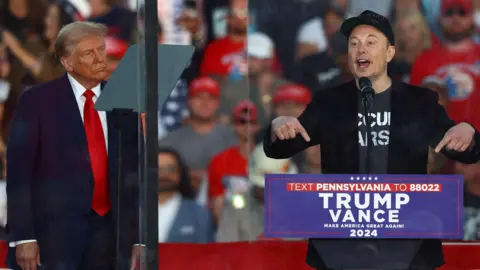

The Impact Of Trump's First 100 Days On Elon Musk's Fortune

Table of Contents

The Impact of Regulatory Changes on Tesla and SpaceX

Automotive Industry Regulations

Trump's early stance on environmental regulations raised questions about the future of the automotive industry and, consequently, Tesla. Changes, or the threat of changes, to fuel efficiency standards and emissions regulations under the Trump administration could have significantly impacted Tesla's sales and production.

- Relaxation of CAFE Standards: The potential rollback of Corporate Average Fuel Economy (CAFE) standards could have initially benefited Tesla indirectly by reducing pressure on competitors to produce more electric vehicles. However, a long-term weakening of environmental regulations might have hampered the overall growth of the electric vehicle market in the long run.

- State-Level Regulations: Conversely, the strong support for electric vehicles from various state governments could have offset some of the negative effects of potential federal deregulation. This created a complex and fluctuating environment affecting Tesla's profitability and stock prices.

- Impact on Stock Prices: The uncertainty surrounding the regulatory landscape during Trump's first 100 days likely contributed to some volatility in Tesla's stock price, directly affecting Elon Musk's net worth. Analyzing the stock performance during this period reveals a correlation between policy announcements and market reactions.

SpaceX and Government Contracts

SpaceX's reliance on government contracts, particularly from NASA and the Department of Defense, made it vulnerable to shifts in government spending priorities under the Trump administration. Trump's emphasis on strengthening the military and space exploration could have had a significant impact.

- Increased Defense Spending: Increased defense spending could have translated into more contracts for SpaceX, boosting its valuation and positively impacting Musk's net worth.

- NASA Funding: Changes in NASA's budget and priorities under the Trump administration could have affected SpaceX's involvement in missions like the Commercial Crew Program and other space exploration initiatives.

- Competition for Contracts: The overall competitive landscape for government contracts in the aerospace industry also played a crucial role. Any changes in procurement policies would have had a ripple effect on SpaceX's prospects.

Economic Policies and their Ripple Effect on Musk's Businesses

Tax Cuts and their Influence on Tesla's Profitability

The Trump administration's significant tax cuts in 2017, though enacted after his first 100 days, set the stage for a potentially positive impact on Tesla's profitability. The reduction in the corporate tax rate could have boosted Tesla's bottom line.

- Reduced Corporate Tax Burden: A lower corporate tax rate directly increased Tesla's after-tax profits, potentially enhancing its financial performance and contributing to the growth of Elon Musk's net worth.

- Impact on Investment: The tax cuts might have also encouraged increased investment in Tesla, further contributing to its positive financial performance.

- Stock Market Reaction: The anticipation and subsequent implementation of tax cuts likely influenced investor sentiment toward Tesla and other companies, influencing stock prices.

Trade Wars and their Potential Impact on Supply Chains

Trump's early focus on trade protectionism and the initiation of trade wars raised concerns about potential disruptions to Tesla's global supply chain. Tariffs on imported goods could have increased Tesla's production costs.

- Increased Input Costs: Tariffs on materials sourced from China or other countries could have directly increased Tesla's production costs, potentially affecting profitability and impacting Musk's wealth.

- Supply Chain Disruptions: Trade disputes could have led to delays or disruptions in the supply chain, potentially hindering Tesla's production and sales.

- Geopolitical Uncertainty: The overall uncertainty created by Trump's trade policies likely added to the volatility in Tesla's stock price, influencing Musk's net worth.

Market Sentiment and Investor Confidence

The overall impact of Trump's presidency on investor confidence

Trump's presidency, characterized by significant policy changes and unpredictable pronouncements, created uncertainty in the markets. This uncertainty affected investor confidence, and consequently, Tesla and SpaceX's stock valuations.

- Stock Market Volatility: The early days of the Trump administration witnessed significant stock market volatility, making it difficult to isolate the direct impact of specific policies on Tesla and SpaceX stock prices.

- Investor Sentiment: Investor sentiment towards Tesla and SpaceX during this period was likely influenced by a complex interplay of factors, including the overall market conditions, regulatory uncertainty, and the perceived impact of Trump's policies.

- Elon Musk's Net Worth Fluctuations: The volatility in the stock market and changing investor sentiment directly translated into fluctuations in Elon Musk's net worth, highlighting the intertwined relationship between political events and the financial fortunes of leading entrepreneurs.

Conclusion: Trump's Legacy on Elon Musk's Fortune – A Summary and Call to Action

In conclusion, the impact of Trump's first 100 days on Elon Musk's net worth was complex and multifaceted. While potential benefits existed from tax cuts and increased defense spending, regulatory uncertainty and the threat of trade wars introduced significant challenges for Tesla and SpaceX. The overall market sentiment and resulting stock price volatility played a crucial role in shaping Musk's financial trajectory during this period. To further understand the intricate relationship between political decisions and the fortunes of tech giants, delve deeper into the analysis of Trump's first 100 days and its lasting impact on Elon Musk's net worth. Researching specific policies and their direct effects on Tesla and SpaceX will provide a more comprehensive understanding of this complex dynamic.

Featured Posts

-

Analyzing Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025

Analyzing Dakota Johnsons Career Path The Chris Martin Factor

May 09, 2025 -

2025 Nhl Trade Deadline Impact On Playoff Contenders

May 09, 2025

2025 Nhl Trade Deadline Impact On Playoff Contenders

May 09, 2025 -

Nottingham Tragedy Survivors Raw Account Of The Triple Murder

May 09, 2025

Nottingham Tragedy Survivors Raw Account Of The Triple Murder

May 09, 2025 -

Elon Musks Net Worth Falls Below 300 Billion Tesla Troubles And Tariff Impacts

May 09, 2025

Elon Musks Net Worth Falls Below 300 Billion Tesla Troubles And Tariff Impacts

May 09, 2025 -

Brekelmans Inzet Voor Een Sterke Band Met India

May 09, 2025

Brekelmans Inzet Voor Een Sterke Band Met India

May 09, 2025