The Power Of Simplicity In Dividend Investing

Table of Contents

Building a Simple Dividend Portfolio

The cornerstone of successful and simple dividend investing lies in building a portfolio focused on quality, not quantity. Instead of spreading your investments thinly across dozens of stocks, concentrate on selecting a handful of high-quality dividend-paying companies. This approach to easy dividend investing significantly reduces the time and effort needed for research and management.

Focus on Quality over Quantity

Over-diversification can be a trap. While diversification is important, excessive diversification can dilute returns and make it difficult to monitor your investments effectively. Focus on identifying companies with a proven track record of dividend growth and strong financial fundamentals.

- Dividend Growth History: Look for companies with a consistent history of increasing their dividend payments annually.

- Payout Ratio: Examine the payout ratio (dividends paid out as a percentage of earnings). A sustainable payout ratio is typically below 70%, indicating the company has enough retained earnings to cover its dividend payments and reinvest in future growth.

- Financial Strength: Assess the company’s balance sheet and cash flow statements to gauge its financial health. Look for low debt levels, strong revenue growth, and healthy margins.

You can find this information through reputable financial websites like Yahoo Finance, Google Finance, and Morningstar, or by utilizing dividend stock screening tools available on many brokerage platforms. Focusing on quality ensures a stronger foundation for your simple dividend investing strategy.

Understanding Your Risk Tolerance

Your risk tolerance significantly impacts your dividend investing strategy. Are you comfortable with potentially higher yields but also accepting slightly higher risk, or do you prefer a more conservative approach with lower yields but greater stability?

- High-Yield, Higher-Risk: High-yield dividend stocks may offer attractive returns, but they often come with increased risk, possibly due to financial instability.

- Low-Yield, Lower-Risk: Low-yield dividend stocks from established companies generally offer more stability and lower risk, but returns may be more modest.

- Blue-Chip Stocks: These established, large-cap companies are known for their consistent dividend payments and relative stability.

- Growth Stocks: While growth stocks may not offer high immediate dividends, they focus on reinvesting earnings for future growth, potentially leading to increased dividends later.

A simple portfolio, carefully curated to your risk profile, allows for more effective risk management and less emotional decision-making within your simple dividend investing journey.

Streamlining Your Investment Process

Once you’ve built your portfolio, simplifying your investment process is crucial for long-term success. This is where automation and strategic approaches like dollar-cost averaging come into play.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a powerful tool for consistent, stress-free investing. It involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- Definition: DCA helps mitigate the risk of investing a lump sum at a market high.

- Benefits: Reduces emotional investing, smooths out volatility, and provides a disciplined approach.

- Implementation: Set up automatic transfers to your brokerage account to purchase shares on a pre-determined schedule (e.g., monthly or quarterly).

For example, investing $500 monthly in a stock regardless of its price will help you avoid trying to time the market. This simple approach to easy dividend investing promotes discipline.

Automating Your Investments

Automating your investments removes emotional decision-making, a common pitfall of active trading. Many brokerage platforms offer tools that allow for automatic dividend reinvestment and scheduled purchases.

- Automatic Dividend Reinvestment (ADR): Automatically reinvest your dividend payments to buy more shares, compounding your returns over time.

- Scheduled Purchases: Set up automatic purchases of your chosen stocks at regular intervals.

By automating your investments, you maintain consistency and discipline within your simple dividend investing strategy.

Avoiding Common Pitfalls in Simple Dividend Investing

Even with a simplified approach, several pitfalls can hinder your success. Avoiding these common mistakes is essential for long-term growth.

Chasing High Yields

While high dividend yields are tempting, they often come with increased risk. Don't be solely fixated on high yields; always investigate the underlying company's fundamentals.

- Red Flags: Consistently declining earnings, high debt levels, and negative cash flow are potential warning signs.

- Due Diligence: Thoroughly research the company’s financial statements and business model before investing.

Focusing on sustainable, reasonably high yields from financially sound companies is key.

Ignoring Fees and Taxes

Minimizing investment fees and understanding tax implications is critical. High fees can significantly eat into your returns over time.

- Investment Fees: Brokerage fees, expense ratios (for mutual funds and ETFs), and transaction fees can all impact your returns.

- Tax Implications: Dividend income is typically taxed as ordinary income. Understanding your tax bracket and implications is important for optimizing your strategy.

Choosing low-cost brokerage accounts and tax-advantaged accounts (like retirement accounts) can significantly minimize these costs.

Conclusion

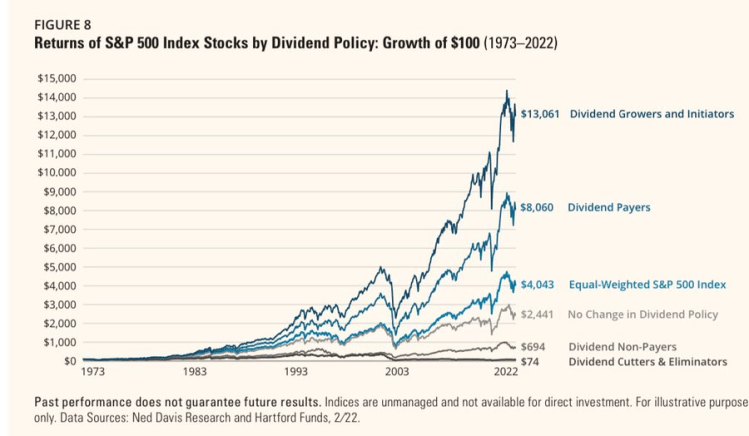

The power of simplicity in dividend investing lies in its ability to deliver consistent returns with reduced stress. By focusing on quality over quantity, streamlining your investment process, and avoiding common pitfalls, you can create a sustainable and rewarding dividend investing strategy. Remember the key takeaways: build a simple portfolio of high-quality dividend-paying stocks, utilize dollar-cost averaging and automation, and always be mindful of fees and taxes. To simplify your dividend investing, start by researching a few high-quality dividend stocks, set up an automated investment plan, and consider consulting a financial advisor if needed. Begin your simple dividend investing journey today and master the art of simple dividend investing for long-term financial success.

Featured Posts

-

Transznemu No Elleni Letartoztatas Floridaban Mosdohasznalati Szabalysertes

May 10, 2025

Transznemu No Elleni Letartoztatas Floridaban Mosdohasznalati Szabalysertes

May 10, 2025 -

Seattles Sports Scene A Boon For Canadian Dollar Holders

May 10, 2025

Seattles Sports Scene A Boon For Canadian Dollar Holders

May 10, 2025 -

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 10, 2025

Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Analysis

May 10, 2025 -

Strictly Come Dancing Katya Joness Exit And The Wynne Evans Allegations

May 10, 2025

Strictly Come Dancing Katya Joness Exit And The Wynne Evans Allegations

May 10, 2025 -

Is Apple Secretly Supporting Google A Deep Dive

May 10, 2025

Is Apple Secretly Supporting Google A Deep Dive

May 10, 2025