The Looming Bond Market Crisis: Are You Prepared?

Table of Contents

Understanding the Current State of the Bond Market

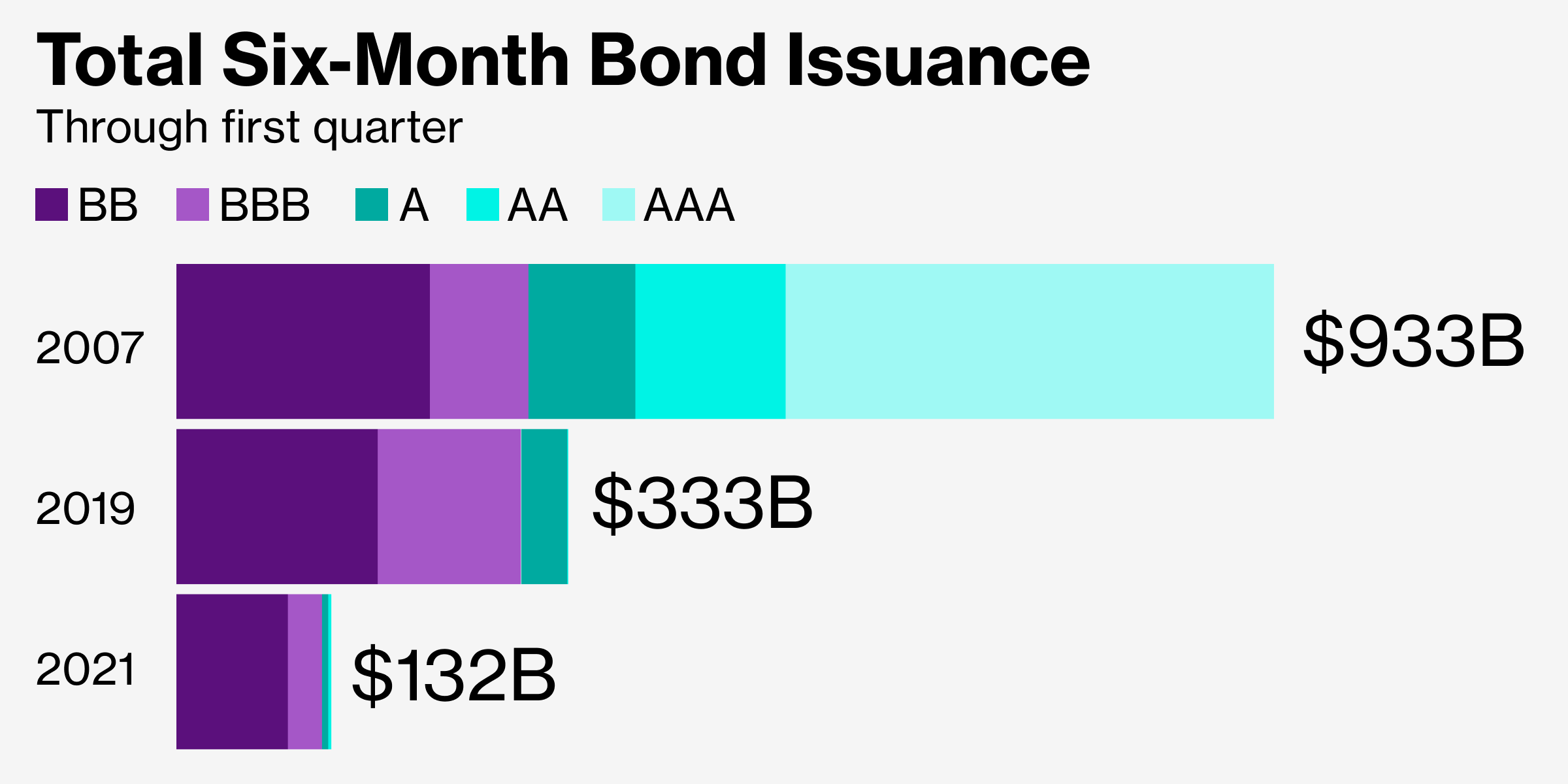

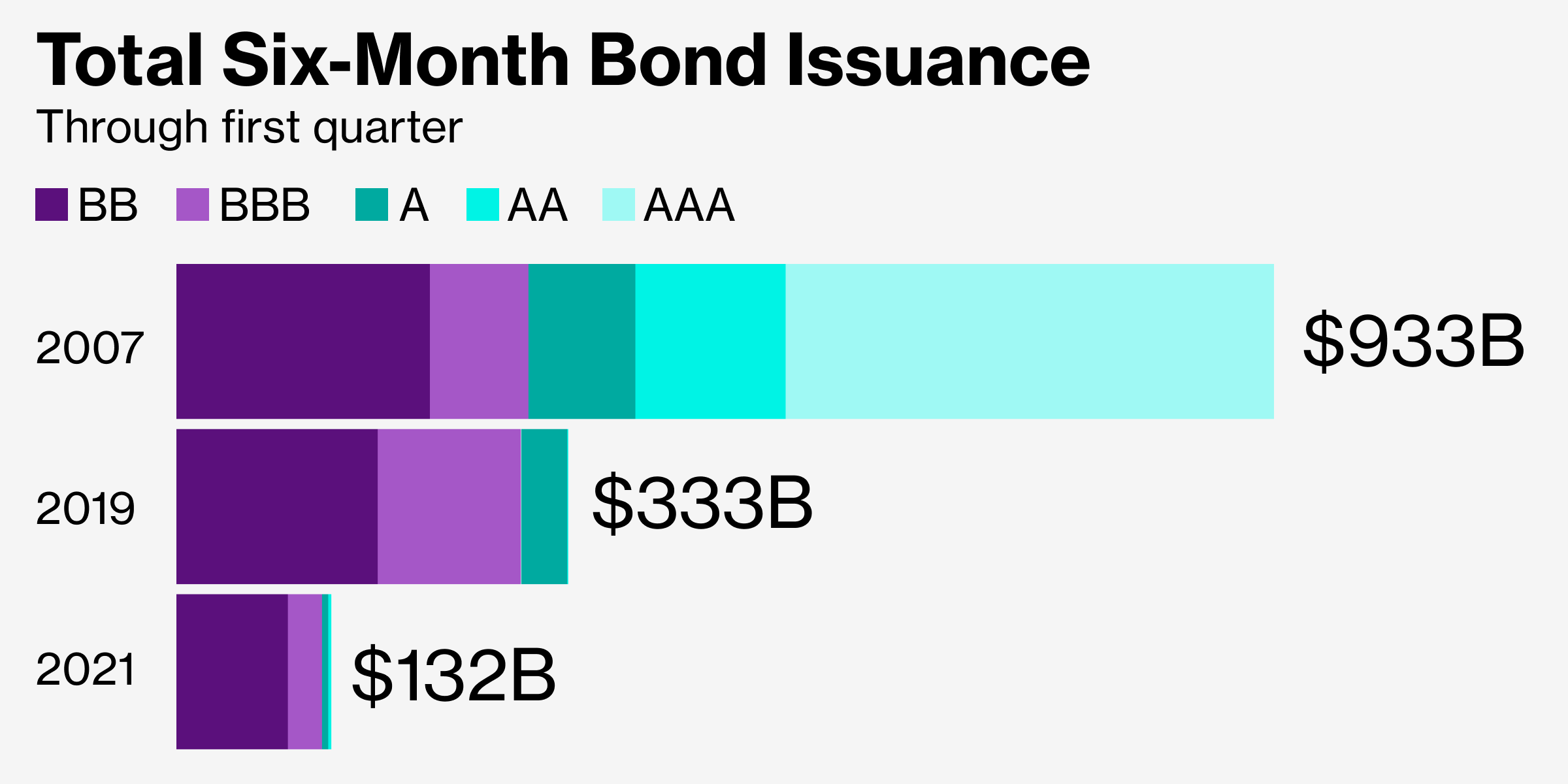

The bond market, a cornerstone of global finance, faces unprecedented challenges. Several factors significantly increase the risk of a major crisis. Bond yields, traditionally seen as a safe haven, are rising sharply due to aggressive interest rate hikes implemented by central banks worldwide to combat stubborn inflation. This rise, in turn, decreases bond prices, creating a precarious situation for investors heavily invested in fixed income.

- The Inverse Relationship: Remember the fundamental inverse relationship between bond prices and interest rates. As interest rates rise, the value of existing bonds falls, as newer bonds offer higher yields.

- Inflation's Impact: High inflation erodes the purchasing power of future bond payments, further diminishing their attractiveness and impacting overall bond yields and returns.

- Sovereign Debt Risks: Several countries face escalating sovereign debt issues, raising concerns about potential defaults. The risk of a government failing to repay its bonds is a major threat to the stability of the entire bond market.

- Corporate Bond Credit Risk: The increasing credit risk associated with corporate bonds adds to the overall instability. As economic conditions deteriorate, the probability of corporate defaults increases, impacting investor confidence and potentially triggering a wider financial crisis.

Identifying Potential Triggers for a Bond Market Crisis

A confluence of factors could act as triggers for a full-blown bond market crisis. Understanding these potential catalysts is crucial for effective risk management.

- Global Recession: A significant global recession would dramatically impact demand for bonds, pushing prices down and potentially causing a liquidity crisis.

- Geopolitical Risks: Ongoing geopolitical risks, such as wars, political instability, or escalating trade tensions, inject uncertainty into markets, negatively affecting investor sentiment and leading to a flight from riskier assets, including bonds.

- Monetary Policy Errors: Mistakes in monetary policy, such as overly aggressive interest rate hikes or a failure to address inflation effectively, can destabilize the market and exacerbate existing vulnerabilities.

- Unexpected Inflation Surge: An unexpected surge in inflation, exceeding central bank forecasts, would further erode bond returns and potentially trigger a sell-off, leading to a sharp decline in bond prices. This could escalate into a wider economic downturn.

Strategies for Protecting Your Portfolio from a Bond Market Crisis

Protecting your portfolio from a potential bond market crash requires proactive risk management strategies. Diversification and a carefully planned asset allocation are essential.

- Diversification: Don't put all your eggs in one basket. Diversify your investments across various asset classes, including stocks, real estate, commodities, and alternative investments. Reducing your exposure to fixed income can significantly mitigate the impact of a bond market crisis.

- Short-Term Bonds and Cash: Consider shifting some of your investments to short-term bonds or cash equivalents, which are less sensitive to interest rate fluctuations.

- Alternative Investments: Explore alternative investments like real estate or commodities, which often have a lower correlation with bond markets, offering some degree of portfolio protection during market downturns.

- Hedging Strategies: Employ hedging strategies to protect against potential losses. These techniques can help mitigate the impact of adverse market movements.

Monitoring Key Indicators for Early Warning Signs

Proactive monitoring of key economic indicators can provide early warnings of an impending bond market crisis.

- Yield Curve Inversion: Pay close attention to the yield curve. An inverted yield curve, where short-term bond yields exceed long-term yields, is a historically reliable predictor of recessions and can foreshadow a significant decline in bond prices.

- Credit Spreads: Monitor credit spreads, the difference between the yields of corporate bonds and government bonds. Widening credit spreads indicate increasing risk aversion and potential future defaults.

- Inflation Data: Track inflation data closely. Persistently high inflation erodes the real value of bond returns, impacting investor sentiment and potentially triggering sell-offs.

- Economic Growth Indicators: Monitor key economic growth indicators, such as GDP growth, employment figures, and consumer sentiment. A weakening economy generally translates to lower demand for bonds and declining prices.

Conclusion

The potential for a bond market crisis is a serious concern. Rising interest rates, high inflation, and geopolitical uncertainty create a volatile environment. However, by understanding the risks, proactively diversifying your portfolio, monitoring key economic indicators, and implementing appropriate risk mitigation strategies, you can significantly improve your chances of navigating a potential fixed income crisis successfully. Don't wait for a bond market crisis to strike; take action today to protect your financial future. Consider seeking professional financial advice to develop a personalized investment strategy tailored to your specific risk tolerance and financial goals.

Featured Posts

-

Remembering Charlie Rangel The Life And Career Of A New York Giant

May 28, 2025

Remembering Charlie Rangel The Life And Career Of A New York Giant

May 28, 2025 -

Blake Lively Justin Baldoni Legal Saga Unexpected Celebrity Entanglement

May 28, 2025

Blake Lively Justin Baldoni Legal Saga Unexpected Celebrity Entanglement

May 28, 2025 -

Arteta And Edu Eye Record Transfer For Elite Striker Arsenals Summer Plans

May 28, 2025

Arteta And Edu Eye Record Transfer For Elite Striker Arsenals Summer Plans

May 28, 2025 -

Wes Andersons World Building Archives London Debut

May 28, 2025

Wes Andersons World Building Archives London Debut

May 28, 2025 -

Padres Face Rockies At Coors Field A Potential For Significant Losses

May 28, 2025

Padres Face Rockies At Coors Field A Potential For Significant Losses

May 28, 2025

Latest Posts

-

Secure Your Gorillaz Tickets Four Special London Shows

May 30, 2025

Secure Your Gorillaz Tickets Four Special London Shows

May 30, 2025 -

Gorillazs 25th Anniversary London Concerts And Exhibition

May 30, 2025

Gorillazs 25th Anniversary London Concerts And Exhibition

May 30, 2025 -

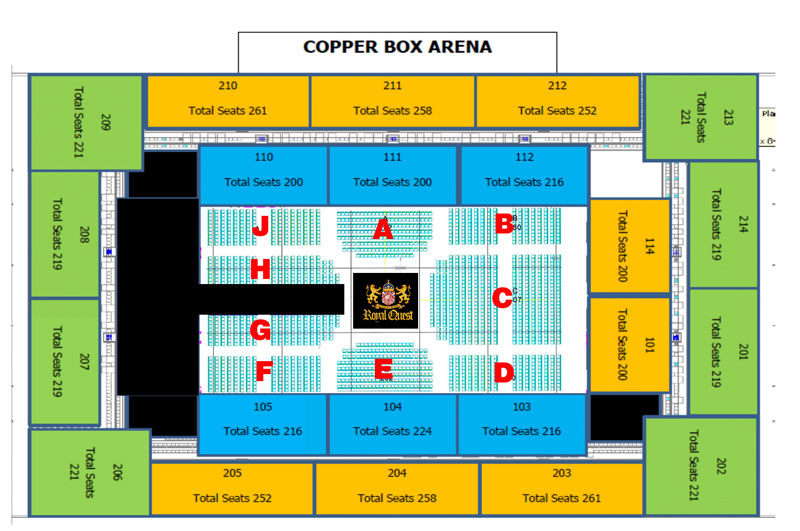

Gorillaz London Copper Box Arena Tickets On Sale Now

May 30, 2025

Gorillaz London Copper Box Arena Tickets On Sale Now

May 30, 2025 -

Gorillaz Celebrate 25 Years With London Gigs And Art Exhibition

May 30, 2025

Gorillaz Celebrate 25 Years With London Gigs And Art Exhibition

May 30, 2025 -

Gorillaz 25th Anniversary Exploring The House Of Kong Exhibition

May 30, 2025

Gorillaz 25th Anniversary Exploring The House Of Kong Exhibition

May 30, 2025