The Financial Aspects Of An Escape To The Country

Table of Contents

Property Costs: More Than Just the Purchase Price

The cost of rural property is a significant hurdle, often exceeding expectations. While property prices in rural areas might seem lower than in bustling cities, the overall financial commitment can be surprisingly high. The purchase price itself is only the tip of the iceberg. Let's break down the various costs involved:

- Purchase Price Variations: Property prices in rural areas vary dramatically depending on location, property type (cottage, farmhouse, etc.), size, and condition. A remote, isolated property might be cheaper than one closer to amenities, but this proximity impacts other costs, as we'll see.

- Additional Costs: Beyond the purchase price, you'll face substantial additional expenses:

- Stamp Duty Land Tax (or equivalent): This tax is levied on property purchases and varies depending on the purchase price and your location.

- Legal Fees: Solicitors' fees for conveyancing and other legal work are unavoidable.

- Surveyor's Fees: A thorough building survey is crucial, especially for older properties, to identify potential problems before purchase.

- Mortgage Options & Challenges: Securing a mortgage for rural properties can be more challenging than in urban areas. Lenders may require larger deposits or higher interest rates due to perceived higher risk. Some lenders specialize in rural mortgages, so researching options is crucial.

- Hidden Costs: Rural properties often come with unique maintenance challenges.

- Well Maintenance: If your property relies on a well for water, regular maintenance and potential repairs can be expensive.

- Septic Tank Emptying: Similar to well maintenance, septic tank upkeep is a recurring cost.

Ongoing Living Expenses: Budgeting for Country Life

The allure of country life often overshadows the ongoing expenses. While escaping the city might seem cost-effective, it's crucial to realistically compare the cost of living in rural areas versus urban centers. Many expenses are higher, and some entirely new costs emerge.

- Higher Transportation Costs: Increased distances to shops, workplaces, schools, and other amenities translate into significantly higher fuel costs and potentially increased car maintenance.

- Potentially Higher Utility Bills: Older, less energy-efficient properties in rural areas can lead to higher heating, water, and electricity bills, especially during harsh winters.

- Grocery Costs: Access to supermarkets might be limited, increasing reliance on smaller, more expensive local shops or online grocery delivery services.

- Maintenance Costs: Larger properties and surrounding land require more maintenance, from gardening and landscaping to repairs and upkeep of outbuildings.

- Internet Access: Reliable high-speed internet access can be a significant challenge in rural areas, with limited availability and potentially higher costs.

Unexpected Expenses: Preparing for the Unforeseen

Rural living often presents unexpected expenses that require careful planning and a robust emergency fund. These include:

- Emergency Repairs: Older properties frequently require unexpected repairs, ranging from plumbing issues to roof damage.

- Unexpected Maintenance Costs: Land and outbuildings can require significant and unforeseen maintenance. A sudden tree fall or fence repair can quickly impact your budget.

- Pest Control: Rural areas often attract various pests, potentially necessitating professional pest control services.

- The Importance of an Emergency Fund: Having a significant emergency fund is paramount to handle these unexpected situations without undue financial strain.

Financial Planning & Resources

Successful relocation requires thorough financial planning. Don't underestimate the importance of careful budgeting and seeking expert advice.

- Creating a Detailed Budget: Develop a comprehensive budget that includes all anticipated expenses, both initial and ongoing, leaving a buffer for unexpected costs.

- Seeking Advice from a Financial Advisor: A financial advisor specializing in rural relocation can provide valuable insights and guidance, helping you navigate the complexities of securing a mortgage, managing investments, and planning for future expenses.

- Exploring Government Grants or Incentives: Depending on your location, government grants or incentives might be available to support rural relocation. Research these possibilities.

- Utilizing Budgeting Tools and Apps: Numerous budgeting tools and apps can help you track expenses, monitor your progress, and stay on track with your financial goals.

Conclusion

The financial aspects of an escape to the country are multifaceted and require careful consideration. While the dream of rural living is undeniably attractive, a realistic assessment of the costs—both upfront and ongoing—is crucial for a successful and stress-free transition. Before you take the leap and embrace your escape to the country, ensure you've carefully considered all the financial aspects outlined above. Start planning your budget for a smooth and enjoyable transition to your new rural life. Proper financial planning is key to a successful country living experience.

Featured Posts

-

Conchita Wursts Esc 2025 Concert A Eurovision Village Highlight With Jj

May 24, 2025

Conchita Wursts Esc 2025 Concert A Eurovision Village Highlight With Jj

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025 -

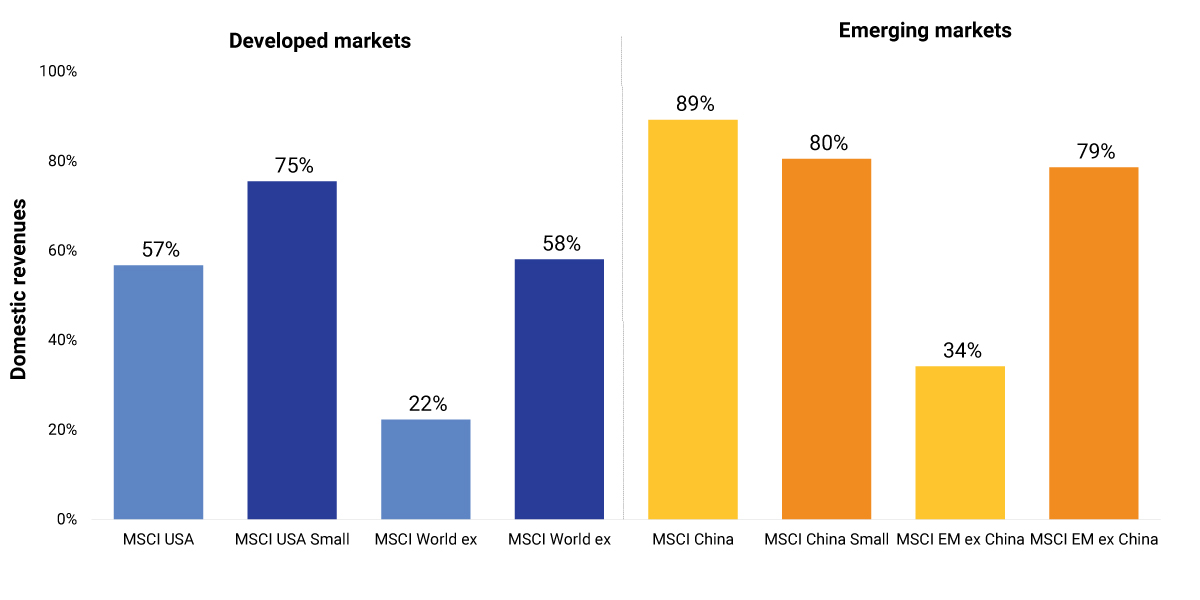

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 24, 2025

Apakah Mtel And Mbma Layak Dibeli Setelah Masuk Msci Small Cap Index

May 24, 2025 -

Mengenal Porsche 356 Sejarah Pabrik Zuffenhausen Dan Warisannya

May 24, 2025

Mengenal Porsche 356 Sejarah Pabrik Zuffenhausen Dan Warisannya

May 24, 2025 -

Frankfurt Equities Opening Dax Continues Record Breaking Rise

May 24, 2025

Frankfurt Equities Opening Dax Continues Record Breaking Rise

May 24, 2025

Latest Posts

-

Road Closed After Serious Collision One Person Hospitalized

May 24, 2025

Road Closed After Serious Collision One Person Hospitalized

May 24, 2025 -

90mph Refuel The Incredible Police Chase Story

May 24, 2025

90mph Refuel The Incredible Police Chase Story

May 24, 2025 -

Forgotten Highways Burys Unbuilt M62 Relief Route

May 24, 2025

Forgotten Highways Burys Unbuilt M62 Relief Route

May 24, 2025 -

Major Crash Closes Road Person Taken To Hospital

May 24, 2025

Major Crash Closes Road Person Taken To Hospital

May 24, 2025 -

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025

Astonishing Police Chase Pair Refuels At 90mph

May 24, 2025