The Saudi ABS Market: A Deep Dive Into The Recent Regulatory Overhaul

Table of Contents

Key Drivers Behind the Saudi ABS Market Regulatory Overhaul

The recent regulatory changes in the Saudi ABS market are driven by a multifaceted need to enhance the sector's efficiency, transparency, and investor appeal. The Saudi government, under its Vision 2030 economic diversification plan, aims to develop a robust and globally competitive financial market. This ambition necessitates a regulatory framework that aligns with international best practices, fostering confidence among both domestic and international investors.

The overhaul seeks to address several key areas:

- Increased Investor Confidence: Strengthening investor protection mechanisms is paramount to attracting significant foreign investment and deepening the local market.

- Improved Market Efficiency: Streamlining processes and enhancing transparency aims to reduce transaction costs and increase the overall efficiency of the Saudi ABS market.

- Alignment with International Best Practices: Harmonizing regulations with global standards will attract greater participation from international investors and issuers.

- Strengthening of the Financial Sector: A more sophisticated and regulated ABS market contributes to the overall stability and growth of the Saudi financial sector.

These goals are interwoven with the broader aims of Vision 2030, signaling a commitment to modernizing the Saudi financial landscape and attracting significant foreign investment into the Kingdom's diverse economy.

Analysis of the New Regulations and Their Impact

The regulatory overhaul introduced significant changes affecting various aspects of the Saudi ABS market. These changes impact issuers, investors, and rating agencies alike. Key modifications include:

- Changes to Disclosure Requirements: More stringent disclosure requirements aim to provide investors with greater transparency regarding the underlying assets and risks associated with ABS.

- New Underwriting Standards: Revised underwriting standards are designed to improve the quality of the underlying assets and mitigate potential risks.

- Revised Risk Management Frameworks: New frameworks mandate more robust risk management practices by issuers, ensuring better oversight and control.

- Impact on Transaction Costs: While some changes may initially increase transaction costs, the long-term aim is to reduce them through improved efficiency and transparency.

- Changes to the Role of Credit Rating Agencies: The regulatory overhaul clarifies the role and responsibilities of credit rating agencies, enhancing their accountability and promoting better ratings quality.

These changes specifically impact various ABS types, including mortgage-backed securities, auto loans, and other asset-backed offerings, leading to a more standardized and regulated market for all participants.

Opportunities and Challenges in the Post-Overhaul Saudi ABS Market

The regulatory changes have created several significant opportunities for growth in the Saudi ABS market:

- Increased Investment Flows: The enhanced regulatory framework is attracting increased investment from both domestic and international investors.

- Development of New ABS Products: The improved regulatory environment facilitates the development of innovative ABS products tailored to specific market needs.

- Potential for Market Growth: With increased investor confidence and greater market efficiency, the Saudi ABS market has the potential for substantial growth in the coming years.

However, challenges remain:

- Challenges Related to Implementation: Effective implementation of the new regulations requires careful planning and execution to ensure a smooth transition.

- Competition from Other Asset Classes: The Saudi ABS market faces competition from other asset classes, requiring ongoing efforts to maintain its attractiveness to investors.

Comparison with Other Regional and International ABS Markets

Benchmarking the Saudi ABS market against regional peers like the UAE and international markets reveals both strengths and areas for improvement. While the market size and liquidity are still developing compared to more mature markets, the recent regulatory overhaul represents a significant step forward.

- Market Size and Liquidity Comparison: The Saudi market is relatively smaller than established markets in the US or Europe, but shows considerable potential for growth.

- Regulatory Frameworks Comparison: The new Saudi framework is increasingly aligned with international best practices, though ongoing refinements are expected.

- Investor Sentiment Comparison: Investor sentiment towards the Saudi ABS market is improving due to the increased transparency and regulatory clarity.

- Areas for Future Development: Further development is needed in areas like market infrastructure and the diversification of ABS products.

Conclusion: Investing in the Future of the Saudi ABS Market

The regulatory overhaul of the Saudi ABS market marks a pivotal moment in its development. While challenges remain, the opportunities for growth are considerable. The increased transparency, improved investor protection, and alignment with international best practices are laying a strong foundation for a vibrant and thriving market. This transformation presents significant potential for investors seeking exposure to a dynamic and rapidly evolving market. Learn more about navigating the opportunities within the dynamic Saudi ABS market and discover how you can participate in this evolving landscape. [Link to relevant resources].

Featured Posts

-

Tulsa Nws Forecaster Reports Near Blizzard Conditions

May 02, 2025

Tulsa Nws Forecaster Reports Near Blizzard Conditions

May 02, 2025 -

Boulangerie Normande Son Poids En Chocolat Pour Le Premier Enfant De L Annee

May 02, 2025

Boulangerie Normande Son Poids En Chocolat Pour Le Premier Enfant De L Annee

May 02, 2025 -

Fortnite Item Shop Highly Requested Skins Return After 1000 Days

May 02, 2025

Fortnite Item Shop Highly Requested Skins Return After 1000 Days

May 02, 2025 -

Medvedev La Terapia Della Russofobia E L Impatto Dei Missili Nucleari In Europa

May 02, 2025

Medvedev La Terapia Della Russofobia E L Impatto Dei Missili Nucleari In Europa

May 02, 2025 -

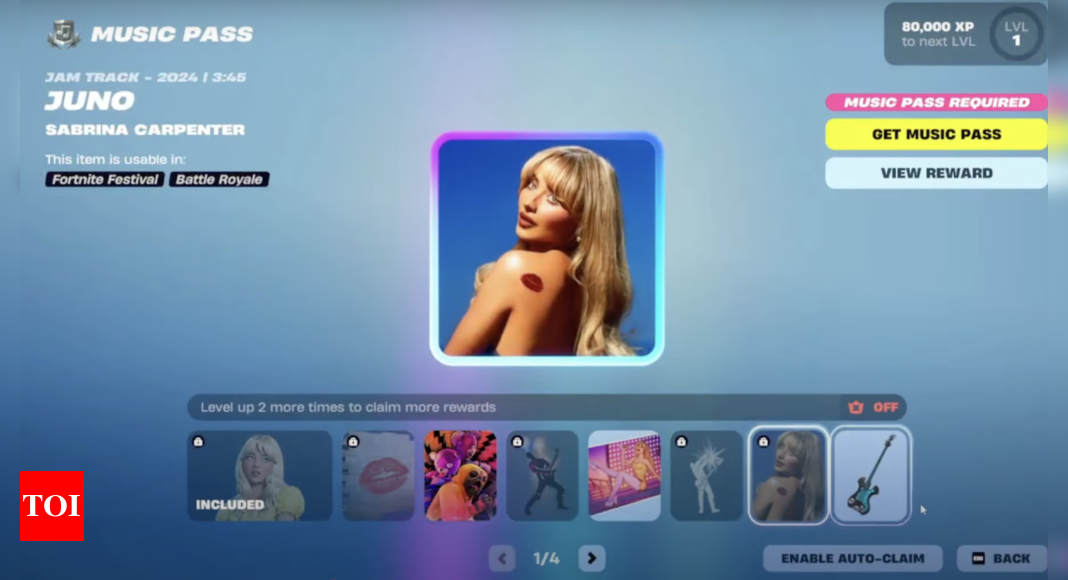

Fortnite V34 30 Update Details Sabrina Carpenter Collaboration And More

May 02, 2025

Fortnite V34 30 Update Details Sabrina Carpenter Collaboration And More

May 02, 2025