The Looming Crisis In The Global Bond Market: A Posthaste Perspective

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This reduced demand leads to a decline in the prices of existing bonds. Central bank policy tightening, aimed at curbing inflation, directly impacts bond yields. Aggressive rate hikes, as witnessed recently by many central banks, exacerbate this effect.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and corporations to borrow money, potentially impacting their ability to service existing debt.

- Reduced demand for existing bonds leading to price declines: Investors sell existing bonds to buy newer, higher-yielding ones, pushing down prices in the secondary market. This downward pressure can be significant, leading to substantial losses for bondholders.

- Potential for widespread defaults on high-yield bonds: Companies with high levels of debt and lower credit ratings are particularly vulnerable to rising interest rates. The increased cost of servicing debt can lead to defaults, triggering a domino effect across the high-yield bond market. This is a key concern within the broader global bond market crisis.

- Impact on pension funds and insurance companies heavily invested in bonds: Many institutional investors, like pension funds and insurance companies, hold substantial bond portfolios. Declining bond prices can significantly impact their liabilities and solvency, potentially triggering a wider financial crisis.

Inflation and the Erosion of Bond Returns

High inflation erodes the purchasing power of future interest payments and the principal value of bonds at maturity. This means that the real return on fixed-income investments, after adjusting for inflation, can be significantly lower or even negative. Investors seeking to protect their capital from inflation face the challenge of finding suitable inflation-protected securities, with limited supply potentially driving up their prices.

- The impact of inflation on purchasing power: If inflation is higher than the bond's yield, the investor effectively loses purchasing power over time. This is a major risk factor within the context of a potential global bond market crisis.

- The search for yield in higher-risk assets: In an inflationary environment, investors often seek higher returns in riskier assets, potentially increasing market volatility and systemic risk.

- The attractiveness of inflation-linked bonds: Inflation-linked bonds, also known as TIPS (Treasury Inflation-Protected Securities) in the US, offer a hedge against inflation. However, their supply is often limited, and demand can fluctuate significantly. [Link to relevant article on TIPS]

- Difficulty in predicting future inflation rates: Accurate inflation forecasting is crucial for making sound investment decisions in the bond market. However, unpredictable geopolitical events and supply chain disruptions make this task increasingly challenging.

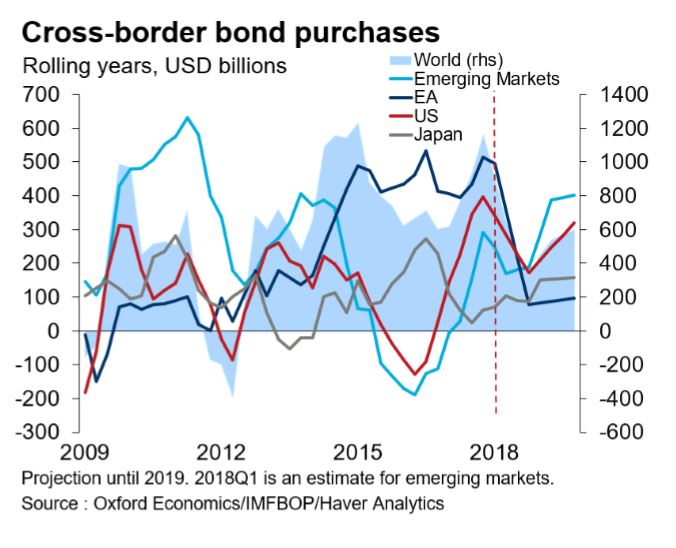

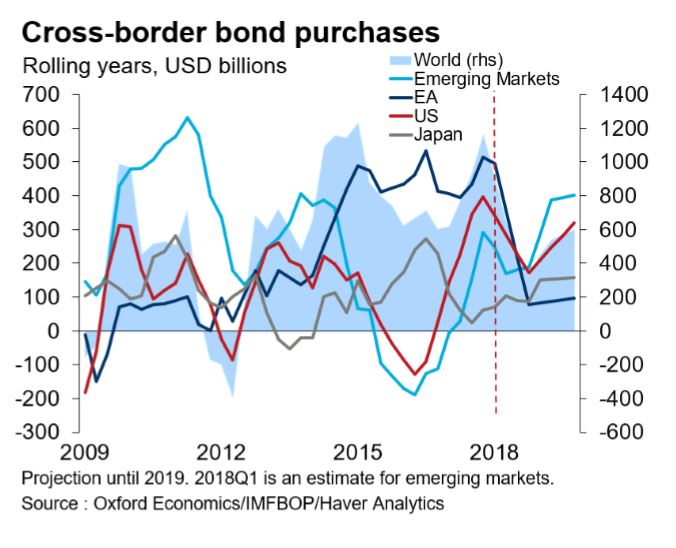

Geopolitical Instability and its Effect on Bond Markets

Global political events, such as wars, trade disputes, and political uncertainty, inject considerable volatility into bond markets. Investors react to these events by adjusting their risk appetite, leading to significant shifts in bond prices and yields. The ongoing war in Ukraine, for example, has created considerable uncertainty, impacting global energy prices and supply chains, further contributing to inflationary pressures and fueling concerns about a global bond market crisis.

- Increased risk aversion amongst investors: Uncertainty leads investors to favor safer assets, such as government bonds of stable economies, driving up their prices and lowering their yields.

- Flight to safety towards government bonds of stable economies: Investors often seek refuge in government bonds perceived as low-risk during periods of geopolitical instability, increasing demand and potentially driving up their prices.

- Impact on emerging market debt: Emerging market economies are often particularly sensitive to geopolitical shocks. Capital flight from these markets can lead to sharp declines in the value of their sovereign and corporate bonds.

- Potential for contagion effects across different bond markets: A crisis in one bond market can quickly spread to others, amplifying the overall impact and contributing to a wider global bond market crisis.

Assessing the Vulnerability of Different Bond Market Segments

Different segments of the bond market exhibit varying degrees of vulnerability to the factors mentioned above. Government bonds issued by countries with high debt levels are particularly susceptible to rising interest rates. Corporate bonds, especially those issued by companies with high leverage, face increased default risk in a slowing economy. High-yield bonds, by their very nature, are riskier and more vulnerable during economic downturns. Emerging market debt is susceptible to currency fluctuations and capital flight, increasing its risk profile significantly.

- Government bond vulnerability in high-debt countries: Countries with high levels of public debt are particularly vulnerable to rising interest rates, as the cost of servicing that debt increases dramatically.

- Corporate bond vulnerability for companies with high leverage: Highly leveraged companies are particularly sensitive to economic downturns and rising interest rates, increasing their default risk.

- High-yield bond vulnerability during economic downturns: High-yield bonds, also known as junk bonds, are inherently riskier and more vulnerable to defaults during economic slowdowns.

- Emerging market debt vulnerability to currency fluctuations and capital flight: Emerging market economies are often susceptible to sudden capital flight, resulting in sharp depreciations of their currencies and defaults on their debt.

Conclusion

The confluence of rising interest rates, persistent inflation, and ongoing geopolitical instability presents a significant threat to the stability of the global bond market. The potential consequences are far-reaching, with the potential for widespread defaults, reduced investment returns, and increased market volatility. Investors need to carefully assess their risk exposure and adapt their portfolios accordingly. Understanding the complexities of the global bond market crisis is crucial for navigating this turbulent environment.

Call to Action: Stay informed about developments in the global bond market and take steps to mitigate your risk. Learn more about strategies for navigating the global bond market crisis and protecting your investments. Seek professional financial advice tailored to your specific circumstances to effectively manage your exposure to the global bond market crisis.

Featured Posts

-

Family Loss Cat Deeley Thanks This Morning Co Star For Support

May 23, 2025

Family Loss Cat Deeley Thanks This Morning Co Star For Support

May 23, 2025 -

Thames Waters Executive Bonuses A Disproportionate Reward

May 23, 2025

Thames Waters Executive Bonuses A Disproportionate Reward

May 23, 2025 -

Complete Guide To The Nyt Mini Crossword March 6 2025

May 23, 2025

Complete Guide To The Nyt Mini Crossword March 6 2025

May 23, 2025 -

Improving Drug Efficacy Through Orbital Space Crystal Research

May 23, 2025

Improving Drug Efficacy Through Orbital Space Crystal Research

May 23, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 23, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus U Liderakh

May 23, 2025

Latest Posts

-

Notenverkauf An Der Uni Duisburg Essen 900 Euro Und Die Folgen

May 23, 2025

Notenverkauf An Der Uni Duisburg Essen 900 Euro Und Die Folgen

May 23, 2025 -

Investigation Launched Into Sexist Abuse Of Female Referee

May 23, 2025

Investigation Launched Into Sexist Abuse Of Female Referee

May 23, 2025 -

900 Euro Fuer Bessere Noten Skandal Erschuettert Uni Duisburg Essen

May 23, 2025

900 Euro Fuer Bessere Noten Skandal Erschuettert Uni Duisburg Essen

May 23, 2025 -

Skandal An Der Uni Duisburg Essen Notenverkauf Fuer 900 Euro

May 23, 2025

Skandal An Der Uni Duisburg Essen Notenverkauf Fuer 900 Euro

May 23, 2025 -

Nrw Eis Trend Die Unerwartete Nummer Eins In Essen

May 23, 2025

Nrw Eis Trend Die Unerwartete Nummer Eins In Essen

May 23, 2025