The Magnificent Seven's 2024 Losses: A $2.5 Trillion Market Cap Drop

Table of Contents

Individual Stock Performance Analysis: Deconstructing the $2.5 Trillion Drop

The $2.5 trillion drop wasn't evenly distributed across the Magnificent Seven. Each company faced unique challenges, contributing to the overall decline. Let's analyze each stock's individual performance and pinpoint key contributing factors to the Magnificent Seven losses 2024:

Microsoft (MSFT) Losses:

Microsoft experienced a significant downturn in 2024, primarily driven by:

- Specific percentage drop: [Insert Percentage, e.g., 20%]

- Key contributing factors: Slowing cloud growth (Azure), increased competition in the AI space, and concerns about overall economic slowdown.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop].

Apple (AAPL) Losses:

Apple's losses in 2024 were influenced by:

- Specific percentage drop: [Insert Percentage, e.g., 15%]

- Key contributing factors: Decreased iPhone sales growth in key markets, supply chain disruptions, and increased competition in the smartphone market.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop].

Amazon (AMZN) Losses:

Amazon's performance in 2024 was impacted by:

- Specific percentage drop: [Insert Percentage, e.g., 25%]

- Key contributing factors: A slowdown in e-commerce growth, increased competition from other e-retailers, and concerns about the profitability of AWS amidst increased cloud infrastructure costs.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop].

Alphabet (GOOG) Losses:

Alphabet faced challenges in 2024, including:

- Specific percentage drop: [Insert Percentage, e.g., 18%]

- Key contributing factors: Decreased advertising revenue due to economic uncertainty, increased competition from other advertising platforms (TikTok), and regulatory scrutiny concerning antitrust concerns.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop].

Tesla (TSLA) Losses:

Tesla's stock experienced significant volatility in 2024:

- Specific percentage drop: [Insert Percentage, e.g., 30%]

- Key contributing factors: Production challenges, increased competition from established automakers entering the EV market, and concerns surrounding CEO Elon Musk's management style and other ventures.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop].

Meta (META) Losses:

Meta's struggles in 2024 were largely due to:

- Specific percentage drop: [Insert Percentage, e.g., 22%]

- Key contributing factors: Slowing user growth, reduced advertising revenue, and skepticism surrounding the long-term viability of the metaverse investments.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop].

Nvidia (NVDA) Losses:

Despite being a standout performer in previous years, Nvidia also experienced a decline in 2024:

- Specific percentage drop: [Insert Percentage, e.g., 10%]

- Key contributing factors: Decreased demand for GPUs in certain sectors (e.g., cryptocurrency mining), supply chain constraints, and concerns about the overall macroeconomic environment.

- Comparison to previous years: [Compare 2024 performance to previous years, highlighting the significant drop, even if smaller than others].

Macroeconomic Factors Contributing to Magnificent Seven Losses

The individual company struggles were exacerbated by broader macroeconomic headwinds significantly contributing to Magnificent Seven losses 2024:

Interest Rate Hikes & Inflation:

- Bullet points: Rising interest rates increased borrowing costs, making it more expensive for tech companies to invest in growth initiatives. High inflation eroded consumer spending, impacting demand for tech products and services. This correlation directly affected valuations, leading to a decline in stock prices.

Recessionary Fears:

- Bullet points: Widespread fears of a looming recession caused investors to move away from riskier assets like tech stocks, seeking safer havens. This flight to safety significantly impacted the Magnificent Seven's valuations.

Geopolitical Uncertainty:

- Bullet points: Geopolitical instability, such as the ongoing war in Ukraine and escalating US-China tensions, created uncertainty in the global markets, prompting investors to adopt a more cautious approach, further contributing to the Magnificent Seven losses 2024.

Long-Term Implications of the Magnificent Seven's 2024 Losses

The 2024 decline of the Magnificent Seven has significant long-term implications:

Impact on the broader market:

- Bullet points: The losses significantly impacted investor confidence, leading to a broader market downturn. The interconnectedness of the tech sector with other industries means the ripple effect was felt across various sectors.

Future growth prospects for the tech sector:

- Bullet points: While the decline presents challenges, the long-term prospects for the tech sector remain positive. Factors like continued advancements in AI, cloud computing, and other technological innovations could drive future growth. However, companies will need to adapt to changing market conditions and navigate economic headwinds.

Conclusion:

The Magnificent Seven's 2024 losses, totaling a staggering $2.5 trillion, represent a significant downturn in the tech sector driven by a combination of individual company challenges and broader macroeconomic factors. Understanding these contributing factors – from slowing growth in key sectors to rising interest rates and geopolitical uncertainty – is crucial for navigating the evolving tech landscape. Stay updated on the performance of the Magnificent Seven and the broader tech sector in 2025 and beyond. Understanding the factors driving their market capitalization changes is crucial for making informed investment decisions. Follow [your website/platform] for more analysis on Magnificent Seven losses and market trends.

Featured Posts

-

Middle Management Their Value To Companies And Their Workforce

Apr 29, 2025

Middle Management Their Value To Companies And Their Workforce

Apr 29, 2025 -

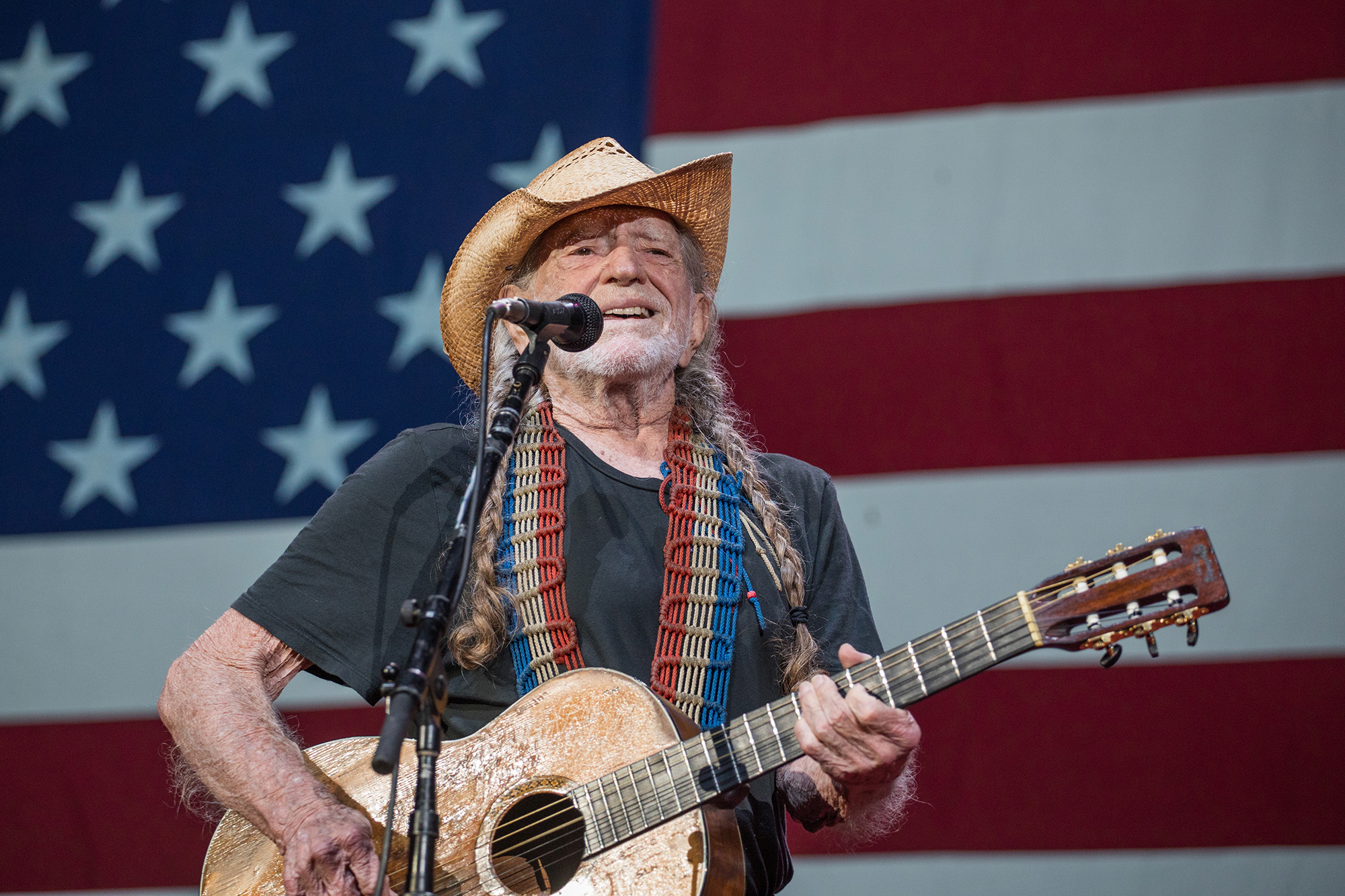

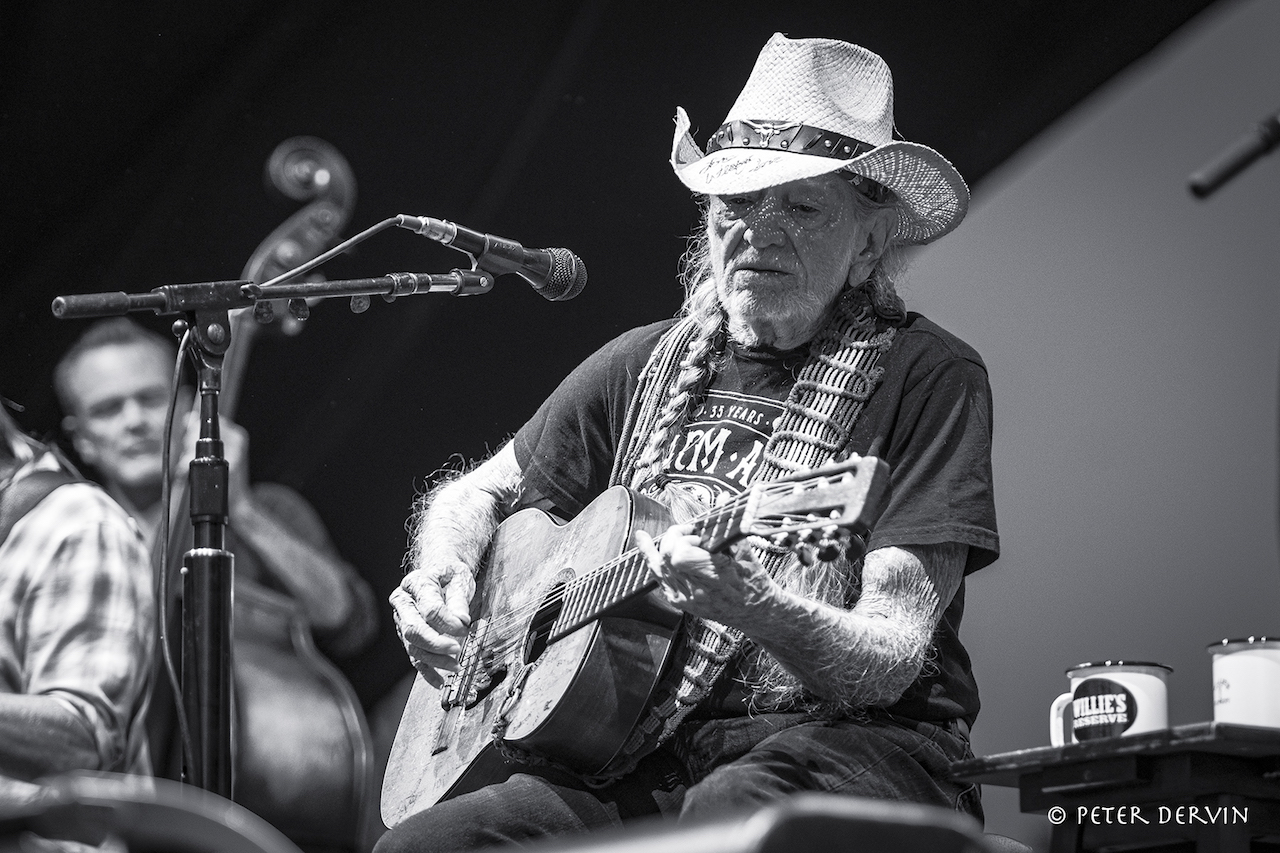

Experience Willie Nelson And Family Live At Austin City Limits A Fans Guide

Apr 29, 2025

Experience Willie Nelson And Family Live At Austin City Limits A Fans Guide

Apr 29, 2025 -

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025

Perplexity Ceo The Fight For Ai Browser Dominance Against Google

Apr 29, 2025 -

From Bathroom Reads To Broadcast Ais Role In Podcast Creation From Repetitive Texts

Apr 29, 2025

From Bathroom Reads To Broadcast Ais Role In Podcast Creation From Repetitive Texts

Apr 29, 2025 -

Canadian Election 2023 Is Mark Carney Losing Momentum

Apr 29, 2025

Canadian Election 2023 Is Mark Carney Losing Momentum

Apr 29, 2025

Latest Posts

-

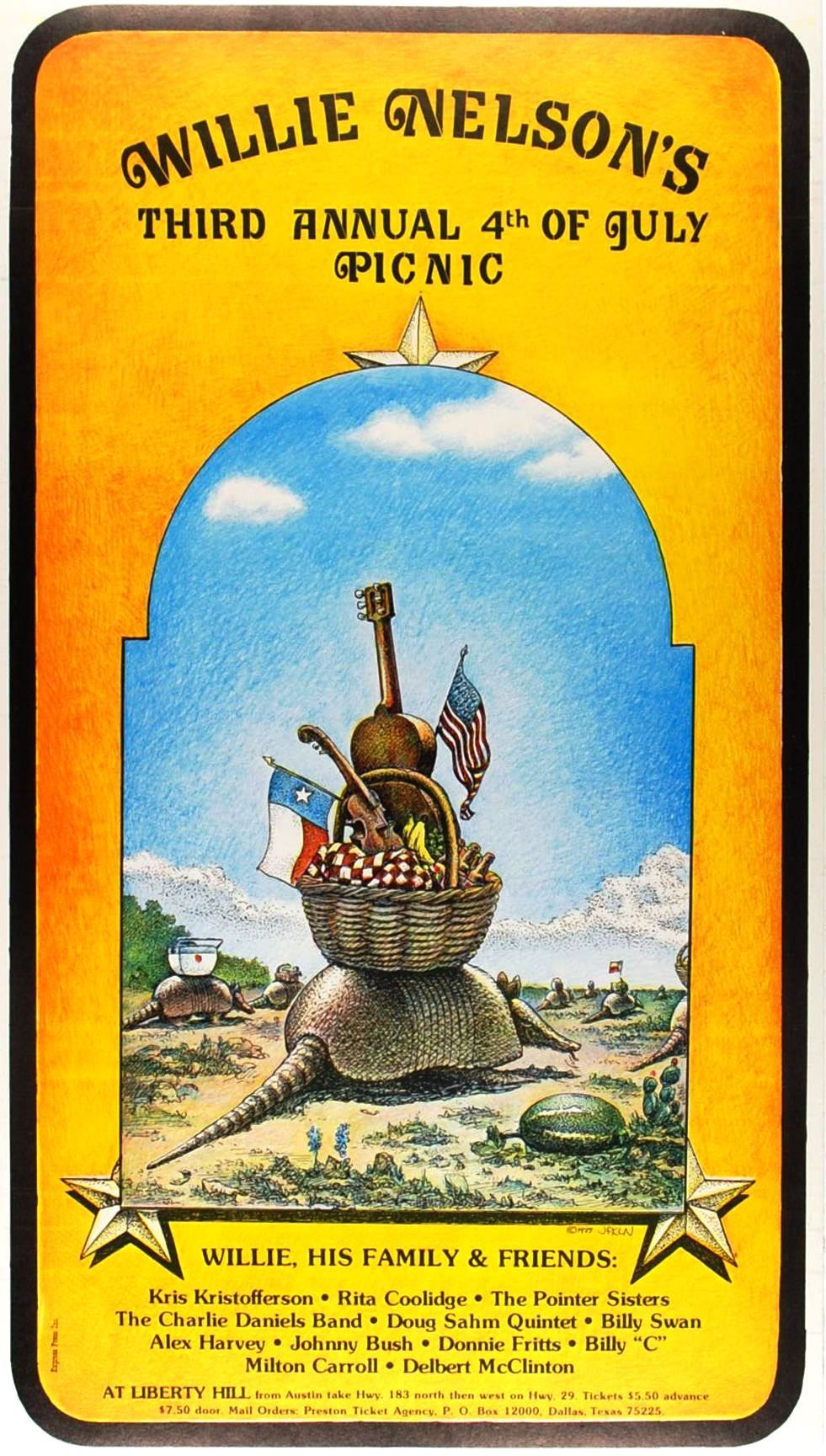

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025

Willie Nelsons 4th Of July Picnic A Texas Tradition Returns

Apr 29, 2025 -

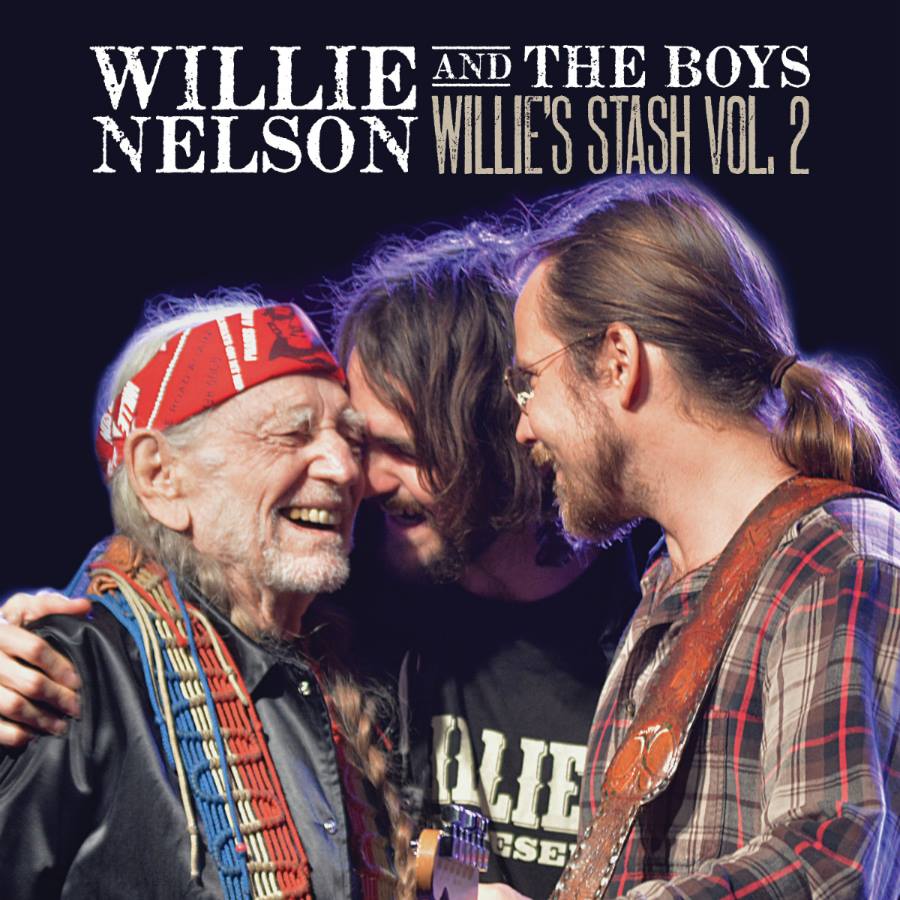

Understanding Willie Nelson Key Facts And Figures

Apr 29, 2025

Understanding Willie Nelson Key Facts And Figures

Apr 29, 2025 -

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelsons New Album Oh What A Beautiful World

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025