The Impact Of Increasing Federal Debt On Mortgage Rates

Table of Contents

The Relationship Between Federal Debt and Interest Rates

A fundamental economic principle dictates that increased government borrowing, reflected in a growing federal debt, typically leads to higher interest rates. This relationship stems from the basic laws of supply and demand applied to the credit market.

- Increased government borrowing competes with private sector borrowing. When the government borrows heavily, it increases the overall demand for loanable funds. This increased demand, all else being equal, pushes interest rates upward.

- The Federal Reserve's response to high debt levels (e.g., raising interest rates). To control inflation potentially fueled by increased government spending and borrowing, the Federal Reserve (the central bank of the U.S.) may raise interest rates. This makes borrowing more expensive, both for the government and the private sector.

- Inflationary pressures stemming from increased debt and their impact on interest rates. High levels of federal debt can contribute to inflationary pressures. When the government spends more than it takes in through taxes, it can lead to an increase in the money supply, potentially driving up prices. To combat inflation, interest rates are often raised.

- The role of investor confidence and risk aversion in influencing interest rate sensitivity to federal debt. Investor confidence in the government's ability to manage its debt plays a crucial role. If confidence wanes, investors may demand higher yields (interest rates) on government bonds to compensate for the increased perceived risk.

How Increased Federal Debt Impacts Mortgage Rates Specifically

The broader interest rate increases caused by higher federal debt directly translate into higher mortgage rates. Mortgage rates are often closely tied to benchmark rates like the 10-year Treasury yield.

- Explanation of how changes in Treasury yields affect mortgage-backed securities. Mortgage-backed securities (MBS), bundles of mortgages sold to investors, are priced relative to Treasury yields. When Treasury yields rise due to increased federal debt, MBS yields also rise, leading to higher mortgage rates.

- The role of government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac in the mortgage market and their sensitivity to interest rate changes. Government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac play a significant role in the mortgage market by purchasing and securitizing mortgages. Their borrowing costs are directly influenced by prevailing interest rates, and these costs are passed on to borrowers.

- Impact on different types of mortgages (e.g., fixed-rate, adjustable-rate). Both fixed-rate and adjustable-rate mortgages are affected by changes in interest rates driven by federal debt. Adjustable-rate mortgages are more immediately sensitive to fluctuations, while fixed-rate mortgages reflect the interest rate environment at the time of origination.

- Case studies or examples illustrating the historical relationship between federal debt and mortgage rates. Examining historical data reveals a clear correlation between periods of high federal debt accumulation and subsequent increases in mortgage rates. For instance, the substantial increase in federal debt following the 2008 financial crisis contributed to higher mortgage rates in subsequent years.

Other Factors Influencing Mortgage Rates Beyond Federal Debt

While federal debt is a significant driver of mortgage rates, it's not the sole determinant. Several other economic indicators play a crucial role.

- Inflation rates and their effect on the Federal Reserve's monetary policy. High inflation prompts the Federal Reserve to raise interest rates to cool down the economy, which directly impacts mortgage rates.

- Housing market supply and demand. A shortage of housing inventory can drive up prices and consequently influence mortgage rates. Increased demand pushes rates upward.

- Consumer confidence and borrowing behavior. Strong consumer confidence and increased borrowing can put upward pressure on interest rates.

- Economic growth and recessionary periods. During periods of strong economic growth, interest rates tend to rise, while recessions often lead to lower rates.

Predicting Future Mortgage Rates Based on Federal Debt Trends

Predicting future mortgage rates with certainty is challenging due to the intricate interplay of numerous economic factors. While the relationship between federal debt and mortgage rates is clear, economic forecasting is inherently complex.

- Discuss the limitations of economic models in predicting future mortgage rates. Economic models rely on assumptions and historical data, which may not always accurately reflect future conditions. Unexpected events can significantly impact forecasts.

- Highlight the importance of considering multiple factors simultaneously. Any prediction must account for inflation, housing market dynamics, consumer confidence, and global economic conditions in addition to federal debt levels.

- Suggest resources for tracking federal debt levels and economic indicators. Reliable sources include the U.S. Treasury Department, the Federal Reserve, and reputable financial news outlets.

Conclusion

In summary, increasing federal debt significantly influences interest rates, and subsequently, mortgage rates. However, this is not a simple, one-to-one relationship. Other critical economic factors influence the cost of borrowing for mortgages. Understanding the complex interplay between federal debt, interest rates, and the housing market is essential for sound financial planning. Stay informed about federal debt levels and their potential impact on your mortgage decisions. Consult with financial advisors to create effective strategies for managing your mortgage in a high-debt environment and navigating the complexities of federal debt and mortgage rate forecasts. Proactive planning, informed by a thorough understanding of the impact of federal debt on mortgages, will allow you to make sound financial decisions.

Featured Posts

-

Mairon Santos Concedes Francis Marshall Won Ufc 313

May 19, 2025

Mairon Santos Concedes Francis Marshall Won Ufc 313

May 19, 2025 -

Analiza Sanse Baby Lasagne Na Eurosongu

May 19, 2025

Analiza Sanse Baby Lasagne Na Eurosongu

May 19, 2025 -

Formation Archiviste Poitiers Devenez Professionnel Des Archives

May 19, 2025

Formation Archiviste Poitiers Devenez Professionnel Des Archives

May 19, 2025 -

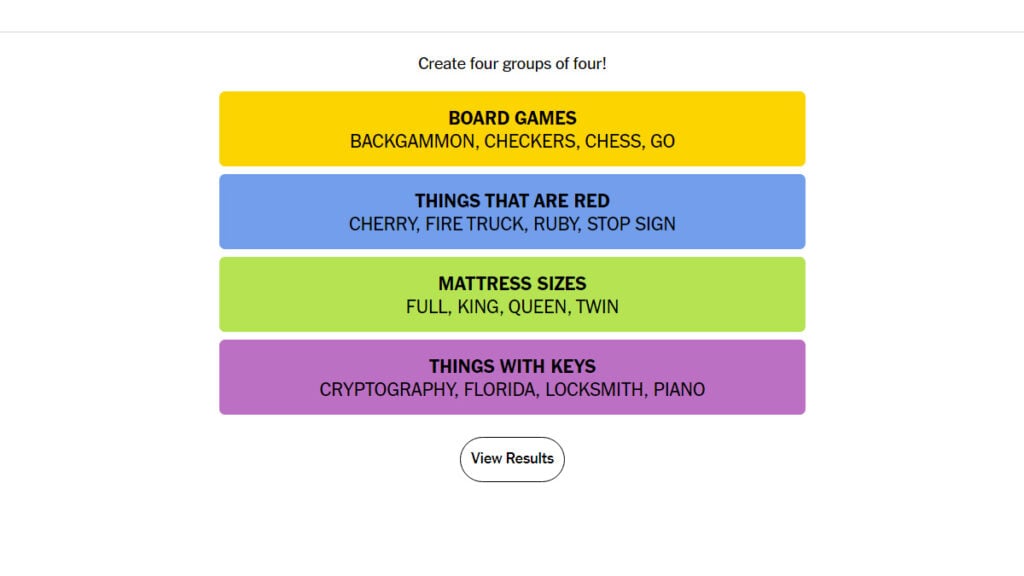

Solve The Nyt Connections Puzzle April 11 2024 670

May 19, 2025

Solve The Nyt Connections Puzzle April 11 2024 670

May 19, 2025 -

How Starving Artists Cope With Earning Less Than Their A List Spouses

May 19, 2025

How Starving Artists Cope With Earning Less Than Their A List Spouses

May 19, 2025