The Forerunner's Long Game: Navigating The Challenges Of Pre-IPO Startups

Table of Contents

Securing Funding in the Pre-IPO Phase

Securing sufficient funding is paramount for pre-IPO startups. The path to an IPO often involves multiple funding rounds, each presenting its own set of challenges. Understanding the landscape and strategically approaching investors is crucial.

Venture Capital & Private Equity

Pre-IPO funding sources often include venture capital (VC) and private equity (PE) firms. These investors demand significant returns and exert considerable influence on the company's direction.

- Negotiating favorable terms while maintaining equity: This delicate balance requires strong financial projections, a compelling business plan demonstrating significant market opportunity, and a clear understanding of your valuation. Expert negotiation skills are essential to secure funding without diluting your ownership too significantly.

- Managing investor relations and expectations: Transparency and consistent communication are critical. Regular updates, clear reporting, and proactive engagement will build trust and foster a positive working relationship. Failing to manage these relationships can lead to conflict and hinder future funding rounds.

- Understanding different investor types and their strategies: VCs and PEs have varying investment philosophies and risk tolerances. Tailoring your pitch to resonate with specific investors' goals – whether it's high growth, disruptive technology, or a stable, predictable return – is key to attracting the right partners.

Strategic Partnerships & Collaborations

Beyond traditional funding, strategic partnerships can provide crucial resources, market access, and even revenue streams, reducing reliance on solely raising capital through funding rounds.

- Identifying potential partners aligned with your vision: Thorough due diligence is essential to ensure a synergistic partnership. Look for companies with complementary strengths and shared objectives.

- Negotiating mutually beneficial agreements: Focus on long-term value creation, not just short-term gains. Clearly define roles, responsibilities, and shared benefits within the partnership.

- Managing partner relationships effectively: Open communication, mutual respect, and a shared commitment to success are paramount for maintaining a healthy and productive partnership. Regular meetings and clear communication channels are essential.

Building and Retaining a High-Performing Team

Attracting and retaining top talent is a significant challenge for pre-IPO startups, especially when competing with established companies offering greater stability and established benefits packages.

Attracting Top Talent in a Competitive Market

Pre-IPO startups often need to offer more than just a competitive salary to attract the best talent.

- Offering competitive compensation and benefits packages: Consider equity options, performance-based bonuses, and other incentives that align employee interests with company success. This can significantly enhance your attractiveness to top candidates.

- Building a strong employer brand and company culture: Showcase your company's mission, values, and the unique opportunities it offers. Highlight your company culture and emphasize employee development opportunities.

- Leveraging employee referral programs: Tap into your existing network for quality candidates. Employee referrals often lead to higher retention rates.

Maintaining Employee Morale and Motivation

The long hours and uncertain outcomes inherent in pre-IPO ventures can impact employee morale.

- Providing regular feedback and recognition: Celebrate milestones and achievements, both big and small. Acknowledge individual and team contributions to boost motivation.

- Investing in employee development and training: Foster a culture of learning and growth by providing opportunities for professional development and skill enhancement.

- Promoting work-life balance initiatives: Support employee well-being through flexible work arrangements, generous vacation time, and wellness programs.

Navigating Regulatory and Legal Hurdles

Pre-IPO companies face a complex regulatory environment, requiring proactive management of legal and compliance issues.

Compliance and Regulatory Requirements

Adherence to various regulations, including those related to finance, securities, and intellectual property, is crucial.

- Ensuring compliance with relevant laws and regulations: Seek expert legal counsel to ensure compliance and mitigate potential risks. This is especially crucial as your company grows and expands into new markets.

- Developing robust internal controls and compliance procedures: Establish clear processes and protocols to ensure consistent adherence to regulations.

- Managing potential legal risks and liabilities: Implement risk mitigation strategies to minimize potential legal issues. This includes thorough due diligence before entering into any agreements.

Intellectual Property Protection

Protecting intellectual property (IP) is crucial for maintaining a competitive edge.

- Filing patents and trademarks: Secure your innovations to prevent competitors from replicating your ideas. This can be crucial for securing future funding and establishing your market position.

- Maintaining confidentiality of sensitive information: Implement robust security measures to protect trade secrets and other confidential information.

- Enforcing IP rights against infringement: Take swift action when necessary to protect your intellectual property.

Scaling Operations and Managing Growth

Efficient scaling is critical for pre-IPO startups. Managing growth while maintaining profitability requires careful planning and execution.

Efficient Resource Allocation

Strategic resource allocation is vital for sustainable growth.

- Prioritizing key initiatives and projects: Focus on high-impact activities that directly contribute to your company’s goals.

- Developing efficient processes and workflows: Streamline operations to enhance efficiency and reduce waste.

- Optimizing resource utilization: Maximize the use of available resources to avoid unnecessary expenses.

Managing Cash Flow and Profitability

Pre-IPO startups must carefully manage cash flow to sustain operations and fund growth.

- Developing accurate financial forecasts: Predict future needs and adjust your strategies accordingly.

- Implementing cost-effective strategies: Reduce expenses without sacrificing quality.

- Securing sufficient working capital: Maintain healthy cash reserves to weather unexpected challenges.

Conclusion

The journey to a successful IPO for pre-IPO startups is a demanding but potentially highly rewarding endeavor. Successfully navigating the challenges outlined above—securing funding, building a strong team, managing regulatory hurdles, and scaling operations—requires a long-term, strategic approach. By focusing on building a solid foundation, fostering a strong company culture, and proactively addressing potential challenges, pre-IPO companies can significantly increase their chances of achieving their ultimate goal. Embrace the long game of pre-IPO startups and position your company for lasting success. Are you ready to navigate the challenges and play the pre-IPO startup game?

Featured Posts

-

Apertura Iscrizioni Servizio Trasporto Scolastico Sanremo

May 14, 2025

Apertura Iscrizioni Servizio Trasporto Scolastico Sanremo

May 14, 2025 -

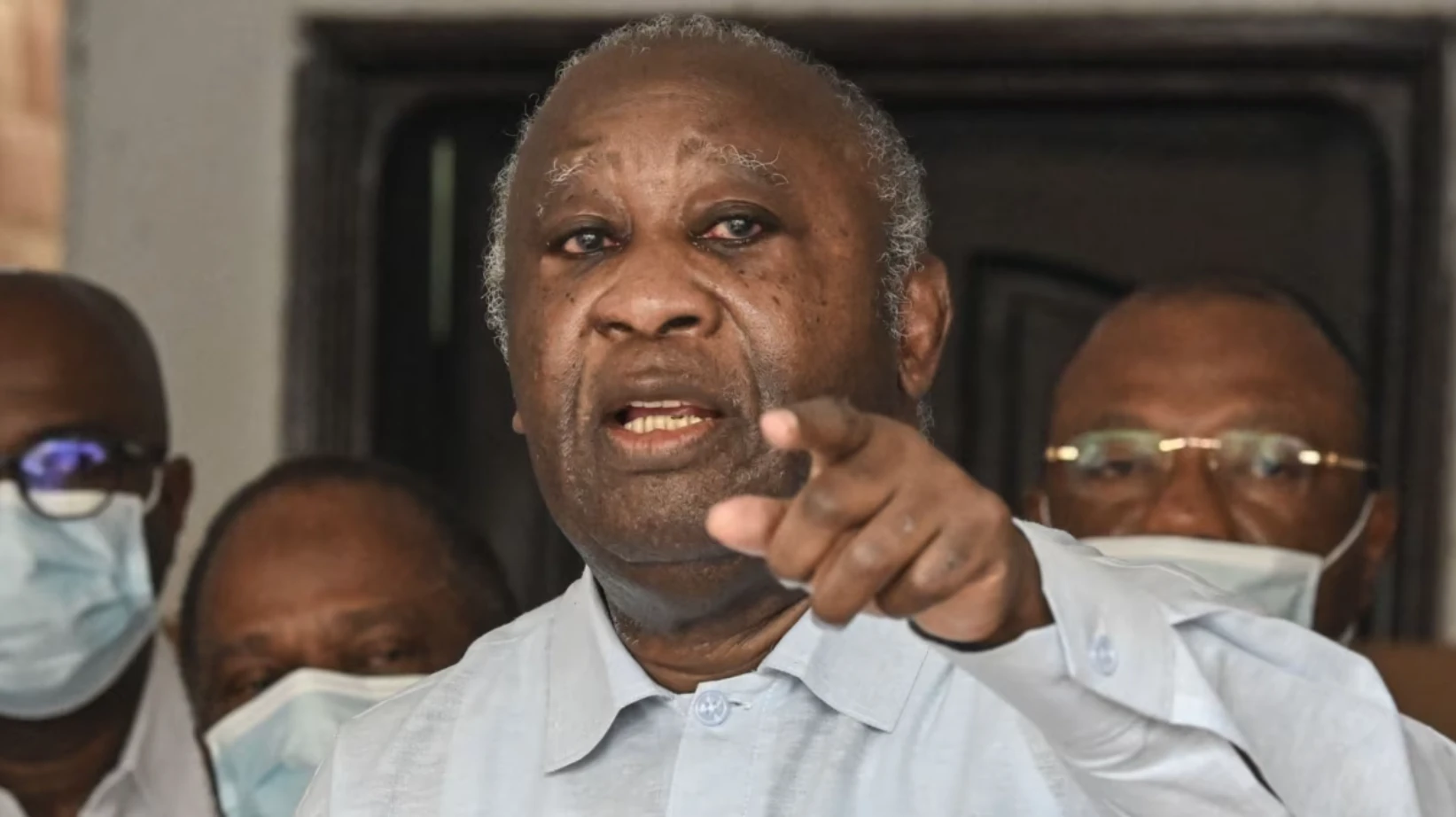

L Audition Refusee De Kohler Transparency International Denonce Une Atteinte A La Democratie

May 14, 2025

L Audition Refusee De Kohler Transparency International Denonce Une Atteinte A La Democratie

May 14, 2025 -

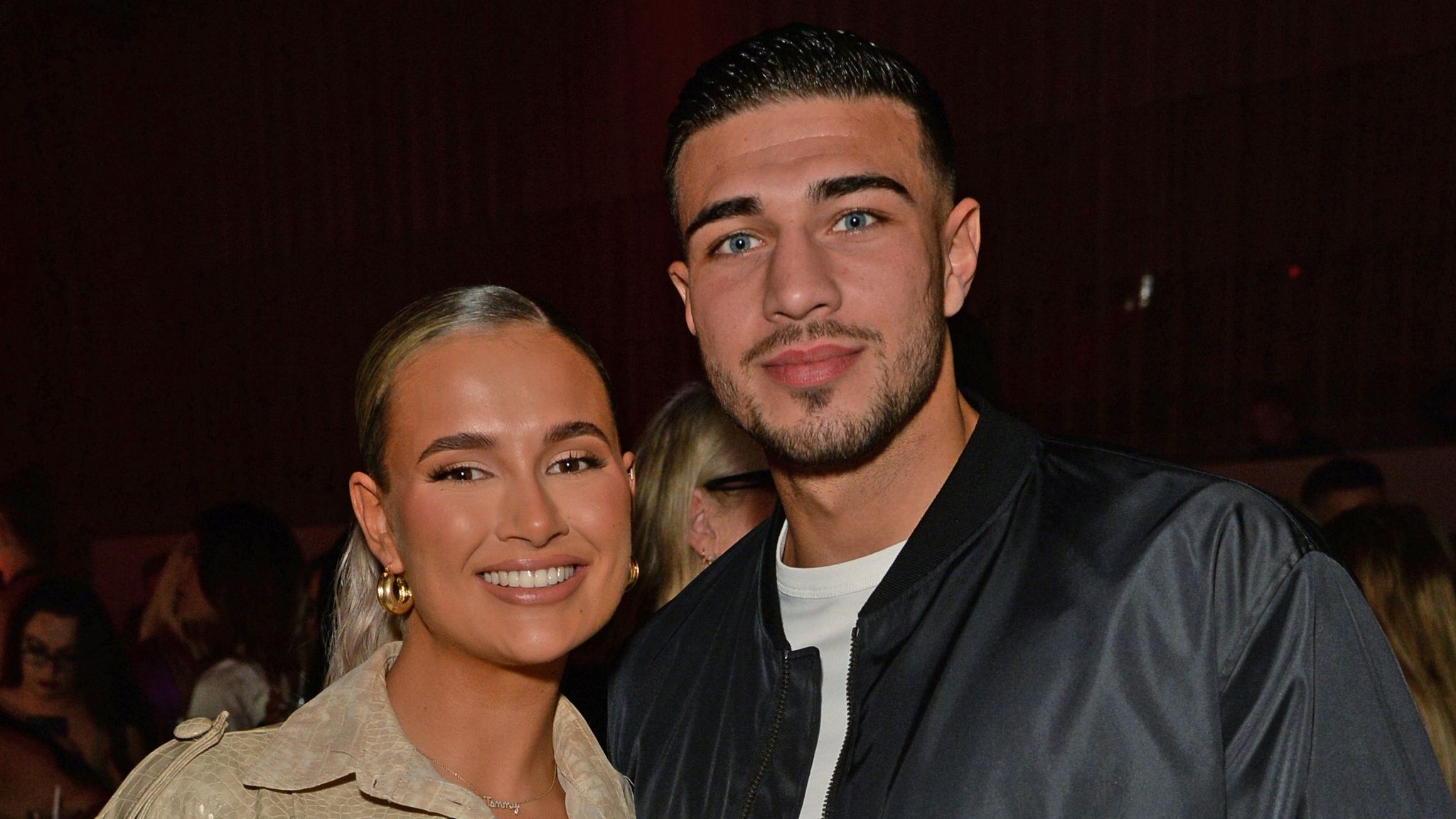

Tommy Fury Fined For Speeding Days After Molly Mae Hague Split

May 14, 2025

Tommy Fury Fined For Speeding Days After Molly Mae Hague Split

May 14, 2025 -

Eurojackpotin Ennaetysvoitot Neljae Pelaajaa Voitti Laehes Puolen Miljoonaa Euroa

May 14, 2025

Eurojackpotin Ennaetysvoitot Neljae Pelaajaa Voitti Laehes Puolen Miljoonaa Euroa

May 14, 2025 -

Maya Jamas Relationship Status Manchester City Connection Confirmed

May 14, 2025

Maya Jamas Relationship Status Manchester City Connection Confirmed

May 14, 2025