The Impact Of Post-Liberation Day Tariffs On Donald Trump's Billionaire Network

Table of Contents

Trump's Pre-Liberation Day Business Holdings and Tariffs

Before the implementation of post-Liberation Day tariffs, Donald Trump's business portfolio spanned various sectors, making him potentially vulnerable to economic shifts. Understanding his pre-existing holdings is crucial to assessing the impact of these tariffs.

Analysis of Key Businesses Affected

Trump's business empire, before Liberation Day, consisted largely of real estate holdings, hospitality ventures (hotels and resorts), and licensing agreements. These sectors proved particularly susceptible to tariff changes impacting imported goods and international trade.

- Real Estate: Trump's numerous real estate projects, both domestically and internationally, relied on global supply chains for construction materials and skilled labor. Tariff increases on imported materials directly impacted construction costs and profitability.

- Hospitality: Trump's hotels and resorts relied heavily on international tourism. Changes in tariffs could impact consumer spending and the overall profitability of these businesses. Increased costs for imported goods also impacted operational expenses.

- Licensing Agreements: Trump's licensing agreements for his brand name were also subject to market fluctuations caused by tariff changes. Reduced consumer spending could impact the licensing revenue stream.

The Post-Liberation Day Tariff Landscape

The post-Liberation Day period saw the implementation of significant tariff changes across multiple sectors. These changes dramatically altered the economic landscape and had a profound effect on Trump's business interests.

Specific Tariff Changes and Their Impact

Several key industries experienced significant tariff hikes after Liberation Day. These included:

- Construction Materials: Tariffs on steel, aluminum, and lumber increased substantially, directly affecting the cost of Trump's real estate projects. Estimates suggest a 15-20% increase in construction costs in some regions.

- Luxury Goods: Tariffs on imported luxury goods, impacting items frequently found in Trump's hotels and resorts, potentially reduced consumer demand and impacted profitability.

- Imported Products: Increased tariffs on a wide range of imported goods affected various aspects of Trump's business operations, from operational supplies to consumer goods sold in his properties.

Financial Impact on Trump's Billionaire Network

Assessing the financial impact of post-Liberation Day tariffs on Trump's billionaire network requires analyzing both the direct effects on his businesses and the indirect consequences for his associates and business partners.

Assessing the Direct and Indirect Effects

While precise figures are difficult to obtain, various analyses suggest a significant negative impact.

- Direct Impact: Increased costs and reduced consumer demand likely resulted in decreased profits for Trump's businesses. Specific financial reports would need to be reviewed for a conclusive assessment.

- Indirect Impact: The ripple effects impacted Trump's associates and business partners who relied on his financial success. This might have resulted in decreased investments and reduced opportunities within the network.

Political and Social Ramifications

The post-Liberation Day tariffs had significant political and social ramifications, impacting public perception of Trump and his administration.

Public Perception and Political Fallout

The implementation and consequences of these tariffs generated considerable public debate and media coverage.

- Public Opinion: Public opinion polls revealed mixed reactions to the tariff policies, with some supporting the protectionist measures and others criticizing their potential economic downsides.

- Political Consequences: The economic impact of the tariffs could have influenced Trump's political standing and affected his ability to secure future investments or business deals. This requires further in-depth analysis.

Conclusion

The Post-Liberation Day tariffs had a multifaceted impact on Donald Trump's billionaire network. While the precise financial consequences remain a subject of ongoing analysis, the increased costs, reduced consumer demand, and wider economic instability undoubtedly presented significant challenges. The political ramifications were also substantial, affecting public perception and potentially influencing Trump's political standing. To gain a deeper understanding of the intricacies involved, further research into specific business impact reports and financial analyses is crucial. We encourage you to delve deeper into the subject and continue researching the long-term effects of Post-Liberation Day Tariffs on Donald Trump's Billionaire Network.

Featured Posts

-

Stock Market Today Sensex Nifty And Key Movers

May 09, 2025

Stock Market Today Sensex Nifty And Key Movers

May 09, 2025 -

Uefa Champions League Inter Milan Defeats Bayern Munich

May 09, 2025

Uefa Champions League Inter Milan Defeats Bayern Munich

May 09, 2025 -

F1 News Jeremy Clarksons Proposal As Ferrari Faces Dq Speculation

May 09, 2025

F1 News Jeremy Clarksons Proposal As Ferrari Faces Dq Speculation

May 09, 2025 -

Luis Enriques Impact How Psg Secured The Ligue 1 Title

May 09, 2025

Luis Enriques Impact How Psg Secured The Ligue 1 Title

May 09, 2025 -

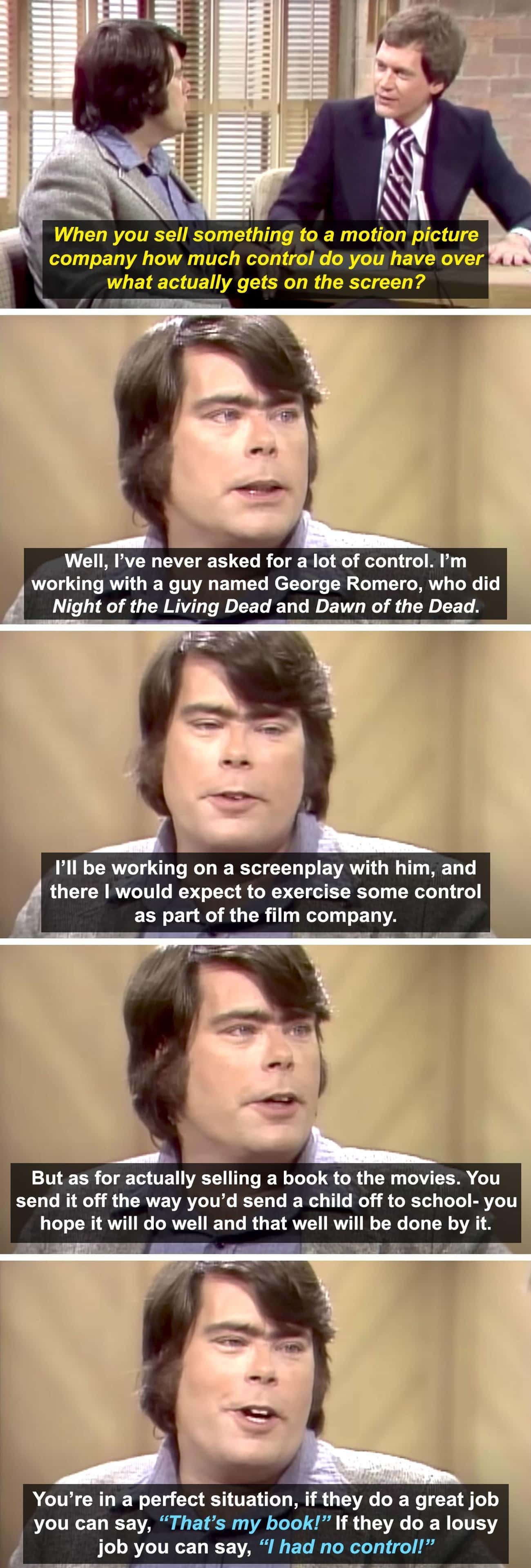

5 Times Stephen King Publicly Clashed With Other Celebrities

May 09, 2025

5 Times Stephen King Publicly Clashed With Other Celebrities

May 09, 2025