The Maluf Factor: Analyzing Ford's Departure And BYD's Entry Into The Brazilian EV Market

Table of Contents

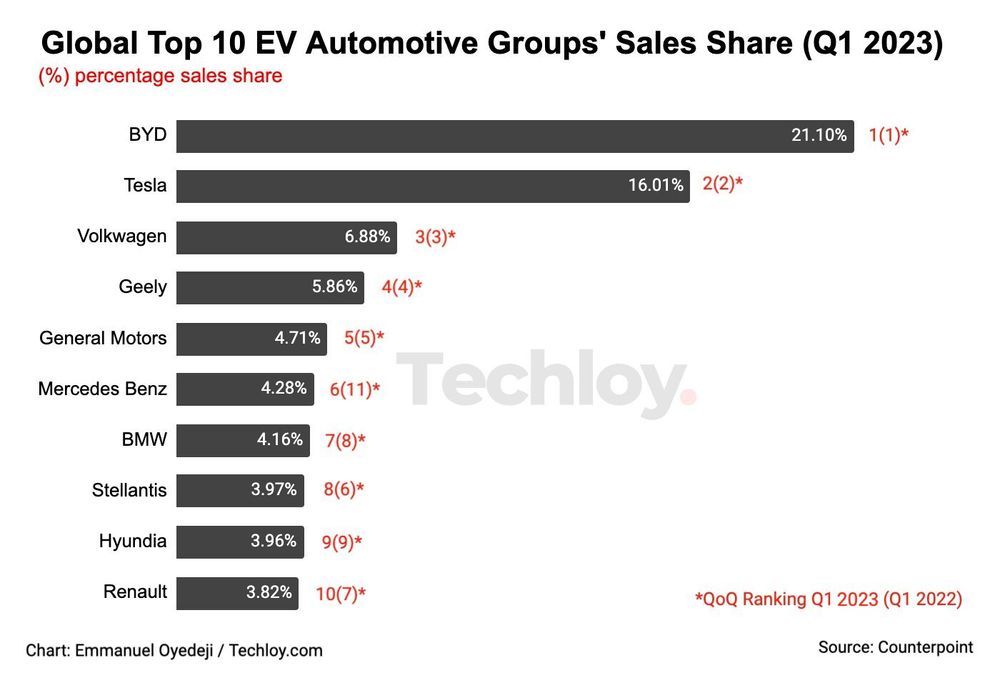

Ford's recent departure from the Brazilian market sent shockwaves through the automotive industry, while BYD's ambitious entry signifies a pivotal moment in the burgeoning Brazilian EV market. This shift highlights the complex interplay of political, economic, and infrastructural factors – what we'll refer to as the "Maluf Factor" – that profoundly influence the Brazilian automotive landscape. This article analyzes the reasons behind Ford's exit and BYD's entrance, exploring the implications of the Maluf Factor on the future of electric vehicles (EVs) in Brazil. We'll examine the challenges and opportunities presented by this dynamic market, focusing on key factors such as government regulations, consumer demand, and the overall economic climate. Keywords like Brazilian EV market, Ford, BYD, electric vehicles, Maluf Factor, and automotive industry Brazil will guide our analysis.

2. Ford's Departure: A Case Study in Challenges

H2: Economic Headwinds and Production Costs

Ford's financial performance in Brazil deteriorated over several years, culminating in its decision to withdraw. High production costs played a significant role. Manufacturing vehicles in Brazil presented a multitude of challenges, including:

- High import tariffs: These tariffs increased the cost of imported components, impacting overall vehicle production costs.

- Labor costs: Compared to other manufacturing regions, labor costs in Brazil remained relatively high.

- Logistical challenges: Inefficient infrastructure and bureaucratic hurdles contributed to increased transportation and distribution expenses.

- Currency fluctuations: The volatility of the Brazilian Real against the US dollar significantly impacted profitability, making it difficult to maintain competitive pricing.

H2: The Regulatory Landscape and Infrastructure Gaps

Navigating the Brazilian automotive regulatory landscape proved challenging for Ford. The complex bureaucracy and inconsistent government policies created uncertainty and hindered efficient operations. Furthermore, a lack of robust charging infrastructure significantly hampered EV adoption. Specifically:

- Bureaucracy: Excessive red tape and lengthy approval processes slowed down operations and increased costs.

- Inconsistent government policies: Frequent changes in regulations created instability and made long-term planning difficult.

- Insufficient investment in charging stations: The limited availability of charging infrastructure discouraged potential EV buyers.

H2: Consumer Demand and Market Competition

Despite a growing awareness of environmental concerns, consumer demand for EVs in Brazil remained relatively low compared to more developed markets. This can be attributed to several factors:

- High purchase price of EVs: The relatively high cost of EVs compared to gasoline-powered vehicles limited accessibility for many Brazilian consumers.

- Limited consumer awareness: A lack of public awareness regarding the benefits of EVs hindered market growth.

- Preference for combustion engine vehicles: Established preferences for combustion engine vehicles, fueled by lower initial costs, continued to dominate the market.

3. BYD's Entry: A Strategic Gamble?

H2: BYD's Global Strategy and Brazilian Market Potential

BYD's aggressive global expansion reflects its confidence in the long-term potential of emerging markets, including Brazil. The growing middle class, government initiatives towards renewable energy, and the potential for export within Mercosur present attractive opportunities. BYD's competitive advantages, such as its vertically integrated battery technology and cost-effective manufacturing processes, position it well to overcome some of the challenges faced by Ford.

- Growing middle class: A burgeoning middle class with increased disposable income presents a significant potential customer base.

- Government initiatives towards renewable energy: Government support for renewable energy initiatives can indirectly boost EV adoption.

- Potential for export within Mercosur: Brazil's position within Mercosur offers opportunities to export EVs to neighboring countries.

H2: BYD's Approach to Navigating the Maluf Factor

BYD appears to be adopting a proactive approach to navigate the Maluf Factor. Their strategies include:

- Local partnerships: Collaborating with local companies to enhance supply chain efficiency and better understand the market.

- Investment in charging infrastructure: BYD is actively investing in expanding charging infrastructure to address a key barrier to EV adoption.

- Targeted marketing campaigns: Tailored marketing campaigns focusing on the cost-effectiveness and environmental benefits of its vehicles.

H2: Opportunities and Risks for BYD in Brazil

While opportunities abound, BYD also faces considerable risks in the Brazilian market:

- Government support: While promising, government support may be inconsistent or insufficient to fully stimulate EV adoption.

- Rising demand for EVs: While demand is growing, it remains relatively low compared to other markets. This represents both an opportunity and a challenge.

- Potential supply chain disruptions: Economic instability and supply chain vulnerabilities can pose challenges to efficient operations.

- Economic instability: Brazil's economic volatility can impact consumer spending and investment decisions.

4. Conclusion: The Future of EVs in Brazil and the Enduring Maluf Factor

Ford's exit underscores the significant challenges inherent in the Brazilian automotive market, while BYD's entry represents a bold bet on its long-term potential. The Maluf Factor, encompassing political, economic, and infrastructural complexities, continues to shape the landscape. The future of EVs in Brazil hinges on addressing these challenges, including fostering a supportive regulatory environment, investing in charging infrastructure, and increasing consumer awareness. While BYD's success remains uncertain, its presence signifies a shift in the Brazilian EV market. To understand the future of electric mobility in Brazil, continued research into the Brazilian EV market and the ongoing impact of the Maluf Factor is crucial. For further insights, explore detailed Brazilian EV market analysis, investigate BYD's Brazil operations, and delve into the future of electric vehicles in Brazil.

Featured Posts

-

Aryna Sabalenkas Controversial Photo A Turning Point In Stuttgart

May 13, 2025

Aryna Sabalenkas Controversial Photo A Turning Point In Stuttgart

May 13, 2025 -

Byd Seal A Comprehensive Buyers Guide

May 13, 2025

Byd Seal A Comprehensive Buyers Guide

May 13, 2025 -

Earth Series 1 Inferno Fan Theories And Discussion

May 13, 2025

Earth Series 1 Inferno Fan Theories And Discussion

May 13, 2025 -

15 Year Old School Stabbing Victim Laid To Rest

May 13, 2025

15 Year Old School Stabbing Victim Laid To Rest

May 13, 2025 -

Performa Jay Idzes Di Venezia Vs Atalanta Implikasi Untuk Timnas Indonesia

May 13, 2025

Performa Jay Idzes Di Venezia Vs Atalanta Implikasi Untuk Timnas Indonesia

May 13, 2025

Latest Posts

-

End Of An Era Pieterburens Seal Rescue Center Closes Releases Last Seals

May 13, 2025

End Of An Era Pieterburens Seal Rescue Center Closes Releases Last Seals

May 13, 2025 -

Schiphol Road And Ferry Traffic Easter And Spring Holiday Peak Days Predicted

May 13, 2025

Schiphol Road And Ferry Traffic Easter And Spring Holiday Peak Days Predicted

May 13, 2025 -

Plan Ahead Peak Travel On Schiphol Roads And Ferries This Easter Weekend

May 13, 2025

Plan Ahead Peak Travel On Schiphol Roads And Ferries This Easter Weekend

May 13, 2025 -

Hip Hop Reacts Tory Lanez And 50 Cent On Megan Thee Stallions Guilty Verdict Prediction

May 13, 2025

Hip Hop Reacts Tory Lanez And 50 Cent On Megan Thee Stallions Guilty Verdict Prediction

May 13, 2025 -

50 Cent And Tory Lanez Weigh In On Predicted Megan Thee Stallion Guilty Verdict

May 13, 2025

50 Cent And Tory Lanez Weigh In On Predicted Megan Thee Stallion Guilty Verdict

May 13, 2025