The Overlooked Bond Crisis: A Growing Threat To Investors

Table of Contents

Rising Interest Rates and Bond Yields

Central banks' aggressive interest rate hikes to combat inflation are significantly impacting bond prices and are a major contributor to the potential bond crisis. Higher rates make existing bonds less attractive, leading to falling prices. This dynamic creates a complex interplay between monetary policy and the fixed-income market.

The Impact of Monetary Policy

- Rising yields lead to capital losses for bondholders. When interest rates rise, the yields on newly issued bonds increase, making older bonds with lower yields less desirable. This leads to a decrease in the market price of existing bonds.

- The duration of a bond significantly impacts its sensitivity to interest rate changes. Longer-duration bonds are more sensitive to interest rate fluctuations than shorter-duration bonds. Investors with longer-term bond portfolios face greater risk during periods of rising interest rates.

- Investors need to carefully analyze the interest rate risk associated with their bond portfolios. Understanding duration and employing strategies like laddering (holding bonds with varying maturities) can help manage interest rate risk. Professional advice can be invaluable in mitigating this exposure.

The Flight to Safety Paradox

Ironically, the search for safety during economic uncertainty can exacerbate the potential bond crisis. As investors flee riskier assets, they pile into bonds, driving up demand and potentially masking underlying weaknesses. This temporary stability can create a false sense of security, delaying necessary adjustments and potentially worsening the eventual outcome.

- Increased demand can temporarily mask underlying vulnerabilities in the bond market. This creates a situation where the apparent strength of the bond market may belie fundamental weaknesses in underlying assets.

- This temporary stability could create a false sense of security. Investors may be lulled into a sense of complacency, delaying necessary diversification or risk mitigation strategies.

- Careful analysis of credit ratings and underlying issuers remains crucial. Even during periods of flight to safety, thorough due diligence is essential to avoid investing in fundamentally weak bonds.

Sovereign Debt Concerns and Default Risks

High levels of government debt in many nations, coupled with rising interest rates, create a significant risk factor in the potential bond crisis. This vulnerability is particularly pronounced in emerging markets, where economic and political instability can further exacerbate the problem.

High Levels of Government Debt

- Rising interest rates increase the cost of servicing government debt. Higher interest payments strain government budgets, potentially leading to austerity measures or default.

- Increased debt servicing costs can squeeze government budgets and potentially lead to defaults. This can trigger a domino effect, impacting investor confidence and potentially destabilizing global markets.

- Investors should carefully assess the creditworthiness of sovereign issuers. Monitoring sovereign credit ratings and understanding the political and economic landscape of the issuing country is critical.

Geopolitical Instability and its Impact

Geopolitical tensions and unforeseen events—wars, pandemics, or other crises—can significantly destabilize the bond market and increase the risk of defaults. These events introduce uncertainty and volatility, making it crucial for investors to adopt defensive strategies.

- Geopolitical uncertainty increases market volatility and risk aversion. This can lead to a sell-off in bonds, particularly those issued by countries deemed politically unstable.

- Investors need to diversify their portfolios across different geographies and asset classes. This diversification strategy can help reduce the impact of geopolitical events on overall portfolio performance.

- Hedging strategies can help mitigate some of the risks associated with geopolitical events. Options and futures contracts can be used to protect against potential losses due to geopolitical instability.

The Shadow Banking System and Systemic Risk

The shadow banking system, encompassing non-bank financial institutions, holds a substantial amount of bonds. The lack of transparency and regulation in this sector poses a significant systemic risk, potentially contributing to a full-blown bond crisis.

Opacity and Lack of Regulation

- The complexity of the shadow banking system makes it difficult to assess systemic risk. This lack of visibility makes it challenging to identify potential vulnerabilities and prevent a crisis.

- Increased regulation might be necessary to improve transparency and stability. Greater oversight and regulation could help mitigate the risks associated with this sector.

- Investors should be aware of the potential risks associated with investing in instruments linked to the shadow banking system. Understanding the complexities of these investments is crucial for informed decision-making.

Liquidity Concerns and Contagion

A crisis in the shadow banking system could trigger a liquidity crunch, impacting the broader bond market and potentially leading to a contagion effect, rapidly spreading across the entire market.

- Liquidity concerns can lead to fire sales of bonds, further depressing prices. This can create a vicious cycle, accelerating the decline in bond prices.

- Contagion can quickly spread across the market, impacting even seemingly safe assets. The interconnectedness of the financial system means that problems in one area can quickly spread to others.

- Diversification and stress testing are crucial for mitigating liquidity risks. Regularly assessing portfolio resilience under various stress scenarios is essential for managing liquidity risk.

Conclusion

The potential for a significant bond crisis is a real and growing threat to investors. Rising interest rates, sovereign debt concerns, and vulnerabilities within the shadow banking system all contribute to this risk. Investors must carefully assess their bond holdings, diversify their portfolios, and understand the potential impact of these factors. Ignoring the potential for a future bond crisis could lead to significant losses. Proactive portfolio management, incorporating risk mitigation strategies and a thorough understanding of the current market dynamics are crucial for navigating this challenging environment. Don't underestimate the risks; actively manage your exposure to the bond market and prepare for potential volatility. Take steps today to protect your investments from the looming bond crisis.

Featured Posts

-

Report Bianca Censori Wants Divorce Amidst Kanye Wests Control

May 28, 2025

Report Bianca Censori Wants Divorce Amidst Kanye Wests Control

May 28, 2025 -

Was Ryan Reynolds Instrumental In Harming Justin Baldoni A Legal Examination

May 28, 2025

Was Ryan Reynolds Instrumental In Harming Justin Baldoni A Legal Examination

May 28, 2025 -

Alejandro Garnacho Transfer Man United Demands E60m

May 28, 2025

Alejandro Garnacho Transfer Man United Demands E60m

May 28, 2025 -

Behind Chicagos Welcome But Late Crime Decrease An Investigation

May 28, 2025

Behind Chicagos Welcome But Late Crime Decrease An Investigation

May 28, 2025 -

Alejandro Garnacho Transfer Saga Chelseas Approach And Future Prospects

May 28, 2025

Alejandro Garnacho Transfer Saga Chelseas Approach And Future Prospects

May 28, 2025

Latest Posts

-

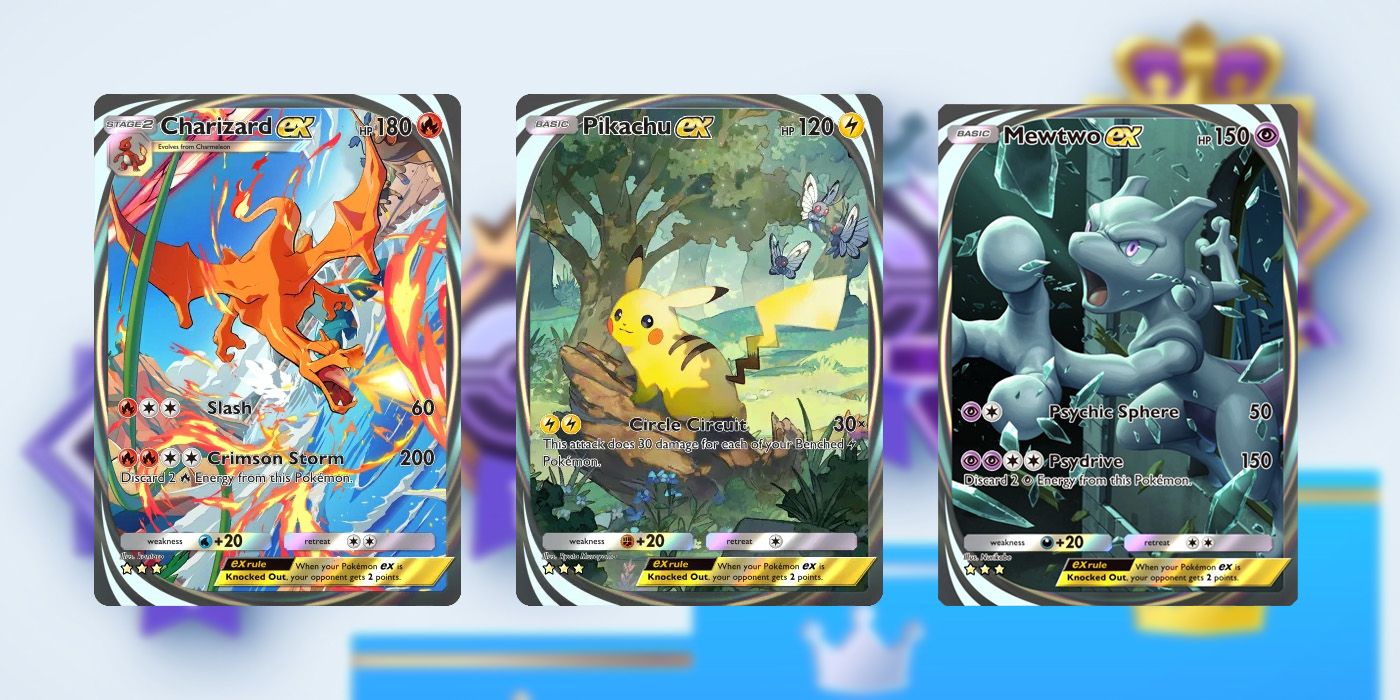

Navigating The Pokemon Tcg Pocket Breakneck Expansion Release Frenzy

May 29, 2025

Navigating The Pokemon Tcg Pocket Breakneck Expansion Release Frenzy

May 29, 2025 -

Pocket Breakneck Expansion My Pokemon Tcg Anxiety

May 29, 2025

Pocket Breakneck Expansion My Pokemon Tcg Anxiety

May 29, 2025 -

Finding Shiny Pokemon Your Guide To Pokemon Tcg Pocket

May 29, 2025

Finding Shiny Pokemon Your Guide To Pokemon Tcg Pocket

May 29, 2025 -

Pokemon Tcg Pocket Breakneck Expansion Release Stress

May 29, 2025

Pokemon Tcg Pocket Breakneck Expansion Release Stress

May 29, 2025 -

Shiny Pokemon In Pokemon Tcg Pocket Rarity Methods And Tips

May 29, 2025

Shiny Pokemon In Pokemon Tcg Pocket Rarity Methods And Tips

May 29, 2025