The Ripple Effect Of Tariffs: Dow's Alberta Project And Economic Slowdown

Table of Contents

Dow's Alberta Project Delays: A Direct Consequence of Tariffs

Increased Costs Due to Tariffs

Tariffs on imported materials and equipment significantly increased the cost of Dow's Alberta project, making it less financially viable. The project, initially slated for completion by [Insert original completion date, if available], faced substantial delays due to these escalating costs. Specific tariff impacts included:

- Steel Tariffs: Increased costs for steel components crucial for the construction of the petrochemical plant. [Insert data on cost increase percentage if available. Example: Steel tariffs added an estimated 15% to the overall project cost].

- Plastic Resin Tariffs: Higher prices for imported plastic resins, a key raw material for the plant's operations. [Insert data on cost increase percentage if available. Example: Tariffs on plastic resins increased material costs by 10%].

- Currency Fluctuations: Tariff disputes often lead to currency volatility, further increasing the cost of imported goods and services. The fluctuating value of the Canadian dollar against the US dollar exacerbated the impact of tariffs on the project's budget.

Uncertainty and Investor Hesitation

The imposition and unpredictability of tariffs created significant uncertainty for investors, leading to delays and potentially a scaling back of the project. This uncertainty discouraged further investment and highlighted the risks associated with large-scale projects in a volatile trade environment.

- Loss of Foreign Investment: The uncertainty surrounding tariffs deterred potential foreign investors who were hesitant to commit capital to a project with unpredictable cost structures.

- Decreased Investment in the Sector: [Insert statistics on decreased investment in the petrochemical sector due to tariffs if available. Example: Investment in the Canadian petrochemical sector fell by X% in the year following the tariff implementation].

- Long-Term Economic Planning: The unpredictability created by tariffs makes long-term economic planning extremely difficult, hindering investment decisions and impacting future growth.

Broader Economic Impacts Beyond Dow's Project

Reduced Economic Growth

The delay of Dow's Alberta project translates into reduced economic activity in Alberta and Canada as a whole. This has a significant impact on employment and overall economic output.

- Job Losses: The project delay resulted in job losses not only in the direct construction and operation of the plant but also in related industries such as transportation, logistics, and manufacturing. [Insert data on potential job losses if available].

- GDP Impact: The delayed project has a significant negative impact on the Canadian GDP, representing a substantial loss in economic output. [Insert data on potential GDP impact if available. Example: The delay is estimated to reduce Canada's GDP by X billion dollars].

- Multiplier Effect: The project delay's impact extends far beyond the immediate losses. The multiplier effect means reduced spending by those employed in the project and related industries, further dampening economic activity.

Impact on Global Trade and Supply Chains

Tariffs disrupt global trade flows and complicate supply chains, affecting numerous industries beyond petrochemicals.

- Availability and Cost of Materials: Tariff disputes affect the availability and cost of materials for various industries, leading to production delays and increased costs.

- International Competitiveness: Tariffs reduce international competitiveness by increasing production costs for domestic companies, making them less attractive in the global market.

- Retaliatory Tariffs and Trade Wars: Tariffs can trigger retaliatory tariffs from other countries, leading to trade wars and further disrupting global trade.

Consumer Impact of Increased Prices

Increased production costs due to tariffs translate into higher prices for consumers, potentially reducing consumer spending and exacerbating economic slowdown.

- Affected Products: The increased costs of imported materials impact the final price of numerous consumer goods, including plastics, chemicals, and related products.

- Reduced Consumer Spending: Higher prices for essential goods lead to reduced consumer spending, further impacting economic growth.

- Overall Economic Slowdown: This decrease in consumer spending contributes to an overall economic slowdown, creating a negative feedback loop.

Alternative Solutions and Mitigation Strategies

Trade Agreements and Negotiation

International trade agreements are crucial for mitigating the negative impacts of tariffs. Collaborative solutions and well-negotiated trade agreements can foster open markets and reduce trade barriers. Successful examples of such agreements demonstrate the benefits of cooperation and mutual benefit.

Diversification and Investment in Domestic Production

Reducing reliance on imported goods and promoting domestic production through diversification and investment is essential. Local sourcing strengthens domestic industries and reduces vulnerability to external trade shocks. Government support programs can encourage this shift.

Sustainable Economic Policies

Sustainable economic policies that prioritize free and open markets are vital for long-term economic stability. Predictable and stable trade policies reduce uncertainty and foster investment. This long-term view minimizes reliance on protectionist measures, improving overall global economic health.

Conclusion

Dow's delayed Alberta project serves as a compelling case study demonstrating the far-reaching consequences of tariffs and economic slowdown. The ripple effect extends beyond a single project, impacting jobs, investment, global trade, and ultimately, consumer prices. Understanding the complexities of tariffs is crucial for policymakers and businesses alike. To ensure sustainable economic growth and stability, careful consideration of the potential consequences of tariffs and economic slowdown is essential. Let's work towards policies that promote free and fair trade and mitigate the negative effects of protectionism. Avoiding the pitfalls highlighted by the Dow case requires a focus on long-term sustainable economic growth and carefully negotiated trade agreements. Therefore, understanding the impact of tariffs and economic slowdown is paramount for navigating a complex global economy.

Featured Posts

-

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Directive

Apr 28, 2025

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Directive

Apr 28, 2025 -

Evaluating Pitchers Name A Mets Rotation Decision

Apr 28, 2025

Evaluating Pitchers Name A Mets Rotation Decision

Apr 28, 2025 -

Talladega Superspeedway 2025 Nascar Jack Link 500 Prop Bets And Winning Strategies

Apr 28, 2025

Talladega Superspeedway 2025 Nascar Jack Link 500 Prop Bets And Winning Strategies

Apr 28, 2025 -

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 28, 2025

Trumps Transgender Athlete Ban Us Attorney General Targets Minnesota

Apr 28, 2025 -

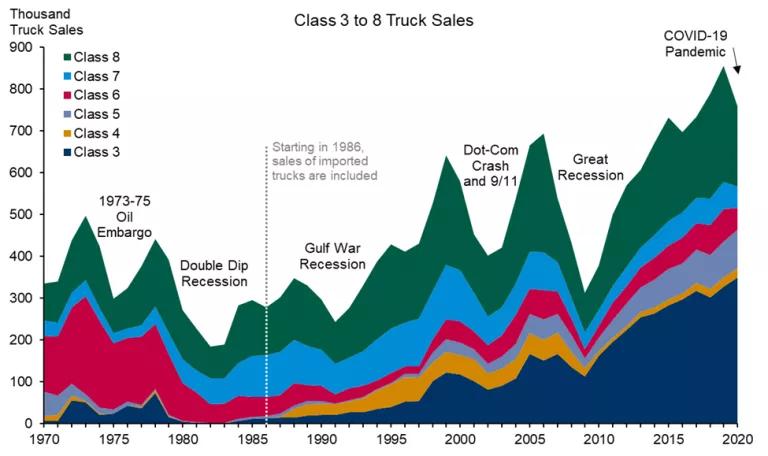

Can We Curb Americas Truck Bloat Exploring Potential Solutions

Apr 28, 2025

Can We Curb Americas Truck Bloat Exploring Potential Solutions

Apr 28, 2025