The GOP Tax Plan And The National Deficit: A Numbers-Based Assessment

Table of Contents

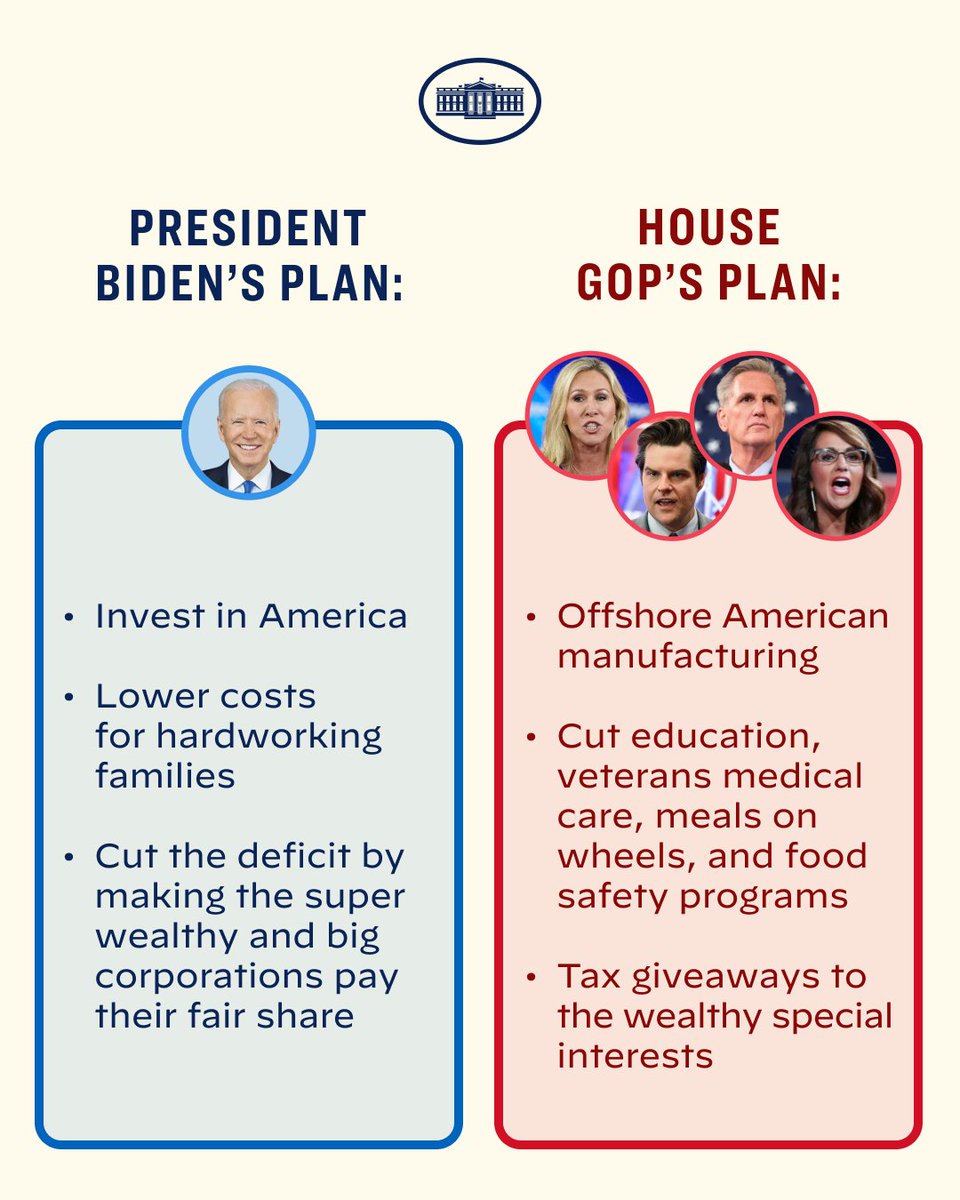

The GOP Tax Plan's Core Provisions and Their Projected Revenue Impacts

The GOP tax plan implemented several key tax cuts, primarily aimed at stimulating economic growth. These included substantial reductions in the corporate tax rate and changes to individual income tax brackets. Let's examine their projected revenue impacts:

-

Corporate Tax Rate Reduction: The plan slashed the top corporate tax rate from 35% to 21%. The Congressional Budget Office (CBO) projected this reduction would lead to a revenue loss of approximately $1.9 trillion over ten years. This substantial decrease was a central element of the plan's design, aiming to encourage business investment and job creation. [Insert chart showing projected revenue loss from corporate tax cuts].

-

Individual Income Tax Bracket Changes: The plan also altered individual income tax brackets, generally reducing rates across the board. While some lower-income taxpayers saw modest benefits, the largest tax cuts disproportionately benefited higher-income individuals. The Tax Policy Center estimated these changes resulted in a combined revenue loss of approximately $1.5 trillion over ten years. [Insert chart showing projected revenue loss from individual income tax changes].

-

Standard Deduction Increase: The increase in the standard deduction simplified tax filing for many individuals but also reduced the number of people itemizing deductions, further lowering tax revenue.

The combined effect of these provisions, along with other smaller changes, resulted in a significant projected decrease in federal tax revenue. These projections, however, are not without their critics, as we will explore in later sections. Keywords used here include: Tax cuts, revenue projections, corporate tax rate, individual income tax, tax revenue.

Analyzing the National Deficit Before and After the GOP Tax Plan

Examining the national deficit's trajectory before and after the GOP tax plan's enactment provides valuable context. Data from the U.S. Treasury shows a consistent upward trend in the national debt before 2017. Following the implementation of the tax cuts, the deficit increased substantially.

-

Pre-2017 Deficit: The national deficit was already a concern before the GOP tax plan. Years of slow economic growth and increased government spending contributed to this trend.

-

Post-2017 Deficit Increase: The CBO's post-tax-cut projections showed a significant increase in the national deficit, exceeding initial estimates in subsequent years. This increase, however, wasn't solely attributable to the tax cuts. Economic factors like unexpected growth or recessions influence government revenue and spending, complicating analysis.

-

Long-Term Projections: Long-term projections of the national debt under the GOP tax plan vary depending on the economic model used. Some models suggest a substantial increase in the debt-to-GDP ratio, while others project more moderate increases or even decreases under specific economic scenarios.

Economic Modeling and Forecasting: Different Perspectives on the GOP Tax Plan's Impact

Economic modeling plays a crucial role in forecasting the impact of the GOP tax plan. However, different models and assumptions yield vastly different results.

-

Supply-Side Economics: Proponents of the GOP tax plan argued the cuts would stimulate economic growth, leading to increased tax revenue that would offset the initial revenue loss. This supply-side argument relies on a strong "multiplier effect"—where tax cuts spur economic activity far exceeding the initial revenue loss.

-

Keynesian Economics: Critics, often adhering to Keynesian economics, argued the tax cuts would primarily benefit the wealthy, leading to a larger deficit without significant economic growth to compensate. They emphasized the importance of government spending in stimulating the economy and warned of the potential for inflationary pressure due to increased national debt.

These differing perspectives underscore the complexity of economic forecasting and highlight the inherent uncertainties involved in predicting the long-term impact of large-scale tax reforms. Keywords: Economic modeling, fiscal forecasts, economic growth, multiplier effect, macroeconomic analysis.

The Role of Government Spending and Other Fiscal Policies

Government spending plays a critical role alongside tax revenue in determining the national deficit. Analyzing the relationship between tax revenue, government spending, and the national debt is crucial for understanding the impact of the GOP tax plan.

-

Government Spending Trends: Government spending, especially on entitlement programs like Social Security and Medicare, has been a significant factor in driving the national debt. Changes in spending policies can significantly affect the budget deficit, independent of tax policies.

-

Fiscal Policy Interactions: The GOP tax cuts interacted with existing government spending patterns, potentially exacerbating the deficit. Other fiscal policies, such as changes to entitlement programs or infrastructure spending, could either mitigate or exacerbate the effects of the tax plan.

Understanding the interplay between tax policy and government spending is crucial for effective fiscal management. Keywords used: Government spending, fiscal policy, monetary policy, debt ceiling, budget allocation.

Conclusion: Assessing the Long-Term Effects of the GOP Tax Plan on the National Deficit

The GOP tax plan undeniably had a significant impact on the national deficit. While initial projections suggested substantial revenue losses, the extent to which economic growth offset these losses remains highly debated. Long-term implications depend heavily on future economic growth, changes in government spending, and other fiscal policies. Understanding the numerical impacts of tax policies like the GOP tax plan on the national debt is essential for informed decision-making.

Continue your research on the GOP tax plan and its impact on the national deficit to form your own informed opinion. For further information, consult resources from the Congressional Budget Office (CBO), the Tax Policy Center, and the U.S. Treasury Department. Understanding these complex issues is critical for fostering fiscal responsibility and engaging in productive political discourse.

Featured Posts

-

Gmas 50th Anniversary A Paley Center Tribute

May 20, 2025

Gmas 50th Anniversary A Paley Center Tribute

May 20, 2025 -

Navys Former Second In Command Convicted In Historic Corruption Case

May 20, 2025

Navys Former Second In Command Convicted In Historic Corruption Case

May 20, 2025 -

First Practice Session For Sinner In Monte Carlo Affected By Rain

May 20, 2025

First Practice Session For Sinner In Monte Carlo Affected By Rain

May 20, 2025 -

Review Of Travels With Agatha Christie Featuring Sir David Suchet

May 20, 2025

Review Of Travels With Agatha Christie Featuring Sir David Suchet

May 20, 2025 -

Jennifer Lawrence O Que Ha Por Tras Da Mudanca Fisica Apos Rumores De Segundo Filho

May 20, 2025

Jennifer Lawrence O Que Ha Por Tras Da Mudanca Fisica Apos Rumores De Segundo Filho

May 20, 2025

Latest Posts

-

Getting To Know Paulina Gretzky Dustin Johnsons Wife Family And Work

May 20, 2025

Getting To Know Paulina Gretzky Dustin Johnsons Wife Family And Work

May 20, 2025 -

Paulina Gretzky Job Family And Life With Dustin Johnson

May 20, 2025

Paulina Gretzky Job Family And Life With Dustin Johnson

May 20, 2025 -

Paulina Gretzky Topless Selfie And Other Hot Photos Revealed

May 20, 2025

Paulina Gretzky Topless Selfie And Other Hot Photos Revealed

May 20, 2025 -

Paulina Gretzkys Leopard Dress Channels A Sopranos Style See The Photos

May 20, 2025

Paulina Gretzkys Leopard Dress Channels A Sopranos Style See The Photos

May 20, 2025 -

See Paulina Gretzkys Playdate Mini Dress

May 20, 2025

See Paulina Gretzkys Playdate Mini Dress

May 20, 2025