The SEC And XRP: Understanding The Commodity Classification Debate

Table of Contents

The SEC's Case Against XRP: A Securities Argument

The SEC's case hinges on its definition of a "security," primarily based on the Howey Test. This test, established in SEC v. W.J. Howey Co., determines whether an investment contract exists based on four criteria: an investment of money, in a common enterprise, with a reasonable expectation of profits, derived from the efforts of others.

The SEC alleges that Ripple's initial sale of XRP and its ongoing distribution constitute an unregistered securities offering, violating federal securities laws. They argue that XRP investors reasonably expected profits based on Ripple's efforts to develop and promote the XRP ledger and its ecosystem. The SEC claims Ripple misled investors about XRP's value and its regulatory status, further strengthening their case.

- The SEC argues XRP is an unregistered security because it meets the Howey Test criteria.

- The SEC alleges Ripple conducted an unregistered securities offering, violating the Securities Act of 1933.

- The SEC claims Ripple's actions misled investors about XRP's value and its regulatory status, potentially violating anti-fraud provisions.

The SEC's case relies heavily on demonstrating a reasonable expectation of profits derived from Ripple's efforts. They point to Ripple's marketing materials and internal communications as evidence of this expectation. [Insert links to relevant SEC filings and legal documents here, if available].

Ripple's Defense: Challenging the SEC's Classification

Ripple's defense strongly contests the SEC's classification, arguing that XRP is a decentralized digital asset, not a security. They emphasize XRP's functionality as a digital currency, highlighting its use in cross-border payments and its operational independence from Ripple. Ripple argues that the vast majority of XRP transactions occur outside of their direct control, negating the "efforts of others" aspect of the Howey Test.

- Ripple argues that XRP is a decentralized digital asset, not a security, citing its open-source nature and distributed ledger technology.

- Ripple points to the operational aspects of XRP, its consensus mechanism, and its lack of centralized control as evidence against the SEC's claims.

- Ripple emphasizes the widespread use of XRP in various financial transactions outside of Ripple's control, undermining the "common enterprise" element of the Howey Test.

Ripple counters the SEC's allegations by presenting evidence of XRP's decentralized usage and market dynamics. They argue that the SEC's interpretation of the Howey Test is overly broad and could stifle innovation in the cryptocurrency space. [Insert links to Ripple's legal responses and supporting documentation here, if available].

The Implications of the XRP Ruling for the Crypto Market

The outcome of the SEC v. Ripple case will have far-reaching consequences for the cryptocurrency market. Uncertainty surrounding regulatory clarity already creates significant challenges for cryptocurrency adoption and investment. A ruling against Ripple could set a precedent for classifying other crypto assets as securities, potentially impacting their market capitalization and future development.

- Uncertainty about regulatory clarity creates challenges for cryptocurrency adoption and investor confidence.

- The outcome could set a precedent for regulating other crypto assets, impacting altcoins and potentially even Bitcoin.

- A ruling against Ripple could significantly impact the market capitalization of other altcoins, depending on their similarities to XRP.

- The decision could influence regulatory frameworks globally, leading to different approaches in various jurisdictions.

This uncertainty could also deter future Initial Coin Offerings (ICOs) and token sales, as projects may hesitate to launch without clear regulatory guidelines. The potential impact on investor confidence is significant, potentially driving investors away from the cryptocurrency market if regulatory ambiguity persists.

The Broader Debate on Crypto Regulation

The SEC v. Ripple case underscores the broader global debate surrounding cryptocurrency regulation. Different countries are adopting diverse approaches, ranging from outright bans to more permissive frameworks. The challenge lies in regulating decentralized technologies, which often operate outside traditional jurisdictional boundaries. Finding a balance between fostering innovation and protecting investors remains a complex task for regulators worldwide.

Conclusion: The Future of XRP and the SEC's Commodity Classification Debate

The SEC v. Ripple case presents a clash between traditional securities law and the decentralized nature of cryptocurrencies. The SEC argues XRP is a security based on the Howey Test, while Ripple maintains XRP is a decentralized digital asset. The ruling will have significant implications for the cryptocurrency market, impacting investor confidence, future ICOs, and the broader regulatory landscape.

The potential consequences of this ruling extend beyond XRP, potentially shaping the future of cryptocurrency regulation globally. Understanding this commodity classification debate is crucial for anyone involved in or interested in the cryptocurrency market. Stay informed about the ongoing developments in the SEC and XRP case. Further research into the legal documents and expert opinions will provide a more comprehensive understanding of this landmark case.

Featured Posts

-

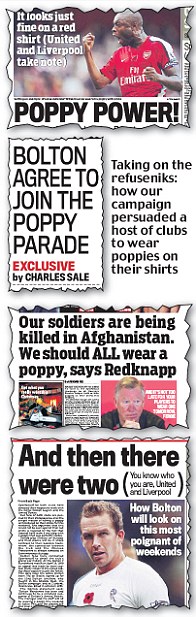

Familys Heartbreaking Tribute To Young Manchester United Fan Poppy

May 02, 2025

Familys Heartbreaking Tribute To Young Manchester United Fan Poppy

May 02, 2025 -

This Country A Regional Overview

May 02, 2025

This Country A Regional Overview

May 02, 2025 -

Sheens Generosity 1 Million Debt Relief For 900

May 02, 2025

Sheens Generosity 1 Million Debt Relief For 900

May 02, 2025 -

Havertz At Arsenal Souness Says Hes Not The Answer

May 02, 2025

Havertz At Arsenal Souness Says Hes Not The Answer

May 02, 2025 -

Economic Slowdown Analyzing The Biden Administrations Role

May 02, 2025

Economic Slowdown Analyzing The Biden Administrations Role

May 02, 2025