The Saudi ABS Market Transformation: A Rule Change With Global Implications

Table of Contents

The New Regulatory Framework

The cornerstone of this transformation is a revised regulatory framework governing the issuance of ABS in Saudi Arabia. These changes are designed to enhance transparency, efficiency, and investor confidence, ultimately fostering growth within the market.

Key Changes in the Regulations

The amendments to the regulations represent a significant overhaul of the existing system. Key changes include:

- Streamlined Approval Processes: The new regulations aim to simplify and expedite the approval process for ABS issuances, reducing bureaucratic hurdles and accelerating time to market.

- Relaxed Capital Requirements: Certain adjustments to capital requirements have been made, potentially incentivizing greater participation from both domestic and international issuers. This could lead to a larger volume of ABS transactions.

- Clarified Permissible Assets: The regulations offer greater clarity on the types of assets that can be securitized, expanding the range of eligible collateral and broadening the appeal of the market.

- Enhanced Disclosure Requirements: Improved transparency is a key focus, with stricter regulations on disclosure of information pertaining to the underlying assets and the structure of the ABS. This promotes greater investor confidence.

The rationale behind these changes is multifaceted. The Saudi Arabian Monetary Authority (SAMA) aims to create a more robust and attractive ABS market, aligning it with international best practices and fostering greater participation from both domestic and international investors. These improvements in the Saudi Arabia ABS regulations are expected to lead to significant growth in the sector.

Impact on Islamic Finance

The new regulatory framework has profound implications for the Islamic finance sector. The changes directly address several challenges that previously limited the growth of Sharia-compliant asset-backed securities.

Increased Access to Capital for Islamic Banks and Institutions

The revised regulations pave the way for increased access to capital for Islamic banks and institutions. This is achieved through several key mechanisms:

- Easier Issuance of Sukuk: The streamlined processes make it easier for Islamic banks to issue Sukuk (Islamic bonds), providing them with a more efficient and cost-effective way to raise capital.

- Wider Investor Base: Increased transparency and standardized reporting attract a broader range of both domestic and international investors, including those specifically seeking Sharia-compliant investments. This expansion of the investor base reduces reliance on a smaller pool of traditional funding sources.

- Development of New Sharia-Compliant Products: The increased clarity on permissible assets also allows for the development of innovative Sharia-compliant ABS products, further expanding the range of investment opportunities.

This increased access to funding will undoubtedly fuel growth within the Islamic banking sector and strengthen its position in the global financial system. The Saudi ABS market's growth directly correlates with the growth of the broader Islamic finance landscape.

Attracting Foreign Investment

The enhanced regulatory framework is a key driver in attracting substantial foreign investment into the Saudi ABS market. The increased transparency and investor confidence are major catalysts in this regard.

Enhanced Transparency and Investor Confidence

The new regulations directly address concerns regarding transparency and information disclosure. Specific improvements include:

- Standardized Reporting: The implementation of standardized reporting frameworks ensures consistency and comparability across different ABS issuances, facilitating easier analysis and comparison for potential investors.

- Clearer Disclosure Requirements: The strengthened disclosure requirements provide investors with a more comprehensive understanding of the underlying assets and the risks associated with the investment.

- Robust Regulatory Oversight: The strengthened regulatory oversight and improved enforcement mechanisms instill greater confidence among international investors.

These improvements significantly enhance the attractiveness of the Saudi ABS market to foreign investors, both in terms of direct investment and portfolio investment. This influx of capital will further fuel market growth and development.

Challenges and Opportunities

While the outlook for the Saudi ABS market is overwhelmingly positive, there are potential challenges and opportunities to consider.

Potential Challenges in Implementation

The successful implementation of the new regulatory framework depends on overcoming several potential hurdles:

- Capacity Building: Regulatory bodies will need to build capacity to effectively monitor and oversee the increased volume of transactions. Training and development programs will be essential.

- Technological Infrastructure: The need for upgraded technological infrastructure to support the efficient processing of transactions and information flow.

- Potential for Delays: There’s always a risk of unforeseen delays in the implementation process, potentially impacting the pace of market development.

Future Growth Prospects for the Saudi ABS Market

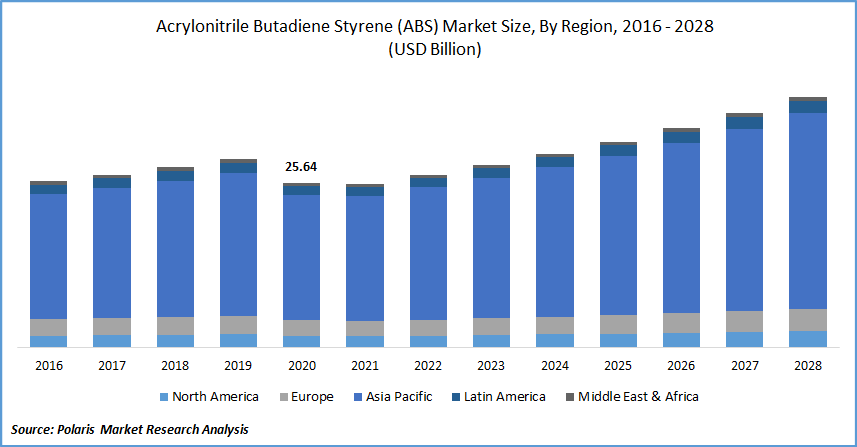

Despite these potential challenges, the long-term growth prospects for the Saudi ABS market are exceptionally promising. Experts predict:

- Significant Market Expansion: The market is expected to experience substantial growth in the coming years, driven by increased issuance of Sukuk and other Sharia-compliant ABS products.

- Attraction of Global Investors: The reforms will attract a wider range of both regional and international investors, leading to a more diversified and liquid market.

- Development of Innovative Products: The clearer regulatory framework will allow for the development of innovative and sophisticated ABS products tailored to the needs of different investors.

The Saudi ABS market is poised for significant expansion, becoming a key player in both the Islamic finance and global investment landscapes.

Conclusion

The Saudi ABS market transformation represents a significant development with profound implications for Islamic finance and global investment. The new regulatory framework, by enhancing transparency and access to capital, promises to unlock substantial growth opportunities. While challenges remain in the implementation process, the long-term outlook for the Saudi ABS market is undeniably positive. Stay informed on further developments in the Saudi ABS market transformation to capitalize on the emerging opportunities in this dynamic sector.

Featured Posts

-

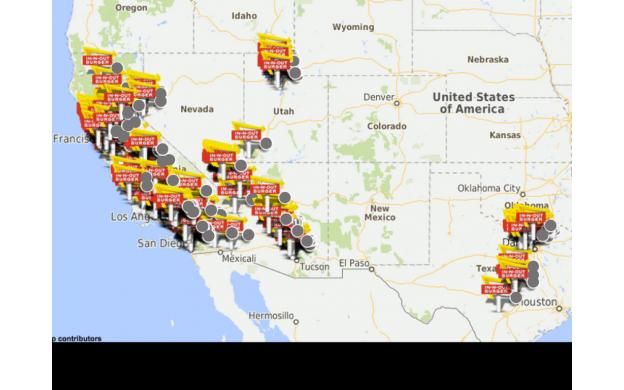

The Countrys Hottest New Business Locations A Geographic Overview

May 02, 2025

The Countrys Hottest New Business Locations A Geographic Overview

May 02, 2025 -

Find The Daily Lotto Results Wednesday April 16 2025

May 02, 2025

Find The Daily Lotto Results Wednesday April 16 2025

May 02, 2025 -

Fortnite Downtime Chapter 6 Season 2 Delayed Players Frustrated

May 02, 2025

Fortnite Downtime Chapter 6 Season 2 Delayed Players Frustrated

May 02, 2025 -

Understanding The Economic Challenges Facing The Biden Administration

May 02, 2025

Understanding The Economic Challenges Facing The Biden Administration

May 02, 2025 -

Utahs Clayton Keller Reaches 500 Nhl Points Missouris Second 500 Point Player

May 02, 2025

Utahs Clayton Keller Reaches 500 Nhl Points Missouris Second 500 Point Player

May 02, 2025