The Impact Of Walleye Credit Cuts On Core Group Performance In Commodities

Table of Contents

H2: Reduced Liquidity and Trading Volume Following Walleye Credit Cuts

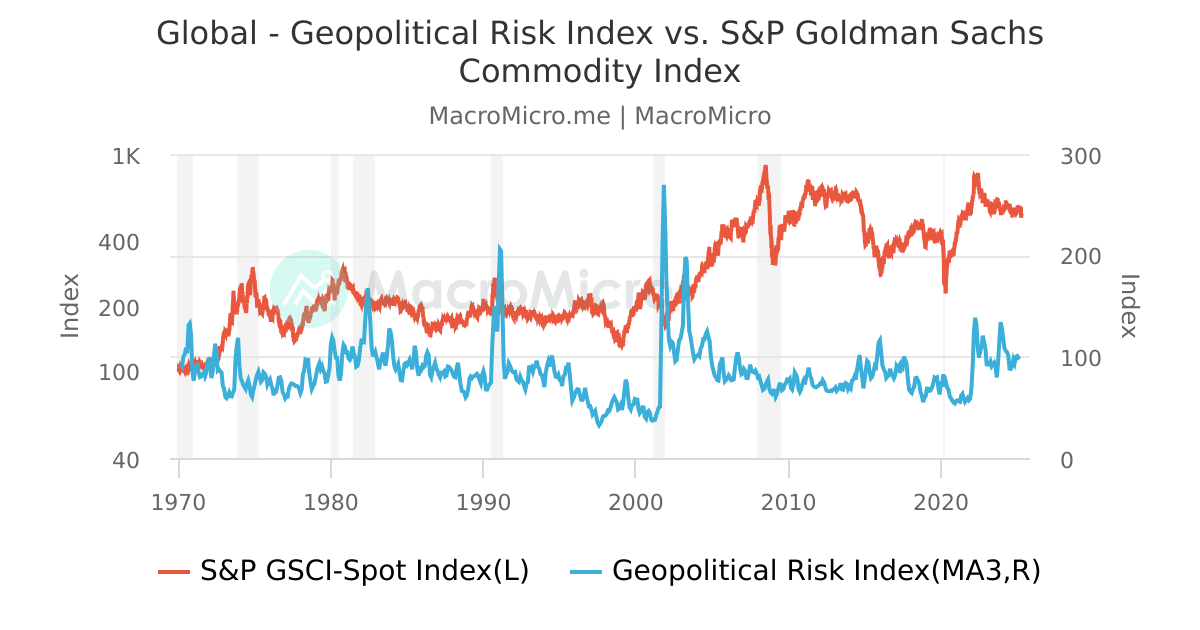

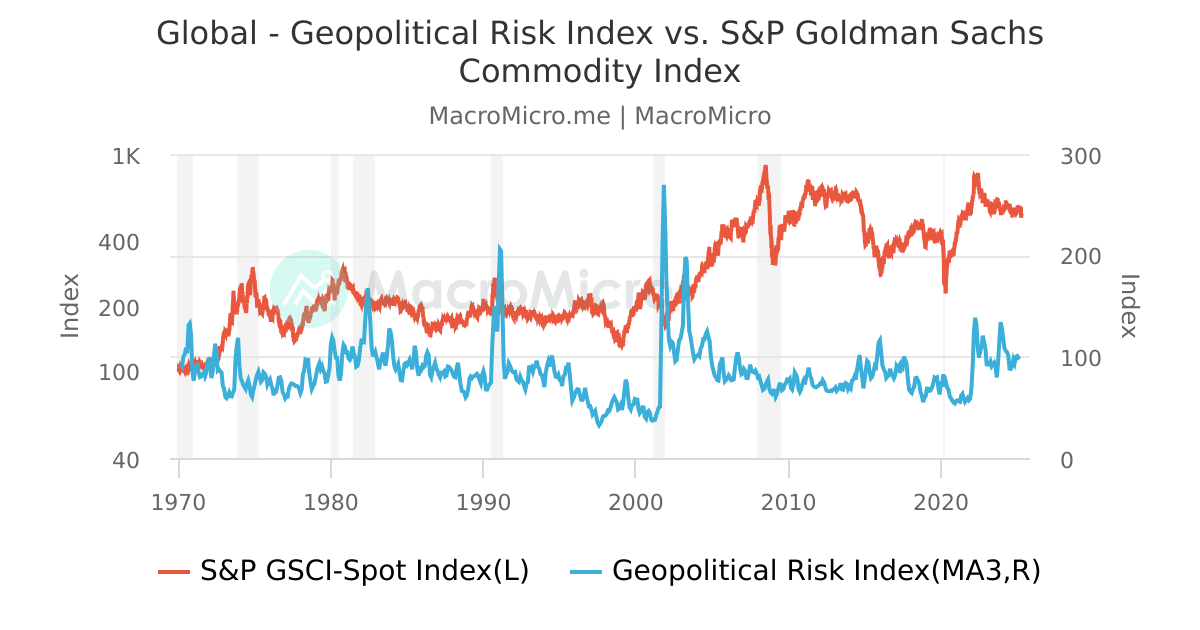

Walleye credit plays a vital role in facilitating smooth and efficient trading in commodity markets. It provides the necessary liquidity for market participants to execute transactions, ensuring a robust and functioning ecosystem. The abrupt cuts to Walleye credit have directly constricted this liquidity, leading to a noticeable decline in trading volumes across numerous commodities. This reduction in liquidity has created a domino effect, influencing price discovery and market stability.

- Decreased trading activity due to reduced access to capital: With less readily available credit, market participants are less inclined to engage in high-volume trading, fearing potential losses stemming from decreased liquidity.

- Increased volatility and price swings caused by constrained liquidity: The reduced liquidity amplifies even minor changes in supply and demand, leading to significant price swings and increased market volatility. This makes it harder for investors to accurately assess risk and make informed decisions.

- Examples of specific commodities heavily impacted by the credit cuts: The impact of Walleye credit cuts is not uniform across all commodities. Sectors like oil and agricultural products, which heavily rely on efficient trading and financing, have been particularly susceptible. The reduced availability of credit has amplified price fluctuations in these sectors.

- Potential market fragmentation as a result: The decreased liquidity may lead to market fragmentation, with certain segments becoming less liquid and more vulnerable to manipulation.

H2: Impact on Core Group Investment Strategies and Risk Management

The core groups in the commodity market, including hedge funds, investment banks, and commodity trading firms, are significantly affected by Walleye credit cuts. These groups often leverage Walleye credit to amplify their returns, and the reduction in credit availability has forced them to reassess their investment strategies and risk management practices.

- Shift in investment strategies towards less leveraged positions: To mitigate risk in the face of reduced liquidity, core groups are adopting less leveraged positions, reducing their exposure to potential losses. This has implications for overall market activity.

- Increased hedging activities to mitigate risk: To further manage risk in this volatile environment, core groups have increased their hedging activities, using instruments like futures contracts and options to protect against adverse price movements.

- Examples of specific risk management strategies adopted by core groups: Some core groups are diversifying their portfolios, focusing on less volatile commodities, and increasing their cash reserves to navigate the current market conditions.

- Potential for increased margin calls and forced liquidations: The increased volatility and reduced liquidity can lead to margin calls, forcing some market participants to liquidate their positions prematurely, potentially triggering further market instability.

H2: The Role of Regulatory Responses in Mitigating the Impact of Walleye Credit Cuts

Regulatory bodies are playing a crucial role in addressing the fallout from Walleye credit cuts. Their responses range from efforts to inject liquidity into the markets to implementing measures to stabilize price fluctuations. The effectiveness of these interventions, however, remains a subject of ongoing debate.

- Government interventions to increase liquidity: Governments may intervene by providing direct financial assistance to struggling firms or implementing policies that encourage lending to commodity businesses.

- Central bank actions to support market stability: Central banks can influence liquidity by adjusting interest rates or through quantitative easing measures to ensure adequate credit availability.

- Impact of regulatory changes on core group activities: Regulatory interventions have the potential to reshape the strategies and operations of core groups, particularly regarding risk management and leverage.

- Discussion of potential long-term regulatory implications: This event may lead to broader discussions about regulating credit in the commodity markets and tightening regulations to prevent similar disruptions in the future.

H2: Long-Term Implications and Future Outlook for Commodities Following Walleye Credit Contraction

The long-term consequences of Walleye credit cuts on the commodity market are still unfolding, but several potential impacts are emerging. The reduced liquidity and increased volatility may lead to significant structural shifts in the market.

- Long-term impact on price discovery mechanisms: The diminished liquidity may impair efficient price discovery, leading to less accurate reflection of market fundamentals.

- Potential for structural changes in the commodity market: The reduced access to credit may drive consolidation within the industry, leading to a smaller number of larger players.

- Changes in market access and participation: Smaller participants may struggle to compete in a less liquid market, potentially hindering their participation and reducing market diversity.

- Prediction of future market trends considering the Walleye credit situation: The future outlook for commodities will depend on several factors, including the recovery of Walleye credit, regulatory responses, and evolving investor sentiment. The long-term impact is likely to be substantial.

Conclusion: Navigating the Future of Commodities in the Post-Walleye Credit Cut Environment

The Walleye credit cuts have had a profound and multifaceted impact on core group performance within the commodity markets. Reduced liquidity, increased volatility, and shifts in investment strategies are just some of the consequences we've explored. Understanding these impacts is crucial for investors and market participants to successfully navigate this evolving landscape. To stay ahead, continuous monitoring of developments regarding Walleye credit and its ripple effects is essential. Further research and analysis into the long-term implications of these cuts are needed to develop effective strategies for the future. Stay informed about future developments regarding Walleye credit and its effects on the commodity market. [Link to relevant resource (if available)].

Featured Posts

-

Zber Dat Pre Aktualizaciu Atlasu Romskych Komunit Sa Zacina V Aprili

May 13, 2025

Zber Dat Pre Aktualizaciu Atlasu Romskych Komunit Sa Zacina V Aprili

May 13, 2025 -

Slobodna Dalmacija Neocekivani Izgled Leonarda Di Capria

May 13, 2025

Slobodna Dalmacija Neocekivani Izgled Leonarda Di Capria

May 13, 2025 -

Foto Ribuan Pekerja Terjebak Jaringan Penipuan Online Myanmar Ada Wni

May 13, 2025

Foto Ribuan Pekerja Terjebak Jaringan Penipuan Online Myanmar Ada Wni

May 13, 2025 -

Byds Rise How The Chinese Ev Maker Challenges Fords Influence In Brazil

May 13, 2025

Byds Rise How The Chinese Ev Maker Challenges Fords Influence In Brazil

May 13, 2025 -

Decoding The Da Vinci Code A Literary And Historical Exploration

May 13, 2025

Decoding The Da Vinci Code A Literary And Historical Exploration

May 13, 2025

Latest Posts

-

Scotty Mc Creerys Son Pays Heartfelt Tribute To George Strait Watch Now

May 14, 2025

Scotty Mc Creerys Son Pays Heartfelt Tribute To George Strait Watch Now

May 14, 2025 -

Watch The Heartwarming Tribute Scotty Mc Creerys Son Honors Country Legend George Strait

May 14, 2025

Watch The Heartwarming Tribute Scotty Mc Creerys Son Honors Country Legend George Strait

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Homage To George Strait

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch Now

May 14, 2025 -

Watch Scotty Mc Creerys Son Honors George Strait With Sweet Tribute

May 14, 2025

Watch Scotty Mc Creerys Son Honors George Strait With Sweet Tribute

May 14, 2025