The Impact Of Trump's Presidency: Financial Losses For Musk, Bezos, And Zuckerberg

Table of Contents

The Trump Administration's Trade Wars and Their Impact on Tech Giants

The Trump administration's aggressive trade policies, particularly its initiation of trade wars, significantly impacted the tech industry. These actions, characterized by the imposition of tariffs, created ripple effects throughout global supply chains, directly affecting the bottom lines of Tesla, Amazon, and Facebook.

Tariffs and Supply Chain Disruptions

Tariffs imposed on various goods during Trump's Presidency increased the cost of raw materials and components for many tech companies. For Tesla, increased tariffs on imported steel and aluminum directly impacted the production costs of its electric vehicles. Amazon, relying heavily on global supply chains for its vast product offerings, faced increased costs for imported goods, impacting profitability margins. Similarly, Facebook, although less directly impacted by tariffs on physical goods, still felt the pressure through increased costs for components used in its data centers and infrastructure.

- Increased production costs: Tariffs led to a notable increase in manufacturing and operational expenses.

- Reduced profitability: Higher input costs directly translated to lower profit margins for these tech giants.

- Market share fluctuations: Some companies absorbed the increased costs, while others passed them on to consumers, potentially impacting market share.

Geopolitical Instability and Investment Uncertainty

Trump's unpredictable foreign policy and frequent shifts in trade negotiations created significant uncertainty in the global market. This instability deterred investment, impacting stock prices across various sectors, including tech. The fluctuating political climate made long-term investment planning challenging for companies like Tesla, Amazon, and Facebook, hindering expansion plans and potentially slowing growth.

- Decreased investor confidence: The volatile political landscape fostered uncertainty, making investors hesitant to commit significant capital.

- Market volatility: Stock prices for these companies experienced increased volatility due to the unpredictable political environment.

- Delayed expansion plans: Companies were forced to reassess and delay expansion projects due to the uncertainty surrounding future trade relations.

Regulatory Changes and Their Influence on Tech Company Valuations

Beyond trade policies, regulatory changes during Trump's Presidency also played a role in shaping the financial fortunes of these tech giants. Increased antitrust scrutiny and a shifting regulatory landscape contributed to increased costs and potential legal risks.

Antitrust Scrutiny and Investigations

Amazon, Facebook, and to a lesser extent Tesla, faced heightened antitrust scrutiny and investigations during the Trump administration. These investigations generated negative publicity, impacting public perception and, consequently, stock prices. The legal costs associated with these investigations added further financial strain.

- Legal fees: Significant financial resources were allocated to legal defense and compliance efforts.

- Reputational damage: Negative publicity surrounding antitrust investigations hurt brand image and consumer confidence.

- Potential fines and penalties: The threat of substantial fines and penalties loomed large, impacting valuations.

Shifting Regulatory Landscape and Compliance Costs

The changing regulatory landscape, particularly concerning data privacy and antitrust, demanded significant investments from these tech giants to ensure compliance. Adapting to new regulations required substantial resources, impacting their bottom lines.

- Increased compliance costs: Implementing new systems and procedures to meet evolving regulations added to operational expenses.

- Investment in new technologies: Companies invested heavily in new technologies to address data privacy concerns and maintain regulatory compliance.

- Potential for non-compliance penalties: The risk of penalties for non-compliance further increased financial uncertainty.

Social and Political Climate's Indirect Impact on Tech Stock Performance

The overall social and political climate during the Trump presidency also played a role in impacting the financial performance of these tech companies, albeit indirectly.

Consumer Sentiment and Market Volatility

The turbulent political climate directly influenced consumer sentiment and overall market volatility. Negative news cycles and political uncertainty often led to decreased consumer spending and increased market uncertainty, negatively affecting tech stock prices.

- Decreased consumer spending: Uncertainty in the economic outlook led to reduced consumer spending, impacting sales for tech products and services.

- Increased market uncertainty: The volatile political climate created a climate of uncertainty that affected investor behavior and market stability.

- Short-term stock price drops: Negative news cycles often resulted in short-term drops in stock prices for tech companies.

Public Opinion and Brand Perception

The political climate also influenced public opinion towards these companies and their CEOs. Negative political sentiment could potentially translate into decreased consumer preference, impacting brand loyalty and, consequently, stock valuations.

- Brand image impacts: The political landscape and public perception of the CEOs influenced brand image and consumer trust.

- Changes in consumer preference: Negative perceptions could lead to shifts in consumer preferences toward competing brands.

- Potential boycotts: In some cases, negative publicity and political associations could lead to consumer boycotts.

Conclusion: Assessing the Trump Presidency's Financial Fallout for Tech Leaders

The Trump administration's policies, from trade wars to regulatory changes, coupled with the overall social and political climate, significantly impacted the financial performance of companies led by Musk, Bezos, and Zuckerberg. Increased costs due to tariffs, heightened antitrust scrutiny, and general market uncertainty all contributed to substantial financial losses. Understanding the impact of Trump's Presidency: Financial Losses for Musk, Bezos, and Zuckerberg is crucial for comprehending the interconnectedness of politics and the economy. Further research into specific policy details and their financial consequences can illuminate the complex relationship between political leadership and corporate success. Delve deeper into the specific policy changes and their financial consequences to gain a more comprehensive understanding of this complex interplay.

Featured Posts

-

Lightning Defeat Oilers 4 1 Behind Kucherovs Stellar Performance

May 10, 2025

Lightning Defeat Oilers 4 1 Behind Kucherovs Stellar Performance

May 10, 2025 -

Amy Walsh Shows Solidarity With Wynne Evans Following Strictly Comment

May 10, 2025

Amy Walsh Shows Solidarity With Wynne Evans Following Strictly Comment

May 10, 2025 -

Can Sports Stadiums Save Dying Downtowns A Look At Urban Revitalization

May 10, 2025

Can Sports Stadiums Save Dying Downtowns A Look At Urban Revitalization

May 10, 2025 -

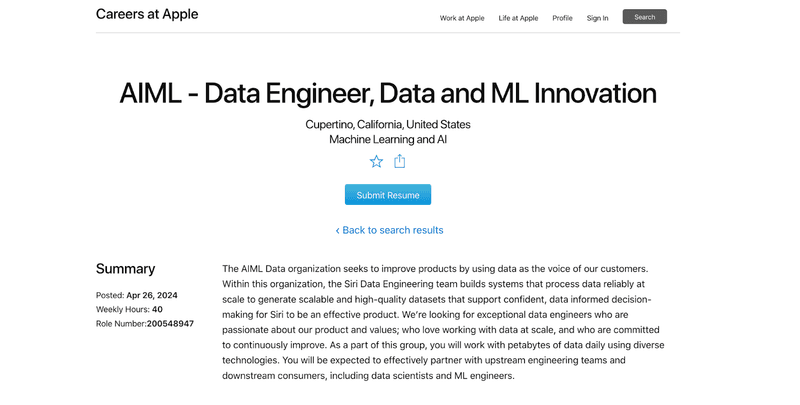

Assessing Apples Position In The Ai Market

May 10, 2025

Assessing Apples Position In The Ai Market

May 10, 2025 -

Romantiki Komodia Materialists Deite To Treiler Me Ntakota Tzonson And Pedro Paskal

May 10, 2025

Romantiki Komodia Materialists Deite To Treiler Me Ntakota Tzonson And Pedro Paskal

May 10, 2025