The Newest April Outlook: Key Updates And Changes

Table of Contents

Economic Indicators Shaping the April Outlook

Economic indicators provide vital clues about the overall health and direction of the economy. Analyzing these indicators helps us forecast future trends and potential challenges. The April outlook is significantly influenced by the interplay of several key indicators.

Inflation and Interest Rates

Current inflation rates are a primary concern shaping the April outlook. High inflation often prompts central banks to raise interest rates to cool down the economy.

- Analysis of recent inflation data: Recent data shows a [insert recent inflation data and source, e.g., "slight decrease in inflation to 3.2%, according to the latest CPI report from the Bureau of Labor Statistics"]. This suggests [insert analysis, e.g., "a potential easing of inflationary pressures, but further monitoring is needed"].

- Predictions for interest rate adjustments: Based on current trends, analysts predict [insert prediction, e.g., "a potential pause or a smaller increase in interest rates in April," or "a further increase to combat persistent inflation"]. This prediction hinges on [explain reasoning, e.g., "the next CPI report and the Federal Reserve's assessment of economic stability"].

- Impact on consumer spending and investment: Increased interest rates generally lead to [explain impact, e.g., "reduced consumer spending as borrowing becomes more expensive and potentially dampened investment due to higher borrowing costs"]. This ripple effect can significantly impact the overall April outlook.

Employment Figures

Employment data offers valuable insights into the health of the labor market and its influence on the April outlook.

- Unemployment rate changes: The unemployment rate currently stands at [insert current unemployment rate and source]. A [rising/falling] unemployment rate suggests [insert analysis, e.g., "a strengthening/weakening labor market," and its implications].

- Job creation trends across different sectors: [Insert data on job creation across key sectors, e.g., "The tech sector continues to see job losses while the healthcare and construction sectors are showing positive growth"]. This uneven job growth contributes to the complexity of the April outlook.

- Implications for economic growth: Strong employment figures typically correlate with robust economic growth, while high unemployment can signal an economic slowdown. Therefore, the April employment data will significantly affect the broader economic outlook for the month.

Consumer Confidence

Consumer confidence, a measure of consumer optimism about the economy, is a critical indicator for the April outlook.

- Factors influencing consumer confidence: Consumer confidence is influenced by factors like inflation, employment, and overall economic sentiment. Recent [insert events, e.g., "geopolitical uncertainty or interest rate hikes"] have [insert impact, e.g., "dampened consumer confidence"].

- Impact on consumer spending and retail sales: Low consumer confidence often translates to reduced spending and slower retail sales, impacting businesses and the overall economy. A positive shift in confidence can boost the April outlook.

- Predictions for consumer behavior in April: Based on current trends, analysts predict [insert prediction, e.g., "cautious consumer spending in April, with a focus on essential purchases"].

Geopolitical Events and their Influence on the April Outlook

Global events significantly influence the economic landscape and consequently shape the April outlook. Understanding these influences is crucial for navigating the complexities of the market.

Global Supply Chains

Geopolitical instability and unforeseen events can disrupt global supply chains, impacting businesses and consumers.

- Impact of geopolitical instability on supply chains: [Insert example of a recent geopolitical event and its impact on supply chains, e.g., "The ongoing conflict in [region] has led to disruptions in the supply of [goods], affecting manufacturing and retail sectors"].

- Potential for shortages or delays: These disruptions can lead to shortages of goods, increased prices, and delays in delivery times. The April outlook considers the potential for continued supply chain challenges.

- Strategies for mitigating supply chain risks: Businesses are implementing strategies such as [insert strategies, e.g., "diversifying sourcing, building up inventory, and investing in resilient supply chain technology"] to mitigate these risks.

Energy Markets

The energy market is highly volatile and susceptible to geopolitical events, influencing the April outlook significantly.

- Fluctuations in oil and gas prices: [Insert data on recent oil and gas price fluctuations and their causes, e.g., "Geopolitical tensions have caused oil prices to surge, impacting energy costs for consumers and businesses"].

- Impact on inflation and energy costs: Rising energy prices contribute directly to inflation, impacting the overall economic outlook and consumer spending.

- Potential for energy security challenges: Geopolitical events can create energy security challenges, leading to concerns about supply and price volatility.

Market Trends and Investment Strategies for April

Understanding market trends is crucial for developing effective investment strategies and navigating the April outlook.

Stock Market Outlook

Predicting stock market performance is challenging, but analyzing key factors can provide valuable insights for the April outlook.

- Key factors influencing stock market performance: Factors like interest rates, inflation, economic growth, and geopolitical events all influence stock market performance.

- Sector-specific predictions: [Insert predictions for specific sectors, e.g., "The technology sector may experience volatility, while the healthcare sector might see steady growth"].

- Recommended investment strategies for April: Based on the April outlook, investors may consider strategies like [insert strategies, e.g., "diversification across different sectors, value investing, or focusing on defensive stocks"].

Real Estate Market Trends

The real estate market is sensitive to interest rate changes and economic conditions, significantly impacting the April outlook.

- Housing market activity predictions: [Insert predictions for housing market activity, e.g., "Analysts predict a slowdown in housing market activity in April due to higher mortgage rates"].

- Interest rate impact on mortgages: Higher interest rates increase the cost of mortgages, potentially reducing demand and affecting housing prices.

- Potential for price changes: The April outlook suggests [insert prediction, e.g., "potential price adjustments in the housing market, either stabilization or slight decreases, depending on regional variations"].

Conclusion

The April outlook is a complex interplay of economic indicators, geopolitical events, and market trends. Understanding the current inflation rates, employment figures, consumer confidence, global supply chain dynamics, energy market fluctuations, and their impact on the stock and real estate markets is crucial for effective decision-making. The interplay of these factors presents both challenges and opportunities for businesses and investors alike. Navigating this landscape requires careful analysis and adaptability.

Stay informed about the evolving April outlook by regularly checking our website for the latest updates and analysis. Understanding the April outlook is crucial for successful planning and navigating the complexities of the current market. Subscribe to our newsletter for timely insights on the April outlook and related economic forecasts.

Featured Posts

-

Update Pacers Remove Suspension On Tyrese Haliburtons Father

May 28, 2025

Update Pacers Remove Suspension On Tyrese Haliburtons Father

May 28, 2025 -

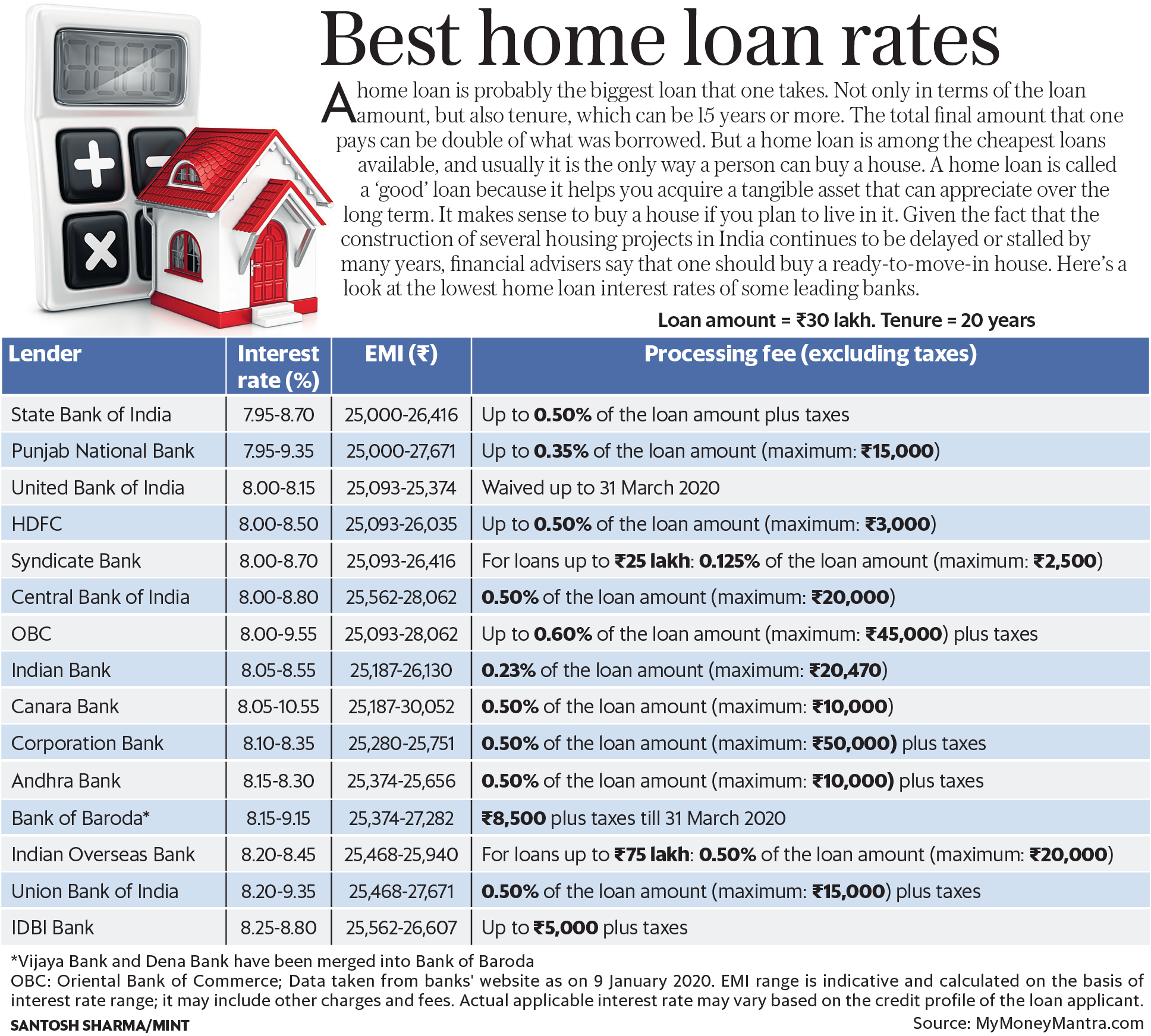

Get The Lowest Personal Loan Interest Rates Today Financing Options Available

May 28, 2025

Get The Lowest Personal Loan Interest Rates Today Financing Options Available

May 28, 2025 -

Trumps Harvard Funding Threat A Shift To Trade Schools

May 28, 2025

Trumps Harvard Funding Threat A Shift To Trade Schools

May 28, 2025 -

Ana Peleteiro Y Otros 12 Atletas Espanoles En El Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025

Ana Peleteiro Y Otros 12 Atletas Espanoles En El Mundial De Atletismo En Pista Cubierta De Nanjing

May 28, 2025 -

Kanye Wests Wife Bianca Censori Stuns In Black Lingerie And Stilettos

May 28, 2025

Kanye Wests Wife Bianca Censori Stuns In Black Lingerie And Stilettos

May 28, 2025

Latest Posts

-

Will Bts Disband The 10 Most Googled Questions About Their 2025 Return

May 30, 2025

Will Bts Disband The 10 Most Googled Questions About Their 2025 Return

May 30, 2025 -

Regreso De Bts Cuanto Tiempo Necesitaran Despues Del Servicio Militar

May 30, 2025

Regreso De Bts Cuanto Tiempo Necesitaran Despues Del Servicio Militar

May 30, 2025 -

Nominasi Amas 2025 Rm Bts Dan Kolaborasi Baru Yang Mengejutkan

May 30, 2025

Nominasi Amas 2025 Rm Bts Dan Kolaborasi Baru Yang Mengejutkan

May 30, 2025 -

Jungkooks Plans And Btss Future 10 Faqs Before The 2025 Reunion

May 30, 2025

Jungkooks Plans And Btss Future 10 Faqs Before The 2025 Reunion

May 30, 2025 -

Bts Tiempo De Regreso Tras El Servicio Militar

May 30, 2025

Bts Tiempo De Regreso Tras El Servicio Militar

May 30, 2025