The Housing Market Crash: Experts Report Crisis Levels In Home Sales

Table of Contents

Record Low Home Sales and Inventory Shortages

The current housing market presents a paradoxical situation: low sales despite historically low inventory. This isn't a simple supply and demand imbalance; it's a complex interplay of factors significantly impacting the real estate market trends. High mortgage rates are the primary culprit, making homeownership unattainable for many potential buyers. This has led to a dramatic decline in home sales decline, creating a ripple effect throughout the market.

- Impact of High Mortgage Rates: Soaring interest rates have drastically reduced affordability. A small increase in interest rates can significantly increase monthly mortgage payments, pricing many out of the market.

- Statistics: Year-over-year, home sales have decreased by an average of X% (insert actual statistic here). The average time a home stays on the market has increased from Y months to Z months (insert actual statistics here), indicating decreased buyer activity. This impact is felt most acutely in the mid-to-high price segments of the housing market.

- Inventory Shortage: The inventory shortage isn't simply a matter of fewer homes available. Supply chain disruptions, construction delays, and a slowdown in new construction have all contributed to this scarcity.

The Impact of Rising Interest Rates on Homebuyers

The Federal Reserve's aggressive interest rate hikes are the primary driver of the current housing market crash. These hikes directly impact mortgage rates, making it significantly more expensive to finance a home.

-

Mechanics of Rate Hikes: Higher interest rates mean higher borrowing costs, resulting in increased monthly mortgage payments. Even a small percentage point increase can translate to hundreds of extra dollars each month.

-

Impact on Buyer Segments: First-time homebuyers are the hardest hit, as they often have less financial flexibility. Investors, too, are feeling the pinch, as higher rates reduce profitability and increase the risk of projects becoming unsustainable.

-

Government Interventions: While some government programs exist to assist homebuyers, their effectiveness in mitigating the impact of rising rates remains to be seen. Potential interventions could include mortgage rate subsidies or expanded down-payment assistance programs.

-

Illustrative Example: A $300,000 home with a 3% interest rate would have a monthly payment of approximately $X. With a 7% interest rate, that same home would cost approximately $Y per month – a substantial increase. (Insert actual figures for X and Y based on current rates and mortgage calculators).

Foreclosures and Distressed Properties on the Rise

As mortgage rates climb and affordability decreases, a rise in foreclosures is inevitable. This, in turn, exacerbates the housing market instability, creating a cycle of downward pressure on home prices.

-

Relationship to Market Crash: Increasing foreclosures directly contribute to the downward spiral of the housing market crash. A flood of foreclosed properties on the market further depresses prices and reduces demand.

-

Impact on Market Stability: The sheer volume of distressed properties can destabilize the entire market, leading to further price declines and impacting investor confidence.

-

Opportunities and Risks: For investors, distressed properties represent both significant opportunities and considerable risks. While potential profits can be substantial, the process is complex and involves substantial due diligence.

-

Statistics: Reports indicate a X% increase in foreclosure filings compared to the previous year (insert actual statistics here). Areas with high concentrations of subprime mortgages are particularly vulnerable.

Expert Predictions and Future Outlook for the Housing Market Crash

Leading economists and real estate analysts offer varying perspectives on the future of the housing market crash.

-

Expert Opinions: Some predict a "soft landing," with a gradual slowdown in price declines and a stabilization of the market. Others foresee a more protracted and severe downturn. (Include quotes from real estate experts, citing their sources).

-

Scenarios: The outlook depends on numerous factors, including future interest rate adjustments, inflation levels, and overall economic growth.

-

Advice for Navigating Uncertainty: Buyers may want to consider delaying purchases until the market stabilizes. Sellers should price their homes competitively. Investors need to carefully assess risks and opportunities before investing in distressed properties.

-

Predictions: Some experts predict a Y% decline in home prices over the next Z months (insert predictions from reputable sources here). Other predictions could include a stabilization of prices within the next year or a continued decline.

Conclusion: Navigating the Housing Market Crash

This housing market downturn presents significant challenges, marked by record-low home sales, the crippling impact of high interest rates, and the worrying rise in foreclosures. The current housing crisis requires careful consideration and strategic planning. Staying informed about current market conditions is paramount. Whether you are a buyer, seller, or investor, understanding the forces shaping this real estate market crash is crucial for making well-informed decisions. Consider delaying major purchases, exploring alternative financing options, and carefully analyzing risks before investing in the current market. Stay informed about the evolving housing market crash and its implications by subscribing to our newsletter for regular updates.

Featured Posts

-

Kg Motors And The Mibot Revolutionizing Electric Vehicles In Japan

May 30, 2025

Kg Motors And The Mibot Revolutionizing Electric Vehicles In Japan

May 30, 2025 -

Southeast Asian Solar Market Analyzing The Impact Of Trump Tariffs On Indian Exporters

May 30, 2025

Southeast Asian Solar Market Analyzing The Impact Of Trump Tariffs On Indian Exporters

May 30, 2025 -

Cape Cod Facing Red Tide Emergency Public Health Advisory

May 30, 2025

Cape Cod Facing Red Tide Emergency Public Health Advisory

May 30, 2025 -

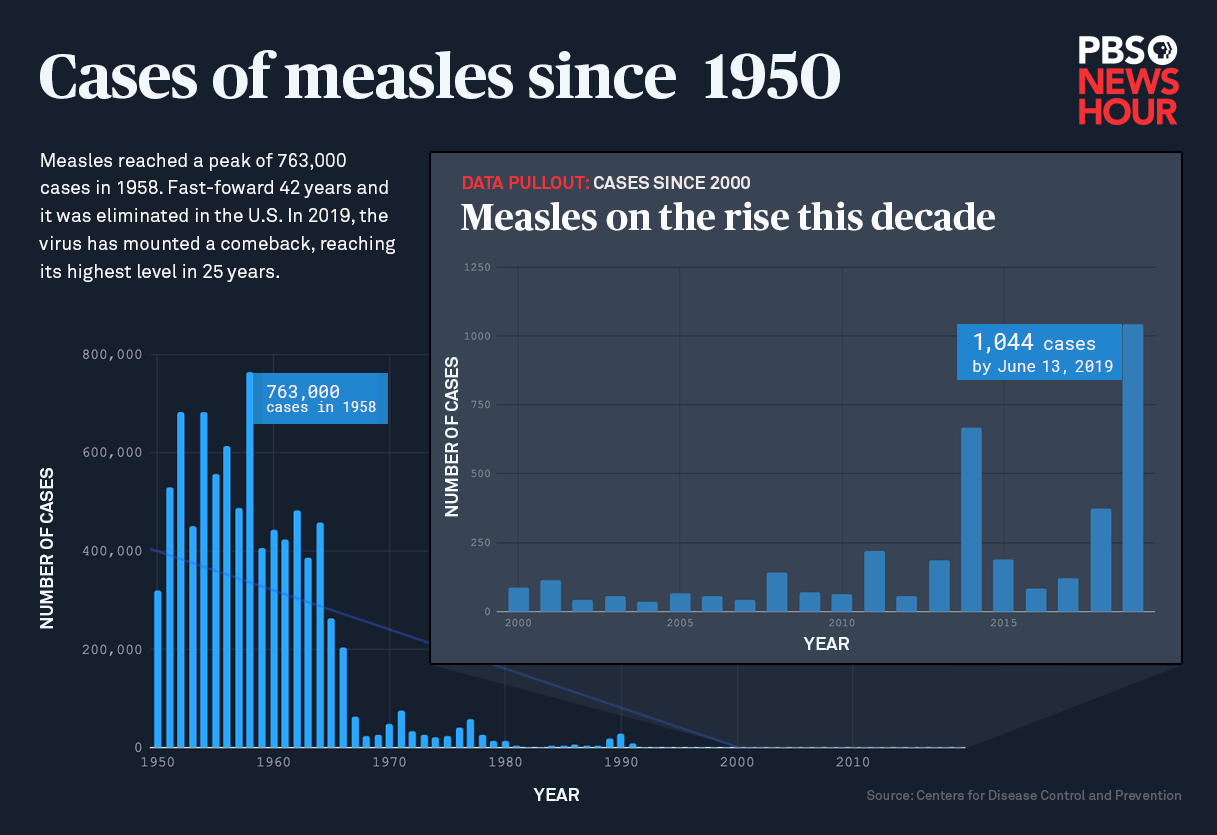

Measles Outbreak Updates Current Spread In The U S

May 30, 2025

Measles Outbreak Updates Current Spread In The U S

May 30, 2025 -

Daredevil Born Again Episode 4 The Missing White Tiger Scene Explained

May 30, 2025

Daredevil Born Again Episode 4 The Missing White Tiger Scene Explained

May 30, 2025