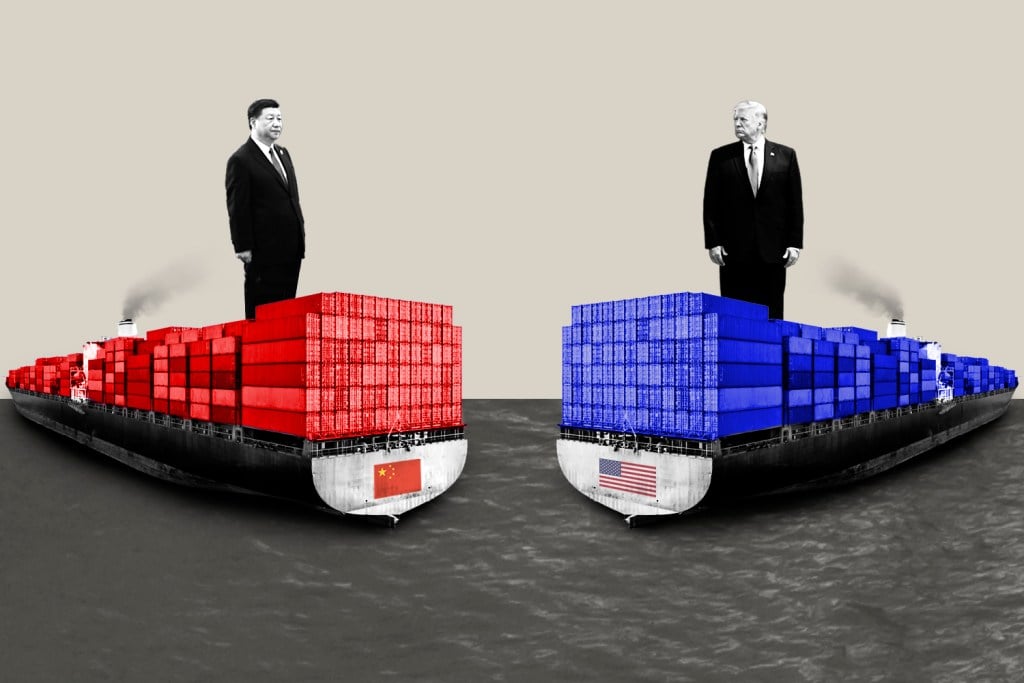

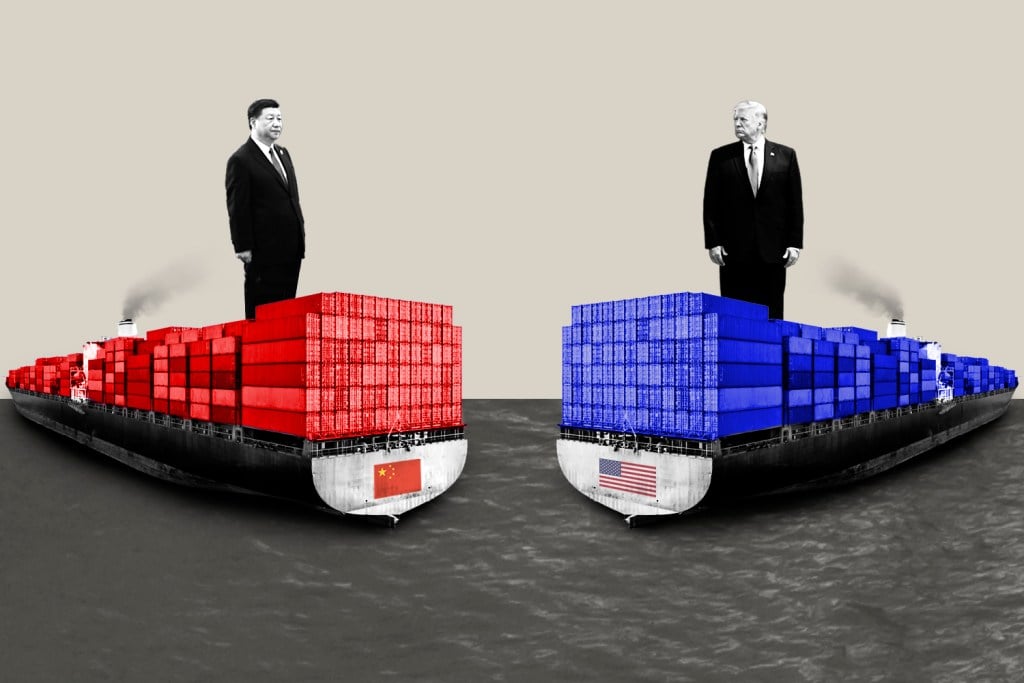

The Great Decoupling: Implications For Global Economics And Geopolitics

Table of Contents

Economic Implications of the Great Decoupling

The Great Decoupling is fundamentally reshaping the global economic landscape. Its effects are far-reaching, impacting everything from supply chains to international trade and investment flows.

Restructuring of Global Supply Chains

The era of globally integrated supply chains, where production processes were intricately linked across numerous countries, is waning. The pursuit of supply chain resilience is driving a significant shift towards nearshoring, reshoring, and friend-shoring. This means companies are increasingly relocating production closer to their home markets or to countries perceived as politically and economically stable allies.

- Impact on Manufacturing: Manufacturers are reassessing their global footprint, seeking to diversify their sourcing and reduce their reliance on single countries.

- Logistics and Transportation Costs: Regionalization inevitably leads to increased transportation costs and logistical complexities. However, this is often offset by decreased risks associated with geopolitical instability and trade disruptions.

- Examples of Diversification: The European Union's efforts to reduce its dependence on China for critical raw materials and manufactured goods, and the US's push for domestic manufacturing are prime examples of this trend. This trade diversification is a key element of the Great Decoupling. The shift impacts global value chains dramatically.

Impact on International Trade and Investment

The Great Decoupling is characterized by a decline in cross-border trade and investment flows. The rise of protectionism, manifested in increased tariffs and other trade barriers, is a major contributing factor. Trade wars, such as the ongoing tensions between the US and China, further exacerbate this trend. The impact varies significantly across industries. For example, industries heavily reliant on global value chains, such as electronics and textiles, are disproportionately affected. This impacts foreign direct investment (FDI) significantly, as companies become more hesitant to invest in countries perceived as risky or politically unstable. Existing trade agreements are being renegotiated or even abandoned in some cases.

Economic Growth and Development

The economic consequences of the Great Decoupling are complex and vary significantly across countries. While some nations may benefit from reshoring and regionalization, others, particularly developing economies heavily reliant on global trade, may experience negative impacts on their economic growth and GDP. The effects on emerging markets and the global south are a particular concern. The shift necessitates a re-evaluation of development economics strategies.

Geopolitical Implications of the Great Decoupling

The Great Decoupling is not merely an economic phenomenon; it has profound geopolitical ramifications, reshaping the global balance of power and increasing geopolitical risk.

Shifting Power Dynamics

The decoupling process is fostering a shift in global power dynamics. We're seeing the rise of regional blocs and alliances, as countries seek to strengthen their relationships with like-minded partners. This fragmentation challenges the existing international order and the influence of long-standing international organizations and institutions. This represents a significant change in geopolitical rivalry and the nature of great power competition.

Increased Geopolitical Risk and Instability

The decoupling process fuels geopolitical risk and instability. The fragmentation of supply chains and trade relationships increases the potential for tensions and conflicts between nations. Technological decoupling, particularly in areas like artificial intelligence and semiconductors, further exacerbates these tensions. The risk of cyber warfare and other forms of asymmetric conflict increases significantly. The impact on international security requires careful monitoring.

The Rise of Tech Nationalism

Technology plays a pivotal role in driving the Great Decoupling. The rise of tech nationalism, reflected in initiatives promoting data sovereignty and digital security, is a key element of this process. Countries are increasingly seeking to control their own technological infrastructure and data flows. This has implications for technological independence and the future of global innovation. Cybersecurity concerns are driving this trend.

Conclusion: Understanding the Great Decoupling's Long-Term Effects

The Great Decoupling is a multifaceted phenomenon with significant economic and geopolitical consequences. Understanding this trend is crucial for businesses, governments, and individuals alike. The shift requires adaptable strategies to navigate the changing global landscape. The restructuring of supply chains, the rise of protectionism, and the shifting power dynamics will continue to shape the global economy and international relations for years to come. We encourage you to further research the Great Decoupling and its impact on your specific industries or regions. Further reading on economic decoupling, geopolitical decoupling, and the future of globalization is readily available online and in academic publications. Understanding the Great Decoupling is essential for navigating the complexities of the evolving global order.

Featured Posts

-

Pochemu Starmer Makron Merts I Tusk Ne Poedut V Kiev 9 Maya

May 09, 2025

Pochemu Starmer Makron Merts I Tusk Ne Poedut V Kiev 9 Maya

May 09, 2025 -

Nhl Playoffs Oilers Vs Kings Prediction For Tonights Game 1

May 09, 2025

Nhl Playoffs Oilers Vs Kings Prediction For Tonights Game 1

May 09, 2025 -

Understanding Wynne And Joanna All At Sea

May 09, 2025

Understanding Wynne And Joanna All At Sea

May 09, 2025 -

Pam Bondi Signals Imminent Release Of Epstein Files

May 09, 2025

Pam Bondi Signals Imminent Release Of Epstein Files

May 09, 2025 -

Police Arrest Suspected Madeleine Mc Cann Imposter In Uk

May 09, 2025

Police Arrest Suspected Madeleine Mc Cann Imposter In Uk

May 09, 2025