The Role Of Tax Credits In Attracting Film And TV Production To Minnesota

Table of Contents

Types of Minnesota Film Tax Credits

Minnesota offers a robust incentive program to attract film and television productions. The cornerstone of this program is the state's film tax credit, designed to offset production costs and encourage investment within the state.

The Minnesota Film and Television Production Tax Credit

This credit offers a significant incentive to productions filming in Minnesota. While the exact percentage can fluctuate based on legislative updates, it generally provides a substantial reduction in eligible production costs.

-

Eligibility Requirements: To qualify, productions must meet specific criteria, including a minimum amount of spending within the state and adherence to guidelines regarding qualified expenditures. This includes:

- Significant spending on Minnesota-based labor, including crew salaries, actor fees, and other personnel costs.

- Expenditures on location fees within Minnesota.

- Costs associated with renting or purchasing equipment within the state.

-

Application Process: The application process typically involves submitting a detailed budget, demonstrating compliance with eligibility requirements, and meeting specific deadlines. Detailed instructions and forms are generally available on the Minnesota Department of Employment and Economic Development (DEED) website.

-

Deadlines: Deadlines for applications vary depending on the fiscal year, so it’s crucial for filmmakers to check the DEED website for up-to-date information. Early planning is essential to secure the necessary approvals before production commences.

Other Relevant Incentives and Programs

Beyond the primary film tax credit, Minnesota may offer additional incentives that complement the main program and create a more attractive environment for film production. These may include:

- Grants: Specific grants may be available for projects that align with particular state priorities, such as those focusing on Minnesota history or culture.

- Rebates: In certain cases, additional rebates might be offered for productions exceeding specific spending thresholds or employing a significant number of Minnesota residents.

- Workforce Development Programs: Initiatives supporting the growth of Minnesota's film crew and support staff may provide additional training and resources.

These combined incentives create a compelling package designed to attract productions of all sizes and genres, further strengthening Minnesota's film industry.

Economic Impact of Film Tax Credits in Minnesota

The impact of Minnesota's film tax credit program extends far beyond individual productions. It has a significant and measurable effect on the state's economy.

Job Creation

Film productions utilizing the tax credits directly generate a considerable number of jobs. These jobs span a wide range of skills and experience levels, including:

- Crew Positions: Directors, cinematographers, editors, sound technicians, and other specialized crew members.

- Acting Roles: Opportunities for both established and aspiring actors.

- Support Staff: Administrative personnel, transportation, catering, and other support services.

These jobs contribute significantly to local economies, particularly in communities hosting film shoots. The positive ripple effect helps stimulate local businesses and create a positive feedback loop.

Revenue Generation

The economic benefits of film production in Minnesota extend beyond direct job creation. Productions contribute to the state’s economy through:

- Increased Tourism: Filming in recognizable Minnesota locations can boost tourism and create interest in the state as a travel destination.

- Local Business Spending: Productions often utilize local businesses for services such as catering, transportation, lodging, and equipment rentals. This influx of spending benefits local entrepreneurs and businesses.

Studies frequently demonstrate a strong return on investment for film tax credit programs. These studies often quantify the multiplier effect, showing how initial spending creates further economic activity within the state.

Competition and Best Practices

Minnesota competes with other states to attract film productions. Understanding this competitive landscape and best practices is crucial for both the state and filmmakers.

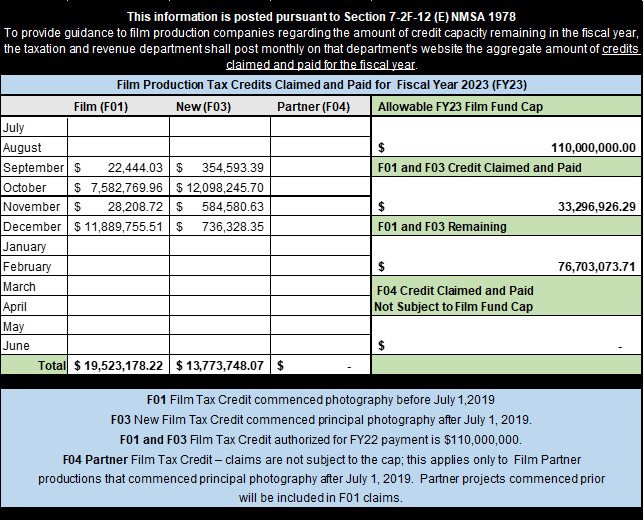

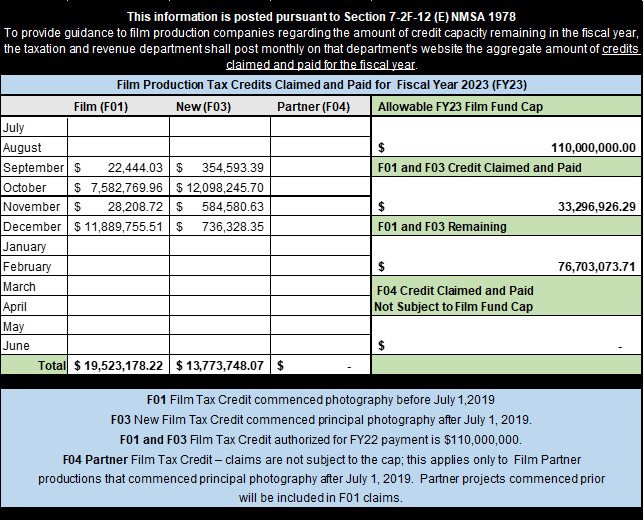

Comparison to Other States

While Minnesota’s tax credit program is competitive, it’s essential to compare it with those offered by neighboring states and other popular filming locations. Some states may offer higher credit percentages or additional incentives. Understanding these nuances is crucial for attracting and retaining high-quality productions. A continuous evaluation and potential adjustments to remain competitive are essential to ensuring the program’s continued success.

Best Practices for Filmmakers Utilizing the Credits

To effectively utilize Minnesota's film tax credits, filmmakers should:

- Plan Ahead: Begin the application process well in advance of production to ensure timely approval.

- Accurate Budgeting: Develop a detailed budget that clearly outlines all eligible expenses.

- Maintain Thorough Records: Keep meticulous records of all expenditures to support the tax credit application.

- Seek Professional Advice: Consult with tax professionals experienced in film production incentives to maximize the benefits of the program. They can advise on complexities and ensure compliance.

Resources and support from organizations such as the Minnesota Film Office can provide valuable assistance throughout the process.

Conclusion

Minnesota's film tax credits play a vital role in attracting film and television productions, stimulating job growth, and generating significant economic activity. The program's success relies on continuous assessment, strategic adjustments, and collaboration between state agencies and the filmmaking community. By understanding the program's benefits and best practices, filmmakers can leverage these valuable incentives to bring their projects to Minnesota and contribute to the state's thriving creative industry. Explore the opportunities presented by Minnesota’s film tax credits. If you're a filmmaker considering Minnesota for your next production, learn more about the and take advantage of these valuable incentives. Don't miss out on the benefits of Minnesota's film tax credits – start planning your production today!

Featured Posts

-

Anthony Edwards Vulgar Remarks To Fan Result In 50 K Nba Fine

Apr 29, 2025

Anthony Edwards Vulgar Remarks To Fan Result In 50 K Nba Fine

Apr 29, 2025 -

Reliance Earnings Surprise Will It Boost Indias Large Cap Stocks

Apr 29, 2025

Reliance Earnings Surprise Will It Boost Indias Large Cap Stocks

Apr 29, 2025 -

The China Factor Assessing The Challenges Faced By Premium Auto Brands

Apr 29, 2025

The China Factor Assessing The Challenges Faced By Premium Auto Brands

Apr 29, 2025 -

China Approves Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025

China Approves Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025 -

Akesos Disappointing Clinical Trial Results Lead To Stock Plunge

Apr 29, 2025

Akesos Disappointing Clinical Trial Results Lead To Stock Plunge

Apr 29, 2025

Latest Posts

-

San Franciscos Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025

San Franciscos Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025 -

127 Years Of Brewing History Anchor Brewing Companys Closure Announced

Apr 29, 2025

127 Years Of Brewing History Anchor Brewing Companys Closure Announced

Apr 29, 2025 -

Anchor Brewing Company To Shutter A Legacy Ends After 127 Years

Apr 29, 2025

Anchor Brewing Company To Shutter A Legacy Ends After 127 Years

Apr 29, 2025 -

Microsoft Activision Deal Ftcs Appeal Explained

Apr 29, 2025

Microsoft Activision Deal Ftcs Appeal Explained

Apr 29, 2025 -

Investing In The Future A Map Of The Countrys Top Business Hotspots

Apr 29, 2025

Investing In The Future A Map Of The Countrys Top Business Hotspots

Apr 29, 2025