The Impact Of Saudi Arabia's New ABS Rules: A Market Set For Expansion

Table of Contents

Increased Transparency and Regulatory Clarity

The new regulations surrounding the Saudi Arabia ABS market aim to create a more transparent and efficient environment for issuing and trading ABS. This increased clarity is crucial for attracting both domestic and international investors.

Streamlined Issuance Process

The new rules significantly simplify the ABS issuance process, reducing bureaucratic hurdles and accelerating time to market for issuers. This streamlined approach fosters a more efficient and competitive Saudi Arabia ABS market.

- Reduced paperwork and administrative burdens: The simplification of documentation requirements reduces the time and cost associated with bringing ABS to market.

- Clearer guidelines on eligible assets: The regulations provide clearer definitions of eligible assets for securitization, reducing ambiguity and uncertainty for issuers.

- Improved efficiency through digitalization initiatives: The adoption of digital platforms and technologies is expected to further streamline the issuance process, enhancing efficiency and transparency within the Saudi Arabia ABS market.

Enhanced Investor Protection

Stronger investor protection mechanisms are a cornerstone of the new framework. These measures build confidence and attract a wider range of investors to the Saudi Arabia ABS market.

- Increased disclosure requirements for issuers: Issuers are now required to provide more comprehensive and transparent disclosures, ensuring investors have access to the necessary information to make informed decisions.

- Robust due diligence procedures for asset evaluation: Stricter due diligence procedures are in place to ensure the accurate valuation of underlying assets, mitigating risk for investors.

- Clearer definitions of investor rights and remedies: The new regulations clearly define investor rights and remedies, providing a robust framework for dispute resolution and investor protection within the Saudi Arabia ABS market.

Diversification of Funding Sources for Saudi Businesses

The new ABS framework provides a vital boost to Saudi businesses, particularly SMEs, by opening up alternative avenues for accessing capital. This diversification of funding sources is crucial for economic growth and diversification.

Access to Capital for SMEs

ABS offer SMEs a crucial alternative to traditional bank lending, often characterized by stringent requirements and limited access. This increased access to capital fosters economic growth and job creation.

- Reduced reliance on traditional bank lending: SMEs can now diversify their funding sources, reducing their dependence on traditional banking channels.

- Increased opportunities for expansion and job creation: Access to capital allows SMEs to expand their operations, leading to increased job creation and economic growth.

- Improved access to long-term funding for infrastructure projects: The new regulations facilitate access to long-term funding for infrastructure projects, supporting sustainable economic development.

Support for Infrastructure Development

The new ABS framework plays a key role in financing large-scale infrastructure projects by offering a mechanism for securitizing related assets and attracting significant investment into the Saudi Arabia ABS market.

- Facilitating public-private partnerships: ABS provide a suitable instrument for facilitating public-private partnerships in infrastructure development.

- Attracting foreign direct investment (FDI) in infrastructure: The enhanced transparency and investor protection offered by the new regulations attract FDI, boosting infrastructure development.

- Accelerating the development of critical infrastructure: The increased availability of funding accelerates the development of critical infrastructure projects, driving economic progress.

Attracting Foreign Investment into the Saudi Arabia ABS Market

The new regulations are designed to align with international best practices, making the Saudi Arabia ABS market significantly more attractive to global investors. This influx of foreign capital further fuels economic growth and development.

Alignment with International Standards

The alignment of Saudi Arabia's ABS framework with international standards instills confidence among international investors, encouraging greater participation in the Saudi Arabia ABS market.

- Increased investor confidence due to regulatory clarity: The clarity and transparency of the new regulations increase investor confidence.

- Improved international recognition and standing: Alignment with international standards enhances the international recognition and standing of the Saudi Arabia ABS market.

- Access to a larger pool of international capital: This attracts a broader range of international investors, increasing the availability of capital.

Growth of the Saudi Capital Markets

The development of a robust Saudi Arabia ABS market strengthens the Kingdom's broader capital markets, fostering financial deepening and innovation.

- Enhanced liquidity in the Saudi financial system: A thriving ABS market enhances liquidity in the Saudi financial system, promoting efficient capital allocation.

- Creation of new investment opportunities for local and international investors: The development of the ABS market creates a diverse range of new investment opportunities.

- Attracting specialized financial expertise to the Kingdom: The growth of the Saudi Arabia ABS market attracts specialized financial expertise, further developing the Kingdom's financial sector.

Conclusion

The introduction of new ABS rules in Saudi Arabia marks a pivotal moment for the Kingdom's financial sector. These regulations are designed to create a more transparent, efficient, and attractive Saudi Arabia ABS market, leading to increased investment, economic diversification, and accelerated infrastructure development. By streamlining the issuance process, enhancing investor protection, and aligning with international standards, Saudi Arabia has positioned itself to become a leading player in the global ABS market. To capitalize on the opportunities presented by this evolving landscape, businesses and investors should explore the potential of the Saudi Arabia ABS market and leverage these new regulations to achieve their financial goals. Learn more about navigating the opportunities within the dynamic Saudi Arabia ABS market and discover how you can benefit from this exciting new era of growth.

Featured Posts

-

Lion Storages 1 4 G Wh Bess Project In The Netherlands Financial Close Achieved

May 03, 2025

Lion Storages 1 4 G Wh Bess Project In The Netherlands Financial Close Achieved

May 03, 2025 -

Mental Health Care The Urgent Need For Improvement

May 03, 2025

Mental Health Care The Urgent Need For Improvement

May 03, 2025 -

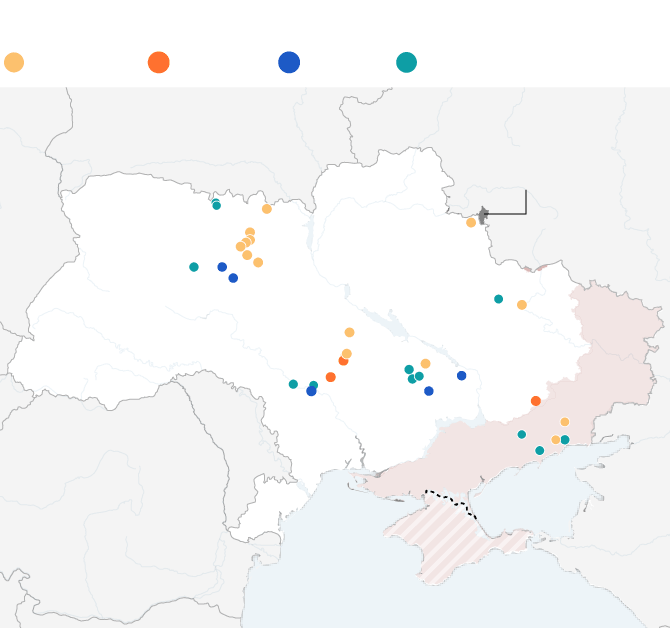

Rare Earth Minerals Ukraine And The U S Announce Key Economic Deal

May 03, 2025

Rare Earth Minerals Ukraine And The U S Announce Key Economic Deal

May 03, 2025 -

Extended Fortnite Server Outage Delays Chapter 6 Season 2 Launch

May 03, 2025

Extended Fortnite Server Outage Delays Chapter 6 Season 2 Launch

May 03, 2025 -

The Exclusive Scoop Who Will Replace Elon Musk At Tesla

May 03, 2025

The Exclusive Scoop Who Will Replace Elon Musk At Tesla

May 03, 2025

Latest Posts

-

Robust Poll Data System Ensuring Election Integrity

May 03, 2025

Robust Poll Data System Ensuring Election Integrity

May 03, 2025 -

Decoding Ap Decision Notes The Minnesota House Special Election Results

May 03, 2025

Decoding Ap Decision Notes The Minnesota House Special Election Results

May 03, 2025 -

Nebraskas Successful Voter Id Campaign A National Award Winner

May 03, 2025

Nebraskas Successful Voter Id Campaign A National Award Winner

May 03, 2025 -

Minnesota Special Election Key Takeaways From Ap Decision Notes

May 03, 2025

Minnesota Special Election Key Takeaways From Ap Decision Notes

May 03, 2025 -

Nebraska Voter Id Initiative Receives National Recognition

May 03, 2025

Nebraska Voter Id Initiative Receives National Recognition

May 03, 2025