The Impact Of Trump Tariffs On Fintech IPOs: An Analysis Of Affirm Holdings (AFRM)

Table of Contents

The Macroeconomic Landscape During the Trump Tariff Era

The Trump tariff era was characterized by significant global trade tensions and subsequent market volatility. Understanding this macroeconomic context is crucial to analyzing the impact on individual companies like Affirm Holdings.

Global Trade Tensions and Market Volatility

The imposition of tariffs created considerable uncertainty in global markets. This uncertainty stemmed from several factors:

- Retaliatory tariffs: The US tariffs prompted retaliatory measures from other countries, escalating trade disputes and creating a complex web of trade restrictions.

- Supply chain disruptions: Tariffs led to disruptions in global supply chains, increasing costs for businesses and impacting production timelines.

- Increased trade costs: Businesses faced higher costs due to tariffs, impacting profitability and potentially leading to price increases for consumers.

These factors contributed to significant market volatility. For example, the S&P 500 experienced considerable fluctuations during this period, reflecting investor anxiety surrounding the ongoing trade war. Keywords: market volatility, investor sentiment, global trade, trade uncertainty.

Sector-Specific Impacts on Fintech

While the impact of tariffs was widespread, the fintech sector faced its own unique challenges:

- Supply chain disruptions: Fintech companies relying on imported hardware or software components experienced disruptions in their supply chains, leading to delays and increased costs.

- Increased borrowing costs: The broader economic uncertainty created by the tariffs potentially led to increased borrowing costs for fintech companies seeking funding or capital. Higher interest rates could impact profitability and expansion plans.

- Reduced consumer spending: The uncertainty surrounding the economy and potential price increases due to tariffs could have led to reduced consumer spending, impacting the growth of companies like Affirm that rely on consumer transactions. Keywords: fintech industry, supply chain disruptions, borrowing costs, interest rates.

Affirm Holdings (AFRM) IPO and its Positioning Before and After Tariffs

Analyzing Affirm Holdings' IPO requires examining its pre-IPO performance and expectations, the IPO process itself, and its post-IPO performance in light of the ongoing trade war.

Pre-IPO Performance and Expectations

Before its IPO, Affirm Holdings demonstrated strong growth and a promising market position within the burgeoning BNPL sector. However, the looming trade war presented a potential headwind. Keywords: Affirm Holdings financials, pre-IPO valuation, growth prospects, market capitalization.

The IPO Process and Pricing Amidst Uncertainty

Launching an IPO during a period of economic uncertainty presents unique challenges. Investors are more risk-averse, potentially leading to lower valuations and a more challenging fundraising process. Affirm likely had to carefully consider the potential impact of tariffs on its IPO pricing and investor response. Keywords: IPO pricing, investor reaction, market conditions, risk assessment.

Post-IPO Performance and Tariff Impacts

Following its IPO, AFRM’s performance needed to be analyzed in the context of the ongoing trade war. It’s crucial to assess whether there was a direct correlation between tariff changes and AFRM’s stock price movements. Did the broader economic uncertainty impact consumer spending on BNPL services, thereby affecting Affirm's financial results? Keywords: post-IPO performance, stock price, financial results, operational impacts.

Comparing AFRM's Trajectory with Other Fintech IPOs During the Same Period

To gain a more comprehensive understanding of the impact of Trump tariffs on fintech IPOs, it's essential to compare AFRM's trajectory with that of its peers. This comparative analysis allows us to identify broader trends within the fintech IPO market during this turbulent period. By examining the performance of other Fintech companies that went public concurrently, we can discern whether the challenges faced by AFRM were unique or indicative of wider industry trends. Keywords: fintech IPO market, comparative analysis, peer performance, industry trends.

Conclusion: Understanding the Long-Term Effects of Trump Tariffs on Fintech IPO Success - The Case of Affirm Holdings (AFRM)

This analysis highlights the significant impact of macroeconomic factors, particularly the Trump-era tariffs, on the success of fintech IPOs. Affirm Holdings' experience serves as a valuable case study, illustrating the challenges and considerations involved in navigating economic uncertainty during a crucial stage of a company's growth. The trade war's influence on investor sentiment, supply chains, and consumer spending had a demonstrable impact on the financial markets, and it's crucial to remember that the effects of such trade policies often have far-reaching and long-lasting consequences.

It’s critical for investors to conduct thorough due diligence, considering the broader economic impact of tariffs and other macroeconomic factors when assessing fintech investment opportunities. Understanding the interplay between global trade policy and the performance of individual companies is vital for navigating the complexities of the fintech IPO market. To learn more about the long-term impacts of trade policy on fintech investments and how to conduct thorough due diligence before investing in fintech IPOs, further research is recommended. Understanding the economic impact of tariffs is paramount to making informed investment decisions.

Featured Posts

-

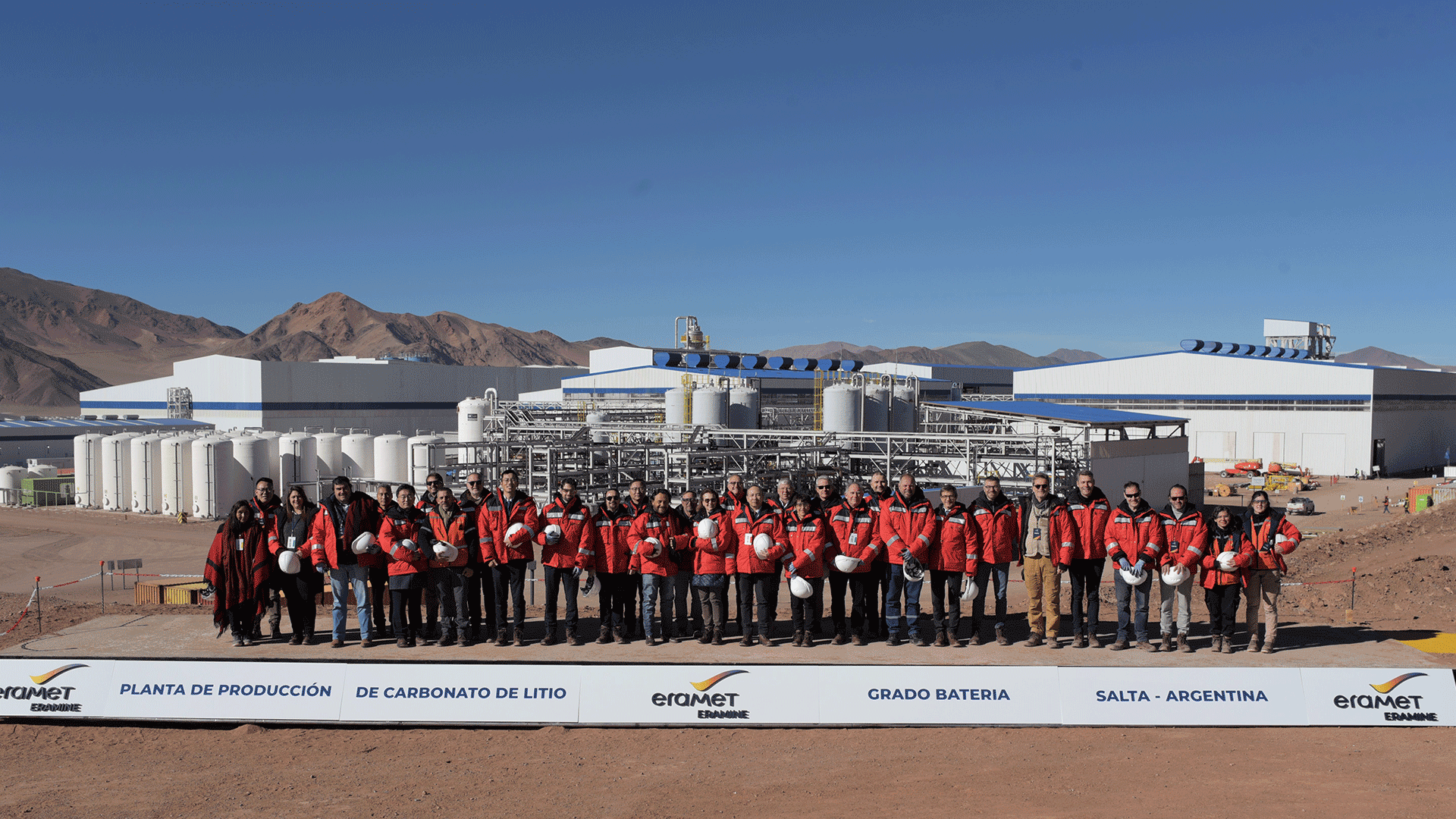

Perspectives De Production Eramet En 2025 Analyse Des Resultats Du Premier Trimestre

May 14, 2025

Perspectives De Production Eramet En 2025 Analyse Des Resultats Du Premier Trimestre

May 14, 2025 -

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025 -

Jose Mujica Expresidente De Uruguay Fallece A Los 89 Anos

May 14, 2025

Jose Mujica Expresidente De Uruguay Fallece A Los 89 Anos

May 14, 2025 -

Uruguay Mujica Expresidente Muere A Los 89 Anos

May 14, 2025

Uruguay Mujica Expresidente Muere A Los 89 Anos

May 14, 2025 -

Direkte Bahnverbindungen Von Oschatz In Die Saechsische Schweiz

May 14, 2025

Direkte Bahnverbindungen Von Oschatz In Die Saechsische Schweiz

May 14, 2025