The Future Of XRP: Analyzing The Impact Of ETF Decisions And SEC Actions

Table of Contents

XRP is a cryptocurrency created by Ripple Labs, designed to facilitate fast and low-cost international payments. It operates within the RippleNet network, a payment processing system used by financial institutions globally. Unlike Bitcoin or Ethereum, XRP isn't primarily a platform for decentralized applications (dApps); its core function is as a bridge currency for seamless cross-border transactions. This unique position makes its future particularly sensitive to regulatory decisions and market sentiment. This article aims to analyze the potential impacts of SEC actions and ETF approvals on the future price and adoption of XRP.

The SEC's Ongoing Legal Battle Against Ripple and its Implications for XRP

The SEC's lawsuit against Ripple Labs, alleging the unregistered sale of securities, casts a long shadow over XRP's future. The outcome of this case will profoundly impact XRP's price, regulatory standing, and overall market perception.

The Core Allegations Against Ripple and the Potential Outcomes

- SEC's Arguments: The SEC claims Ripple sold XRP as an unregistered security, violating federal securities laws. They argue XRP sales were investment contracts, offering investors the expectation of profit based on Ripple's efforts.

- Ripple's Counterarguments: Ripple contends XRP is a currency, not a security, and its sales were not subject to SEC registration requirements. They point to the decentralized nature of XRP's distribution and its use in facilitating cross-border payments.

Potential scenarios include:

- Ripple Wins: A Ripple victory could significantly boost XRP's price and remove a major regulatory hurdle, fostering broader adoption. Investor confidence would likely surge.

- Ripple Loses: An SEC victory could severely depress XRP's price, potentially leading to delistings from exchanges and hindering its use in financial institutions. Investor confidence would plummet.

- Settlement: A settlement could offer a compromise, potentially resulting in a less drastic price impact than a complete loss for Ripple. However, the terms of any settlement would be crucial in determining XRP's future.

How the SEC's Decision Could Influence Future Cryptocurrency Regulation

The Ripple case sets a critical precedent for the entire cryptocurrency industry. Its outcome will heavily influence:

- Regulation of other cryptocurrencies: The SEC's definition of a "security" will impact how other crypto projects are classified and regulated.

- Impact on the broader crypto market: The decision could trigger market volatility across the board, affecting investor sentiment and potentially leading to increased regulatory scrutiny for other digital assets.

- Implications for other crypto projects facing SEC scrutiny: The outcome could significantly affect the legal battles faced by other cryptocurrency projects under SEC investigation.

The Potential Impact of XRP ETFs on Market Liquidity and Adoption

The approval of XRP exchange-traded funds (ETFs) would be a game-changer. ETFs offer several advantages that could dramatically increase XRP's liquidity and adoption.

Understanding the Benefits of XRP ETFs for Investors

- Increased Accessibility: ETFs make XRP accessible to a wider range of investors, including those unfamiliar with cryptocurrency trading.

- Increased Liquidity: ETFs typically offer high liquidity, allowing investors to buy and sell XRP easily and efficiently.

- Attracting Institutional Investors: ETFs are attractive to institutional investors, who are often hesitant to invest directly in cryptocurrencies due to regulatory and operational complexities. This influx of institutional capital could drive significant price increases.

Challenges and Hurdles to XRP ETF Approval

Several significant hurdles stand in the way of XRP ETF approval:

- Regulatory Hurdles: The SEC's overall stance on crypto ETFs is cautious, with many applications facing delays or rejections.

- Influence of the Ripple Lawsuit: The outcome of the Ripple lawsuit will likely heavily influence the SEC's decision on XRP ETF applications. A negative outcome could effectively kill any chance of approval in the near term.

- Competing Factors: Approval timelines also depend on factors like market conditions, investor demand, and the overall regulatory environment.

Analyzing Market Sentiment and Predicting Future Price Movements of XRP

While SEC actions and ETF approvals are paramount, other factors also influence XRP's price.

Factors Influencing XRP's Price Beyond SEC Actions and ETF Approvals

- Technological Advancements: Ongoing development within the Ripple ecosystem, including improvements to its technology and functionalities, will positively impact XRP's value.

- Growing Adoption: Increased adoption of XRP by financial institutions and businesses for cross-border payments will strengthen its position in the market.

- Overall Crypto Market Performance: The general performance of the cryptocurrency market plays a significant role, with positive trends generally boosting XRP's price.

Developing a Reasoned Forecast for XRP’s Future Price

Predicting XRP's future price is inherently speculative. However, considering the various scenarios outlined above, we can envision potential outcomes:

- Positive Scenario (Ripple wins, ETFs approved): XRP could see significant price appreciation, potentially reaching new all-time highs.

- Neutral Scenario (Settlement, ETF delayed): XRP's price might remain relatively stable, with moderate growth depending on market conditions and adoption rates.

- Negative Scenario (Ripple loses, ETFs rejected): XRP's price could experience a sharp decline, potentially falling significantly from its current levels.

It's crucial to rely on fundamental analysis, assessing the underlying technology, adoption rates, and regulatory landscape, rather than solely relying on speculation.

The Future of XRP: A Summary and Call to Action

The future of XRP is intricately linked to the outcome of the SEC lawsuit against Ripple and the potential approval of XRP ETFs. A positive outcome in both could lead to substantial price appreciation and widespread adoption. Conversely, negative outcomes could severely impact XRP's price and market position. While predicting the future is impossible, understanding the various factors at play – legal battles, ETF approvals, technological advancements, and broader market trends – is key to making informed investment decisions.

Remember, investing in cryptocurrencies carries significant risk. Conduct your own thorough research, understand the potential rewards and risks associated with "The Future of XRP," and always invest responsibly. Stay informed about regulatory developments and market trends by following reputable news sources and engaging with the cryptocurrency community. The future of XRP is unwritten, but understanding the forces shaping it empowers you to navigate the potential opportunities and challenges.

Featured Posts

-

Altitude E Enjoo Estevao Deixa O Jogo Do Palmeiras

May 01, 2025

Altitude E Enjoo Estevao Deixa O Jogo Do Palmeiras

May 01, 2025 -

Tabung Baitulmal Sarawak Rm 36 45 Juta Disalurkan Kepada Penerima Asnaf Sehingga Mac 2025

May 01, 2025

Tabung Baitulmal Sarawak Rm 36 45 Juta Disalurkan Kepada Penerima Asnaf Sehingga Mac 2025

May 01, 2025 -

Processo Becciu Data Appello 22 Settembre E La Sua Professione Di Innocenza

May 01, 2025

Processo Becciu Data Appello 22 Settembre E La Sua Professione Di Innocenza

May 01, 2025 -

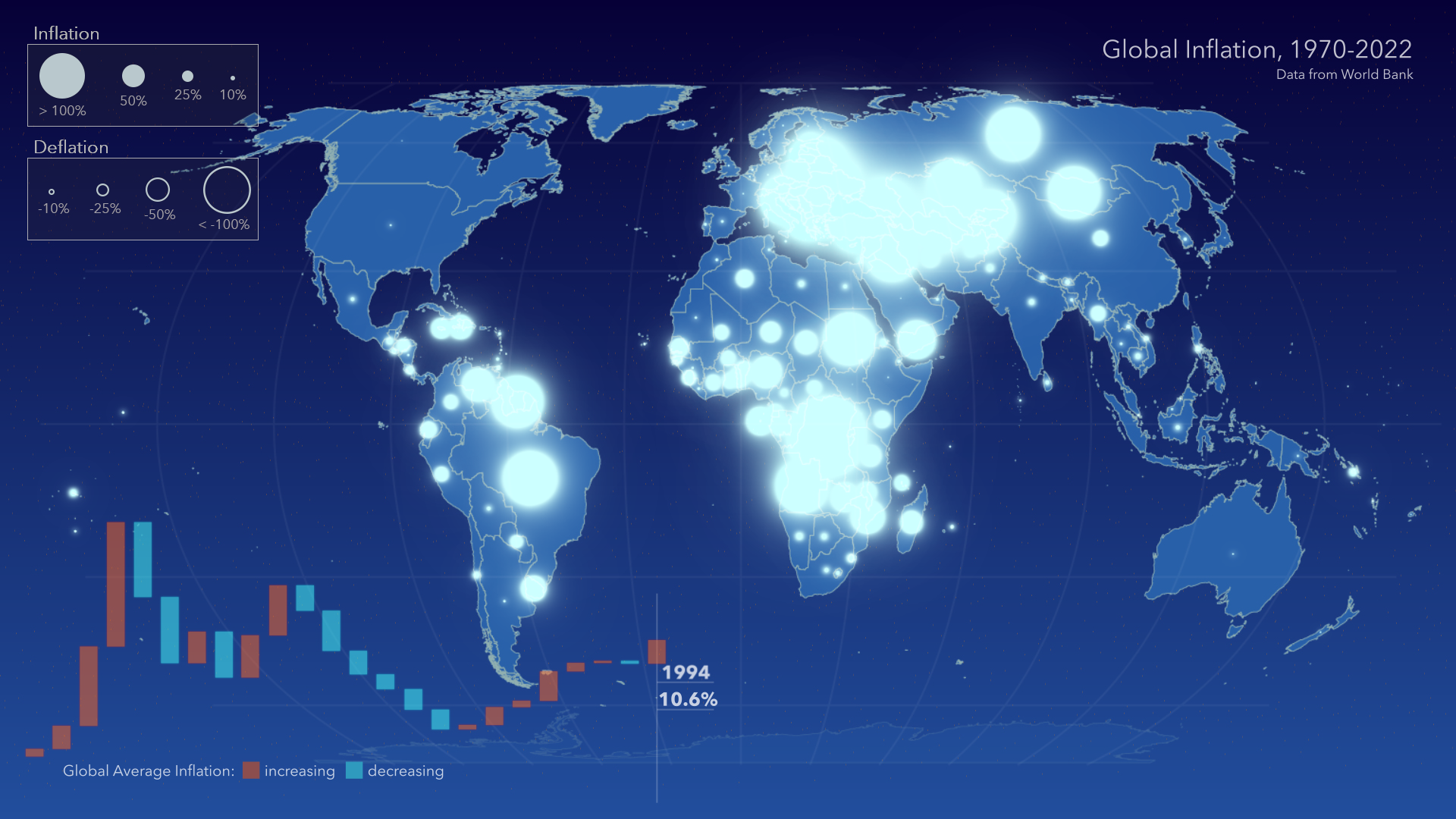

Global Inflation The Surprising Role Of A Pregnancy Craving And A Popular Chocolate Bar

May 01, 2025

Global Inflation The Surprising Role Of A Pregnancy Craving And A Popular Chocolate Bar

May 01, 2025 -

Jan 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News

May 01, 2025

Jan 6th Conspiracy Theories Ray Epps Defamation Case Against Fox News

May 01, 2025