The Impact Of Tariffs On Brookfield's US Manufacturing Plans

Table of Contents

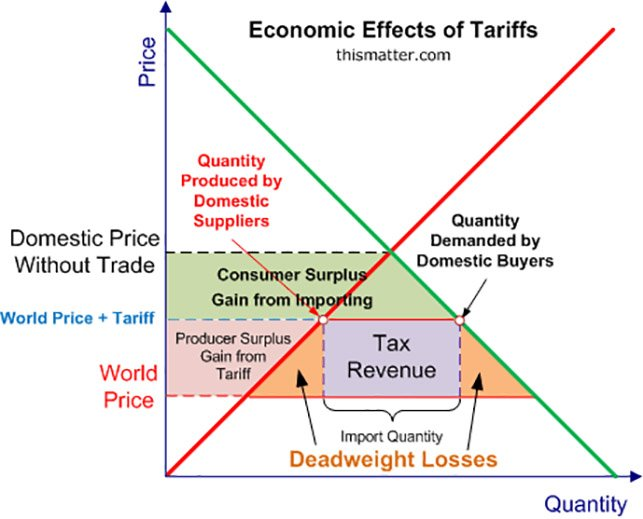

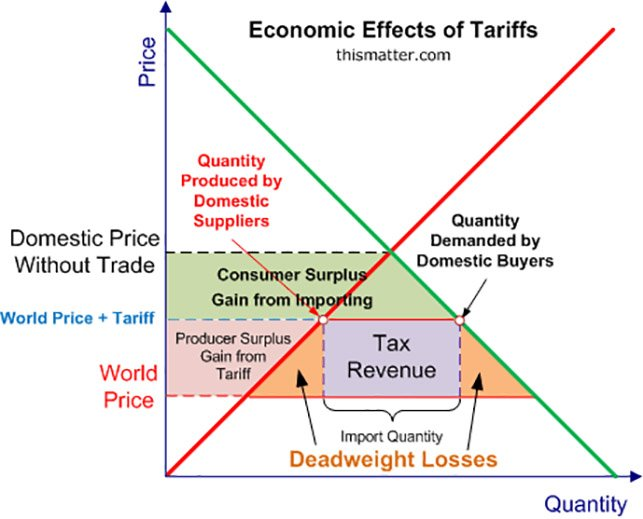

Increased Input Costs and Reduced Profitability

Tariffs significantly increase the cost of doing business for US manufacturers, impacting Brookfield's bottom line in several key ways.

Raw Material Price Hikes

Tariffs directly increase the cost of imported raw materials essential for many manufacturing processes. This has a cascading effect throughout the supply chain.

- Increased steel prices: Tariffs on imported steel directly impact manufacturers reliant on this crucial material, increasing their production costs.

- Higher costs for electronic components: Many manufactured goods rely on imported electronic components. Tariffs on these components translate to higher final product costs.

- Impact on finished goods pricing competitiveness: Increased input costs force manufacturers like Brookfield to either absorb the increased expense, reducing profit margins, or raise prices, potentially losing market share to competitors.

For example, a 10% tariff on imported steel used in one of Brookfield's manufacturing ventures could increase their raw material costs by 5%, depending on the proportion of imported steel used. This directly impacts their profitability and competitiveness.

Diminished Export Competitiveness

Tariffs imposed by the US can lead to retaliatory tariffs from other countries, making Brookfield's US-manufactured goods less competitive in the global market.

- Reduced demand for exports: Higher prices due to tariffs make US-made goods less attractive to international buyers.

- Potential loss of market share: Competitors in countries without similar tariffs gain a significant price advantage.

- Need for strategic price adjustments: Brookfield might be forced to lower prices to maintain market share, further squeezing profit margins.

The impact is particularly felt in markets like the European Union and China, where retaliatory tariffs have been implemented. Brookfield may need to consider strategies like shifting some production overseas to mitigate these negative effects.

Shifting Production Strategies and Investment Decisions

The uncertainty surrounding tariffs forces Brookfield to reassess its production strategies and investment decisions in the US.

Reshoring vs. Nearshoring

Brookfield faces a critical choice: reshoring (returning manufacturing to the US) or nearshoring (moving production to nearby countries with lower tariffs).

- Analysis of labor costs: Reshoring may involve higher labor costs compared to overseas production.

- Transportation expenses: Nearshoring can offer lower transportation costs compared to reshoring.

- Logistical complexities: Both reshoring and nearshoring present logistical challenges requiring careful planning.

- Government incentives: Government incentives for reshoring can offset some of the higher labor costs.

Companies facing similar dilemmas often perform detailed cost-benefit analyses, considering factors like labor costs, transportation, and potential government incentives before making a decision.

Investment Delays and Cancellations

Tariff uncertainty significantly impacts investment decisions. Brookfield may delay or cancel planned investments in new US manufacturing facilities.

- Impact on job creation: Delayed or canceled investments mean fewer jobs created in the affected regions.

- Economic growth in affected regions: Reduced manufacturing investment negatively impacts regional economic growth.

- Loss of potential future revenue: Delayed projects mean a loss of potential future revenue streams for Brookfield.

The inherent uncertainty associated with future tariff policies makes long-term investment planning incredibly challenging. Any public statements made by Brookfield regarding their investment plans will offer valuable insight into their decision-making process in the face of these challenges.

Lobbying Efforts and Policy Advocacy

Brookfield is likely engaged in various lobbying efforts to influence tariff policy and mitigate the negative impacts on its business.

Engaging with Government Officials

Brookfield, like many other businesses, engages in lobbying activities to influence policy.

- Participation in industry associations: Brookfield likely participates actively in industry associations advocating for tariff reform.

- Direct lobbying of legislators: Direct engagement with legislators to voice concerns and seek policy changes.

- Public relations campaigns to shape public opinion: Public relations efforts to sway public opinion regarding the negative impact of tariffs.

The effectiveness of these efforts depends on various factors, including the political climate and the strength of the lobbying coalition.

Impact on Supply Chain Diversification

Brookfield may adapt by diversifying its supply chains to lessen its dependence on tariff-affected countries.

- Sourcing materials from multiple locations: Reducing reliance on single-source suppliers can mitigate disruptions.

- Negotiating long-term contracts with suppliers: Securing long-term contracts provides price stability.

- Investing in alternative technologies: Investing in technologies that reduce reliance on imported components.

Supply chain diversification involves significant strategic planning and investment but is crucial for resilience in the face of trade uncertainties.

Conclusion

Brookfield US manufacturing tariffs have a significant and multifaceted impact, leading to increased costs, reduced competitiveness, and uncertainty surrounding future investments. Brookfield faces difficult choices regarding reshoring, nearshoring, and lobbying efforts. Understanding the ongoing effects of Brookfield US manufacturing tariffs is crucial for investors, policymakers, and the broader manufacturing sector. Further analysis of Brookfield's specific responses and adaptation strategies will be essential in determining the long-term consequences. Stay informed about the impact of Brookfield US manufacturing tariffs and their implications for the future of US manufacturing.

Featured Posts

-

Fortnite Game Mode Shutdown A Concerning Trend

May 02, 2025

Fortnite Game Mode Shutdown A Concerning Trend

May 02, 2025 -

Almwasfat Almtwqet Lblay Styshn 6 Thlyl Shaml

May 02, 2025

Almwasfat Almtwqet Lblay Styshn 6 Thlyl Shaml

May 02, 2025 -

Navigating The China Market The Struggles Of Bmw Porsche And Other Automakers

May 02, 2025

Navigating The China Market The Struggles Of Bmw Porsche And Other Automakers

May 02, 2025 -

Kort Geding Kampen Vs Enexis Duurzame School Zonder Stroom

May 02, 2025

Kort Geding Kampen Vs Enexis Duurzame School Zonder Stroom

May 02, 2025 -

In Memoriam Lisa Ann Keller East Idaho News

May 02, 2025

In Memoriam Lisa Ann Keller East Idaho News

May 02, 2025