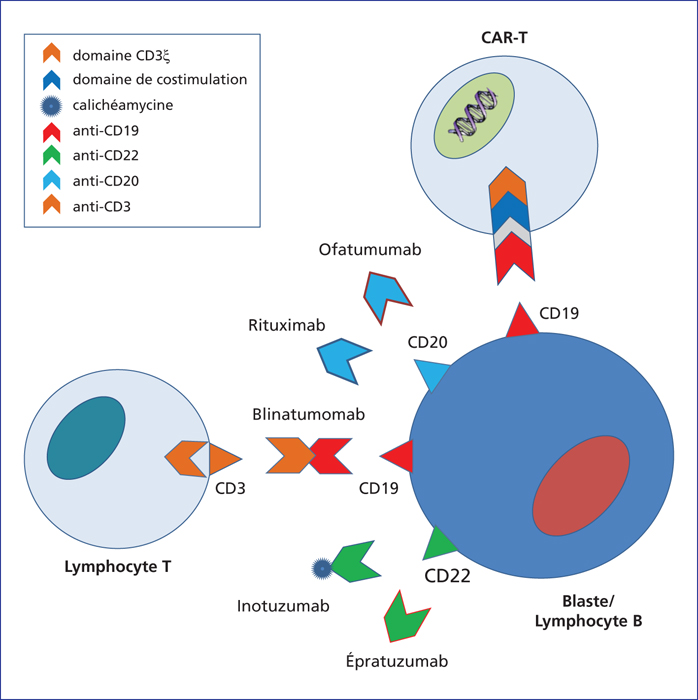

Acquisition Sanofi Nouveaux Anticorps Bispecifiques De Dren Bio

May 31, 2025

Acquisition Sanofi Nouveaux Anticorps Bispecifiques De Dren Bio

May 31, 2025 -

Anticorps Bispecifiques Sanofi Signe Un Accord Avec Dren Bio

May 31, 2025

Anticorps Bispecifiques Sanofi Signe Un Accord Avec Dren Bio

May 31, 2025 -

Sanofi Et Dren Bio Acquisition D Anticorps Bispecifiques

May 31, 2025

Sanofi Et Dren Bio Acquisition D Anticorps Bispecifiques

May 31, 2025 -

Lancement D Un Nouveau Site Sanofi En France Communique De Presse

May 31, 2025

Lancement D Un Nouveau Site Sanofi En France Communique De Presse

May 31, 2025 -

Sanofi Acquiert Les Anticorps Bispecifiques De Dren Bio Un Accord Majeur

May 31, 2025

Sanofi Acquiert Les Anticorps Bispecifiques De Dren Bio Un Accord Majeur

May 31, 2025