The Posthaste Threat: Unrest In The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact

The current volatility in the global bond market is significantly fueled by rising interest rates. This "posthaste threat" is largely a consequence of central bank actions aimed at curbing inflation.

The Federal Reserve's Aggressive Monetary Policy

The US Federal Reserve's rapid interest rate hikes to combat persistent inflation are a primary driver of global bond market volatility. This aggressive monetary policy impacts bond yields globally, creating a ripple effect across international markets.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and corporations to borrow money, potentially slowing economic growth and increasing the risk of defaults. This directly impacts the demand for new bond issuance.

- Reduced demand for existing bonds, pushing prices down: As interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This reduced demand leads to a decrease in bond prices. This is a key aspect of the posthaste threat's impact.

- Increased risk of defaults for highly indebted entities: Companies and governments with high levels of debt become more vulnerable to default as borrowing costs increase. This increases the risk premium demanded by investors, further impacting bond prices.

The Ripple Effect on Other Central Banks

Other central banks around the world are following the Federal Reserve's lead, implementing their own interest rate hikes. This synchronized tightening of monetary policy, while intended to combat inflation, poses significant challenges.

- Coordination challenges between central banks: The differing economic conditions and priorities of various central banks make coordinated action difficult, leading to potential inconsistencies in monetary policy and increased market uncertainty.

- Differing economic conditions across regions exacerbating the impact: The impact of rising interest rates varies significantly across different regions and countries, exacerbating existing economic imbalances and contributing to global instability.

- Potential for currency fluctuations and capital flight: Interest rate differentials between countries can lead to significant currency fluctuations and capital flight, further destabilizing the global bond market. This is a key component of the posthaste threat.

Inflationary Pressures and Their Influence on Bond Yields

Persistent inflationary pressures represent another crucial element of the "posthaste threat" impacting the global bond market. High inflation erodes the purchasing power of fixed-income investments.

Persistent Inflation Eroding Purchasing Power

High inflation significantly reduces the real return on bond investments, making them less appealing to investors seeking to preserve their capital.

- Inflation expectations influencing long-term bond yields: Investors factor expected future inflation into their demand for bonds, pushing up long-term yields to compensate for the erosion of purchasing power.

- Demand shift towards inflation-protected securities: As inflation rises, investors shift their demand towards inflation-protected securities (TIPS), which offer a hedge against inflation, further impacting the market for traditional bonds.

- Central bank credibility under pressure to control inflation: The ability of central banks to effectively control inflation impacts investor confidence and their willingness to hold bonds. Failure to curb inflation strengthens the posthaste threat.

Supply Chain Disruptions and Commodity Price Volatility

Geopolitical instability and ongoing supply chain disruptions fuel persistent inflationary pressures. The resulting volatility in commodity prices directly affects bond yields and investor sentiment.

- Uncertainty affecting investment decisions: The uncertainty surrounding future inflation and economic growth makes investors more risk-averse, leading to a decreased demand for bonds.

- Increased risk premiums demanded by investors: Investors demand higher risk premiums to compensate for the increased uncertainty and risk of inflation eroding the value of their investments.

- Potential for stagflationary scenarios: The combination of high inflation and slow economic growth ("stagflation") further dampens investor confidence and increases the likelihood of bond market turmoil.

Geopolitical Risks and Their Destabilizing Effects

Geopolitical risks contribute significantly to the current unrest in the global bond market, exacerbating the "posthaste threat".

The War in Ukraine and its Global Ramifications

The ongoing war in Ukraine has triggered a surge in energy prices and heightened geopolitical uncertainty, negatively impacting investor sentiment and significantly contributing to market volatility.

- Energy price volatility impacting inflation and growth prospects: The war has led to significant volatility in energy prices, fueling inflation and dampening economic growth prospects globally. This is a key driver of the posthaste threat.

- Increased risk aversion leading to capital flight from emerging markets: Increased geopolitical uncertainty leads to risk aversion among investors, resulting in capital flight from emerging markets and a shift towards safer assets.

- Sanctions and geopolitical tensions increasing market instability: International sanctions and geopolitical tensions increase market instability, creating further uncertainty for investors and increasing the risk of default.

Other Geopolitical Hotspots and their Impact

Beyond the war in Ukraine, various other geopolitical hotspots around the world contribute to the overall instability and uncertainty in the global bond market, reinforcing the “posthaste threat”.

- Increased political risk premiums: Investors demand higher risk premiums to compensate for the increased political risks associated with investing in certain regions or countries.

- Potential for capital flight from riskier regions: Geopolitical instability leads to capital flight from riskier regions, further impacting market liquidity and stability.

- Impact on international trade and supply chains: Geopolitical tensions and conflicts disrupt international trade and supply chains, contributing to inflationary pressures and economic uncertainty.

Conclusion

The "posthaste threat" facing the global bond market is complex, arising from the interplay of rising interest rates, persistent inflation, and escalating geopolitical risks. Understanding these interconnected factors is crucial for investors to navigate the current turbulent environment. Effectively managing risk and diversifying investment portfolios are vital strategies to mitigate the impact of this global bond market unrest. To stay informed about the evolving "posthaste threat" and its implications, continue monitoring global economic indicators and geopolitical developments. Staying informed about the latest developments in the global bond market and actively managing your investment strategy is crucial to mitigating the risks associated with this posthaste threat. Don't underestimate the power of staying ahead of the curve in managing your exposure to global bond market unrest.

Featured Posts

-

Pameran Seni Dan Otomotif Porsche Indonesia 2025 Classic Art Week

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia 2025 Classic Art Week

May 24, 2025 -

Heineken Tops Revenue Projections Tariff Concerns Addressed

May 24, 2025

Heineken Tops Revenue Projections Tariff Concerns Addressed

May 24, 2025 -

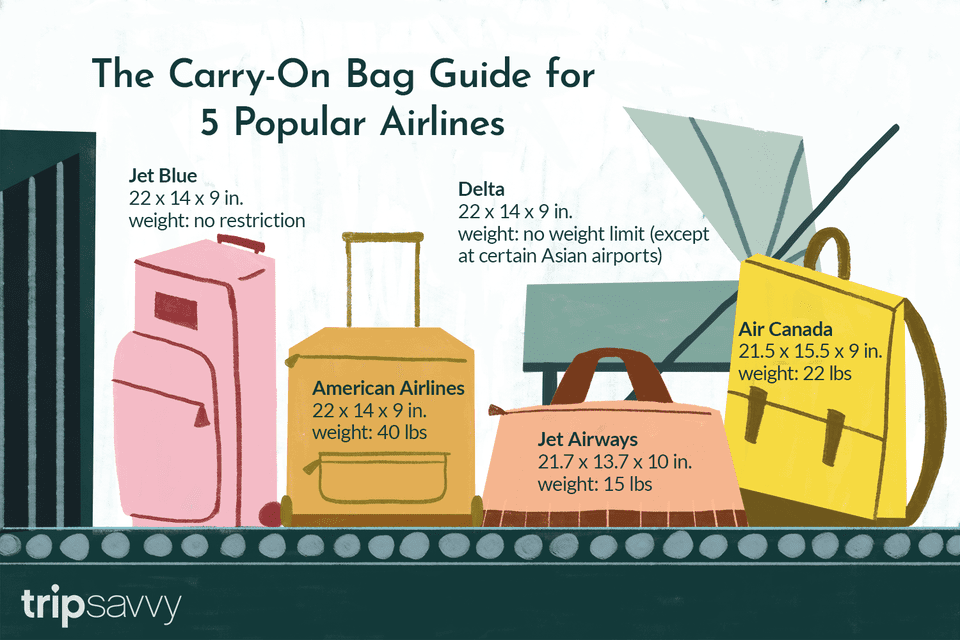

Southwest Airlines Carry On Baggage New Portable Charger Rules

May 24, 2025

Southwest Airlines Carry On Baggage New Portable Charger Rules

May 24, 2025 -

Porsche Classic Art Week 2025 Acara Seni Dan Otomotif Di Indonesia

May 24, 2025

Porsche Classic Art Week 2025 Acara Seni Dan Otomotif Di Indonesia

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Faces Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Faces Significant Losses

May 24, 2025

Latest Posts

-

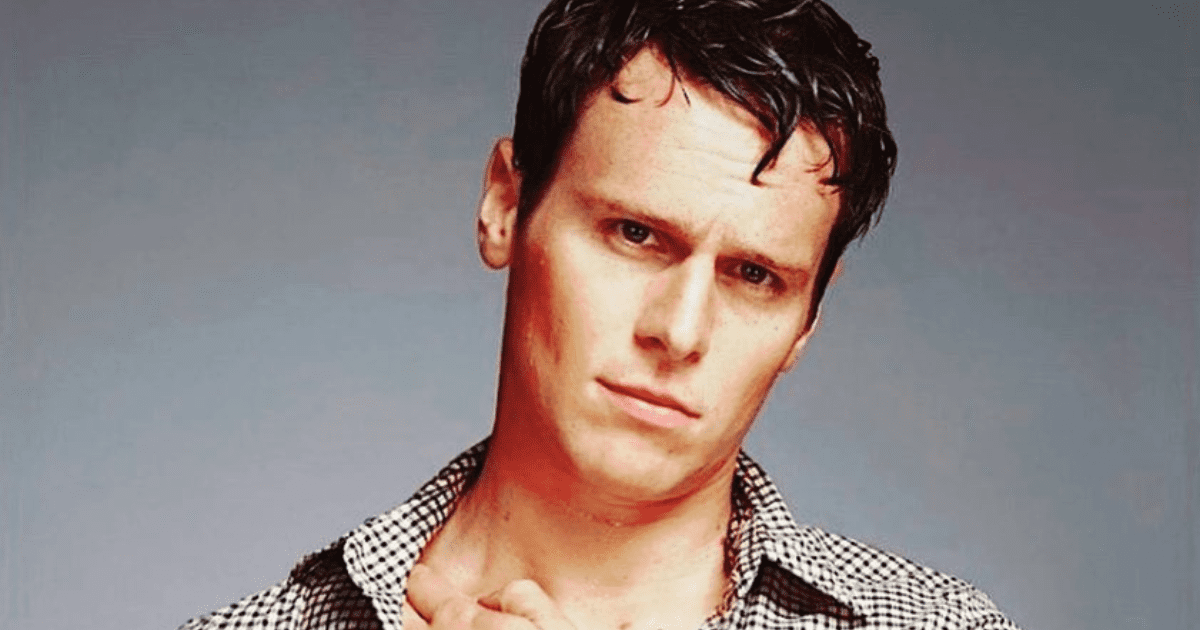

Jonathan Groff On Asexuality Instinct Magazine Interview

May 24, 2025

Jonathan Groff On Asexuality Instinct Magazine Interview

May 24, 2025 -

Jonathan Groffs Past An Open Discussion Of Asexuality

May 24, 2025

Jonathan Groffs Past An Open Discussion Of Asexuality

May 24, 2025 -

Broadway Buzz Jonathan Groffs Performance In Just In Time And His Connection To Bobby Darin

May 24, 2025

Broadway Buzz Jonathan Groffs Performance In Just In Time And His Connection To Bobby Darin

May 24, 2025 -

Jonathan Groff Channels Bobby Darin A Deep Dive Into Just In Time

May 24, 2025

Jonathan Groff Channels Bobby Darin A Deep Dive Into Just In Time

May 24, 2025 -

Etoile A Spring Awakening Reunion Brings Laughter With Gideon Glick And Jonathan Groff

May 24, 2025

Etoile A Spring Awakening Reunion Brings Laughter With Gideon Glick And Jonathan Groff

May 24, 2025