The Scale Of The Bond Market Crisis: An Investor's Guide

Table of Contents

Understanding the Magnitude of the Crisis

The sheer size of the global bond market makes the potential for widespread defaults or losses exceptionally concerning. The interconnectedness of various financial sectors—from banks and insurance companies to pension funds and individual investors—means that a crisis in one area can quickly trigger a domino effect. This interconnectedness amplifies the risk and makes a thorough understanding of the crisis's magnitude essential for effective risk management.

-

Global Bond Market Size: The global bond market is estimated to be worth tens of trillions of dollars, dwarfing the size of the equity market. This immense scale means that even a relatively small percentage of defaults can have significant consequences for the global economy.

-

Rising Interest Rates and Bond Prices: Rising interest rates, a common tool used by central banks to combat inflation, inversely impact bond prices. As interest rates rise, existing bonds with lower coupon rates become less attractive, leading to a decline in their market value. This is particularly true for longer-term bonds, which are more sensitive to interest rate changes.

-

Vulnerable Sectors: Several sectors within the bond market are particularly vulnerable. High-yield corporate bonds, often issued by companies with lower credit ratings, face increased default risks in a period of economic uncertainty. Similarly, emerging market debt is susceptible to currency fluctuations and potential sovereign debt crises.

-

Contagion Effects: A crisis in one sector can quickly spread to others. For example, defaults in the high-yield corporate bond market could trigger losses for banks and other financial institutions holding these bonds, potentially leading to a broader credit crunch. This contagion effect can impact various asset classes and exacerbate the overall market turmoil.

-

Data and Statistics: Reports from organizations like the Bank for International Settlements (BIS) and the International Monetary Fund (IMF) provide crucial data and analysis on global debt levels and the potential for widespread defaults. Careful monitoring of these reports is vital for understanding the evolving nature of the bond market crisis.

Identifying Vulnerable Sectors Within the Bond Market

Specific areas within the bond market are exhibiting heightened vulnerability. Understanding these vulnerabilities is critical for investors to assess and manage their risk exposure effectively.

-

High-Yield Corporate Bonds: These bonds, also known as junk bonds, offer higher yields but carry significantly higher default risk. As economic conditions deteriorate, the creditworthiness of these companies weakens, increasing the likelihood of defaults.

-

Emerging Market Sovereign Debt: Governments in emerging markets often rely on foreign borrowing to finance their operations. Currency fluctuations, rising interest rates, and global economic slowdowns can severely strain their ability to service their debt, leading to potential defaults and significant losses for investors.

-

Municipal Bonds: These bonds finance public projects and infrastructure at the local level. Fiscal challenges faced by many local governments, especially those with high debt burdens, increase the risk of defaults on municipal bonds.

-

Mortgage-backed Securities (MBS): These securities are backed by pools of mortgages and are highly sensitive to interest rate changes. Rising interest rates can lead to increased mortgage defaults, resulting in losses for investors holding MBS.

-

Inflation's Exacerbating Role: High inflation erodes the purchasing power of fixed-income investments like bonds. This effect is particularly damaging for bonds with long maturities, as their future payments are worth less in real terms due to inflation.

Strategies for Investors During a Bond Market Crisis

Navigating a bond market crisis requires proactive strategies to protect your portfolio and mitigate potential losses. A well-defined approach is essential to withstand market volatility and maintain long-term financial stability.

-

Diversification: Diversifying investments across various asset classes—including equities, real estate, and alternative investments—can help to reduce the overall impact of a bond market crisis on your portfolio.

-

Risk Management Plan: A robust risk management plan is crucial. This plan should outline your risk tolerance, define your investment goals, and specify strategies for managing losses during market downturns.

-

Defensive Investments: Consider shifting a portion of your portfolio into more defensive investment options, such as government bonds or cash, which tend to be less volatile during market crises.

-

Portfolio Re-allocation: Re-evaluate your portfolio allocation based on your updated risk tolerance and the changing market conditions. This might involve reducing exposure to riskier bond investments and increasing exposure to more stable assets.

-

Alternative Investments: Explore alternative investment opportunities, such as commodities or private equity, which may offer diversification benefits and potentially higher returns during periods of market distress.

-

Seek Professional Advice: Consulting with a qualified financial advisor can provide invaluable guidance during a bond market crisis. They can help you tailor a resilient investment strategy to your specific circumstances and risk tolerance.

Government and Central Bank Responses to the Bond Market Crisis

Governments and central banks play a vital role in mitigating the impact of a bond market crisis. Their actions can significantly influence market stability and investor confidence.

-

Quantitative Easing (QE): Central banks may implement QE programs, which involve purchasing bonds to increase the money supply and lower interest rates. While QE can inject liquidity into the market, its effectiveness can vary depending on the severity of the crisis.

-

Interest Rate Adjustments: Central banks may adjust interest rates to stimulate economic growth and stabilize the bond market. However, interest rate adjustments need to be carefully calibrated to avoid unintended consequences.

-

Government Intervention: Governments may intervene in specific sectors by providing financial assistance to struggling companies or institutions, or by implementing regulatory measures to prevent further market instability.

-

International Cooperation: International cooperation among central banks and governments is crucial in addressing a global bond market crisis. Coordination of monetary and fiscal policies is necessary to ensure consistent and effective responses.

-

Long-Term Consequences: The long-term consequences of government and central bank actions can be significant, potentially influencing inflation, economic growth, and the overall stability of the financial system. Understanding these potential long-term impacts is essential for investors to make informed decisions.

Conclusion

The scale of a potential bond market crisis is significant, impacting various sectors and demanding proactive strategies from investors. Understanding vulnerable sectors like high-yield corporate bonds and emerging market debt is crucial for effective risk management. Diversification, a robust risk management plan, and seeking professional financial advice are essential steps in navigating this challenging market environment. Government and central bank responses play a critical role, but their long-term effects need careful consideration. Navigating the complexities of a bond market crisis requires careful planning and informed decisions. Stay informed about developments in the bond market and consult with a financial advisor to create a resilient investment strategy tailored to your risk tolerance. Learn more about protecting your portfolio from the effects of the bond market crisis today.

Featured Posts

-

Revealed Morgan Wallens Grandmas Endearing Nickname For Him

May 29, 2025

Revealed Morgan Wallens Grandmas Endearing Nickname For Him

May 29, 2025 -

Prakiraan Cuaca Besok Di Jawa Barat Hujan Hingga Sore

May 29, 2025

Prakiraan Cuaca Besok Di Jawa Barat Hujan Hingga Sore

May 29, 2025 -

Discovering The Parents Of Taylor Dearden

May 29, 2025

Discovering The Parents Of Taylor Dearden

May 29, 2025 -

Trump Coin Short Sell Leads To Unexpected White House Invitation

May 29, 2025

Trump Coin Short Sell Leads To Unexpected White House Invitation

May 29, 2025 -

The Stranger Things Comics Bridging The Gap Until Season 5

May 29, 2025

The Stranger Things Comics Bridging The Gap Until Season 5

May 29, 2025

Latest Posts

-

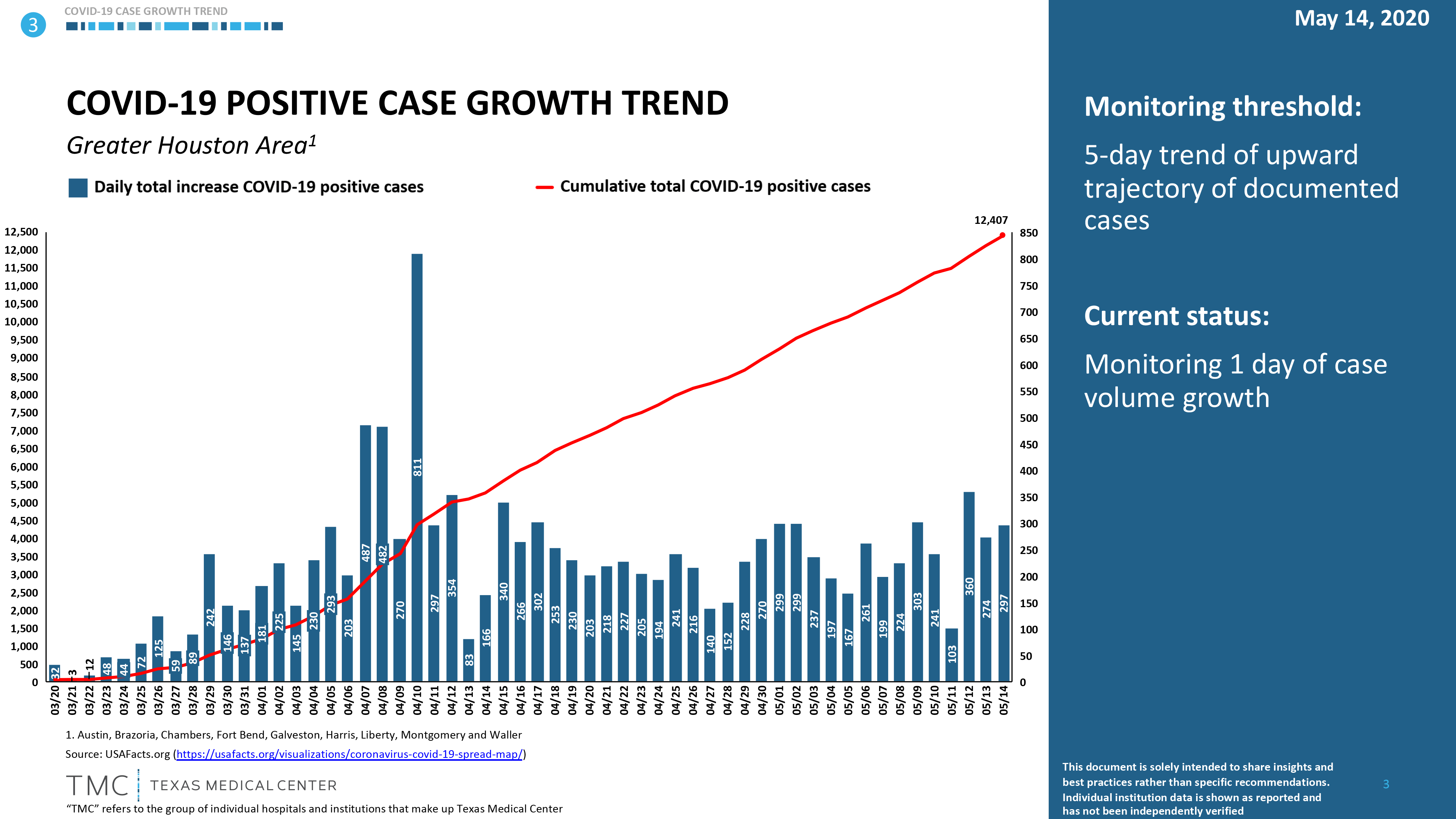

Recent Covid 19 Case Increase A New Variants Potential Contribution

May 31, 2025

Recent Covid 19 Case Increase A New Variants Potential Contribution

May 31, 2025 -

Analyzing The Surge In Covid 19 Cases A New Variants Influence

May 31, 2025

Analyzing The Surge In Covid 19 Cases A New Variants Influence

May 31, 2025 -

Rising Covid 19 Infections Investigating The Potential Of A New Variant

May 31, 2025

Rising Covid 19 Infections Investigating The Potential Of A New Variant

May 31, 2025 -

Italian International Open Alcaraz Advances Passaro Upsets Dimitrov

May 31, 2025

Italian International Open Alcaraz Advances Passaro Upsets Dimitrov

May 31, 2025 -

New Covid 19 Variant Driving Up Cases What We Know So Far

May 31, 2025

New Covid 19 Variant Driving Up Cases What We Know So Far

May 31, 2025