The Impact Of US Regulations On Elon Musk And Tesla's Financial Success

Table of Contents

Navigating the Complexities of Automotive Regulations

Tesla's journey is inextricably linked to its ability to meet stringent US automotive regulations. Compliance significantly affects its production costs, profitability, and ultimately, its financial success.

Emission Standards and Fuel Efficiency

The Corporate Average Fuel Economy (CAFE) standards and other emission regulations play a crucial role in shaping the automotive landscape. While traditional automakers face immense pressure to meet these increasingly stringent targets while juggling gasoline and electric vehicle production, Tesla, focused solely on electric vehicles (EVs), enjoys a significant advantage. This strategic focus has allowed Tesla to capitalize on the growing demand for EVs and benefit from the incentives associated with regulatory compliance in this area.

- Regulation Examples: CAFE standards, EPA emission regulations, state-level zero-emission vehicle (ZEV) mandates.

- Compliance Costs: Investment in battery technology, emission control systems (though less relevant to Tesla), and infrastructure for EV charging.

- Tesla's Strategic Responses: Focusing solely on EVs, investing heavily in battery technology innovation, leveraging economies of scale.

Safety Regulations and Testing

The National Highway Traffic Safety Administration (NHTSA) and other safety regulatory bodies exert considerable influence on Tesla's design, manufacturing, and post-market processes. Meeting these standards requires substantial investment in testing and design modifications. Any recalls or safety investigations, however minor, can significantly damage Tesla's reputation and impact its stock price, directly affecting its financial success.

- Safety Regulation Examples: Crash testing standards, autonomous driving system regulations, cybersecurity requirements.

- Testing Procedures: Extensive crash testing, rigorous software validation, ongoing monitoring of vehicle performance.

- Financial Implications: Costs associated with recalls, legal fees related to safety investigations, potential loss of consumer confidence.

The Influence of Securities and Exchange Commission (SEC) Regulations

As a publicly traded company, Tesla faces intense scrutiny from the SEC. Compliance with SEC regulations governing public company disclosures, insider trading, and market manipulation is paramount to maintaining investor confidence and ensuring financial stability. Elon Musk's highly visible and often controversial public statements have, at times, landed the company in hot water with the SEC.

Public Company Disclosure Requirements

Meeting the SEC's stringent disclosure requirements is crucial for maintaining transparency and investor trust. However, the sheer volume of regulations and the potential for misinterpretation can be challenging. Elon Musk's tweets, while often impactful in generating buzz, have also led to significant regulatory scrutiny and legal battles, impacting Tesla's financial performance.

- SEC Investigation Examples: Investigations into Musk's tweets regarding Tesla's privatization, production numbers, and other company-related information.

- Fines and Penalties: Significant financial penalties levied against Tesla and Elon Musk for violations of SEC regulations.

- Financial Ramifications: Increased legal expenses, potential loss of investor confidence, negative impacts on Tesla's stock price.

Insider Trading and Market Manipulation Concerns

Allegations of insider trading and market manipulation, particularly those related to Elon Musk's public statements, pose significant legal and financial risks for Tesla. These concerns can erode investor confidence and negatively affect Tesla's stock valuation, directly impacting its financial success. The ethical implications of his pronouncements on Tesla's future are also constantly debated.

- Controversial Instances: Examples of tweets or public statements that have led to allegations of market manipulation or insider trading.

- Impact on Investor Confidence: The potential erosion of trust in Tesla due to uncertainty and regulatory risk.

- Impact on Stock Valuation: Fluctuations in Tesla’s stock price directly linked to regulatory actions and controversies.

The Impact of Subsidies and Tax Incentives

Government subsidies and tax incentives have played a significant role in boosting Tesla's sales and profitability. These incentives significantly impact Tesla's pricing strategy and market competitiveness, particularly within the electric vehicle market.

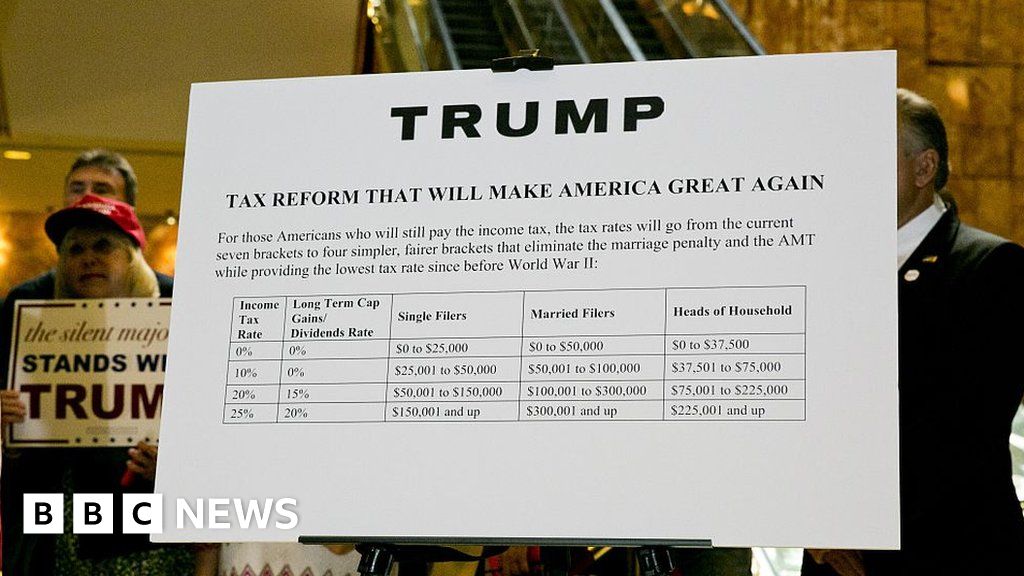

Federal and State Incentives for Electric Vehicles

Federal and state tax credits and other incentives have been crucial to the adoption of electric vehicles, including Tesla's models. These incentives lower the purchase price for consumers, driving sales and making Tesla more competitive against gasoline-powered vehicles. However, the future of these incentives remains uncertain, posing a potential risk to Tesla's long-term financial model.

- Incentive Examples: Federal tax credits, state-level rebates, and incentives for EV charging infrastructure.

- Financial Value to Tesla: Increased sales volume, improved market share, and enhanced profitability.

- Influence on Market Share: Subsidies have played a significant part in enabling Tesla to achieve its current market position.

Renewable Energy and Infrastructure Investments

Government investment in renewable energy infrastructure has also boosted Tesla's growth in energy storage solutions, such as the Powerwall and Megapack. Government support for renewable energy initiatives has created a favorable environment for Tesla's energy business, driving demand and facilitating expansion.

- Government Initiatives: Investments in renewable energy infrastructure, smart grid development, and energy storage projects.

- Financial Effects on Tesla's Energy Sector: Increased sales of Powerwall and Megapack units, growth in energy storage market share.

- Future Opportunities: Potential for increased government funding in renewable energy, creating more opportunities for Tesla's energy business.

Conclusion: Understanding the Regulatory Landscape for Tesla's Future Success

US regulations have profoundly impacted Tesla's financial performance and Elon Musk's leadership, creating both opportunities and challenges. The regulatory environment for electric vehicle manufacturers and technology companies remains highly complex and dynamic. The future regulatory landscape will likely continue to shape Tesla's trajectory, influencing its innovation, production costs, and market position. Learn more about the impact of US regulations on the financial success of Tesla and other electric vehicle companies by researching specific regulations or engaging in further analysis of the company's financial reports and regulatory filings. Deepen your understanding of the intricate relationship between US regulatory compliance and Tesla's financial performance.

Featured Posts

-

Ntakota Tzonson Pedro Paskal Sto Treiler Tis Romantikis Komodias Materialists

May 10, 2025

Ntakota Tzonson Pedro Paskal Sto Treiler Tis Romantikis Komodias Materialists

May 10, 2025 -

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 10, 2025

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 10, 2025 -

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 10, 2025

Sports Stadiums A Key To Breaking The Downtown Doom Loop

May 10, 2025 -

Are Tariffs Trumps Only Weapon Warner Weighs In

May 10, 2025

Are Tariffs Trumps Only Weapon Warner Weighs In

May 10, 2025 -

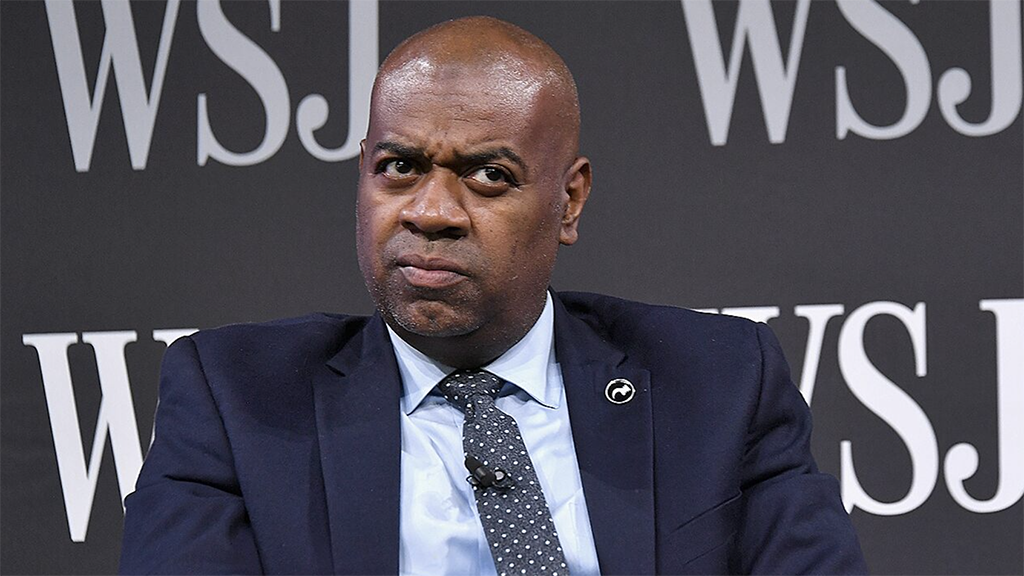

Ice Protest Leads To Newark Mayor Ras Barakas Arrest

May 10, 2025

Ice Protest Leads To Newark Mayor Ras Barakas Arrest

May 10, 2025