The Future Of XRP: SEC Case, ETF Applications, And Ripple's Roadmap

Table of Contents

The SEC Lawsuit's Impact on XRP's Future

The SEC lawsuit against Ripple Labs is arguably the most significant factor influencing XRP's trajectory. Understanding the intricacies of this case is crucial for any XRP investment strategy.

The Core of the SEC's Case Against Ripple

The SEC alleges that Ripple sold XRP as an unregistered security, violating federal securities laws. Their argument centers around the Howey Test, which defines an investment contract based on an investment of money in a common enterprise with a reasonable expectation of profits derived from the efforts of others. The SEC contends that XRP investors expected profits based on Ripple's efforts to develop and promote the cryptocurrency.

- SEC's Key Arguments: XRP sales were unregistered securities offerings; Ripple profited from XRP sales; investors purchased XRP with the expectation of profits based on Ripple's efforts.

- Ripple's Key Arguments: XRP is a currency, not a security; XRP sales were not investment contracts; the Howey Test doesn't apply to XRP.

The outcome of the SEC vs Ripple case could dramatically affect XRP's future. A favorable ruling for Ripple could boost XRP's price and adoption. Conversely, an unfavorable ruling could severely impact its value and market standing, potentially leading to delisting from exchanges. A settlement could offer a middle ground, but its impact would depend on its specific terms.

Ripple's Legal Strategies and Their Implications

Ripple's defense strategy involves a multifaceted approach. They've engaged leading legal experts, presented evidence highlighting XRP's decentralized nature, and pointed to the lack of regulatory clarity in the crypto space. They've also highlighted successful legal precedents which have defined cryptocurrencies as commodities rather than securities.

- Key Aspects of Ripple's Defense: Emphasis on XRP's decentralized functionality; Presentation of expert testimony on the nature of cryptocurrencies; Argument for regulatory clarity.

This case’s outcome has significant implications beyond Ripple and XRP. It could set a precedent for future cryptocurrency regulation, impacting the entire crypto landscape and influencing other crypto regulation efforts worldwide.

Short-Term and Long-Term Effects on XRP Price and Adoption

The SEC lawsuit's impact on XRP price volatility is already evident. Depending on the outcome:

- Positive Ruling: A favorable judgment could lead to a substantial XRP price increase and renewed investor confidence, boosting market capitalization and crypto adoption.

- Negative Ruling: An adverse ruling could cause a significant drop in XRP's price, leading to decreased market capitalization and potentially delisting from major exchanges, hindering crypto adoption.

- Settlement: A settlement may lead to a moderate price fluctuation, depending on the terms agreed upon.

The legal battle's influence on long-term XRP adoption is equally significant, impacting its use in cross-border payments.

ETF Applications and Their Potential Role in XRP's Growth

The approval of an XRP ETF could significantly alter its market trajectory.

The Rise of Crypto ETFs and XRP's Eligibility

The global landscape of crypto ETFs is evolving rapidly. While Bitcoin ETFs have gained traction in some markets, XRP ETF applications are still pending. The approval process involves rigorous scrutiny, considering factors such as market manipulation risk, regulatory compliance, and investor protection. Examples like the Grayscale Bitcoin Trust and various Canadian Bitcoin ETFs provide context.

- Potential Benefits of ETF Listing: Increased liquidity; Enhanced accessibility for institutional investors; Potential for significant price appreciation due to increased demand.

- Factors Influencing Approval: Regulatory landscape; Market volatility; Evidence of market manipulation.

Impact of ETF Listing on XRP Price and Market Sentiment

An XRP ETF approval would likely trigger a substantial price increase, driven by increased institutional investment and improved market sentiment. However, rejection could lead to the opposite effect.

- ETF Approval Scenario: Could result in a significant XRP price increase, attracting a wave of institutional investment, and solidifying XRP's place in the broader financial markets.

- ETF Rejection Scenario: Could negatively impact market sentiment, leading to a price decrease and dampening investor confidence in the long-term prospects of XRP price.

Ripple's Roadmap and Technological Advancements

Ripple's continued innovation and development play a crucial role in shaping XRP's future.

RippleNet and its Expanding Global Reach

RippleNet, Ripple's payment solution, continues to expand its global reach, facilitating cross-border payments for financial institutions. Its on-demand liquidity (ODL) solution is gaining traction, allowing for faster and more cost-effective transactions using XRP.

- Successful RippleNet Partnerships: Illustrate the growing adoption and trust in Ripple’s technology among financial institutions.

- Impact on XRP Utility and Demand: Increased utilization of XRP within RippleNet directly boosts demand and strengthens its position as a bridge currency.

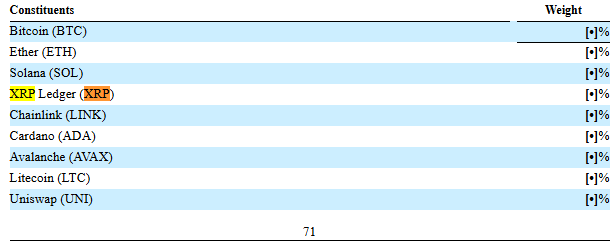

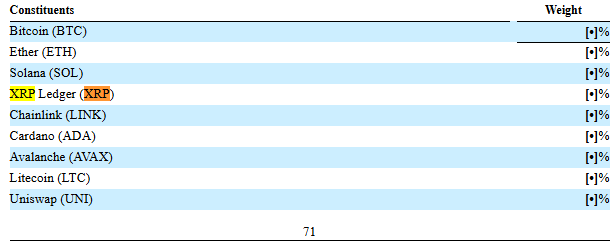

Innovation in XRP Ledger and Future Developments

The XRP Ledger (XRPL) is constantly evolving, with ongoing improvements focused on scalability, security, and the introduction of new use cases.

- XRPL Updates: New features and upgrades are designed to address challenges and unlock new potentials, thereby bolstering XRPL's competitiveness among other blockchain platforms.

- Influence on XRP's Long-Term Prospects: Continued innovation and enhancement of the XRPL underpin the longer-term potential of XRP and its broader utility.

Conclusion: Forecasting the Future of XRP

The future of XRP hinges on the interplay of several key factors: the outcome of the SEC lawsuit, the success of ETF applications, and Ripple's continued technological advancements. While the SEC case presents significant uncertainty, Ripple's ongoing development and potential ETF listings offer substantial opportunities for growth. However, investors should remain cautious and fully understand the inherent risks associated with cryptocurrency investments.

It's crucial to conduct thorough research before making any XRP investment. Stay informed about developments related to the SEC case, ETF applications, and Ripple's roadmap. Understanding these factors will better equip you to navigate the complexities of XRP investment and assess the future of XRP. Remember to make informed decisions based on your own research and risk tolerance before investing in XRP or any other cryptocurrency.

Featured Posts

-

Christina Aguileras Altered Image A Look At The Photoshop Controversy

May 02, 2025

Christina Aguileras Altered Image A Look At The Photoshop Controversy

May 02, 2025 -

Gratis New York Times Via Nrc De Reden Achter De Actie

May 02, 2025

Gratis New York Times Via Nrc De Reden Achter De Actie

May 02, 2025 -

The Impact Of The Dual Hollywood Strike On The Entertainment Industry

May 02, 2025

The Impact Of The Dual Hollywood Strike On The Entertainment Industry

May 02, 2025 -

Former Wallaby Phipps Highlights Super Rugbys Hemispheric Imbalance

May 02, 2025

Former Wallaby Phipps Highlights Super Rugbys Hemispheric Imbalance

May 02, 2025 -

Ekonomicheskoe Sotrudnichestvo Rossii I Chekhii Itogi Peregovorov

May 02, 2025

Ekonomicheskoe Sotrudnichestvo Rossii I Chekhii Itogi Peregovorov

May 02, 2025